Pay related social insurance information

Home » Trending » Pay related social insurance informationYour Pay related social insurance images are ready in this website. Pay related social insurance are a topic that is being searched for and liked by netizens today. You can Download the Pay related social insurance files here. Download all free images.

If you’re searching for pay related social insurance images information related to the pay related social insurance topic, you have come to the ideal site. Our site always provides you with hints for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

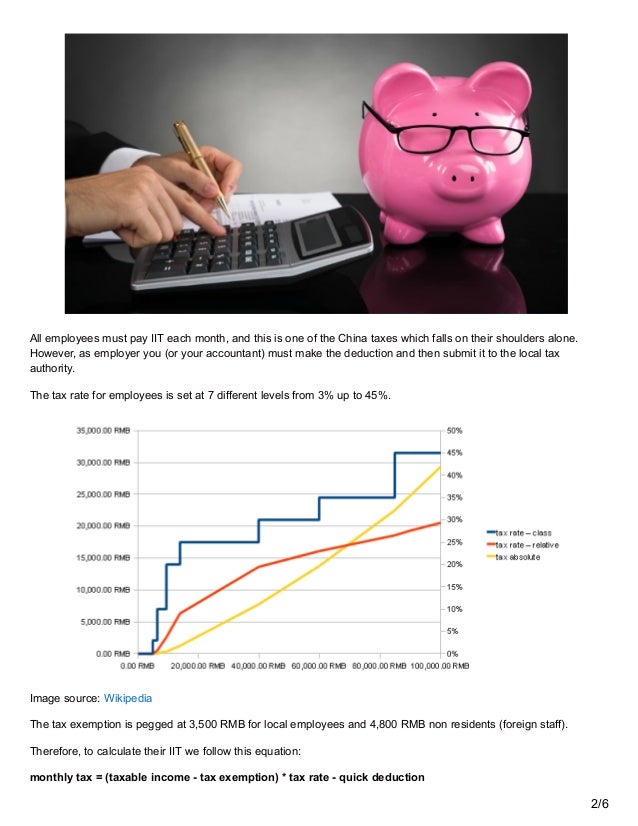

Pay Related Social Insurance. Pay related social insurance (prsi) goes to the social insurance fund which helps pay for social welfare benefits and pensions. The value of this payment is based on the amount of your employee�s pay. There are several categories for prsi but in general an individual would pay 4% on their gross income. Pay related social insurance (prsi) under the social welfare code, social welfare benefits can be divided into three main categories:

Can Severance Pay Affect Me Receiving Social Security From pinterest.com

Can Severance Pay Affect Me Receiving Social Security From pinterest.com

Gross pay less superannuation and permanent health insurance contributions, deducted under a net pay arrangement by the employer, which are allowable for income tax purposes). Gross pay less superannuation and permanent health insurance contributions. Public relations society of india: Pay related social insurance prsi contributions: Pay related social insurance (prsi) note the information on this page refers to your current obligations. The indigent receive certain benefits on a noncontributory basis.

There are several categories for prsi but in general an individual would pay 4% on their gross income.

Contributory (social insurance) payments, which are made on the basis of a person’s pay related social insurance (prsi) record; Public relations society of india: Contributory (social insurance) payments, which are made on the basis of a person’s pay related social insurance (prsi) record; Pay related social insurance prsi contributions: The prsi contribution, normally payable by employer and employee, is a percentage of the employee�s reckonable earnings (i.e. Pacific region security & intelligence (washington)

Source: luatvietnam.vn

Source: luatvietnam.vn

Pay related social insurance (prsi) 1. It applies to people in industrial, commercial and service type employment who are employed under a contract of service with a reckonable pay. Most employers and employees, aged between 16 years and the pension age which is currently 66, pay prsi contributions into the sif. Your social insurance contributions in ireland are referred to as prsi (pay related social insurance). Pay related social insurance (prsi) contributions are paid into the social insurance fund (sif) which helps pay for benefits and pensions.

Source: bedfordcenterrehab.com

Source: bedfordcenterrehab.com

Pay related social insurance (prsi) goes to the social insurance fund which helps pay for social welfare benefits and pensions. Prsi is the social security fund of the country. Pay related social insurance (prsi) contributions go to the social insurance fund (sif) which helps pay for social welfare benefits and pensions. Your social insurance contributions in ireland are referred to as prsi (pay related social insurance). Pay related social insurance (prsi) reduced rate a 0.5% rate of employer’s pay related social insurance (prsi) will continue to apply for wages that are eligible for the subsidy.

Source: pinterest.com

Source: pinterest.com

Pay related social insurance (prsi) goes to the social insurance fund which helps pay for social welfare benefits and pensions. The indigent receive certain benefits on a noncontributory basis. Pacific region security & intelligence (washington) Contributory (social insurance) payments, which are made on the basis of a person’s pay related social insurance (prsi) record; Persatuan renang seluruh indonesia (indonesian:

Source: gov.ie

Source: gov.ie

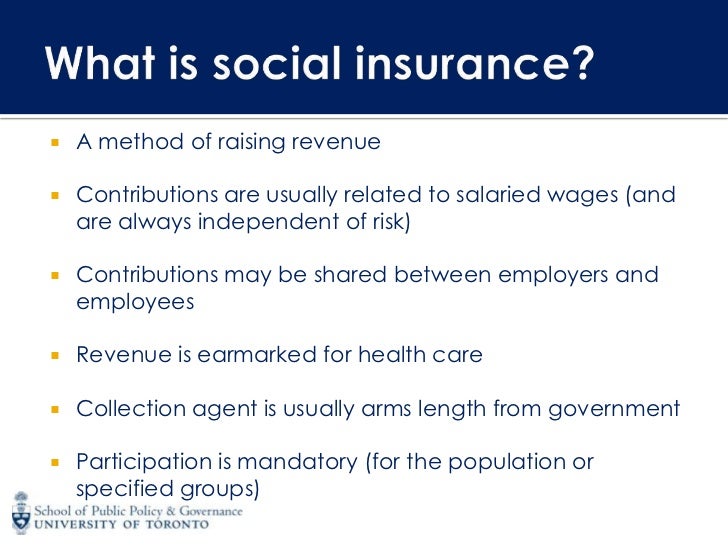

Different rates can apply to each of these three categories and each rate entitles the staff member to different benefits. Pay related social insurance (prsi) note the information on this page refers to your current obligations. The prsi contribution, normally payable by employer and employee, is a percentage of the employee�s reckonable earnings (i.e. Social insurance is a concept where the government intervenes in the insurance market to ensure that a group of individuals are insured or protected against the risk of any emergencies that lead to financial problems. For your obligations before 1 january 2019, please see the employer�s guide to paye.

Source: socialsecuritylawcenter.info

Source: socialsecuritylawcenter.info

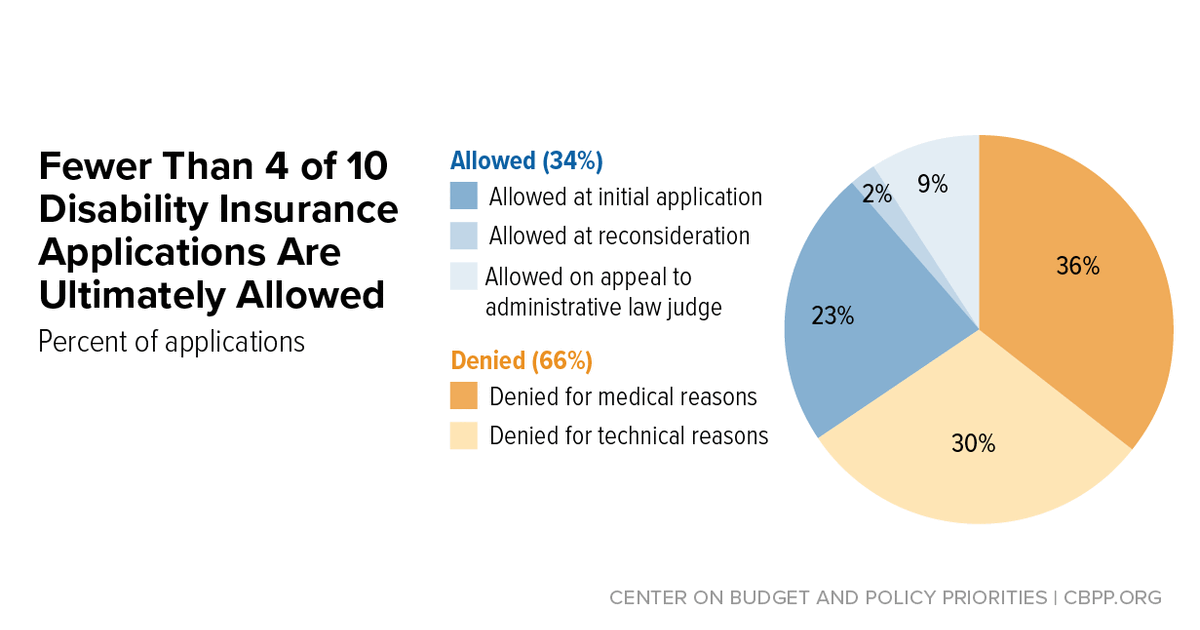

Pay related social insurance (prsi) under the social welfare code, social welfare benefits can be divided into three main categories: Contributory (social insurance) payments, which are made on the basis of a person’s pay related social insurance (prsi) record; For this reason it is called pay related social insurance (prsi). You must report and apply the full rates of employer and employee prsi as normal. Pay related social insurance prsi contributions:

Source: youtube.com

Source: youtube.com

You must report and apply the full rates of employer and employee prsi as normal. The prsi contribution, normally payable by employer and employee, is a percentage of the employee�s reckonable earnings (i.e. Public relations society of india: Pay related social insurance (prsi) reduced rate a 0.5% rate of employer’s pay related social insurance (prsi) will continue to apply for wages that are eligible for the subsidy. Pay related social insurance (prsi) under the social welfare code, social welfare benefits can be divided into three main categories:

Source: fdvnlawfirm.vn

Employers and employees prsi is charged on all earnings from employments, including benefits in kind. Paying social insurance can help you qualify for social insurance payments, such as the state pension (contributory). Pacific region security & intelligence (washington) If you are in employment, the amount of social insurance you pay depends on your earnings and the type of work you do. Prsi is a payment made by you and your employees.

Source: hongdaservice.com

Source: hongdaservice.com

Different rates can apply to each of these three categories and each rate entitles the staff member to different benefits. Contributory (social insurance) payments, which are made on the basis of a person’s pay related social insurance (prsi) record; The indigent receive certain benefits on a noncontributory basis. There are several categories for prsi but in general an individual would pay 4% on their gross income. The value of this payment is based on the amount of your employee�s pay.

Source: researchgate.net

Source: researchgate.net

Your social insurance contributions in ireland are referred to as prsi (pay related social insurance). Gross pay less superannuation and permanent health insurance contributions, deducted under a net pay arrangement by the employer, which are allowable for income tax purposes). Pay related social insurance (prsi) under the social welfare code, social welfare benefits can be divided into three main categories: Social insurance is a concept where the government intervenes in the insurance market to ensure that a group of individuals are insured or protected against the risk of any emergencies that lead to financial problems. Prsi is the social security fund of the country.

Source: slideshare.net

Source: slideshare.net

The prsi contribution, normally payable by employer and employee, is a percentage of the employee�s reckonable earnings (i.e. Your social insurance contributions in ireland are referred to as prsi (pay related social insurance). Your social insurance class is in turn determined by your earnings and the type of work you do. Pay related social insurance (prsi) goes to the social insurance fund which helps pay for social welfare benefits and pensions. Gross pay less superannuation and permanent health insurance contributions, deducted under a net pay arrangement by the employer, which are allowable for income tax purposes).

Source: into.ie

Source: into.ie

The amount of prsi paid by you and your employer depends on your social insurance class. The amount of prsi paid by you and your employer depends on your social insurance class. The indigent receive certain benefits on a noncontributory basis. Contributory (social insurance) payments, which are made on the basis of a person’s pay related social insurance (prsi) record; If you are an employee pay related social insurance (prsi) deductions are made from your earnings each week.

Source: info.brandtotal.com

Source: info.brandtotal.com

Paying social insurance can help you qualify for social insurance payments, such as the state pension (contributory). Contributory (social insurance) payments, which are made on the basis of a person’s pay related social insurance (prsi) record; The social insurance payments available include: It applies to people in industrial, commercial and service type employment who are employed under a contract of service with a reckonable pay. Pay related social insurance (prsi) under the social welfare code, social welfare benefits can be divided into three main categories:

The amount of prsi paid by you and your employer depends on your social insurance class. The law makes your employer responsible for prsi, though you may have to pay an employee�s share. If you are an employee pay related social insurance (prsi) deductions are made from your earnings each week. In general, the payment of prsi is compulsory. Most employers and employees (between the ages of 16 and pensionable age, currently 66 years) pay social insurance (prsi) contributions into the national sif.

Source: cbpp.org

Source: cbpp.org

Pacific region security & intelligence (washington) There are several categories for prsi but in general an individual would pay 4% on their gross income. For your obligations before 1 january 2019, please see the employer�s guide to paye. Paying social insurance can help you qualify for social insurance payments, such as the state pension (contributory). Employers and employees pay prsi on the employee’s salary after deduction of any contributions to an approved pension scheme.

Pay related social insurance (prsi) under the social welfare code, social welfare benefits can be divided into three main categories: Prsi is the social security fund of the country. Pacific region security & intelligence (washington) Pay related social insurance (prsi) under the social welfare code, social welfare benefits can be divided into three main categories: Pay related social insurance (prsi) prsi classes and people insured in each class most people pay class a prsi.

Source: slideshare.net

Source: slideshare.net

Pay related social insurance prsi contributions: Your social insurance class is in turn determined by your earnings and the type of work you do. Contributory (social insurance) payments, which are made on the basis of a person’s pay related social insurance (prsi) record; The indigent receive certain benefits on a noncontributory basis. Gross pay less superannuation and permanent health insurance contributions, deducted under a net pay arrangement by the employer, which are allowable for income tax purposes).

Source: mc2accountants.ie

Source: mc2accountants.ie

12 rows pay related social insurance (prsi) as an employer, you pay social insurance (prsi). Contributory (social insurance) payments, which are made on the basis of a person’s pay related social insurance (prsi) record; The amount of prsi paid by you and your employer depends on your social insurance class. Pay related social insurance prsi contributions: It applies to people in industrial, commercial and service type employment who are employed under a contract of service with a reckonable pay.

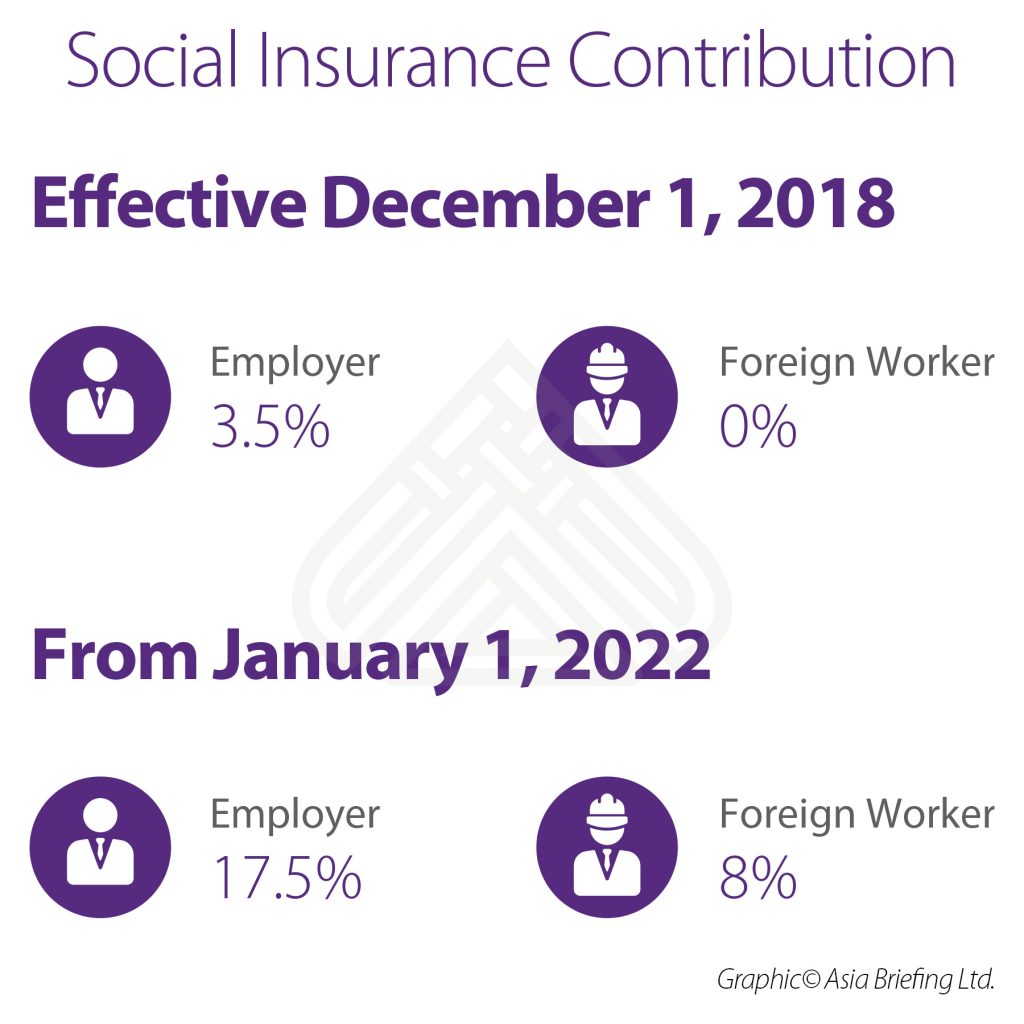

Source: vietnam-briefing.com

Source: vietnam-briefing.com

Pay related social insurance prsi contributions: Pay related social insurance (prsi) 1. Public relations society of india: In general, the payment of prsi is compulsory. Pay related social insurance prsi contributions:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title pay related social insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information