P c vs life insurance Idea

Home » Trending » P c vs life insurance IdeaYour P c vs life insurance images are ready in this website. P c vs life insurance are a topic that is being searched for and liked by netizens today. You can Download the P c vs life insurance files here. Find and Download all free photos and vectors.

If you’re searching for p c vs life insurance pictures information related to the p c vs life insurance keyword, you have come to the right blog. Our site always gives you hints for downloading the maximum quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

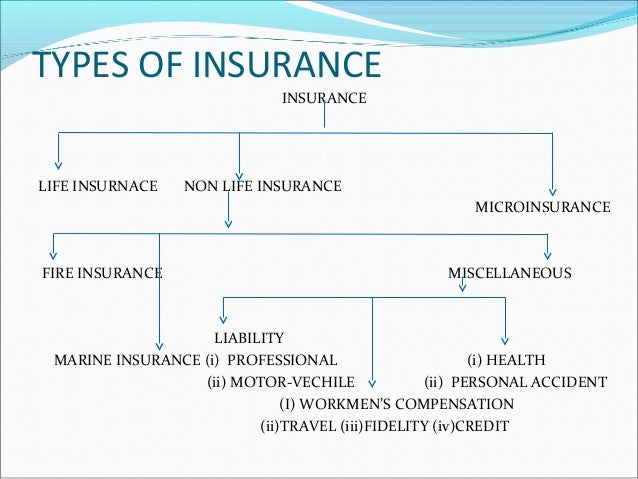

P C Vs Life Insurance. Remember that starting out in insurance, there can be fairly large discrepancies between salaries in the different insurance lines, for example, between life and health vs property and casualty insurance base incomes. The type of risk determines the type of insurance policy, whether it is. Life products are much longer in duration, and are generally more complicated. Life, p&c insurers in harmony historically life and property casualty insurance companies have typically had different investment themes, even though they have had access to all the same technology building blocks.

(PDF) Measuring underwriting profitability of the nonlife From researchgate.net

(PDF) Measuring underwriting profitability of the nonlife From researchgate.net

Whereas life insurance covers risks associated with human mortality and morbidity, p&c insurance is focused on risks that result in loss to property and possessions. The type of risk determines the type of insurance policy, whether it is. A lot of investment style products require stochastic modelling, and a lot of the products are backed by options that need to be valued using interested techniques. Life insurance covers the risk of the policy holder’s death; P&c insurance contracts insure the policyholders from liability, risks to property, and casualty, such as. You must be knowledgeable about your products.

Furthermore, what is property & casualty insurance?

Auto insurance, which covers losses to individuals and property due to accidents and other unforeseen events Chairman, life insurance corporation of india and others date of judgment: 23951 of 2005) s.b sinha, j. The 6 vs of big data in insurance are all about helping insurers maximize the data they’re collecting. Whether you’re living with dependent on your family or not, having a life insurance policy is significant as it protects your loved ones financially if you die in an unfortunate event. J u d g m e n t (arising out of slp (c) no.

Source: valuewalk.com

Source: valuewalk.com

However, homeowners� insurance will typically cover any exterior damages, as well as property that was inside of the residence. You must be knowledgeable about your products. P&c insurance generally cover short time horizons, whereas life insurance policies span across decades; Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. 23951 of 2005) s.b sinha, j.

Source: sec.report

Source: sec.report

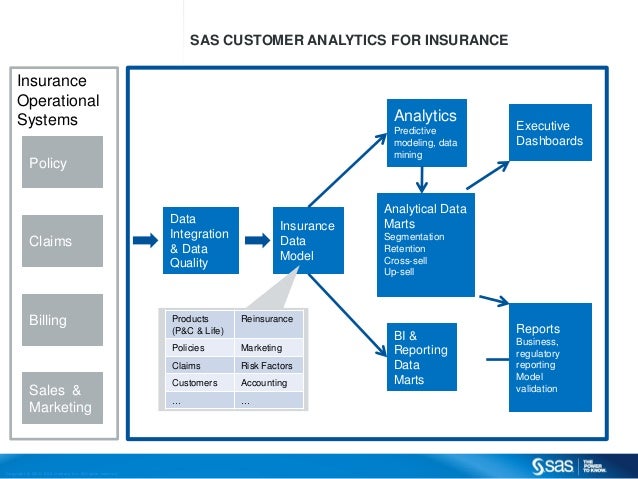

The type of risk determines the type of insurance policy, whether it is. P&c insurance generally cover short time horizons, whereas life insurance policies span across decades; Not only should you be able to answer the “what” about your products, but the “why” as well. P&c insurance makes use of reinsurance to manage the associated risk; To achieve that, p&c insurers are implementing predictive analytics systems to leverage their big data and glean actionable insights about their customers, operations, and business practices.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Life insurance companies use reinsurance and product diversification to mitigate risk on their insurance products Whether you’re living with dependent on your family or not, having a life insurance policy is significant as it protects your loved ones financially if you die in an unfortunate event. We used all sorts of models to value our business. 23951 of 2005) s.b sinha, j.

Source: sandeepbhowmick.blogspot.com

Source: sandeepbhowmick.blogspot.com

However, homeowners� insurance will typically cover any exterior damages, as well as property that was inside of the residence. Similarly, buying general insurance policies like motor insurance, home insurance, travel, and health should be a priority. How is day to day different and how does the sales. Auto insurance, which covers losses to individuals and property due to accidents and other unforeseen events Chairman, life insurance corporation of india and others supreme court of india (nov 20, 2007) nov 20, 2007

Source: sketchbookdeogl.blogspot.com

Source: sketchbookdeogl.blogspot.com

Life insurance covers the risk of the policy holder’s death; Chairman, life insurance corporation of india and others supreme court of india (nov 20, 2007) nov 20, 2007 Property and casualty insurance, or p&c insurance, is an umbrella term to describe a bunch of different types of insurance, covering your personal property and offering liability coverage. Whether you’re living with dependent on your family or not, having a life insurance policy is significant as it protects your loved ones financially if you die in an unfortunate event. Furthermore, what is property & casualty insurance?

Source: slideshare.net

Source: slideshare.net

P&c insurance contracts insure the policyholders from liability, risks to property, and casualty, such as. However, homeowners� insurance will typically cover any exterior damages, as well as property that was inside of the residence. In terms of difference in income by line, life and health agents tend to have an easier time earning commissions upfront, while. I would love some advice on what similarities and differences there are between p&c and health and life based on your experiences. Whereas life insurance covers risks associated with human mortality and morbidity, p&c insurance is focused on risks that result in loss to property and possessions.

Source: researchgate.net

Source: researchgate.net

Whether you’re living with dependent on your family or not, having a life insurance policy is significant as it protects your loved ones financially if you die in an unfortunate event. Some examples of this include: Similarly, buying general insurance policies like motor insurance, home insurance, travel, and health should be a priority. Life, p&c insurers in harmony historically life and property casualty insurance companies have typically had different investment themes, even though they have had access to all the same technology building blocks. Furthermore, what is property & casualty insurance?

Source: cbinsights.com

Source: cbinsights.com

Some examples of this include: How is day to day different and how does the sales. Anna rapoport, mba on linkedin moody�s talks focus on from www.linkedin.com I would love some advice on what similarities and differences there are between p&c and health and life based on your experiences. Also included in this category is fire protection and liability insurance in case your clients are responsible for an accident causing injuries to another person or damage to another person’s belongings or.

Broadly speaking, property insurance refers to your personal belongings ie. Whereas life insurance covers risks associated with human mortality and morbidity, p&c insurance is focused on risks that result in loss to property and possessions. It also covers liability issues to protect people against lawsuits that might come their way. Life, p&c insurers in harmony historically life and property casualty insurance companies have typically had different investment themes, even though they have had access to all the same technology building blocks. Anna rapoport, mba on linkedin moody�s talks focus on from www.linkedin.com

Source: dailyfintech.com

Source: dailyfintech.com

Sinha & harjit singh bedi judgment: It also covers liability issues to protect people against lawsuits that might come their way. Homeowners� and condo insurance can go hand in hand as they both cover the interior structures of the residence; P&c insurance contracts insure the policyholders from. Key players in the life insurance sector include metlife (met), prudential financial (pru), and aflac (afl).

Source: icaagencyalliance.com

Source: icaagencyalliance.com

After employment with a home services company terminated due to office closure i am once again looking at insurance sales. Appeal (civil) 5322 of 2007 petitioner: Life insurance companies use reinsurance and product diversification to mitigate risk on their insurance products Property and casualty insurance, or p&c insurance, is an umbrella term to describe a bunch of different types of insurance, covering your personal property and offering liability coverage. Some examples of this include:

Source: pwc.com

Some examples of this include: In terms of difference in income by line, life and health agents tend to have an easier time earning commissions upfront, while. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. You must be knowledgeable about your products. A lot of investment style products require stochastic modelling, and a lot of the products are backed by options that need to be valued using interested techniques.

Whereas life insurance covers risks associated with human mortality and morbidity, p&c insurance is focused on risks that result in loss to property and possessions. The 6 vs of big data in insurance are all about helping insurers maximize the data they’re collecting. Sinha & harjit singh bedi judgment: P&c insurance makes use of reinsurance to manage the associated risk; Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: researchgate.net

Source: researchgate.net

After employment with a home services company terminated due to office closure i am once again looking at insurance sales. Chairman, life insurance corporation of india and others supreme court of india (nov 20, 2007) nov 20, 2007 Car insurance is generally required to legally drive throughout the country and is the most common type of p&c insurance policy. Also included in this category is fire protection and liability insurance in case your clients are responsible for an accident causing injuries to another person or damage to another person’s belongings or. Similarly, buying general insurance policies like motor insurance, home insurance, travel, and health should be a priority.

Source: cbinsights.com

Source: cbinsights.com

P&c insurance does not include other types of insurance coverage such as life insurance, health insurance, and fire insurance. P&c insurance generally cover short time horizons, whereas life insurance policies span across decades; I would love some advice on what similarities and differences there are between p&c and health and life based on your experiences. In terms of difference in income by line, life and health agents tend to have an easier time earning commissions upfront, while. Furthermore, what is property & casualty insurance?

Source: researchgate.net

Source: researchgate.net

Also included in this category is fire protection and liability insurance in case your clients are responsible for an accident causing injuries to another person or damage to another person’s belongings or. Broadly speaking, property insurance refers to your personal belongings ie. P&c insurance contracts insure the policyholders from liability, risks to property, and casualty, such as. Homeowners� and condo insurance can go hand in hand as they both cover the interior structures of the residence; 23951 of 2005) s.b sinha, j.

Source: patelinsuranceservices.co.in

Source: patelinsuranceservices.co.in

It also covers liability issues to protect people against lawsuits that might come their way. Broadly speaking, property insurance refers to your personal belongings ie. Also included in this category is fire protection and liability insurance in case your clients are responsible for an accident causing injuries to another person or damage to another person’s belongings or. How is day to day different and how does the sales. Life insurance companies use reinsurance and product diversification to mitigate risk on their insurance products

Source: slideshare.net

Source: slideshare.net

In terms of difference in income by line, life and health agents tend to have an easier time earning commissions upfront, while. The type of risk determines the type of insurance policy, whether it is. We used all sorts of models to value our business. Life insurance companies use reinsurance and product diversification to mitigate risk on their insurance products Homeowners� and condo insurance can go hand in hand as they both cover the interior structures of the residence;

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title p c vs life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information