Overfunded whole life insurance policy Idea

Home » Trend » Overfunded whole life insurance policy IdeaYour Overfunded whole life insurance policy images are available. Overfunded whole life insurance policy are a topic that is being searched for and liked by netizens now. You can Get the Overfunded whole life insurance policy files here. Find and Download all free photos and vectors.

If you’re searching for overfunded whole life insurance policy images information related to the overfunded whole life insurance policy interest, you have come to the ideal blog. Our website frequently provides you with suggestions for viewing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

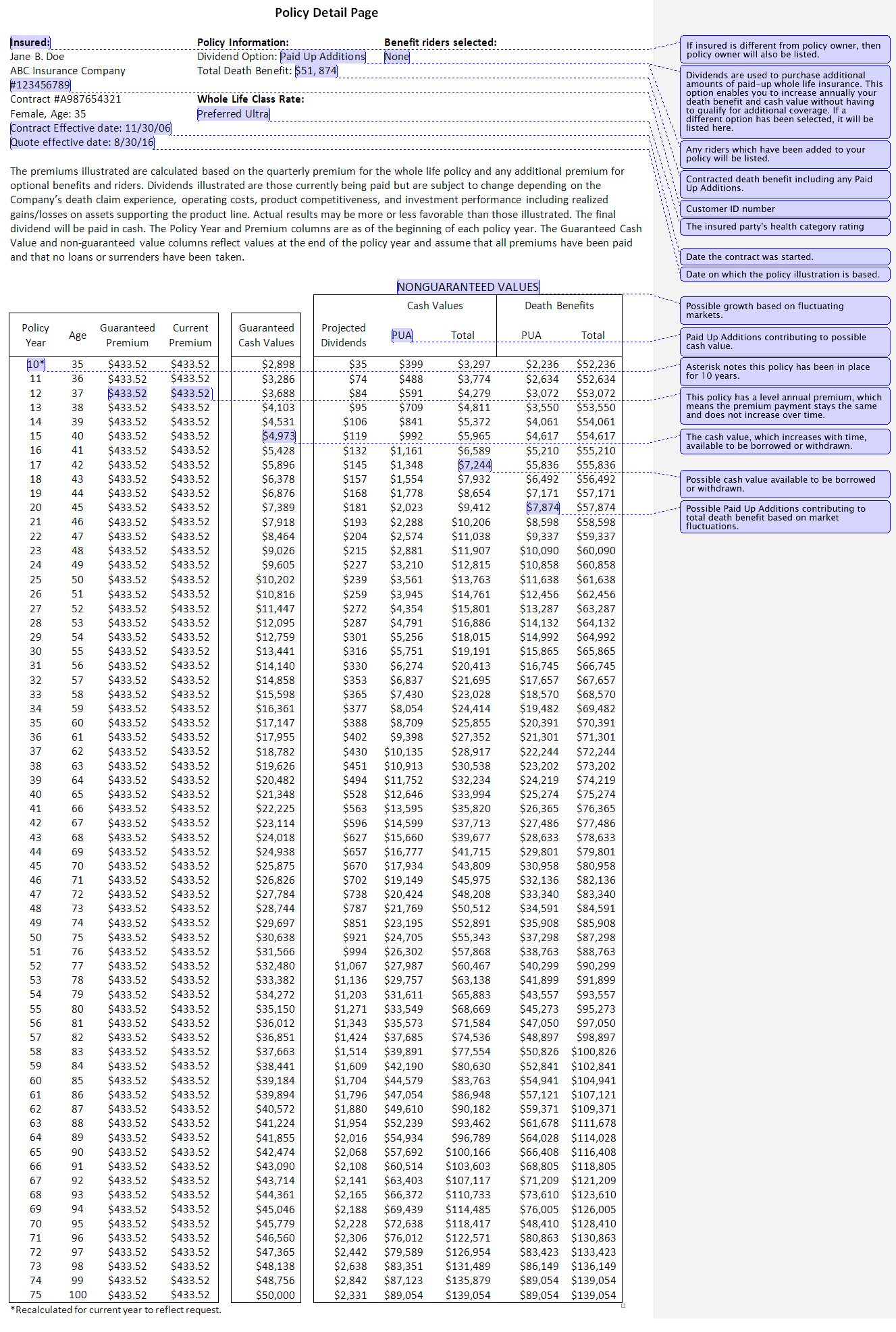

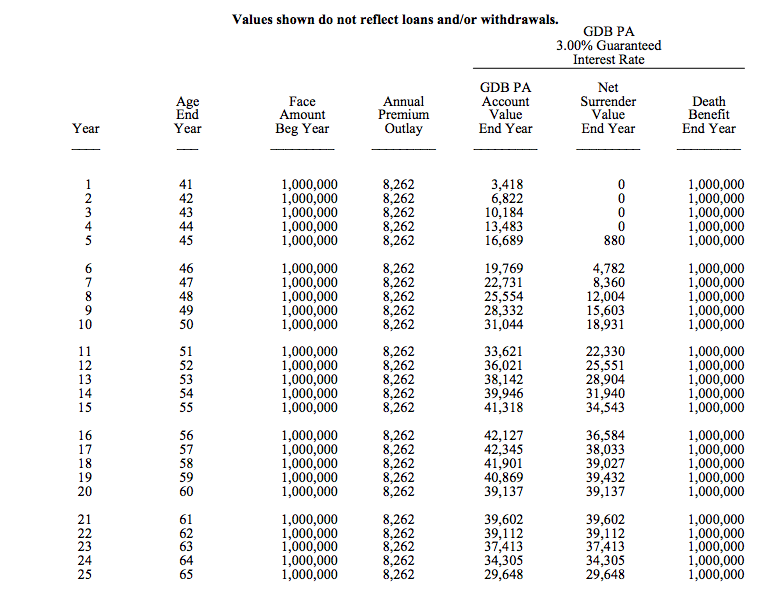

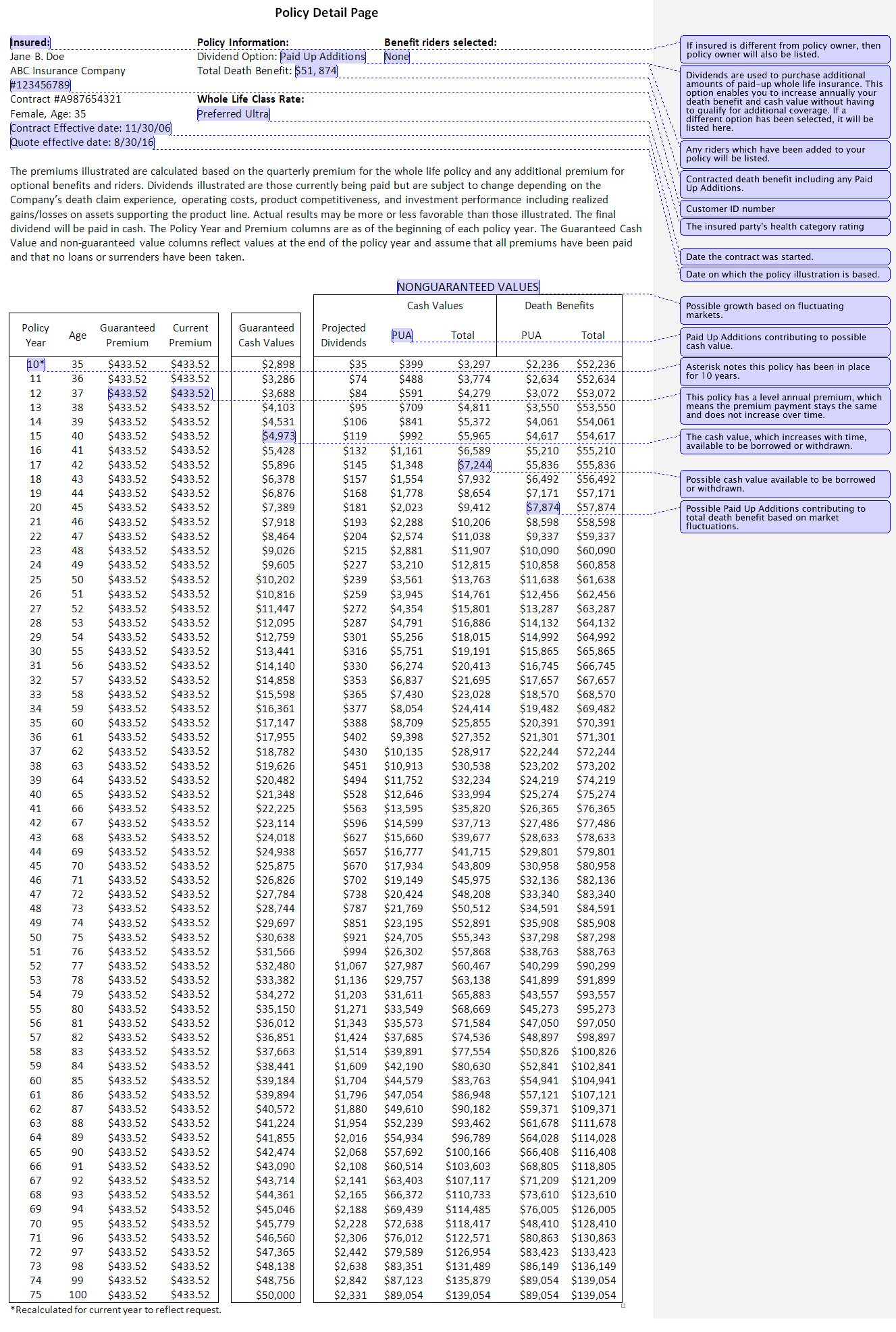

Overfunded Whole Life Insurance Policy. However, an overfunded iul or whole life can be a great product for most insurance portfolios. Overfunded life insurance is when you pay more into a policy than is required. If you hold a whole life insurance policy, you’re likely to get paid dividends by the insurance. This added cash grows tax free in the policy’s cash account and can be accessed via cash withdrawals or policy loans.

How to read your life insurance policy From insure.com

How to read your life insurance policy From insure.com

In this article, we’re going to discuss a strategy whereby someone can take advantage of overfunding their cash value whole life insurance policy for the purpose of then using this cash accumulation to grow and preserve wealth. However, an overfunded iul or whole life can be a great product for most insurance portfolios. So if you did not access cash value, we would suggest looking into a universal life policy. Whole life insurance guarantees level policy premiums for life. Overfunded life insurance, or oli, is essentially a permanent life insurance policy, such as a whole or universal life plan, in which a policyholder has paid higher premiums than what is necessary to maintain the death benefit. Most life insurance policies require a specific premium monthly, quarterly, or annually to keep the policy active.

Whole life insurance (wl), or variable universal life (vul) overfunded life insurance is using one of these permanent products to contribute additional cash into the policy to boost the policy’s cash value.

Overfunded life insurance is a policy that maximizes cash value and minimizes death benefits. The idea is to build cash value quickly that you can access for any reason during your lifetime. 10 and 20 pay products We go over overfunding and give samples here: An overfunded policy will generate cash value faster, and can possibly increase the death benefit or dividends. Overfunded life insurance is when you pay more into a policy than is required.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

Overfunded life insurance [15 pros and cons] updated april 19, 2021. An overfunded policy will generate cash value faster, and can possibly increase the death benefit or dividends. A traditional whole life insurance policy gives you a guaranteed premium and minimum rate of return on your cash value portion. An overfunded life insurance policy is a whole or universal life insurance policy (or variation of those, such as indexed universal life) in which more premium is paid in than required to secure the death benefit. The goal is usually to generate enough cash value in the policy so that they can take loans against the policy—that are generally tax free.

Source: insuranceandestates.com

Source: insuranceandestates.com

One of the main benefits of oli is tax advantages for growth and. For consumers that have this objective, they have a life insurance need but also have a very strong focus on cash value growth and minimizing the cost of insurance charges. This cash value grows predictably and safely. Overfunded life insurance policies file number: Permanent policies like whole life insurance or universal life insurance have cash value attached, so by overfunding, you contribute more to the cash value.

Source: locallifeagents.com

Source: locallifeagents.com

For consumers that have this objective, they have a life insurance need but also have a very strong focus on cash value growth and minimizing the cost of insurance charges. You typically need to pay a certain premium each year or each month to ensure. When you own a cash value life insurance policy, ownership builds equity (i.e., cash value). It was viewed as a way to protect loved ones, while at the same time help subsidize retirement planning. So, by overfunding your policy, you contribute more to the cash value.

Source: youtube.com

Source: youtube.com

Advantages of overfunded life insurance dividend payments. Overfunded life insurance offers many benefits, such as guaranteed death and level premiums. This cash value grows predictably and safely. Because this excess money isn’t needed to fund the death benefit or cover administrative costs, it immediately adds to the cash value of the policy. You will need to determine if getting an overfunded whole life insurance is the right fit for you.

Source: topwholelife.com

Source: topwholelife.com

Because this excess money isn’t needed to fund the death benefit or cover administrative costs, it immediately adds to the cash value of the policy. Because this excess money isn’t needed to fund the death benefit or cover administrative costs, it immediately adds to the cash value of the policy. This letter addresses the issue in general and is not meant as a blanket opinion on the issue. As you can probably tell, there are some advantages one might get from overfunding their life insurance policy. 5285.0001 dear triangle usa ;

Source: insurancenewsnetmagazine.com

Source: insurancenewsnetmagazine.com

So if you did not access cash value, we would suggest looking into a universal life policy. Overfunded life insurance is a policy that maximizes cash value and minimizes death benefits. 10 and 20 pay products Here are some of the most important ones: So, by overfunding your policy, you contribute more to the cash value.

Source: youtube.com

Source: youtube.com

So if you did not access cash value, we would suggest looking into a universal life policy. For consumers that have this objective, they have a life insurance need but also have a very strong focus on cash value growth and minimizing the cost of insurance charges. Overfunded life insurance offers many benefits, such as guaranteed death and level premiums. Think of it like this. Overfunded life insurance, or oli, is essentially a permanent life insurance policy, such as a whole or universal life plan, in which a policyholder has paid higher premiums than what is necessary to maintain the death benefit.

Source: clientfocusedadvisors.com

Source: clientfocusedadvisors.com

The idea is to build cash value quickly that you can access for any reason during your lifetime. So if you did not access cash value, we would suggest looking into a universal life policy. So, by overfunding your policy, you contribute more to the cash value. An overfunded life insurance policy is a whole or universal life insurance policy (or variation of those, such as indexed universal life) in which more premium is paid in than required to secure the death benefit. You typically need to pay a certain premium each year or each month to ensure.

Source: fasesdeumaadolescenteb.blogspot.com

Source: fasesdeumaadolescenteb.blogspot.com

You will need to determine if getting an overfunded whole life insurance is the right fit for you. Overfunded life insurance refers to the act of paying more into your life insurance policy than is required. Without overfunding a policy, there are whole life products that are designed to grow cash value faster. 10 and 20 pay products If you hold a whole life insurance policy, you’re likely to get paid dividends by the insurance.

Source: mbkinc.co

Source: mbkinc.co

Overfunded life insurance, or oli, is essentially a permanent life insurance policy, such as a whole or universal life plan, in which a policyholder has paid higher premiums than what is necessary to maintain the death benefit. Overfunded life insurance is a policy that maximizes cash value and minimizes death benefits. However, an overfunded iul or whole life can be a great product for most insurance portfolios. The benefits of whole life insurance typically outweigh the risks of an index universal life insurance policy in most cases. Here are some of the most important ones:

Source: zadishqr.blogspot.com

We go over overfunding and give samples here: However, an overfunded iul or whole life can be a great product for most insurance portfolios. An overfunded life insurance policy is a whole or universal life insurance policy (or variation of those, such as indexed universal life) in which more premium is paid in than required to secure the death benefit. Overfunded life insurance policies file number: This letter addresses the issue in general and is not meant as a blanket opinion on the issue.

Source: insure.com

Source: insure.com

Without overfunding a policy, there are whole life products that are designed to grow cash value faster. Overfunded life insurance, or oli, is essentially a permanent life insurance policy, such as a whole or universal life plan, in which a policyholder has paid higher premiums than what is necessary to maintain the death benefit. Whole life insurance guarantees level policy premiums for life. Overfunded life insurance policies file number: Think of it like this.

Source: topwholelife.com

Source: topwholelife.com

From 1940 to 1970 whole life insurance was the most popular insurance product. You will need to determine if getting an overfunded whole life insurance is the right fit for you. In this article, we’re going to discuss a strategy whereby someone can take advantage of overfunding their cash value whole life insurance policy for the purpose of then using this cash accumulation to grow and preserve wealth. However, an overfunded iul or whole life can be a great product for most insurance portfolios. Overfunded life insurance policies file number:

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

An overfunded life insurance policy is a whole or universal life insurance policy (or variation of those, such as indexed universal life) in which more premium is paid in than required to secure the death benefit. Unlike most other permanent life insurance policies, though. Here are some of the most important ones: A traditional whole life insurance policy gives you a guaranteed premium and minimum rate of return on your cash value portion. An overfunded life insurance policy is a whole or universal life insurance policy (or variation of those, such as indexed universal life) in which more premium is paid in than required to secure the death benefit.

Source: youtube.com

Source: youtube.com

Overfunded life insurance refers to the act of paying more into your life insurance policy than is required. So if you did not access cash value, we would suggest looking into a universal life policy. You have requested that i address the issue of “overfunded” whole life or universal life insurance policies. The benefits of whole life insurance typically outweigh the risks of an index universal life insurance policy in most cases. Its primary goal is to.

Source: youtube.com

Source: youtube.com

In this article, we’re going to discuss a strategy whereby someone can take advantage of overfunding their cash value whole life insurance policy for the purpose of then using this cash accumulation to grow and preserve wealth. However, an overfunded iul or whole life can be a great product for most insurance portfolios. An overfunded policy will generate cash value faster, and can possibly increase the death benefit or dividends. Overfunded life insurance policies file number: The benefits of whole life insurance typically outweigh the risks of an index universal life insurance policy in most cases.

Source: gantins.com

Source: gantins.com

Its primary goal is to. For consumers that have this objective, they have a life insurance need but also have a very strong focus on cash value growth and minimizing the cost of insurance charges. From 1940 to 1970 whole life insurance was the most popular insurance product. Without overfunding a policy, there are whole life products that are designed to grow cash value faster. Whole life insurance policies aren’t subject to market volatility.

Source: fasesdeumaadolescenteb.blogspot.com

It was viewed as a way to protect loved ones, while at the same time help subsidize retirement planning. Get it whole life insurance y. Overfunded life insurance offers many benefits, such as guaranteed death and level premiums. Overfunded life insurance is, quite simply, when you pay more into a policy than is required. This cash value grows predictably and safely.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title overfunded whole life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information