Own damage claim in motor insurance Idea

Home » Trend » Own damage claim in motor insurance IdeaYour Own damage claim in motor insurance images are available. Own damage claim in motor insurance are a topic that is being searched for and liked by netizens today. You can Get the Own damage claim in motor insurance files here. Find and Download all royalty-free photos.

If you’re looking for own damage claim in motor insurance images information connected with to the own damage claim in motor insurance topic, you have come to the ideal site. Our website frequently provides you with hints for seeking the maximum quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

Own Damage Claim In Motor Insurance. You can make an own damage claim to either repair or replace the bumper. To cover own damage losses and act liability. Motor insurance diploma in insurance services form “b” : In witness whereof, i have hereunto set/affixed my signature this _____ at _____, philippines.

Damaged your car? Why thirdparty insurance claims might From businesstoday.in

Damaged your car? Why thirdparty insurance claims might From businesstoday.in

Voluntary deductibles is the money that you have chosen to pay on your own while filing claims with the insurer. What is own damage car insurance? In witness whereof, i have hereunto set/affixed my signature this _____ at _____, philippines. Own damage car insurance a.k.a. You have a comprehensive policy. You will be covered for the repair cost and replacement of the damaged parts of your car with your insurance.

Covers available under a motor insurance policy:

If you’re filing an own damage claim, you must contact your car insurance provider to request for a representative to inspect the scene of the accident. You have a comprehensive policy. When you buy a comprehensive motor insurance policy, you are covered for own damage, ie if your own vehicle is damaged, you can get the insurer to pay for the damage, whether or not you are at fault. You can make an own damage claim to either repair or replace the bumper. Insurance claims help pay for the repair of the vehicle and other financial issues incurred. Section 1 normally covers own damage claim.

Source: icicilombard.com

Source: icicilombard.com

When you buy a comprehensive motor insurance policy, you are covered for own damage, ie if your own vehicle is damaged, you can get the insurer to pay for the damage, whether or not you are at fault. Own damage (od) helps you stay covered against damage caused to your vehicle due to accidents like fire, theft, etc. A claim under a motor insurance policy could be for personal injury or property damage related to someone else. What is covered by a standard comprehensive motor policy: You will be covered for the repair cost and replacement of the damaged parts of your car with your insurance.

Source: relakhs.com

Source: relakhs.com

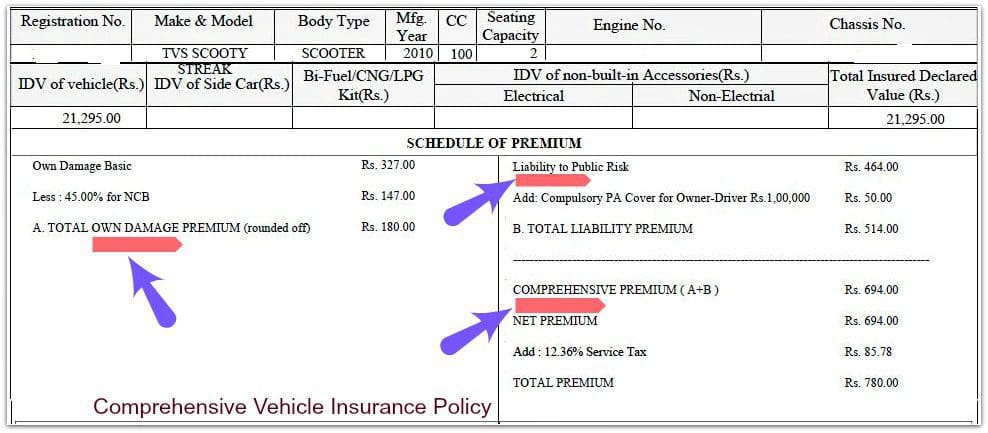

Your ncd (no claims discount) is forfeited when you make this claim. How to file an own damage car insurance claim? You have a comprehensive policy. A claim under a motor insurance policy could be for personal injury or property damage related to someone else. Own damage premium on the other hand is computed based on the idv, year of purchase, location and type of the vehicle.

Source: mintwise.com

Source: mintwise.com

By increasing your voluntary deductibles percentage you can reduce your own damage premium. This person is called a third party in this context) or for damage to your own, insured, vehicle. A claim under a motor insurance policy could be for personal injury or property damage related to someone else. You can buy own damage cover standalone (in practice from. When you damage your own car on the road, you will need to file an own damage claim.

Source: dreamstime.com

Source: dreamstime.com

Additionally, it carries a deductible, which means a certain amount you must pay as your participation in the claim. Own damage (od) helps you stay covered against damage caused to your vehicle due to accidents like fire, theft, etc. Required documents for submitting claim: However, you will lose your ncd entitlement. Own damage claim this is when you make a damage claim against your insurance policy.

Source: anidjarlevine.com

Source: anidjarlevine.com

Own damage premium on the other hand is computed based on the idv, year of purchase, location and type of the vehicle. Voluntary deductibles is the money that you have chosen to pay on your own while filing claims with the insurer. In witness whereof, i have hereunto set/affixed my signature this _____ at _____, philippines. It is fixed by the insurance regulator depending on the cubic capacity of the vehicle. Your ncd (no claims discount) is forfeited when you make this claim.

Source: formsbirds.com

Source: formsbirds.com

$500 (section 1 only) means the excess applies to an own damage claim only. What is own damage car insurance? Od insurance is a motor insurance policy that is intended to safeguard your car against unforeseen own damages. A claim under a motor insurance policy could be for personal injury or property damage related to someone else. Own damage claim this refers to making a claim on your own insurance policy, i.e.

Source: andymohrcollision.com

Source: andymohrcollision.com

The policy can also be extended to cover additional liabilities as provided in the tariff. Buying a car involves more than just being able to drive — it’s important to know all the different ways you can protect your investment, your. Od insurance is a motor insurance policy that is intended to safeguard your car against unforeseen own damages. Additionally, it carries a deductible, which means a certain amount you must pay as your participation in the claim. Own damage car insurance is helpful in case of damages caused to the car owing to natural calamities such as storms, earthquakes, floods etc.

Source: businesstoday.in

Source: businesstoday.in

Od insurance is a motor insurance policy that is intended to safeguard your car against unforeseen own damages. Additionally, it carries a deductible, which means a certain amount you must pay as your participation in the claim. If a driver gets behind the wheel of his or her car and suffers damage, then a claim may be filed under the collision provision. A claim towards loss or damages sustained by your vehicle in an accident on your own policy with comprehensive coverage. In notifying your insurance company of the accident, enquire about the names of approved workshops to.

Source: researchgate.net

Source: researchgate.net

Own damage car insurance coverage is based on your car’s fair market value. What are the benefits of car own damage insurance? You can make an own damage claim to either repair or replace the bumper. Original accident report duly signed by traffic department or najm company with the information required. Keep your policy number and engine chassis number handy and mention the exact date and time of the accident when asked.

Source: youtube.com

Source: youtube.com

Own damage car insurance a.k.a. You can make an own damage claim to either repair or replace the bumper. What are the benefits of car own damage insurance? In case of an accident, an own damage cover compensates you for expense to repair or replace parts of your car damaged in the accident. Covers available under a motor insurance policy:

Source: dreamstime.com

Source: dreamstime.com

Note that you can only make an own damage claim if you own comprehensive insurance. Own damage car insurance a.k.a. Keep your policy number and engine chassis number handy and mention the exact date and time of the accident when asked. A claim towards loss or damages sustained by your vehicle in an accident on your own policy with comprehensive coverage. Covers available under a motor insurance policy:

Source: takemycounsel.com

Source: takemycounsel.com

Note that you can only make an own damage claim if you own comprehensive insurance. Covers available under a motor insurance policy: The accident does not even have to involve hitting another car. If a driver gets behind the wheel of his or her car and suffers damage, then a claim may be filed under the collision provision. Form “a” is called “standard form for “a” policy for act liability”.

Source: formsbirds.com

Source: formsbirds.com

A claim under a motor insurance policy could be for personal injury or property damage related to someone else. Keep your policy number and engine chassis number handy and mention the exact date and time of the accident when asked. A claim towards loss or damages sustained by your vehicle in an accident on your own policy with comprehensive coverage. Voluntary deductibles is the money that you have chosen to pay on your own while filing claims with the insurer. Form “a” is called “standard form for “a” policy for act liability”.

Source: dreamstime.com

Source: dreamstime.com

However, you will lose your ncd entitlement. If a driver gets behind the wheel of his or her car and suffers damage, then a claim may be filed under the collision provision. A claim towards loss or damages sustained by your vehicle in an accident on your own policy with comprehensive coverage. There are insurance companies that provide own damage insurance cover for your vehicle. Additionally, it carries a deductible, which means a certain amount you must pay as your participation in the claim.

Source: dreamstime.com

Source: dreamstime.com

What is covered by a standard comprehensive motor policy: A claim under a motor insurance policy could be for personal injury or property damage related to someone else. Form “a” is called “standard form for “a” policy for act liability”. In witness whereof, i have hereunto set/affixed my signature this _____ at _____, philippines. To cover own damage losses and act liability.

Source: thebalance.com

Source: thebalance.com

Motor insurance diploma in insurance services form “b” : While you can opt for the reimbursement claim process, choosing cashless claims method is an absolute convenience. You can buy own damage cover standalone (in practice from. I am executing this affidavit to attest to the truth of the forgoing and in support of the claim against the insurer for the repair of the damage caused to my vehicle. To cover own damage losses and act liability.

Source: actionlifemedia.com

Source: actionlifemedia.com

You have a comprehensive policy. How to file an own damage car insurance claim? What is covered by a standard comprehensive motor policy: To cover own damage losses and act liability. In notifying your insurance company of the accident, enquire about the names of approved workshops to.

Source: johnnyphillipslaw.com

Source: johnnyphillipslaw.com

Voluntary deductibles is the money that you have chosen to pay on your own while filing claims with the insurer. The own damage cover allows you to compensate for the repair and replacement expenses. This person is called a third party in this context) or for damage to your own, insured, vehicle. When you damage your own car on the road, you will need to file an own damage claim. It is fixed by the insurance regulator depending on the cubic capacity of the vehicle.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title own damage claim in motor insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information