Payroll insurance information

Home » Trend » Payroll insurance informationYour Payroll insurance images are available in this site. Payroll insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Payroll insurance files here. Download all free photos and vectors.

If you’re searching for payroll insurance pictures information related to the payroll insurance interest, you have pay a visit to the right blog. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly search and find more enlightening video articles and graphics that fit your interests.

Payroll Insurance. If you need assistance with kronos, please contact the school�s bookkeeper or secretary. Such insurance can be combined with workers’ compensation insurance for added protection. Our mission is to make “paycheck protection” accessible to all americans. Insurance policies that can protect against payroll mistakes.

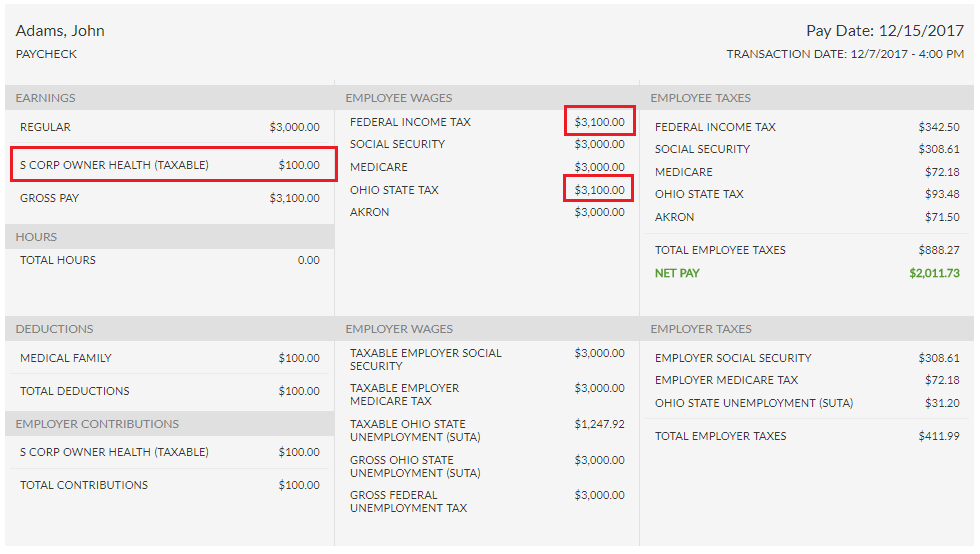

At the End of the Day, How Much Does an Employee Cost From legalreader.com

At the End of the Day, How Much Does an Employee Cost From legalreader.com

Payroll processing outsourcing pays big dividends if done properly, and when payroll administration is combined with workers compensation management, your payroll service becomes a strategic weapon for your business. Payroll & insurance group, inc. Check out this reference for more insights and complete instructions: The only exceptions are officers, executives, department managers and employees who are under contract. Open quickbooks payroll and find employees which is located on the left side of the window Filed as a statement & designation by foreign corporation in the state of california on friday, march 1, 2002 and is approximately twenty years old, according to public records filed with california secretary of state.a corporate filing is called a foreign filing when an existing corporate entity files in a state.

Payroll — the premium basis used to calculate premium in workers compensation insurance and, for some classifications, in general liability.

All such, payroll is covered as a necessary expense in the event of a catastrophic loss under a business interruption policy. Welcome to the payroll, insurance, retirement page. With insurance payroll services from surepayroll, spend less than 2 minutes per pay period to review employee payroll and approve it with our fast and accurate online payroll services. Open quickbooks payroll and find employees which is located on the left side of the window Pinkerton payroll & insurance is located in venice, fl and has been helping business and individuals with their insurance needs for over 20 years. You will log into this system at the school you are subbing for.

Source: stgcontentqa.statefundca.com

Source: stgcontentqa.statefundca.com

Payroll & social insurance related articles. Pinkerton payroll & insurance is located in venice, fl and has been helping business and individuals with their insurance needs for over 20 years. Here you will find the policies and forms for each of these sections, listed in alphabetical order. This email address is being protected from spambots. With insurance payroll services from surepayroll, spend less than 2 minutes per pay period to review employee payroll and approve it with our fast and accurate online payroll services.

Source: stgcontentqa.statefundca.com

Source: stgcontentqa.statefundca.com

Paycheck protection plans offers disability insurance directly to consumers. You will log into this system at the school you are subbing for. Running any business is rewarding, but it also comes with risks. Payroll & insurance group, inc. You need javascript enabled to view it.

Source: patriotsoftware.com

Source: patriotsoftware.com

No matter how prepared you think you are, there will always be challenging instances. Check out this reference for more insights and complete instructions: You can also see the primary contact for each area in case you have a question and can�t find the answer. Such insurance can be combined with workers’ compensation insurance for added protection. Our mission is to make “paycheck protection” accessible to all americans.

Source: evergreensmallbusiness.com

Source: evergreensmallbusiness.com

Payroll processing outsourcing pays big dividends if done properly, and when payroll administration is combined with workers compensation management, your payroll service becomes a strategic weapon for your business. In the deductions section, select the payroll item you just created and enter the amount. To get started with setting up health insurance contributions and deductions in quickbooks payroll, here are the steps mentioned below for the same: We work with clients from all industries and specialties. With insurance payroll services from surepayroll, spend less than 2 minutes per pay period to review employee payroll and approve it with our fast and accurate online payroll services.

Source: quickbooks-training.net

Source: quickbooks-training.net

In the deductions section, select the payroll item you just created and enter the amount. From insurance needs to payroll service. You need javascript enabled to view it. This email address is being protected from spambots. Our mission is to make “paycheck protection” accessible to all americans.

Source: canalhr.com

Source: canalhr.com

This email address is being protected from spambots. General liability insurance let us help safeguard your business against general liability claims with a policy that manages risk, protects assets, and addresses your specific needs. To get started with setting up health insurance contributions and deductions in quickbooks payroll, here are the steps mentioned below for the same: Check out this reference for more insights and complete instructions: Set up a payroll item for an insurance.

Source: iwins.com

Source: iwins.com

No matter how prepared you think you are, there will always be challenging instances. Insurance policies that can protect against payroll mistakes. Payroll & insurance group, inc. Open quickbooks payroll and find employees which is located on the left side of the window To get started with setting up health insurance contributions and deductions in quickbooks payroll, here are the steps mentioned below for the same:

Source: helpdesk.collsoft.ie

General liability insurance let us help safeguard your business against general liability claims with a policy that manages risk, protects assets, and addresses your specific needs. Paycheck protection plans offers disability insurance directly to consumers. Payroll will use this system to pay you. Insurance policies that can protect against payroll mistakes. Professional liability insurance, or errors and omissions, helps protect businesses against actionable mistakes made by owners, managers, employees, and contractors.

Source: fearnowinsurance.com

Source: fearnowinsurance.com

We apply our same model of direct customer service, responsible cost management, and low fees to each of the three pillars of our business. This email address is being protected from spambots. Open quickbooks payroll and find employees which is located on the left side of the window The only exceptions are officers, executives, department managers and employees who are under contract. Typically, ordinary payroll is defined as the entire expense of payroll for all employees of an insured entity.

Source: tpa-group.al

Source: tpa-group.al

No matter how prepared you think you are, there will always be challenging instances. If you would like to know more regarding payroll and social insurance issues, please refer to link below for additional information. Insurance policies that can protect against payroll mistakes. From financial protection to preserving your brand and reputation, business insurance. In the deductions section, select the payroll item you just created and enter the amount.

Source: legalreader.com

Source: legalreader.com

Our mission is to make “paycheck protection” accessible to all americans. Payroll & social insurance related articles. Professional liability insurance, or errors and omissions, helps protect businesses against actionable mistakes made by owners, managers, employees, and contractors. We apply our same model of direct customer service, responsible cost management, and low fees to each of the three pillars of our business. Payroll & insurance group, inc.

Source: pinkertonpi.com

Source: pinkertonpi.com

You will log into this system at the school you are subbing for. Check out this reference for more insights and complete instructions: To get started with setting up health insurance contributions and deductions in quickbooks payroll, here are the steps mentioned below for the same: Filed as a statement & designation by foreign corporation in the state of california on friday, march 1, 2002 and is approximately twenty years old, according to public records filed with california secretary of state.a corporate filing is called a foreign filing when an existing corporate entity files in a state. This email address is being protected from spambots.

Insurance policies that can protect against payroll mistakes. We work with clients from all industries and specialties. You can also see the primary contact for each area in case you have a question and can�t find the answer. Here you will find the policies and forms for each of these sections, listed in alphabetical order. Payroll — the premium basis used to calculate premium in workers compensation insurance and, for some classifications, in general liability.

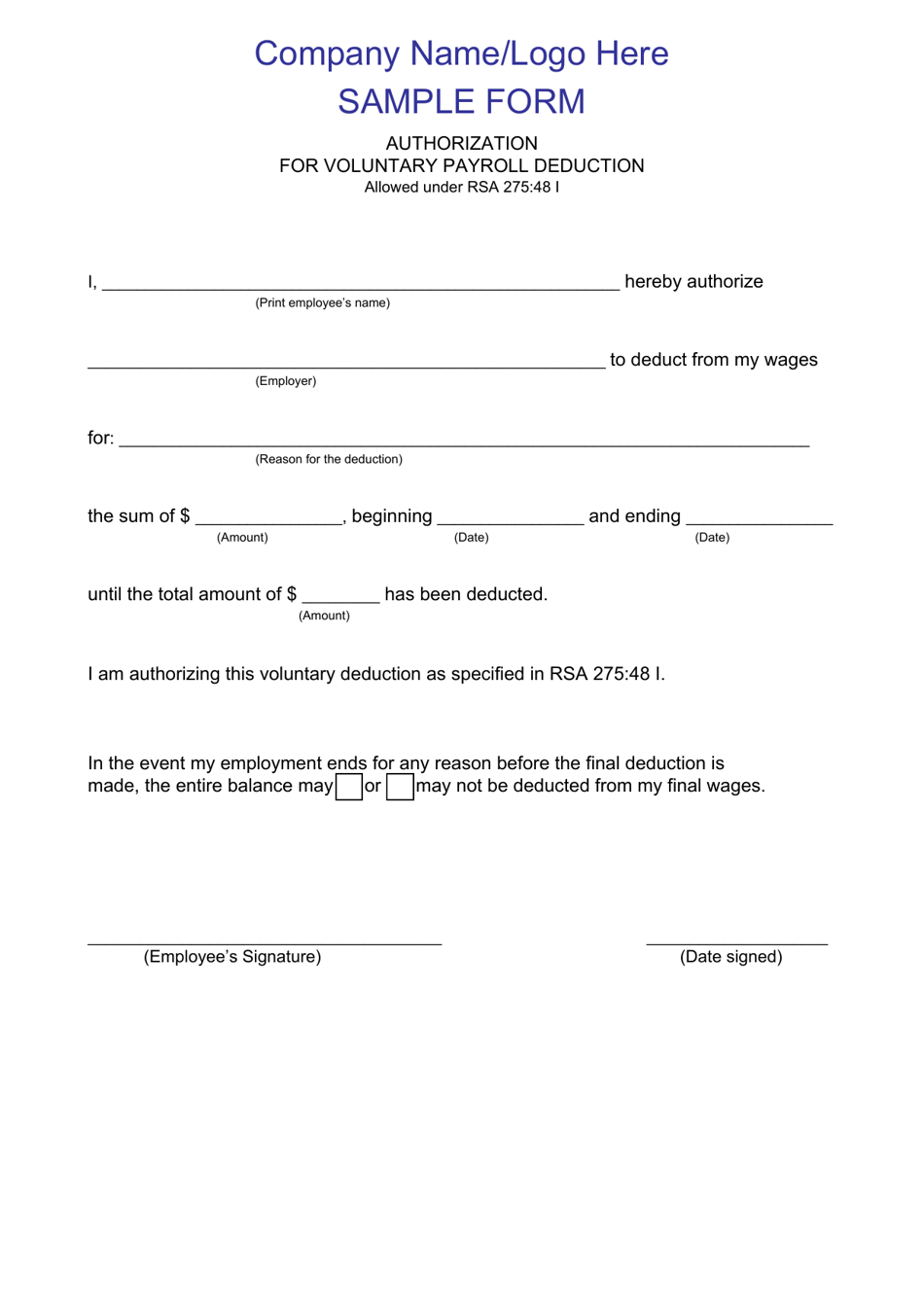

Source: templateroller.com

Source: templateroller.com

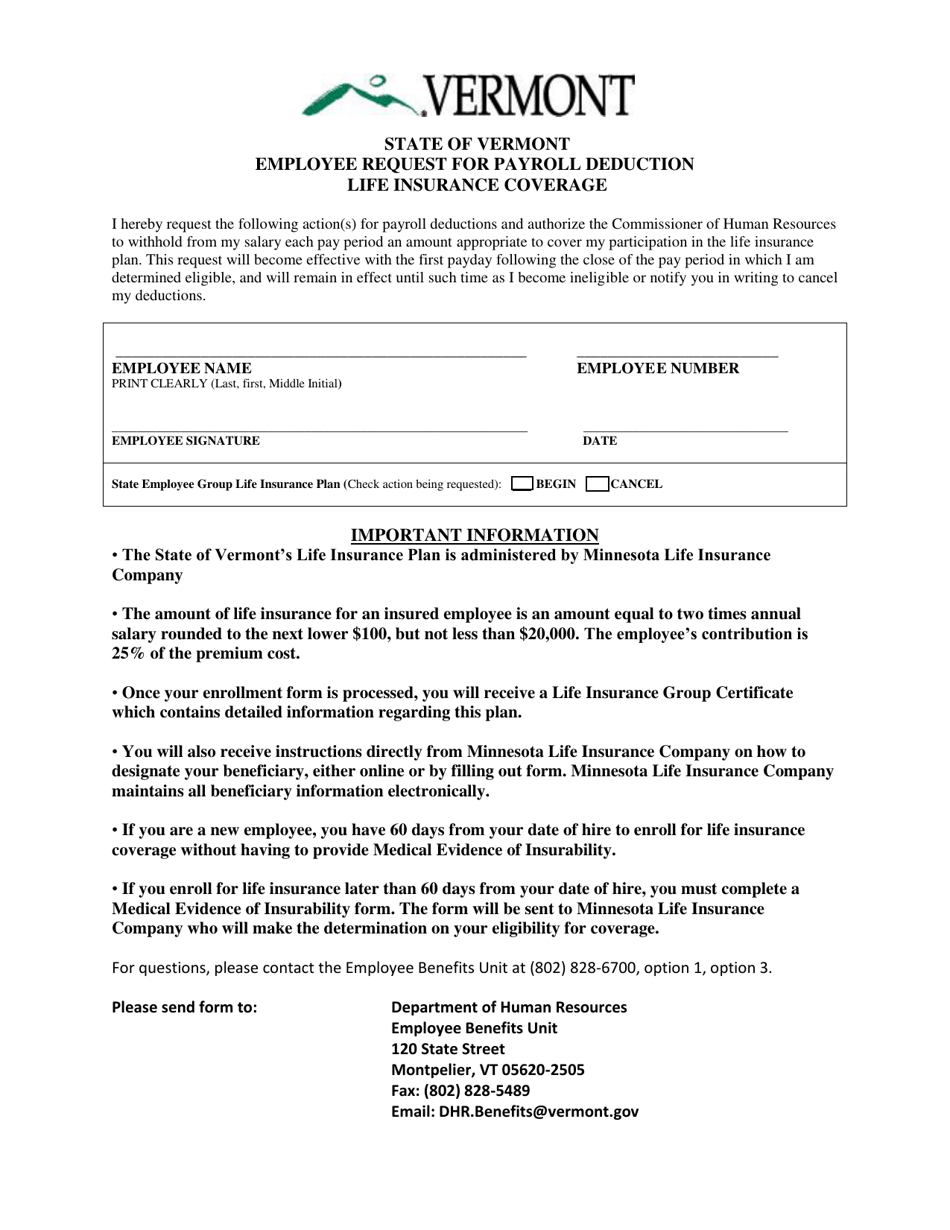

If you would like to know more regarding payroll and social insurance issues, please refer to link below for additional information. All such, payroll is covered as a necessary expense in the event of a catastrophic loss under a business interruption policy. Insurance policies that can protect against payroll mistakes. Increasingly, payroll is outsourced to specialized firms that handle paycheck processing, employee benefits, insurance, and accounting tasks, such as tax withholding. With insurance payroll services from surepayroll, spend less than 2 minutes per pay period to review employee payroll and approve it with our fast and accurate online payroll services.

Source: eselectins.com

Source: eselectins.com

Filed as a statement & designation by foreign corporation in the state of california on friday, march 1, 2002 and is approximately twenty years old, according to public records filed with california secretary of state.a corporate filing is called a foreign filing when an existing corporate entity files in a state. With insurance payroll services from surepayroll, spend less than 2 minutes per pay period to review employee payroll and approve it with our fast and accurate online payroll services. Filed as a statement & designation by foreign corporation in the state of california on friday, march 1, 2002 and is approximately twenty years old, according to public records filed with california secretary of state.a corporate filing is called a foreign filing when an existing corporate entity files in a state. Insurance policies that can protect against payroll mistakes. Payroll & insurance group, inc.

Source: templateroller.com

Source: templateroller.com

From insurance needs to payroll service. In the deductions section, select the payroll item you just created and enter the amount. Welcome to the payroll, insurance, retirement page. Paycheck protection plans offers disability insurance directly to consumers. No matter how prepared you think you are, there will always be challenging instances.

Source: strausstroy.com

Source: strausstroy.com

Check out this reference for more insights and complete instructions: Set up a payroll item for an insurance. To get started with setting up health insurance contributions and deductions in quickbooks payroll, here are the steps mentioned below for the same: Go to the payroll info. Payroll will use this system to pay you.

Source: ebs4payroll.com

Source: ebs4payroll.com

Go to the payroll info. We apply our same model of direct customer service, responsible cost management, and low fees to each of the three pillars of our business. With insurance payroll services from surepayroll, spend less than 2 minutes per pay period to review employee payroll and approve it with our fast and accurate online payroll services. No matter how prepared you think you are, there will always be challenging instances. Open quickbooks payroll and find employees which is located on the left side of the window

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title payroll insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information