Parts of an insurance policy information

Home » Trend » Parts of an insurance policy informationYour Parts of an insurance policy images are available in this site. Parts of an insurance policy are a topic that is being searched for and liked by netizens today. You can Find and Download the Parts of an insurance policy files here. Find and Download all free photos and vectors.

If you’re searching for parts of an insurance policy pictures information connected with to the parts of an insurance policy topic, you have visit the right blog. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

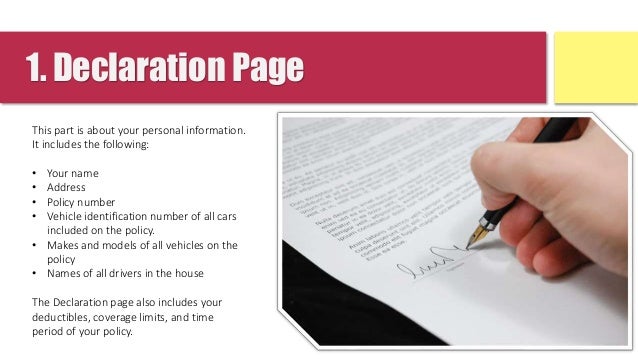

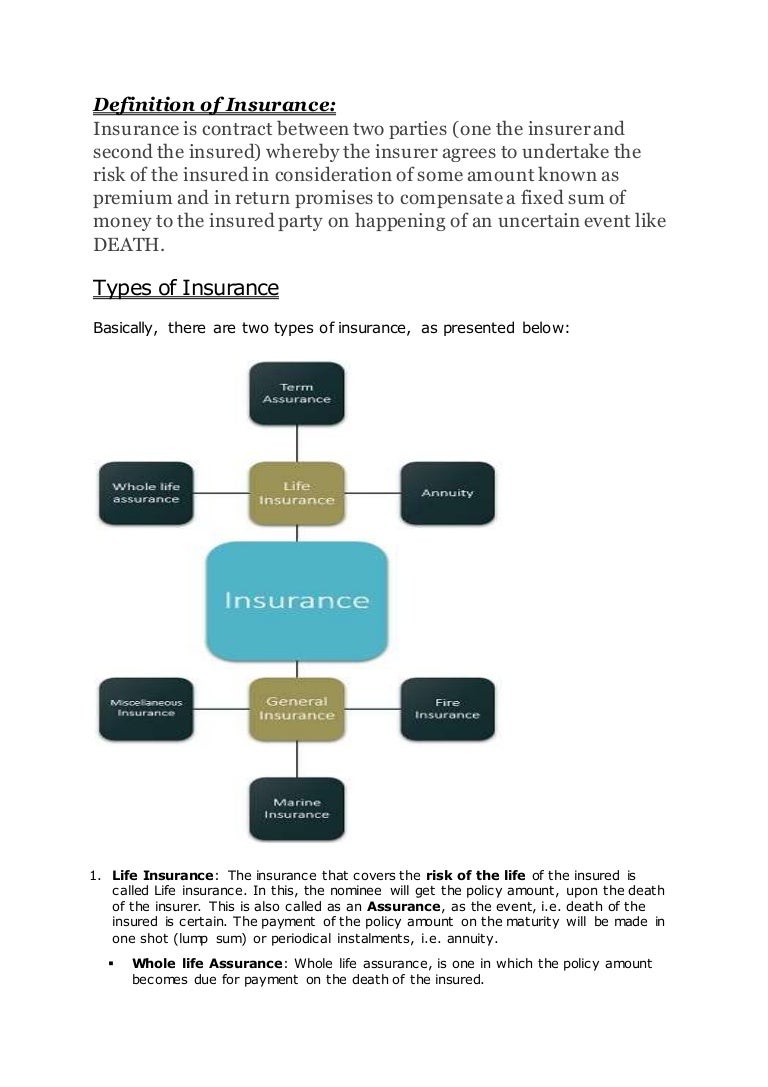

Parts Of An Insurance Policy. For more information, please contact electric insurance company at 800.227.2757. Car insurance policies typically include liability coverage, personal injury protection or medical payments coverage, comprehensive coverage, collision coverage, and uninsured/underinsured motorist. A declarations page, an insuring agreement, exclusions, conditions, and definitions. The instrument containing the terms of the contract is known as a policy.

Which part of an insurance policy describes what property From proprofs.com

Which part of an insurance policy describes what property From proprofs.com

Figuring out what insurance to buy and from whom can be a significant undertaking on its own. And trying to understand all the different parts of the insurance policy is a whole other headache that may leave you wondering who writes these kinds of obtuse documents. Specifically the 4 parts of an insurance policy and coverage limits. Most policies have 5 key elements that you should be aware of. Your policy will feel much more manageable, however, if you look at its various parts and address only those sections applicable to your current question. If you can understand the basics of policy composition and the information each section provides, you are well on your way to a fuller, more usable comprehension of your insurance coverage.

One of the most important things we can do to ensure out continued good health is to find a good health insurance policy that will cover us and our loved ones for years to come.

If you can understand the basics of policy composition and the information each section provides, you are well on your way to a fuller, more usable comprehension of your insurance coverage. A declarations page, an insuring agreement, exclusions, conditions, and definitions. Car insurance policies typically include liability coverage, personal injury protection or medical payments coverage, comprehensive coverage, collision coverage, and uninsured/underinsured motorist. Insurance a contract under which one party (the insurer), in consideration of receipt of a premium, undertakes to pay money to another person (the assured) on the happening of a specified event (as, for example, on death or accident or loss or damage to property). Our health is dear to us, and we need to do all that we can to protect it. Skip all the pages on your policy and focus your attention on this page.

Source: damianswiecki.blogspot.com

Source: damianswiecki.blogspot.com

Many policies contain a sixth part: Homeowners insurance has several parts to it. For more information, please contact electric insurance company at 800.227.2757. The personal auto policy (pap) is a standardized design for auto insurance. Skip all the pages on your policy and focus your attention on this page.

Source: youtube.com

Source: youtube.com

Just the same, you might want… This is part one in a series of four posts discussing homeowners insurance policies, including terms and conditions in such policies that homeowner insureds should keep in mind, whether in obtaining insurance or in the event of claim or potential claim. The instrument containing the terms of the contract is known as a policy. The information provided on this site is provided for informational purposes only and is not a full explanation of products, services or coverage. Just make sure all the information is correct.

Source: youtube.com

Source: youtube.com

It protects your parts salespersons business from the claims themselves and as well to any. Part a explains the liability coverage, part b explains the medical payments. A car insurance policy is made up of five different parts: While different states mandate different types of insurance and there are several additional options (such as gap insurance) available, most basic auto policies consist of: Car insurance policies typically include liability coverage, personal injury protection or medical payments coverage, comprehensive coverage, collision coverage, and uninsured/underinsured motorist.

Source: youtube.com

Source: youtube.com

For more information, please contact electric insurance company at 800.227.2757. Declarations, insuring agreements, definitions, exclusions and conditions. Every insurance policy has five parts: Many policies contain a sixth part: The described location is shown on the declarations page.

Source: safeguardme.com

Source: safeguardme.com

Your policy will feel much more manageable, however, if you look at its various parts and address only those sections applicable to your current question. While different states mandate different types of insurance and there are several additional options (such as gap insurance) available, most basic auto policies consist of: Most policies have 5 key elements that you should be aware of. The described location is shown on the declarations page. Our health is dear to us, and we need to do all that we can to protect it.

Source: lifeinsurancevideo.com

Source: lifeinsurancevideo.com

Figuring out what insurance to buy and from whom can be a significant undertaking on its own. This is part one in a series of four posts discussing homeowners insurance policies, including terms and conditions in such policies that homeowner insureds should keep in mind, whether in obtaining insurance or in the event of claim or potential claim. And trying to understand all the different parts of the insurance policy is a whole other headache that may leave you wondering who writes these kinds of obtuse documents. A personal auto policy has a set layout of six sections. Policy, limits of coverage, and displays the premium and our name.

Source: insuranceonmarket.blogspot.com

Source: insuranceonmarket.blogspot.com

Direct physical loss by or from flood. The following breakdown of an auto insurance policy is based on four types of coverage and may not apply to certain motorists. Homeowners insurance has several parts to it. Skip all the pages on your policy and focus your attention on this page. For more information, please contact electric insurance company at 800.227.2757.

Source: carinsurancequotes-free.blogspot.com

Source: carinsurancequotes-free.blogspot.com

The following breakdown of an auto insurance policy is based on four types of coverage and may not apply to certain motorists. A personal auto policy has a set layout of six sections. The following breakdown of an auto insurance policy is based on four types of coverage and may not apply to certain motorists. This is part one in a series of four posts discussing homeowners insurance policies, including terms and conditions in such policies that homeowner insureds should keep in mind, whether in obtaining insurance or in the event of claim or potential claim. The information provided on this site is provided for informational purposes only and is not a full explanation of products, services or coverage.

Source: youtube.com

Source: youtube.com

This is part one in a series of four posts discussing homeowners insurance policies, including terms and conditions in such policies that homeowner insureds should keep in mind, whether in obtaining insurance or in the event of claim or potential claim. John carinci vp & head, operations & client experience If there are discrepancies between the information on this site and the policy, the terms in the policy apply. This is part one in a series of four posts discussing homeowners insurance policies, including terms and conditions in such policies that homeowner insureds should keep in mind, whether in obtaining insurance or in the event of claim or potential claim. The following breakdown of an auto insurance policy is based on four types of coverage and may not apply to certain motorists.

Source: calilaw.com

Source: calilaw.com

Our health is dear to us, and we need to do all that we can to protect it. The following breakdown of an auto insurance policy is based on four types of coverage and may not apply to certain motorists. Bodily injury liability, personal injury protection, property damage liability, collision, comprehensive and uninsured/underinsured motorist. General liability insurance policy for your parts salespersons business insures you against claims coming from injury to customers or damage to their property. The personal auto policy (pap) is a standardized design for auto insurance.

Source: franbeiler.blogspot.com

Source: franbeiler.blogspot.com

Car insurance policies typically include liability coverage, personal injury protection or medical payments coverage, comprehensive coverage, collision coverage, and uninsured/underinsured motorist. Use these sections as guideposts in reviewing the policies. The location where the insured building or personal property is found. John carinci vp & head, operations & client experience A personal auto policy has a set layout of six sections.

Source: youtube.com

Source: youtube.com

These policies offer coverage for liability, medical payments, damage to the vehicle and damage from uninsured/underinsured motorists. Policy, limits of coverage, and displays the premium and our name. While different states mandate different types of insurance and there are several additional options (such as gap insurance) available, most basic auto policies consist of: Examine each part to identify its key provisions and requirements. General liability insurance policy for your parts salespersons business insures you against claims coming from injury to customers or damage to their property.

Source: redwoodagencygroup.com

Source: redwoodagencygroup.com

Direct physical loss by or from flood. It protects your parts salespersons business from the claims themselves and as well to any. Rino d�onofrio president and chief executive officer. Most policies have 5 key elements that you should be aware of. If you can understand the basics of policy composition and the information each section provides, you are well on your way to a fuller, more usable comprehension of your insurance coverage.

Source: pinterest.com

Source: pinterest.com

Many policies contain a sixth part: The declarations page is a part of this flood insurance policy. For more information, please contact electric insurance company at 800.227.2757. While different states mandate different types of insurance and there are several additional options (such as gap insurance) available, most basic auto policies consist of: Just the same, you might want…

Source: proprofs.com

Source: proprofs.com

Most policies have 5 key elements that you should be aware of. One of the most important things we can do to ensure out continued good health is to find a good health insurance policy that will cover us and our loved ones for years to come. A personal auto policy has a set layout of six sections. The declarations page is a part of this flood insurance policy. Your policy will feel much more manageable, however, if you look at its various parts and address only those sections applicable to your current question.

Source: youtube.com

Source: youtube.com

A car insurance policy is made up of five different parts: Rino d�onofrio president and chief executive officer. This is part one in a series of four posts discussing homeowners insurance policies, including terms and conditions in such policies that homeowner insureds should keep in mind, whether in obtaining insurance or in the event of claim or potential claim. Your policy will feel much more manageable, however, if you look at its various parts and address only those sections applicable to your current question. Note that each type of coverage is priced separately, so.

Source: lifeinsurancevideo.com

Source: lifeinsurancevideo.com

These policies offer coverage for liability, medical payments, damage to the vehicle and damage from uninsured/underinsured motorists. It is important to look at each of these parts and check the limits of coverage. Insurance a contract under which one party (the insurer), in consideration of receipt of a premium, undertakes to pay money to another person (the assured) on the happening of a specified event (as, for example, on death or accident or loss or damage to property). Breakdown of the six parts of auto insurance policies. Declarations, insuring agreements, definitions, exclusions and conditions.

Source: youtube.com

Source: youtube.com

The location where the insured building or personal property is found. Your insurance policy policy on the life of rbc life insurance company agrees to pay benefits in accordance with the terms and conditions of this policy for losses occurring while this policy is in force. If there are discrepancies between the information on this site and the policy, the terms in the policy apply. Declarations, insuring agreements, definitions, exclusions and conditions. If you can understand the basics of policy composition and the information each section provides, you are well on your way to a fuller, more usable comprehension of your insurance coverage.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title parts of an insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information