Overhead and profit insurance definition information

Home » Trending » Overhead and profit insurance definition informationYour Overhead and profit insurance definition images are ready. Overhead and profit insurance definition are a topic that is being searched for and liked by netizens today. You can Find and Download the Overhead and profit insurance definition files here. Get all royalty-free vectors.

If you’re searching for overhead and profit insurance definition images information related to the overhead and profit insurance definition topic, you have come to the ideal site. Our site frequently provides you with hints for seeing the highest quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

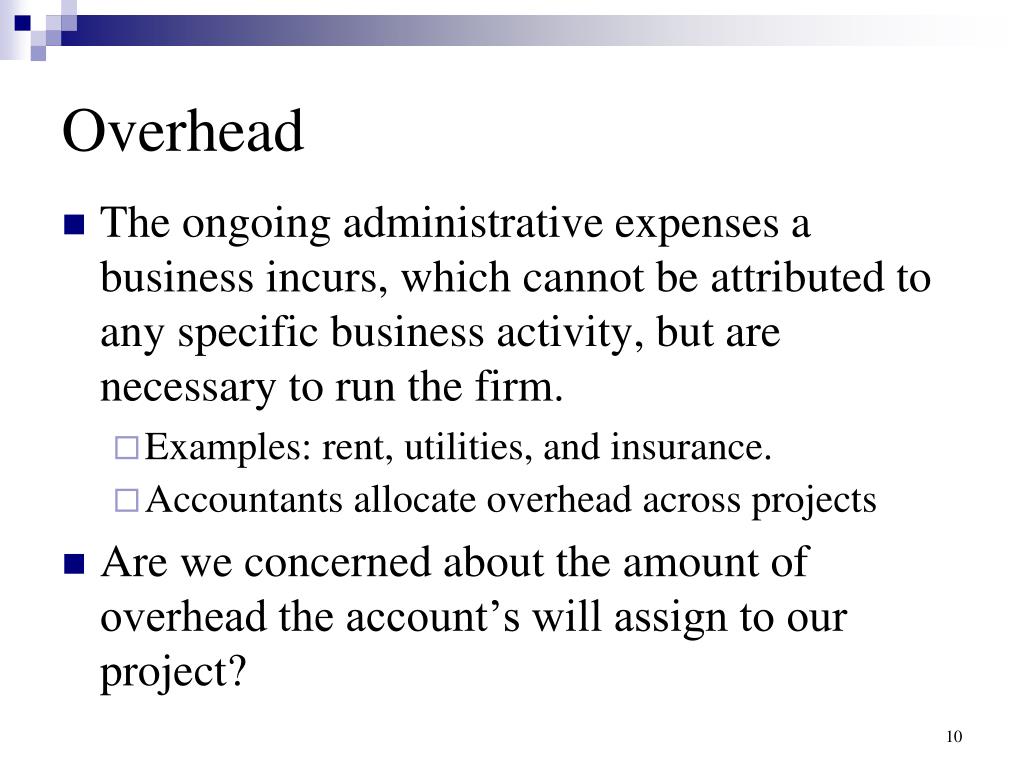

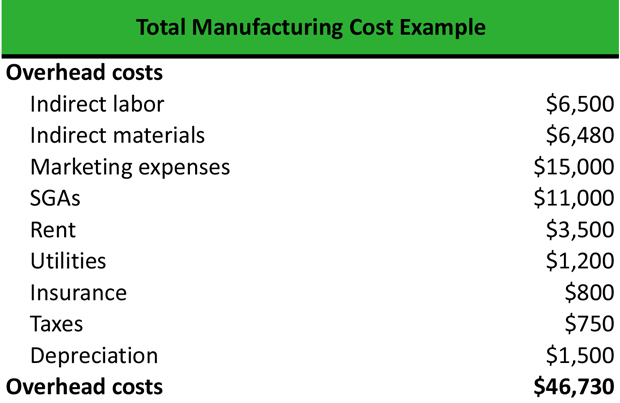

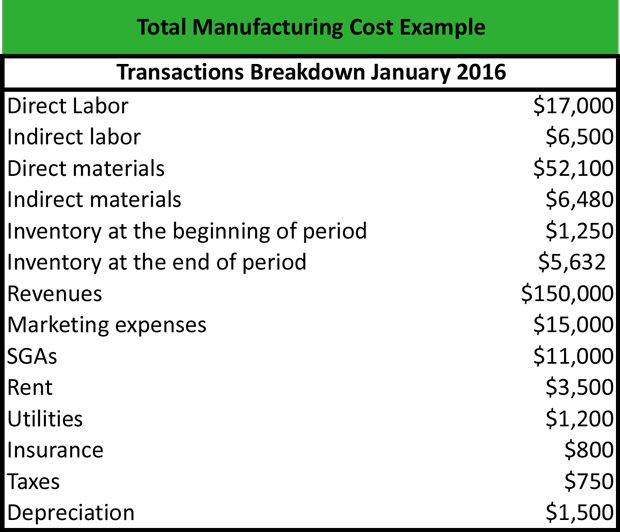

Overhead And Profit Insurance Definition. Contractor overhead and profits (gcop) is almost always justified. Rather, it compensates the insured for the value of the item as if it were being sold at a garage sale. For those not aware, overhead and profit (generally estimated at 20% of the total amount of the estimate) is intended to cover the overhead/operating costs of a general contractor as well as the amount. Overhead costs are operating expenses for necessary equipment and facilities.

Business Considerations For Firm Owners During Tough Times From blog.xyplanningnetwork.com

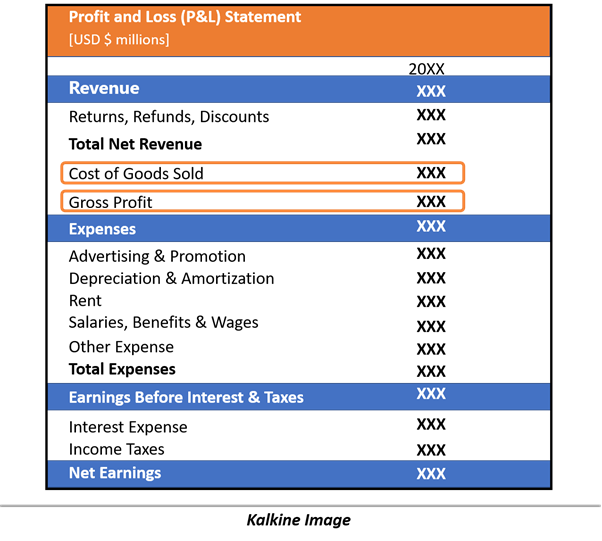

What is overhead and profit? There is a tremendous amount of confusion, deception and litigation over these words. Profit is formally defined as “the excess of the selling price of goods over cost.”* profit is typically added to the cost It can help pay for expense like salaries, rent, and utilities. Insurance companies pay overhead and profit on property insurance claims. The terms overhead and profit are used together by a business in reference to their profit and expenses.

What does this mean to you, the insured?

Overhead and profit is a term that goes by many names: Overhead and profit is generally charged by contractors, and so as a policyholder, it is ultimately part of your cost. There is a tremendous amount of confusion, deception and litigation over these words. One common problem that has been arising is when overhead and profit should be paid in response to a property insurance claim. Overhead costs are operating expenses for necessary equipment and facilities. While profit is the a financial gain, the difference between the amount earned and the amount spent such as overhead.

Source: sbinfocanada.about.com

Source: sbinfocanada.about.com

For property insurance adjusters and roofing or general contractors alike, it often sparks a debate. Proper care should be taken to understand the project size, scope and duration so as determine a reasonable and accurate markup to allow the project to be completed in a proper fashion in a reasonable time frame. The terms overhead and profit are used together by a business in reference to their profit and expenses. The two most common questions that arise when dealing with this issue in the coverage context are: There is a tremendous amount of confusion, deception and litigation over these words.

Source: myaccountingcourse.com

Source: myaccountingcourse.com

The ultimate point of overhead and profit is that there’s a certain chunk of money that doesn’t fit into the “actual cash value” of your home. For those not aware, overhead and profit (generally estimated at 20% of the total amount of the estimate) is intended to cover the overhead/operating costs of a general contractor as well as the amount. Proper care should be taken to understand the project size, scope and duration so as determine a reasonable and accurate markup to allow the project to be completed in a proper fashion in a reasonable time frame. For example “10 and 10”. The overhead and profit is restricted to the rates set forth in the contractor’s submission to the rfp.

Source: slideserve.com

Source: slideserve.com

What does this mean to you, the insured? For property insurance adjusters and roofing or general contractors alike, it often sparks a debate. The florida supreme court has explained that “overhead and profit are like all other costs of a repair, such as labor and materials, the insured is reasonably likely to incur. Pennsylvania’s highest court sides with the insurance company claiming that farmers (truck insurance) contracted around the requirement to include general contractor overhead and profit in the actual cash value (acv) payment. The mere mention of it to your agent is liable to send them sidestepping for a politically correct and often confusing answer.

Source: myaccountingcourse.com

Source: myaccountingcourse.com

O&p, as it�s called, is typically 20% of the total amount of the estimate. O&p, as it�s called, is typically 20% of the total amount of the estimate. General overhead and profit percentages can be added in the estimate parameters window within an xactimate estimate. Overhead is typically classified as an indirect cost. In the insurance industry, overhead (10%) and profit (10%), commonly referred to as o&p, is owed when it becomes necessary to have multiple subcontractors perform work to repair damages to your property cause by a covered peril in the policy.

Source: zahiraccounting.com

Source: zahiraccounting.com

It is typically estimated at 20% of the total amount of the contractor’s own rebuild or renovation estimate. What is overhead and profit? One common problem that has been arising is when overhead and profit should be paid in response to a property insurance claim. In the insurance industry, overhead (10%) and profit (10%), commonly referred to as o&p, is owed when it becomes necessary to have multiple subcontractors perform work to repair damages to your property cause by a covered peril in the policy. Overhead insurance (or overhead expense insurance) is a type of insurance that business owners purchase to cover various business costs in the event that they become disabled.

Source: zahiraccounting.com

Source: zahiraccounting.com

Overhead is typically classified as an indirect cost. The florida supreme court has explained that “overhead and profit are like all other costs of a repair, such as labor and materials, the insured is reasonably likely to incur. Overhead expenses vary depending on the nature of the business and the industry it operates in. After an insurer suffers a loss, such as roof damage from a storm, insurance companies work to reimburse them. Proper care should be taken to understand the project size, scope and duration so as determine a reasonable and accurate markup to allow the project to be completed in a proper fashion in a reasonable time frame.

Source: iedunote.com

Source: iedunote.com

The following is a simple explanantion: The following is a simple explanantion: Proper care should be taken to understand the project size, scope and duration so as determine a reasonable and accurate markup to allow the project to be completed in a proper fashion in a reasonable time frame. Overhead costs are important in determining how much a company must charge for its products or services in order to generate a profit. Overhead and profit is a term that goes by many names:

Source: allfinanceterms.com

Source: allfinanceterms.com

For property insurance adjusters and roofing or general contractors alike, it often sparks a debate. Overhead expense insurance — a form of health insurance that pays the overhead expenses of a business owner in the event of disability, such as rent, utilities, and employee salaries. Insurance restoration industry as general contractor’s o&p, or just o&p. After an insurer suffers a loss, such as roof damage from a storm, insurance companies work to reimburse them. The ultimate point of overhead and profit is that there’s a certain chunk of money that doesn’t fit into the “actual cash value” of your home.

Source: slidesharenow.blogspot.com

Source: slidesharenow.blogspot.com

Insurance restoration industry as general contractor’s o&p, or just o&p. In the insurance industry, overhead (10%) and profit (10%), commonly referred to as o&p, is owed when it becomes necessary to have multiple subcontractors perform work to repair damages to your property cause by a covered peril in the policy. Contractor expenses, often referred to as overhead and profit (o&p) is intended to cover the general contractor’s overhead and operating costs, as well as profit. It is usually insufficient to replace the damaged item. Overhead and profit are two different types of costs, but they’re almost always paired under the label “o & p” and stated as two separate numbers;

Source: kalkinemedia.com

Source: kalkinemedia.com

Overhead and profit are two different types of costs, but they’re almost always paired under the label “o & p” and stated as two separate numbers; The florida supreme court has explained that “overhead and profit are like all other costs of a repair, such as labor and materials, the insured is reasonably likely to incur. General overhead and profit percentages can be added in the estimate parameters window within an xactimate estimate. To understand this question, you must first know what o&p means. It is usually insufficient to replace the damaged item.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Overhead is typically classified as an indirect cost. Proper care should be taken to understand the project size, scope and duration so as determine a reasonable and accurate markup to allow the project to be completed in a proper fashion in a reasonable time frame. General overhead and profit percentages can be added in the estimate parameters window within an xactimate estimate. It can help pay for expense like salaries, rent, and utilities. Overhead is typically classified as an indirect cost.

Source: claimsmate.com

Source: claimsmate.com

Overhead and profit is generally charged by contractors, and so as a policyholder, it is ultimately part of your cost. Overhead expense insurance — a form of health insurance that pays the overhead expenses of a business owner in the event of disability, such as rent, utilities, and employee salaries. O&p, as it�s called, is typically 20% of the total amount of the estimate. The terms overhead and profit are used together by a business in reference to their profit and expenses. Overhead is typically classified as an indirect cost.

Source: myaccountingcourse.com

Source: myaccountingcourse.com

The internal revenue service definition is what Contractor expenses, often referred to as overhead and profit (o&p) is intended to cover the general contractor’s overhead and operating costs, as well as profit. In the insurance industry, overhead (10%) and profit (10%), commonly referred to as o&p, is owed when it becomes necessary to have multiple subcontractors perform work to repair damages to your property cause by a covered peril in the policy. It can help pay for expense like salaries, rent, and utilities. For example “10 and 10”.

Source: healthcarereform.procon.org

Source: healthcarereform.procon.org

Overhead is typically classified as an indirect cost. The mere mention of it to your agent is liable to send them sidestepping for a politically correct and often confusing answer. Overhead costs are operating expenses for necessary equipment and facilities. The overhead and profit is restricted to the rates set forth in the contractor’s submission to the rfp. Overhead and profit is a term that insurance companies like to avoid as much as possible.

Source: slidesharenow.blogspot.com

Source: slidesharenow.blogspot.com

Overhead is typically classified as an indirect cost. Overhead and profit is a term that goes by many names: The internal revenue service definition is what Overhead and profit is a term that goes by many names: Acv is the depreciated value of property at the time of the loss.

Source: logingit.com

Source: logingit.com

One common problem that has been arising is when overhead and profit should be paid in response to a property insurance claim. Profit is formally defined as “the excess of the selling price of goods over cost.”* profit is typically added to the cost In the insurance industry, overhead (10%) and profit (10%), commonly referred to as o&p, is owed when it becomes necessary to have multiple subcontractors perform work to repair damages to your property cause by a covered peril in the policy. Overhead is consist of the direct and indirect cost for company such as manpower cost, utility bills, office rental, labour, equipment cost and etc. Overhead insurance (or overhead expense insurance) is a type of insurance that business owners purchase to cover various business costs in the event that they become disabled.

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

The overhead and profit is restricted to the rates set forth in the contractor’s submission to the rfp. Insurance companies pay overhead and profit on property insurance claims. While profit is the a financial gain, the difference between the amount earned and the amount spent such as overhead. Overhead insurance (or overhead expense insurance) is a type of insurance that business owners purchase to cover various business costs in the event that they become disabled. It is typically estimated at 20% of the total amount of the contractor’s own rebuild or renovation estimate.

Source: ecosolutioons.blogspot.com

Source: ecosolutioons.blogspot.com

It is usually insufficient to replace the damaged item. The terms overhead and profit are used together by a business in reference to their profit and expenses. What does this mean to you, the insured? Overhead insurance (or overhead expense insurance) is a type of insurance that business owners purchase to cover various business costs in the event that they become disabled. Overhead expenses vary depending on the nature of the business and the industry it operates in.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title overhead and profit insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information