Parametric insurance information

Home » Trending » Parametric insurance informationYour Parametric insurance images are ready in this website. Parametric insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Parametric insurance files here. Download all royalty-free vectors.

If you’re looking for parametric insurance pictures information related to the parametric insurance topic, you have come to the ideal blog. Our website frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

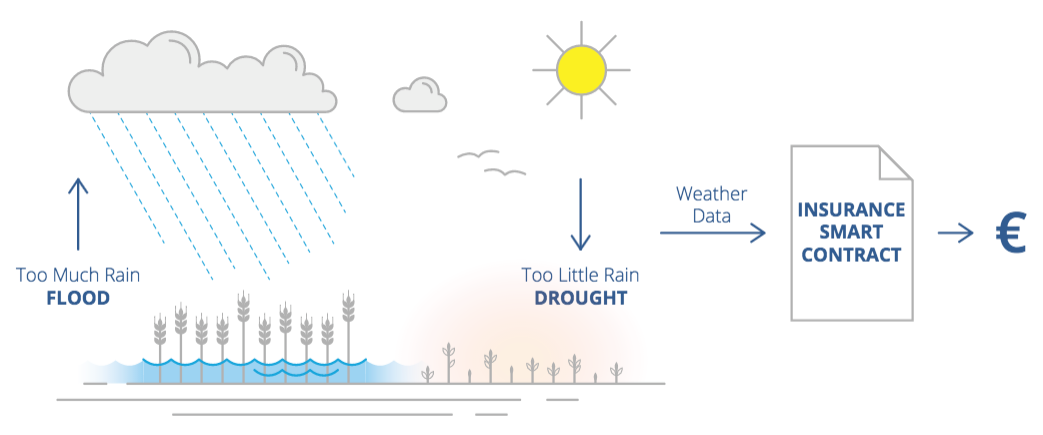

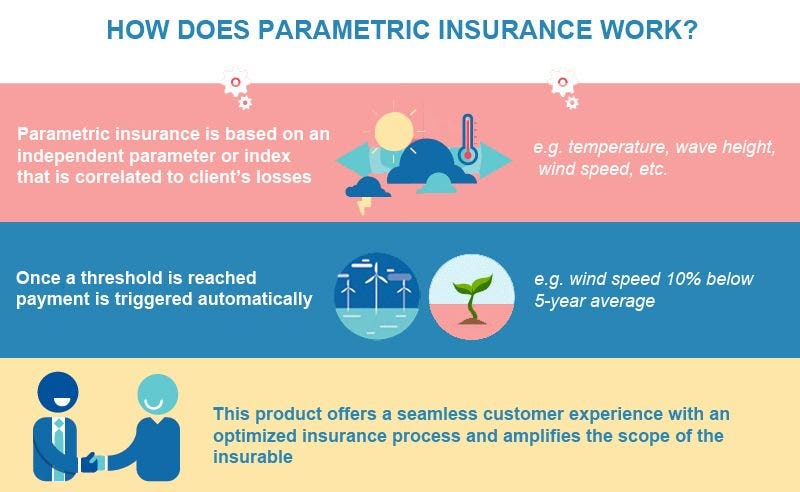

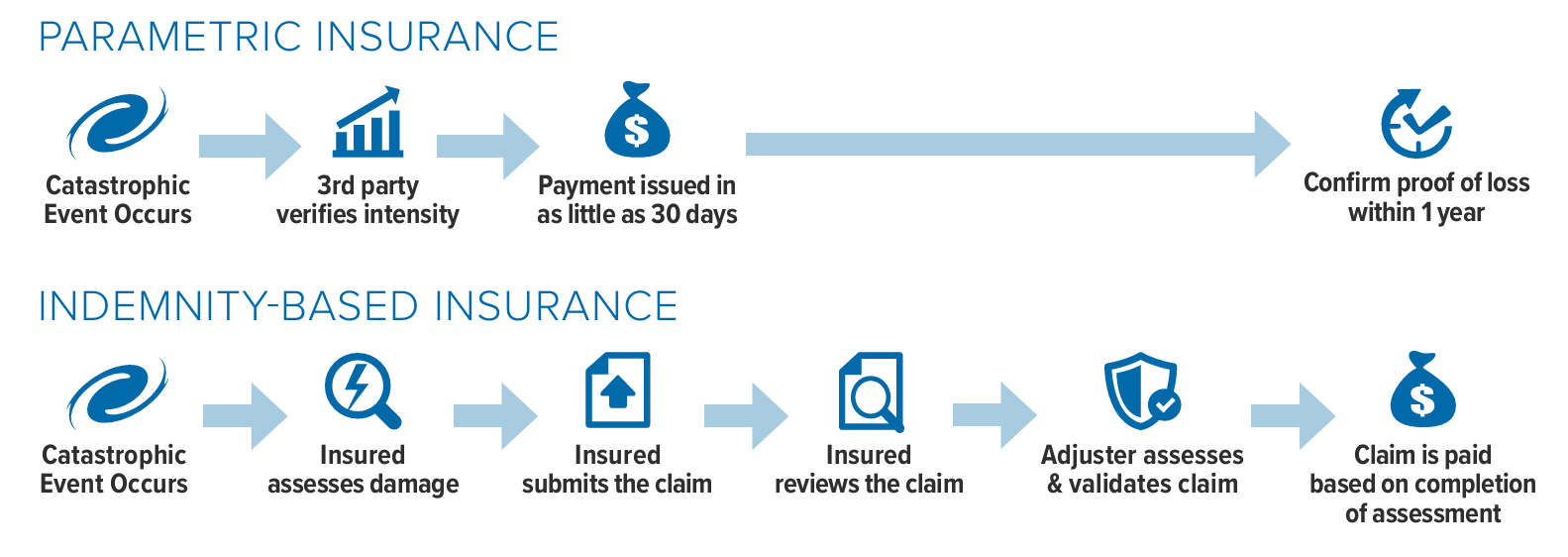

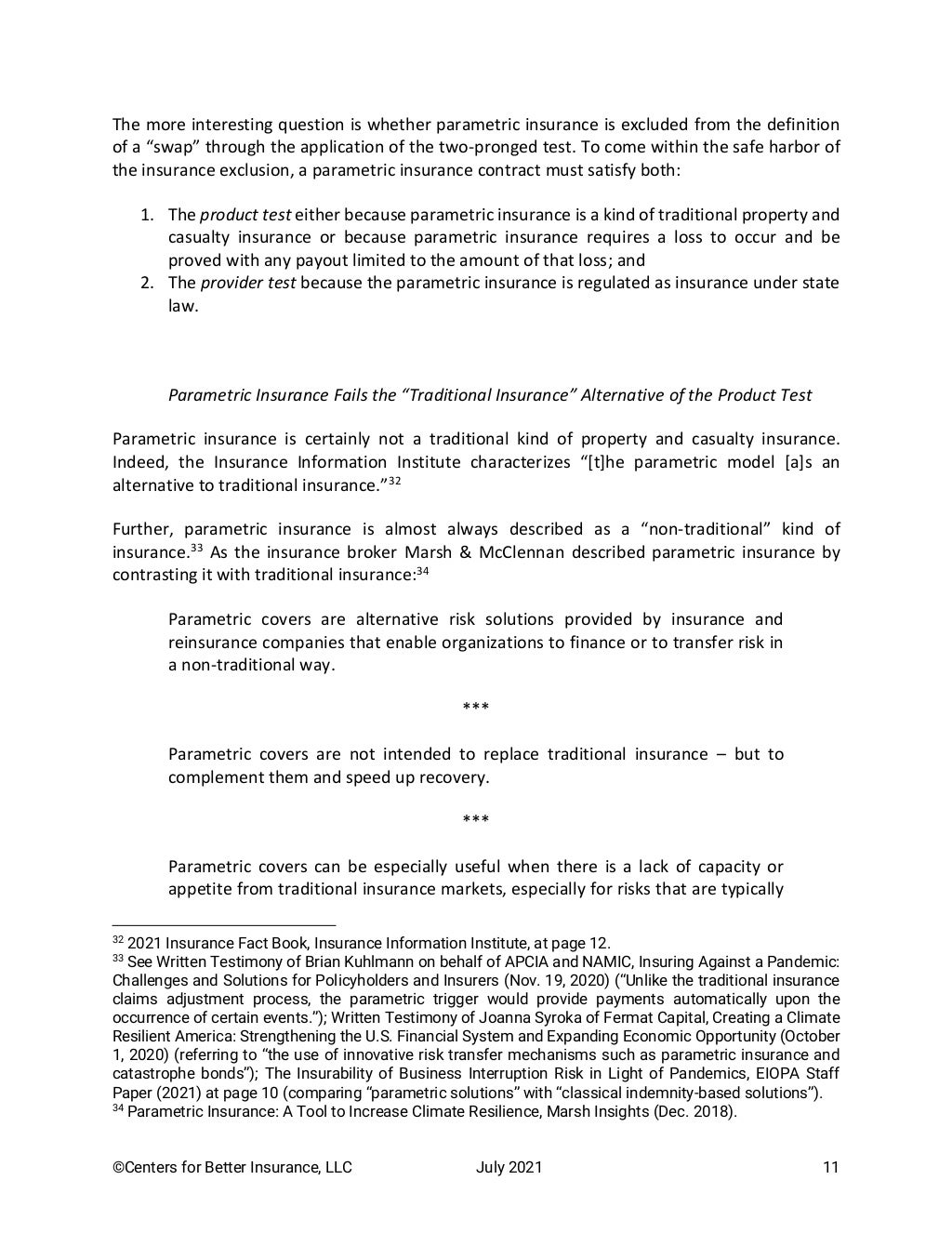

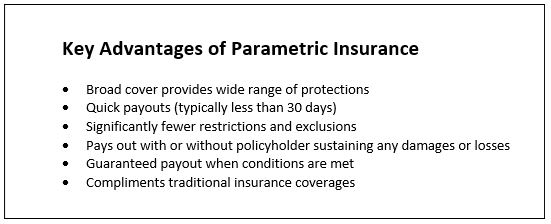

Parametric Insurance. Parametrics open up opportunities to those that can develop or tap into. When the insured event occurs, payment is triggered. Parametric insurance, or, “a type of insurance contract that insures a policyholder against the occurrence of a specific event by paying a set amount based on the magnitude of the event, as opposed to the magnitude of the losses in a traditional indemnity policy” ( naic) is becoming the insurance option that allows a policyholder a payment. The event, or parameter, is often indicated by an established and authoritative.

Parametric insurance insurance From greatoutdoorsabq.com

Parametric insurance insurance From greatoutdoorsabq.com

Parametric solutions are the perfect complement to traditional insurance for policy holders aiming to reduce their risk exposure and bridge the gap between insurable and, so far, uninsurable risks. Parametric insurance fills the gaps often left by traditional insurance. Parametric solutions are a smart choice for general contractors, owners and. Parametric insurance is based on a ‘triggered’ event rather than a claim for actual harm or loss. Parametric insurance or parametric risk transfer is a type of. Parametric insurance has been around for over 20 years.

Customers are demanding speed, convenience and a more personalised service from their insurance products.

And since the payouts are certain and delivered promptly, parametric coverages can significantly boost a company’s ability to quickly respond to and rebound from a damaging event, i.e., become more resilient. Parametric insurance is much simpler and has the potential to be far more powerful, varied, exciting, and innovative than traditional insurance. Parametric insurance is a tonic for insurers and their customers. Access to more data and more reliable sources of how that data is transferred is opening up an opportunity to take parametric insurance to companies small, medium and large. Parametric coverage is the ‘new’ insurance phenomenon. Parametric solutions are a smart choice for general contractors, owners and.

Source: medium.com

Source: medium.com

Insurance has gotten a lot more interesting over the past few years. A parametric solution always consists of the following: Parametric insurance is based on a ‘triggered’ event rather than a claim for actual harm or loss. Parametric insurance is much simpler and has the potential to be far more powerful, varied, exciting, and innovative than traditional insurance. This coverage provides an alternative to help fund the delay costs and economic losses of a project due to extreme weather events such as severe heat, cold, hailstorms, rainstorms and blizzards.

Source: premium-me.com

Source: premium-me.com

And since the payouts are certain and delivered promptly, parametric coverages can significantly boost a company’s ability to quickly respond to and rebound from a damaging event, i.e., become more resilient. The triggering event is often a catastrophic natural event which may ordinarily precipitate a loss or a series of losses. Parametric insurance or parametric risk transfer is a type of insurance, reinsurance or risk transfer arrangement that does not indemnify the full loss for the protection buyer. Parametric insurance is much simpler and has the potential to be far more powerful, varied, exciting, and innovative than traditional insurance. Parametric insurance is based on a ‘triggered’ event rather than a claim for actual harm or loss.

Source: blog.etherisc.com

Source: blog.etherisc.com

Parametric insurance is one of the major global trends in insurance innovation. The event, or parameter, is often indicated by an established and authoritative. Parametric insurance is a tonic for insurers and their customers. Parametric insurance is a more codified version of traditional insurance, where: Claims are settled quickly, the payout.

Source: gammali.co.uk

Source: gammali.co.uk

Insurance has gotten a lot more interesting over the past few years. Parametric insurance has been around for over 20 years. Customers are demanding speed, convenience and a more personalised service from their insurance products. This article will explain why. Parametric insurance provides transparent, predefined and fast financial recovery after weather and climate risks have occurred (e.g., tropical cyclones, earthquake, lack of wind, lack of snow, low river level.).

Source: instech.london

Source: instech.london

Parametric insurance or parametric risk transfer is a type of. Parametric insurance has been around for over 20 years. When the insured event occurs, payment is triggered. The event, or parameter, is often indicated by an established and authoritative. Parametric insurance or parametric risk transfer is a type of insurance, reinsurance or risk transfer arrangement that does not indemnify the full loss for the protection buyer.

Source: medium.com

Source: medium.com

Parametric insurance has the potential to work alongside standard indemnity policies in the case of a parametric policy that pays an amount equal to the deductible or a hybrid policy that pays an immediate sum based on the parameter and proceeds with the claims adjustment process so that indemnification is still the end result. Parametric insurance is a more codified version of traditional insurance, where: The event, or parameter, is often indicated by an established and authoritative. The movement towards utilising big data and mobile technology to provide new, innovative solutions is revolutionising the once traditional insurance sector. A parametric solution always consists of the following:

Source: amwins.com

Source: amwins.com

The triggering event is often a catastrophic natural event which may ordinarily precipitate a loss or a series of losses. This article will explain why. Parametric insurance or parametric risk transfer is a type of. When the insured event occurs, payment is triggered. Parametrics open up opportunities to those that can develop or tap into.

Source: twitter.com

Source: twitter.com

This coverage provides an alternative to help fund the delay costs and economic losses of a project due to extreme weather events such as severe heat, cold, hailstorms, rainstorms and blizzards. Parametric solutions are a smart choice for general contractors, owners and. The triggering event is often a catastrophic natural event which may ordinarily precipitate a loss or a series of losses. Parametric insurance is based on a ‘triggered’ event rather than a claim for actual harm or loss. Parametric insurance has the potential to work alongside standard indemnity policies in the case of a parametric policy that pays an amount equal to the deductible or a hybrid policy that pays an immediate sum based on the parameter and proceeds with the claims adjustment process so that indemnification is still the end result.

Source: slideshare.net

Source: slideshare.net

It’s an insurance alternative that’s good for the customer and it looks like it’s here to stay. Parametric insurance products are developing rapidly around the world. Parametrics open up opportunities to those that can develop or tap into. When the insured event occurs, payment is triggered. A parametric solution always consists of the following:

Source: villageinsurancedirect.com

Source: villageinsurancedirect.com

A parametric solution always consists of the following: And since the payouts are certain and delivered promptly, parametric coverages can significantly boost a company’s ability to quickly respond to and rebound from a damaging event, i.e., become more resilient. The event, or parameter, is often indicated by an established and authoritative. Access to more data and more reliable sources of how that data is transferred is opening up an opportunity to take parametric insurance to companies small, medium and large. Parametric solutions are a smart choice for general contractors, owners and.

Parametric insurance is based on a ‘triggered’ event rather than a claim for actual harm or loss. Parametric solutions are the perfect complement to traditional insurance for policy holders aiming to reduce their risk exposure and bridge the gap between insurable and, so far, uninsurable risks. Parametric insurance — an agreement under which an entity assuming risk (the insurer) agrees to pay the indemnitee (the insured) an agreed amount upon the occurrence of a specified event, such as an earthquake or hurricane of specified intensity. Parametric insurance is a way to bring innovation into insurance. The occurrence of an insured event — referred to as the trigger —.

Source: slideshare.net

Source: slideshare.net

Parametric insurance is one of the major global trends in insurance innovation. Access to more data and more reliable sources of how that data is transferred is opening up an opportunity to take parametric insurance to companies small, medium and large. Parametrics open up opportunities to those that can develop or tap into. The movement towards utilising big data and mobile technology to provide new, innovative solutions is revolutionising the once traditional insurance sector. Parametric insurance is a way to bring innovation into insurance.

Source: youtube.com

Source: youtube.com

When the insured event occurs, payment is triggered. Access to more data and more reliable sources of how that data is transferred is opening up an opportunity to take parametric insurance to companies small, medium and large. Today, it makes up around 15% of issued catastrophe bonds in a $100 billion market. The occurrence of an insured event — referred to as the trigger —. Parametric insurance or parametric risk transfer is a type of insurance, reinsurance or risk transfer arrangement that does not indemnify the full loss for the protection buyer.

Source: the-digital-insurer.com

Source: the-digital-insurer.com

Parametric solutions are the perfect complement to traditional insurance for policy holders aiming to reduce their risk exposure and bridge the gap between insurable and, so far, uninsurable risks. Parametric insurance is a more codified version of traditional insurance, where: Parametric insurance is a way to bring innovation into insurance. The occurrence of an insured event — referred to as the trigger —. Insurance has gotten a lot more interesting over the past few years.

Source: corporatesolutions.swissre.com

Source: corporatesolutions.swissre.com

A parametric solution always consists of the following: In practice, this event could be an earthquake, tropical cyclone, or flood where the. And since the payouts are certain and delivered promptly, parametric coverages can significantly boost a company’s ability to quickly respond to and rebound from a damaging event, i.e., become more resilient. Claims are settled quickly, the payout. Parametric solutions are a smart choice for general contractors, owners and.

Source: greco.services

Source: greco.services

When the insured event occurs, payment is triggered. Parametric solutions are a smart choice for general contractors, owners and. Access to more data and more reliable sources of how that data is transferred is opening up an opportunity to take parametric insurance to companies small, medium and large. Parametrics open up opportunities to those that can develop or tap into. Parametric insurance has been around for over 20 years.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The occurrence of an insured event — referred to as the trigger —. Parametric insurance or parametric risk transfer is a type of. Parametric insurance provides transparent, predefined and fast financial recovery after weather and climate risks have occurred (e.g., tropical cyclones, earthquake, lack of wind, lack of snow, low river level.). The event, or parameter, is often indicated by an established and authoritative. Parametric insurance is based on a ‘triggered’ event rather than a claim for actual harm or loss.

Source: mynewmarkets.com

Source: mynewmarkets.com

Parametric insurance is based on a ‘triggered’ event rather than a claim for actual harm or loss. Parametric insurance is a way to bring innovation into insurance. Parametric insurance has the potential to work alongside standard indemnity policies in the case of a parametric policy that pays an amount equal to the deductible or a hybrid policy that pays an immediate sum based on the parameter and proceeds with the claims adjustment process so that indemnification is still the end result. Parametric insurance fills the gaps often left by traditional insurance. This coverage provides an alternative to help fund the delay costs and economic losses of a project due to extreme weather events such as severe heat, cold, hailstorms, rainstorms and blizzards.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title parametric insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information