Paying employees who opt out of health insurance information

Home » Trending » Paying employees who opt out of health insurance informationYour Paying employees who opt out of health insurance images are available. Paying employees who opt out of health insurance are a topic that is being searched for and liked by netizens today. You can Download the Paying employees who opt out of health insurance files here. Find and Download all free vectors.

If you’re looking for paying employees who opt out of health insurance images information linked to the paying employees who opt out of health insurance keyword, you have pay a visit to the right blog. Our site always gives you hints for downloading the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that fit your interests.

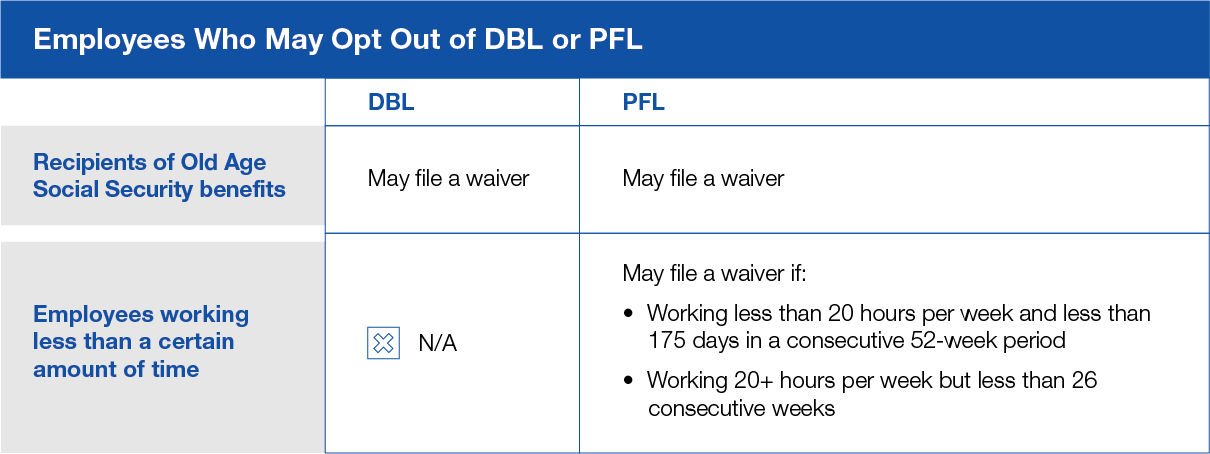

Paying Employees Who Opt Out Of Health Insurance. Most people get health insurance through their employer as an employee benefit. Business owners say finding the right health insurance is one of. However, in order to be (18). There are scenarios in which it may make more sense to decline employer health insurance and opt for a plan through the healthcare.gov (19).

Insurance plan to help pay our social care bills From worldmedicinefoundation.com

Insurance plan to help pay our social care bills From worldmedicinefoundation.com

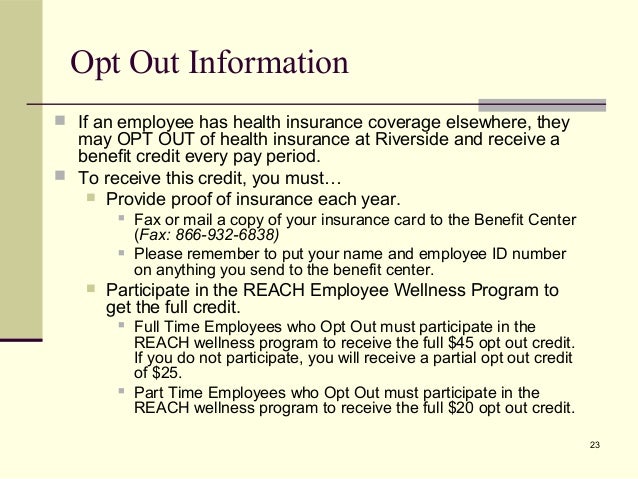

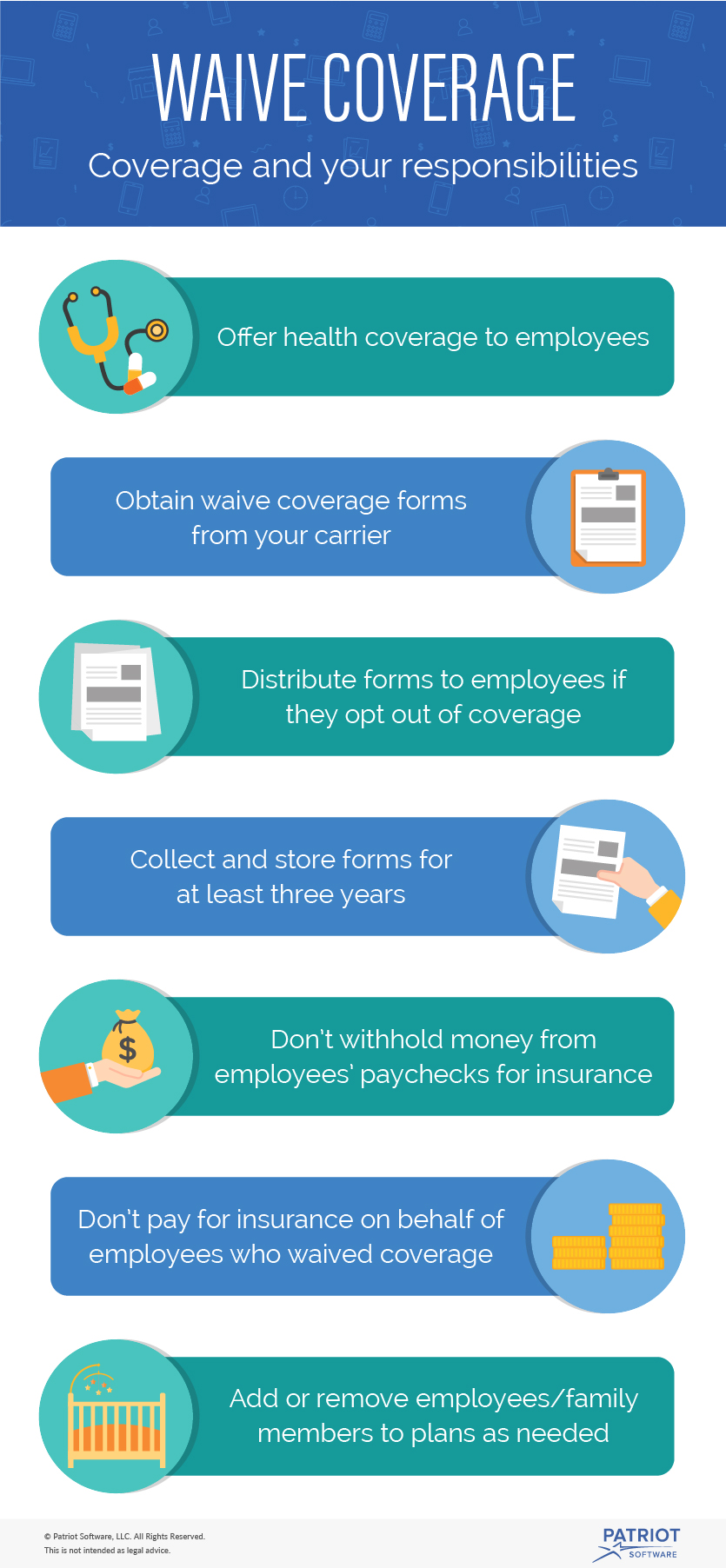

Most employers cover 60 to 80% of the costs of their health insurance, but they’re only required to cover at least 50% by law. You can obtain a waiver of coverage form from your insurance carrier. A large employer (50 or more employees) has the same two options. There are scenarios in which it may make more sense to decline employer health insurance and opt for a plan through the healthcare.gov (19). From the irs’s perspective, the employee has to forgo the $100/month “opt out” amount in addition to having to pay the $200/month for coverage. The programs generally work by paying you to opt out of a workplace health insurance plan.

Most employers cover 60 to 80% of the costs of their health insurance, but they’re only required to cover at least 50% by law.

A large employer (50 or more employees) has the same two options. Opting out policies to consider are: Kaiser family foundation estimates that the average annual premiums for employer sponsored health insurance in 2019. Employees who receive such payments may claim that extra cash as part of their premium obligation. So an employer who must comply with the mandate can offer increased compensation, but can�t treat it has a qualifying arrangement unless they offer a group plan. Ashley hall is a writer and fact checker who has been published in multiple medical jour.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

From the irs’s perspective, the employee has to forgo the $100/month “opt out” amount in addition to having to pay the $200/month for coverage. Employees who receive such payments may claim that extra cash as part of their premium obligation. Do get the advice of an accountant to make sure you aren�t causing some unintended problem as mentioned above. However, if the employee is offered an unconditional opt out payment of $50 per month if the employee waives the employer coverage, then generally the deemed cost of coverage will be $150 per month (i.e., the $100 out of pocket cost plus the “opportunity cost” of losing the $50 opt out payment) and the coverage will only satisfy the aca affordability. From the irs’s perspective, the employee has to forgo the $100/month “opt out” amount in addition to having to pay the $200/month for coverage.

Source: insurancevision.co

Source: insurancevision.co

Most employers cover 60 to 80% of the costs of their health insurance, but they’re only required to cover at least 50% by law. Roughly 57 per cent of organizations allow employees to opt out of all or some components of their group benefits plans under certain conditions, according to the conference board. However, in order to be (18). Kaiser family foundation estimates that the average annual premiums for employer sponsored health insurance in 2019. However, if the employee is offered an unconditional opt out payment of $50 per month if the employee waives the employer coverage, then generally the deemed cost of coverage will be $150 per month (i.e., the $100 out of pocket cost plus the “opportunity cost” of losing the $50 opt out payment) and the coverage will only satisfy the aca affordability.

Source: healthhearty.com

Source: healthhearty.com

From the irs’s perspective, the employee has to forgo the $100/month “opt out” amount in addition to having to pay the $200/month for coverage. So an employer who must comply with the mandate can offer increased compensation, but can�t treat it has a qualifying arrangement unless they offer a group plan. The payment amount is smaller than they’d spend on your benefit costs for health insurance. Do get the advice of an accountant to make sure you aren�t causing some unintended problem as mentioned above. From the irs’s perspective, the employee has to forgo the $100/month “opt out” amount in addition to having to pay the $200/month for coverage.

Source: benefitspro.com

Source: benefitspro.com

Here are three reasons why a person may reject employer health insurance: The programs generally work by paying you to opt out of a workplace health insurance plan. The payment amount is smaller than they’d spend on your benefit costs for health insurance. A large employer (50 or more employees) has the same two options. Most employers cover 60 to 80% of the costs of their health insurance, but they’re only required to cover at least 50% by law.

Source: slideshare.net

Source: slideshare.net

Do get the advice of an accountant to make sure you aren�t causing some unintended problem as mentioned above. The programs generally work by paying you to opt out of a workplace health insurance plan. The payment amount is smaller than they’d spend on your benefit costs for health insurance. Roughly 57 per cent of organizations allow employees to opt out of all or some components of their group benefits plans under certain conditions, according to the conference board. So an employer who must comply with the mandate can offer increased compensation, but can�t treat it has a qualifying arrangement unless they offer a group plan.

Source: ervadocelembrancinhas.blogspot.com

From the irs’s perspective, the employee has to forgo the $100/month “opt out” amount in addition to having to pay the $200/month for coverage. Most people get health insurance through their employer as an employee benefit. Here are three reasons why a person may reject employer health insurance: Do get the advice of an accountant to make sure you aren�t causing some unintended problem as mentioned above. However, in order to be (18).

Source: keyseragency.com

Source: keyseragency.com

You can obtain a waiver of coverage form from your insurance carrier. Here are three reasons why a person may reject employer health insurance: Roughly 57 per cent of organizations allow employees to opt out of all or some components of their group benefits plans under certain conditions, according to the conference board. Business owners say finding the right health insurance is one of. A large employer (50 or more employees) has the same two options.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

A large employer (50 or more employees) has the same two options. From the irs’s perspective, the employee has to forgo the $100/month “opt out” amount in addition to having to pay the $200/month for coverage. The payment amount is smaller than they’d spend on your benefit costs for health insurance. Opting out policies to consider are: Most employers cover 60 to 80% of the costs of their health insurance, but they’re only required to cover at least 50% by law.

Here are three reasons why a person may reject employer health insurance: A large employer (50 or more employees) has the same two options. A large employer (50 or more employees) has the same two options. Ashley hall is a writer and fact checker who has been published in multiple medical jour. Roughly 57 per cent of organizations allow employees to opt out of all or some components of their group benefits plans under certain conditions, according to the conference board.

Source: harbingersdaily.com

Source: harbingersdaily.com

Ashley hall is a writer and fact checker who has been published in multiple medical jour. Do get the advice of an accountant to make sure you aren�t causing some unintended problem as mentioned above. Opting out policies to consider are: The employee must include information like their name, social security number, who they are waiving coverage for, and why they are waiving coverage on the waiver of coverage form. A large employer (50 or more employees) has the same two options.

Source: worldmedicinefoundation.com

Source: worldmedicinefoundation.com

However, if the employee is offered an unconditional opt out payment of $50 per month if the employee waives the employer coverage, then generally the deemed cost of coverage will be $150 per month (i.e., the $100 out of pocket cost plus the “opportunity cost” of losing the $50 opt out payment) and the coverage will only satisfy the aca affordability. Kaiser family foundation estimates that the average annual premiums for employer sponsored health insurance in 2019. However, if the employee is offered an unconditional opt out payment of $50 per month if the employee waives the employer coverage, then generally the deemed cost of coverage will be $150 per month (i.e., the $100 out of pocket cost plus the “opportunity cost” of losing the $50 opt out payment) and the coverage will only satisfy the aca affordability. There are scenarios in which it may make more sense to decline employer health insurance and opt for a plan through the healthcare.gov (19). So an employer who must comply with the mandate can offer increased compensation, but can�t treat it has a qualifying arrangement unless they offer a group plan.

Source: wqad.com

Source: wqad.com

Most people get health insurance through their employer as an employee benefit. The payment amount is smaller than they’d spend on your benefit costs for health insurance. So an employer who must comply with the mandate can offer increased compensation, but can�t treat it has a qualifying arrangement unless they offer a group plan. The programs generally work by paying you to opt out of a workplace health insurance plan. Most employers cover 60 to 80% of the costs of their health insurance, but they’re only required to cover at least 50% by law.

Source: equinoxbusinesslaw.com

Source: equinoxbusinesslaw.com

From the irs’s perspective, the employee has to forgo the $100/month “opt out” amount in addition to having to pay the $200/month for coverage. Ashley hall is a writer and fact checker who has been published in multiple medical jour. Opting out policies to consider are: Employees who receive such payments may claim that extra cash as part of their premium obligation. So an employer who must comply with the mandate can offer increased compensation, but can�t treat it has a qualifying arrangement unless they offer a group plan.

Source: govexec.com

Source: govexec.com

There are scenarios in which it may make more sense to decline employer health insurance and opt for a plan through the healthcare.gov (19). You can obtain a waiver of coverage form from your insurance carrier. However, if the employee is offered an unconditional opt out payment of $50 per month if the employee waives the employer coverage, then generally the deemed cost of coverage will be $150 per month (i.e., the $100 out of pocket cost plus the “opportunity cost” of losing the $50 opt out payment) and the coverage will only satisfy the aca affordability. Federal tax withholding must be applied to any remuneration paid to employees that is not specifically exempt from the requirement. Employees who receive such payments may claim that extra cash as part of their premium obligation.

Source: theglobeandmail.com

Source: theglobeandmail.com

Federal tax withholding must be applied to any remuneration paid to employees that is not specifically exempt from the requirement. Here are three reasons why a person may reject employer health insurance: The employee must include information like their name, social security number, who they are waiving coverage for, and why they are waiving coverage on the waiver of coverage form. Roughly 57 per cent of organizations allow employees to opt out of all or some components of their group benefits plans under certain conditions, according to the conference board. Most employers cover 60 to 80% of the costs of their health insurance, but they’re only required to cover at least 50% by law.

Source: standard.com

Source: standard.com

From the irs’s perspective, the employee has to forgo the $100/month “opt out” amount in addition to having to pay the $200/month for coverage. However, if the employee is offered an unconditional opt out payment of $50 per month if the employee waives the employer coverage, then generally the deemed cost of coverage will be $150 per month (i.e., the $100 out of pocket cost plus the “opportunity cost” of losing the $50 opt out payment) and the coverage will only satisfy the aca affordability. A large employer (50 or more employees) has the same two options. Most employers cover 60 to 80% of the costs of their health insurance, but they’re only required to cover at least 50% by law. Employees who receive such payments may claim that extra cash as part of their premium obligation.

Source: friendship-f0rever.blogspot.com

Source: friendship-f0rever.blogspot.com

So an employer who must comply with the mandate can offer increased compensation, but can�t treat it has a qualifying arrangement unless they offer a group plan. Federal tax withholding must be applied to any remuneration paid to employees that is not specifically exempt from the requirement. There are scenarios in which it may make more sense to decline employer health insurance and opt for a plan through the healthcare.gov (19). You can obtain a waiver of coverage form from your insurance carrier. The programs generally work by paying you to opt out of a workplace health insurance plan.

Source: longbeachhotnews.blogspot.com

Source: longbeachhotnews.blogspot.com

Business owners say finding the right health insurance is one of. The payment amount is smaller than they’d spend on your benefit costs for health insurance. Employees who receive such payments may claim that extra cash as part of their premium obligation. A large employer (50 or more employees) has the same two options. Do get the advice of an accountant to make sure you aren�t causing some unintended problem as mentioned above.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title paying employees who opt out of health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information