Overseas life insurance Idea

Home » Trending » Overseas life insurance IdeaYour Overseas life insurance images are ready. Overseas life insurance are a topic that is being searched for and liked by netizens today. You can Download the Overseas life insurance files here. Download all free images.

If you’re looking for overseas life insurance images information connected with to the overseas life insurance interest, you have visit the ideal blog. Our website always gives you hints for viewing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Overseas Life Insurance. Prudential or icici policy in india aia policy in singapore part of your australian superannuation or provident fund is it taxable? The fbar life insurance policy reporting rules have many components to it — and the reporting revolves around surrender value. Moving overseas for less than six months, depending on the country, probably won’t affect the operation of a life insurance policy, although some providers may restrict this to ‘holidays’ and short stays. And part of your australian superannuation

International term life insurance for expats is a key From gninsurance.com

International term life insurance for expats is a key From gninsurance.com

Rather, only certain life insurance policies are reportable once they have what is referred to as a surrender value. Moving overseas for less than six months, depending on the country, probably won’t affect the operation of a life insurance policy, although some providers may restrict this to ‘holidays’ and short stays. On your end, you pay regular premiums to the insurance company. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. This doesn’t make these policies any less financially sound, they just were not designed with the intent of complying with the internal revenue code. And part of your australian superannuation

No matter where you head when the sun is out, you have a guarantee to your safety if an unfortunate event happened.

When an individual takes out a life insurance policy overseas, one issue that arises is that these policies are not held to the same regulations. And part of your australian superannuation Not all life insurance policies are reported. Life insurance plans for expats living overseas an international life insurance policy is a contract between you, the policyholder, and an insurance company. International life insurance, anywhere in the world. Life insurance life insurance is much easier to deal with on an international scale than it once was.

Source: pinterest.com

Source: pinterest.com

And part of your australian superannuation Rather, only certain life insurance policies are reportable once they have what is referred to as a surrender value. Prudential or icici policy in india; On your end, you pay regular premiums to the insurance company. Individual solutions life insurance international life insurance.

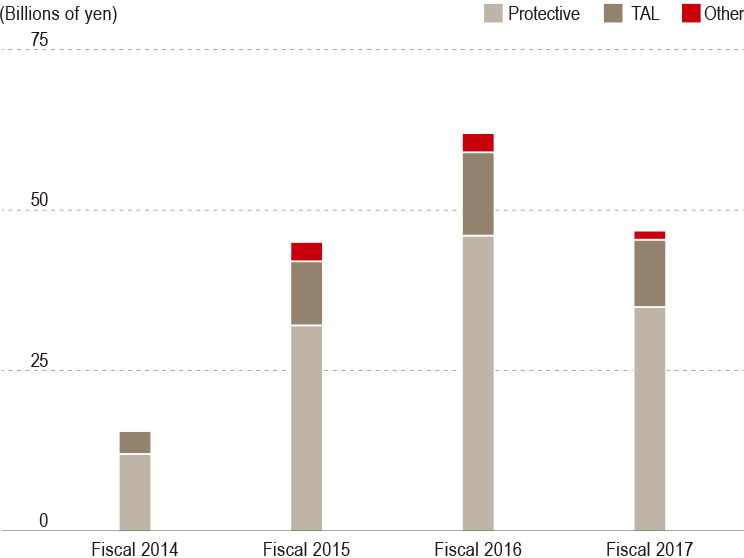

Source: dai-ichi-life-hd.com

Source: dai-ichi-life-hd.com

Cover when living & working abroad us$250k life benefits start at just us$22 per month 95% of claims paid in the last 5 years who needs international life insurance? Individual solutions life insurance international life insurance. International life insurance policies ensure that in the sad event of death while traveling or living abroad, a lump sum is paid to members of your family. You would report the maximum cash surrender value during the year. Means an insurance company which is not resident in the united kingdom but which carries on life assurance business in the united kingdom through a permanent establishment there,

Company Limited%2FChina Life Insurance (Overseas) Company Limited_2.jpg “CB3800 Business Practice Internship, City University of”) Source: cb.cityu.edu.hk

Life insurance companies care a lot about your travel plans, especially international destinations. Creating an international group life insurance scheme for your company can deliver this. When an individual takes out a life insurance policy overseas, one issue that arises is that these policies are not held to the same regulations. While overseas life insurance is not a standalone product, you can still get covered for life insurance when living abroad if you�re eligible. Define overseas life insurance company.

Source: aswesawit.com

Source: aswesawit.com

Expat term life insurance provides protection to your family in the event of your death when living overseas. No matter where you head when the sun is out, you have a guarantee to your safety if an unfortunate event happened. Rather, only certain life insurance policies are reportable once they have what is referred to as a surrender value. Prudential or icici policy in india; They are very popular investment vehicles abroad.

Source: clements.com

Source: clements.com

In the past it was only possible to buy life insurance in your home country if you maintained an active connection there (holding a driver’s license, maintaining a bank account, etc.). In the past it was only possible to buy life insurance in your home country if you maintained an active connection there (holding a driver’s license, maintaining a bank account, etc.). These reporting requirements are to the policy holder and not the beneficiary. For peace of mind for expatriates and travelers, you’ll need an international policy with a worldwide coverage. When an individual takes out a life insurance policy overseas, one issue that arises is that these policies are not held to the same regulations.

Source: expatriates.co.uk

Source: expatriates.co.uk

International life insurance policies ensure that in the sad event of death while traveling or living abroad, a lump sum is paid to members of your family. And part of your australian superannuation Individual solutions life insurance international life insurance. The money will help them to cover outstanding medical bills, repatriation of remains, funeral expenses, and similar costs. Prudential or icici policy in india;

Prudential or icici policy in india; Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Common examples of foreign life insurance policies, include: International life insurance providing international insurance protections to the world. Not all life insurance policies are reported.

Source: gninsurance.com

Source: gninsurance.com

You can insure your life up to 20 times your current annual salary (up to us$2m), and plans are available in us dollars, pounds sterling, euros, and uae dirhams. You would report the maximum cash surrender value during the year. Broadly speaking, you should be able to get uk life insurance if you live abroad for half of the year, so long as: These reporting requirements are to the policy holder and not the beneficiary. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: internationalinsurance.com

Source: internationalinsurance.com

Moving overseas for less than six months, depending on the country, probably won’t affect the operation of a life insurance policy, although some providers may restrict this to ‘holidays’ and short stays. Life insurance life insurance is much easier to deal with on an international scale than it once was. While overseas life insurance is not a standalone product, you can still get covered for life insurance when living abroad if you�re eligible. International life insurance policies ensure that in the sad event of death while traveling or living abroad, a lump sum is paid to members of your family. Foreign life insurance policies are life insurance policies that are based overseas.

Source: nriol.net

Source: nriol.net

For peace of mind for expatriates and travelers, you’ll need an international policy with a worldwide coverage. You would report the maximum cash surrender value during the year. For peace of mind for expatriates and travelers, you’ll need an international policy with a worldwide coverage. Prudential or icici policy in india; Individual solutions life insurance international life insurance.

The money will help them to cover outstanding medical bills, repatriation of remains, funeral expenses, and similar costs. While overseas life insurance is not a standalone product, you can still get covered for life insurance when living abroad if you�re eligible. Common examples of foreign life insurance policies, include: Life insurance life insurance is much easier to deal with on an international scale than it once was. Designed specifically with expats in mind, expatriate group offer expat life insurance with worldwide protection and can cover periods of one to 30 years.

Source: lifeinsurancedirect.com.au

Source: lifeinsurancedirect.com.au

Moving overseas for less than six months, depending on the country, probably won’t affect the operation of a life insurance policy, although some providers may restrict this to ‘holidays’ and short stays. Prudential or icici policy in india aia policy in singapore part of your australian superannuation or provident fund is it taxable? And part of your australian superannuation This doesn’t make these policies any less financially sound, they just were not designed with the intent of complying with the internal revenue code. You can insure your life up to 20 times your current annual salary (up to us$2m), and plans are available in us dollars, pounds sterling, euros, and uae dirhams.

Source: medium.com

Source: medium.com

Moving overseas for less than six months, depending on the country, probably won’t affect the operation of a life insurance policy, although some providers may restrict this to ‘holidays’ and short stays. They are very popular investment vehicles abroad. Creating an international group life insurance scheme for your company can deliver this. Foreign life insurance policies are life insurance policies that are based overseas. In exchange, the insurance company pays a financial benefit to the beneficiaries you’ve selected when you pass away.

Source: gninsurance.com

Source: gninsurance.com

Means an insurance company which is not resident in the united kingdom but which carries on life assurance business in the united kingdom through a permanent establishment there, On your end, you pay regular premiums to the insurance company. Work with a partner who understands the value of what you‘ve worked so hard to achieve. This doesn’t make these policies any less financially sound, they just were not designed with the intent of complying with the internal revenue code. Life insurance plans for expats living overseas an international life insurance policy is a contract between you, the policyholder, and an insurance company.

Source: hk.joblum.com

Source: hk.joblum.com

Not all life insurance policies are reported. Creating an international group life insurance scheme for your company can deliver this. You can insure your life up to 20 times your current annual salary (up to us$2m), and plans are available in us dollars, pounds sterling, euros, and uae dirhams. Individual solutions life insurance international life insurance. When an individual takes out a life insurance policy overseas, one issue that arises is that these policies are not held to the same regulations.

Source: internations.org

Source: internations.org

Means an insurance company which is not resident in the united kingdom but which carries on life assurance business in the united kingdom through a permanent establishment there, Designed specifically with expats in mind, expatriate group offer expat life insurance with worldwide protection and can cover periods of one to 30 years. These reporting requirements are to the policy holder and not the beneficiary. Prudential or icici policy in india aia policy in singapore part of your australian superannuation or provident fund is it taxable? Common examples of foreign life insurance policies, include:

Source: visual.ly

Source: visual.ly

International life insurance providing international insurance protections to the world. Define overseas life insurance company. If you already have life insurance, your policy won’t be affected by a death caused by coronavirus. This doesn’t make these policies any less financially sound, they just were not designed with the intent of complying with the internal revenue code. Life insurance life insurance is much easier to deal with on an international scale than it once was.

Source: jobstreet.com.ph

Source: jobstreet.com.ph

The classical case of life insurance is often called “term insurance”. In exchange, the insurance company pays a financial benefit to the beneficiaries you’ve selected when you pass away. Foreign life insurance policies are life insurance policies that are based overseas. No matter where you head when the sun is out, you have a guarantee to your safety if an unfortunate event happened. For peace of mind for expatriates and travelers, you’ll need an international policy with a worldwide coverage.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title overseas life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information