P c insurance market share canada information

Home » Trend » P c insurance market share canada informationYour P c insurance market share canada images are available. P c insurance market share canada are a topic that is being searched for and liked by netizens now. You can Find and Download the P c insurance market share canada files here. Get all free images.

If you’re searching for p c insurance market share canada images information related to the p c insurance market share canada topic, you have visit the right blog. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

P C Insurance Market Share Canada. Insurance bureau of canada (ibc) Life and health insurers’ market shares in canada in 2020. Property and casualty (p&c) insurance in addition to life insurance companies, there are a large number of companies in canada that offer p&c insurance. To demonstrate the industry�s annual contribution to the canadian economy.

For more information, visit www.ibc.ca. Ibc is the trade association representing canada’s private property and casualty (p&c) insurance companies. Domestic carriers regularly dominate their markets, maintaining a higher market share and better profitability compared with multinational players. Since 1972, ibc has published facts to provide a snapshot of the state of the p&c insurance industry. Includes only insurance carriers that require all customers to bind online. By comparing market dynamics, we found that p&c overwhelmingly remains a local game in many countries.

Around three in four canadians have auto insurance generally high willingness to share data for lower premiums;

For many, a merger or acquisition (m&a) may be the solution. In 2018, private p&c insurers wrote cad 13.2 billion in direct written premiums for personal property insurance and paid out cad 7.8 billion for direct claims incurred. Effectively target insurance department resources. Property and casualty (p&c) insurance in addition to life insurance companies, there are a large number of companies in canada that offer p&c insurance. We have written this piece to share our observations on issues that have an impact on mergers and acquisitions (m&a) activity in the canadian property and casualty (p&c) insurance industry. M&a activity in the canadian insurance sector was relatively modest in 2013:

Source: manometcurrent.com

Source: manometcurrent.com

Ibc publishes facts of the property and casualty insurance industry in canada. This is important when responding to market or financial conditions in their jurisdiction. P&c insurance touches the lives of nearly every canadian and plays a critical role in keeping businesses safe and the canadian economy strong. Statistics for canada are available here. The property/casualty market share report serves as an important tool for insurance regulators and can help them identify the top p/c writers in their jurisdictionknowing this allows them to quickly and.

Source: xprimm.com

Source: xprimm.com

Ibc publishes facts of the property and casualty insurance industry in canada. For many, a merger or acquisition (m&a) may be the solution. Feb 2, 2022 the canadian insurer intact group emerged as the leading canadian private property and casualty insurer in 2019, with 15.08 percent of the market share. Life and health insurers’ market shares in canada in 2020. Around three in four canadians have auto insurance generally high willingness to share data for lower premiums;

Source: fsco.gov.on.ca

Source: fsco.gov.on.ca

For many, a merger or acquisition (m&a) may be the solution. For more information, visit www.ibc.ca. Intact earnings passed the $2 billion mark in 2021. Insurance brokerage sets up employee solutions for indigenous workforces. Feb 2, 2022 the canadian insurer intact group emerged as the leading canadian private property and casualty insurer in 2019, with 15.08 percent of the market share.

Source: marketprimes.com

Source: marketprimes.com

Facts of the property and casualty insurance industry in canada 2020 is. Whereas life insurance covers risks associated with human mortality and morbidity, p&c insurance is focused on risks that result in loss to property and possessions. Fraser group produces the group universe report for its clients each year estimating market size and market share of the canadian group life and health business. For many, a merger or acquisition (m&a) may be the solution. Statistics for canada are available here.

It employs more than 128,000 canadians, pays $9.4 billion in taxes and has a total premium base of $59.6 billion. In the first six months of 2020, the p&c industry (including personal and In 2018, canadian p&c insurers paid out $39.1 billionin claims. Of its $175.7 billion in total assets, the p&c insurance industry had$117.0 billionin invested assets in 2018. For more information, visit www.ibc.ca.

Source: sec.gov

Source: sec.gov

Ibc is the trade association representing canada’s private property and casualty (p&c) insurance companies. Of its $175.7 billion in total assets, the p&c insurance industry had$117.0 billionin invested assets in 2018. Feb 2, 2022 the canadian insurer intact group emerged as the leading canadian private property and casualty insurer in 2019, with 15.08 percent of the market share. Our business has grown organically and through acquisitions to over $20 billion of total annual premiums. M&a activity in the canadian insurance sector was relatively modest in 2013:

Since 1972, ibc has published facts to provide a snapshot of the state of the p&c insurance industry. The property/casualty market share report serves as an important tool for insurance regulators and can help them identify the top p/c writers in their jurisdictionknowing this allows them to quickly and. To demonstrate the industry�s annual contribution to the canadian economy. A public summary is available for download below. For more information, visit www.ibc.ca.

Source: pinterest.com

Source: pinterest.com

Scope of the report this report aims to provide a detailed analysis of the property and casualty insurance market in. The rise in losses from extreme weather is a key contributor to insurers’ underwriting profit pressures and the shift into a hard market in 2019. A public summary is available for download below. Published by insurance bureau of canada (ibc). Whereas life insurance covers risks associated with human mortality and morbidity, p&c insurance is focused on risks that result in loss to property and possessions.

Source: appsruntheworld.com

Source: appsruntheworld.com

100 buyers for every seller. Fraser group produces the group universe report for its clients each year estimating market size and market share of the canadian group life and health business. Facts of the property and casualty insurance industry in canada 2020 is. Insurance brokerage sets up employee solutions for indigenous workforces. Equitable offers health monitoring to all ci claimants.

Source: slideserve.com

Source: slideserve.com

Insurance bureau of canada (ibc) The underwriting performance of canada’s property/casualty industry overall has been consistent in recent years, and even through year. Facts of the property and casualty insurance industry in canada 2020 is. Equitable offers health monitoring to all ci claimants. The report covers the market size, recent trends, growth, and competitive analysis.

Source: blog.coverwallet.com

Source: blog.coverwallet.com

To demonstrate the industry�s annual contribution to the canadian economy. For more information, visit www.ibc.ca. On wednesday, mclean presented a slide showing that intact, desjardins, aviva, lloyd’s underwriters and wawanesa had market share in. Equitable offers health monitoring to all ci claimants. 100 buyers for every seller.

Source: youtube.com

Source: youtube.com

We have written this piece to share our observations on issues that have an impact on mergers and acquisitions (m&a) activity in the canadian property and casualty (p&c) insurance industry. Statistics for canada are available here. It employs more than 128,000 canadians, pays $9.4 billion in taxes and has a total premium base of $59.6 billion. In the first six months of 2020, the p&c industry (including personal and We are the largest provider of property and casualty (p&c) insurance in canada with an estimated market share of 21%, a leading provider of global specialty insurance, and, with rsa, a leader in the u.k.

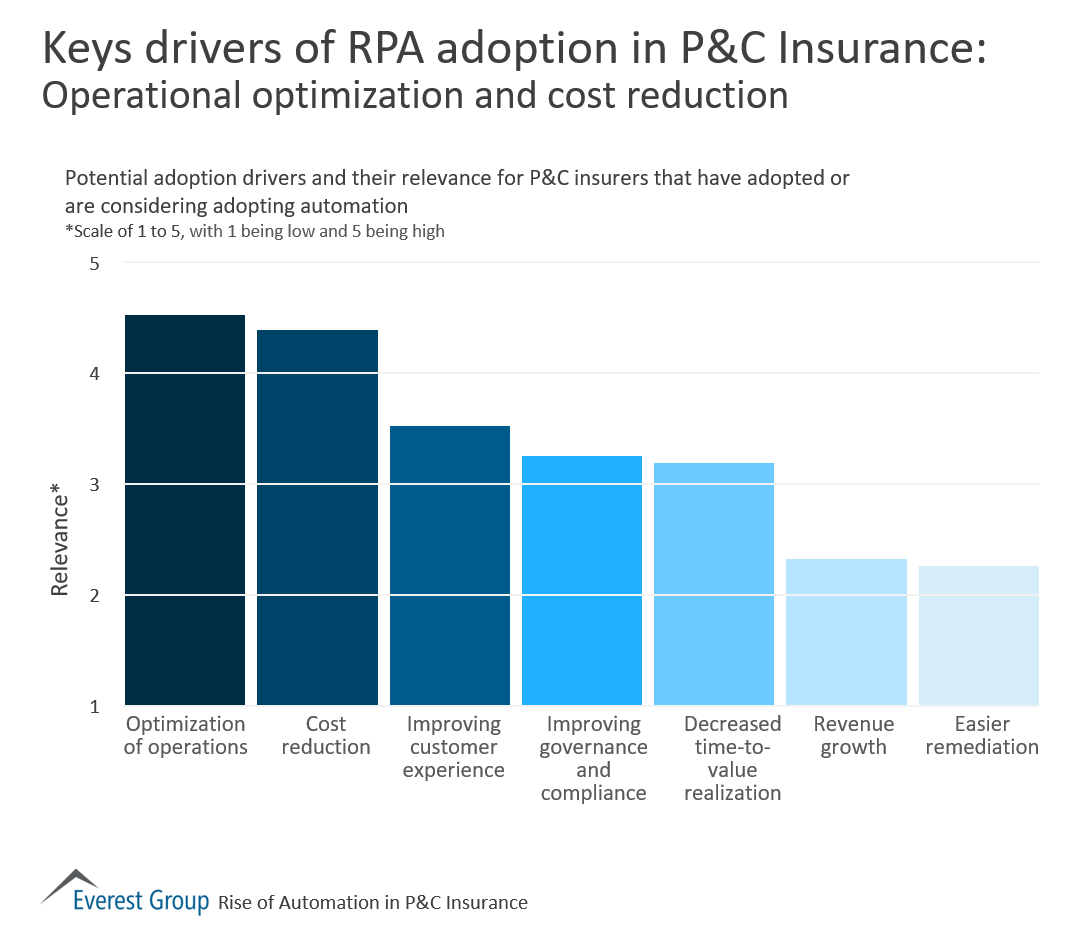

Source: everestgrp.com

Source: everestgrp.com

By comparing market dynamics, we found that p&c overwhelmingly remains a local game in many countries. We are the largest provider of property and casualty (p&c) insurance in canada with an estimated market share of 21%, a leading provider of global specialty insurance, and, with rsa, a leader in the u.k. Life and health insurers’ market shares in canada in 2020. Our business has grown organically and through acquisitions to over $20 billion of total annual premiums. It employs more than 128,000 canadians, pays $9.4 billion in taxes and has a total premium base of $59.6 billion.

Source: munichre.com

Source: munichre.com

Includes only insurance carriers that require all customers to bind online. Ibc is the trade association representing canada’s private property and casualty (p&c) insurance companies. Effectively target insurance department resources. Our business has grown organically and through acquisitions to over $20 billion of total annual premiums. We are the seventh largest p&c insurance carrier in canada and the fourth largest in the broker channel.

Source: appsruntheworld.com

Source: appsruntheworld.com

In 2018, private p&c insurers wrote cad 13.2 billion in direct written premiums for personal property insurance and paid out cad 7.8 billion for direct claims incurred. This is important when responding to market or financial conditions in their jurisdiction. Equitable offers health monitoring to all ci claimants. For more information, visit www.ibc.ca. This report looks at ownership rates for auto and home insurance products, choice of company, usage of and interest in smart home products and driving tracking devices, willingness to share data,

Source: repairerdrivennews.com

Source: repairerdrivennews.com

The property/casualty market share report serves as an important tool for insurance regulators and can help them identify the top p/c writers in their jurisdictionknowing this allows them to quickly and. For more information, visit www.ibc.ca. Equitable offers health monitoring to all ci claimants. Intact earnings passed the $2 billion mark in 2021. Life and health insurers’ market shares in canada in 2020.

Source: insurance-canada.ca

Source: insurance-canada.ca

In its new best’s market segment report, titled, “canada insurance: Property and casualty (p&c) insurance in addition to life insurance companies, there are a large number of companies in canada that offer p&c insurance. Facts of the property and casualty insurance industry in canada 2020 is. It also serves as a consumer guide to how insurance works. M&a activity in the canadian insurance sector was relatively modest in 2013:

Source: repairerdrivennews.com

Source: repairerdrivennews.com

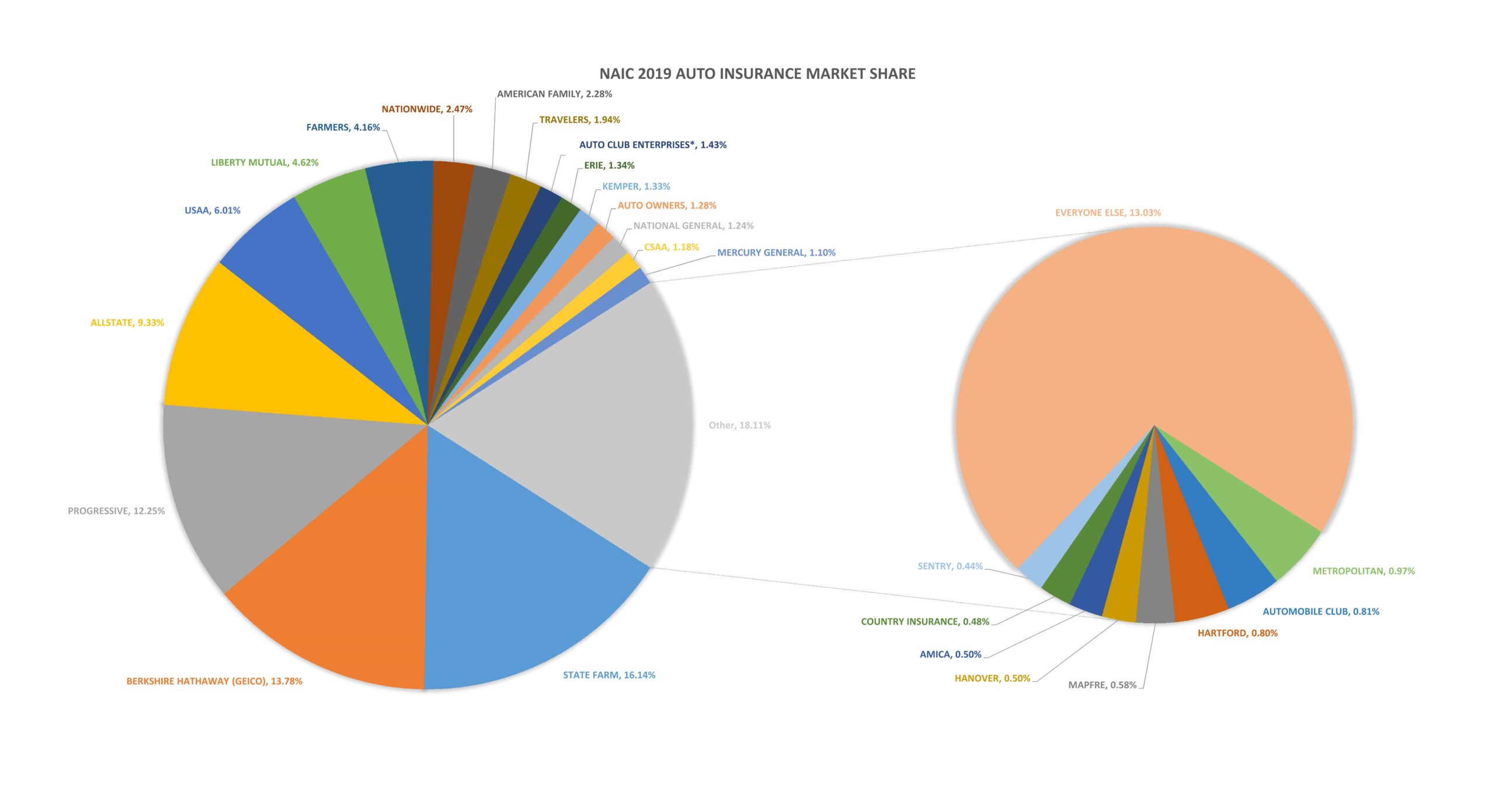

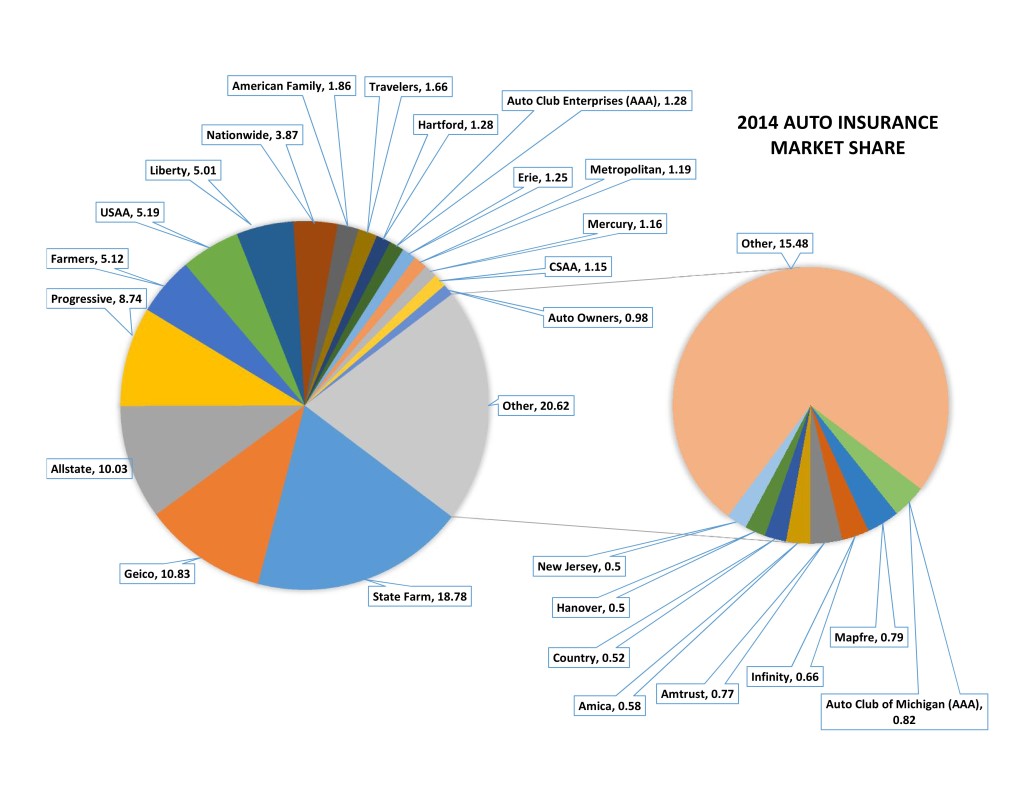

1 based on market share by dwp. Feb 2, 2022 the canadian insurer intact group emerged as the leading canadian private property and casualty insurer in 2019, with 15.08 percent of the market share. In 2018, canadian p&c insurers paid out $39.1 billionin claims. Of its $175.7 billion in total assets, the p&c insurance industry had$117.0 billionin invested assets in 2018. 42.0%of direct written premiums were for car insurance in 2018.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title p c insurance market share canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information