Peo unemployment insurance information

Home » Trend » Peo unemployment insurance informationYour Peo unemployment insurance images are ready in this website. Peo unemployment insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Peo unemployment insurance files here. Find and Download all free photos.

If you’re looking for peo unemployment insurance pictures information related to the peo unemployment insurance interest, you have visit the ideal site. Our website frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

Peo Unemployment Insurance. Please suspend or close your previous unemployment. This often refers to employee health insurance, but could be any kind of insurance that benefits employees (such as unemployment insurance or life insurance). Justworks will report unemployment taxes under the justworks unemployment account number. Your employees continue to work at your company locations (s).

PEOs as a Workers� Compensation Insurance Solution From bankersinsurance.net

PEOs as a Workers� Compensation Insurance Solution From bankersinsurance.net

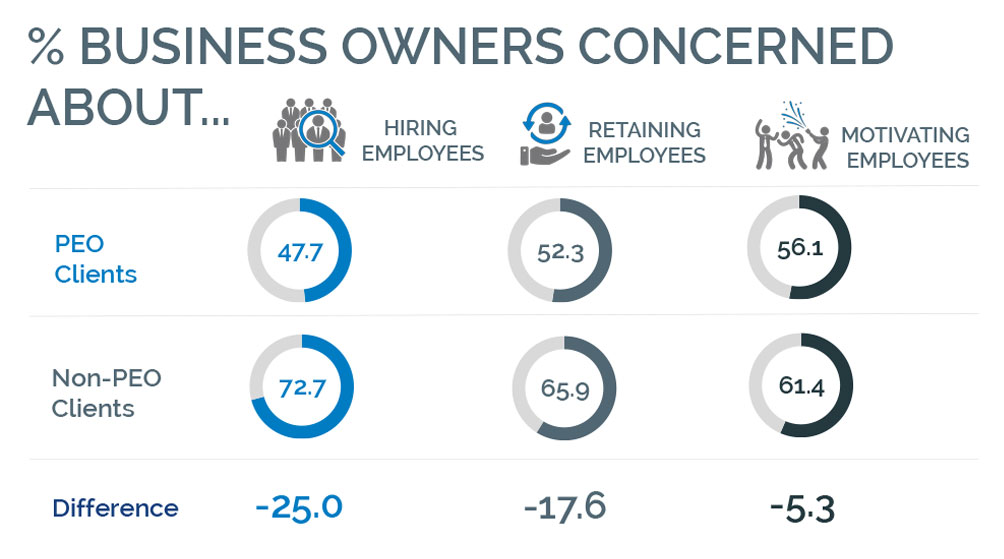

To complete the partial unemployment process, we will need the following items: Peos employ thousands of employees for different companies. What makes coadvantage peo stand out in our eyes are the great insurance savings you will get combined with best in class hr software. Peos can ensure that employees receive the benefits that they are legally entitled to. Typically, the peo offering may include human resource consulting, safety and risk mitigation services, payroll processing, employer payroll tax filing, workers� compensation insurance, health benefits, employers� practice and liability insurance. Private unemployment insurance may be difficult to find, as the two main providers, incomeassure and safetynet, are no longer issuing new policies.

What makes coadvantage peo stand out in our eyes are the great insurance savings you will get combined with best in class hr software.

Provides that a peo is responsible for the payment of contributions, penalties, and interest on wages paid by the peo to the peo’s covered employees during the term of the pe agreement; Peos often source and manage benefits for employees including, health insurance, retirement/pension contributions, workers’ compensation and unemployment insurance contributions. Typically, the peo offering may include human resource consulting, safety and risk mitigation services, payroll processing, employer payroll tax filing, workers� compensation insurance, health benefits, employers� practice and liability insurance. Section 3401 (d) of the internal revenue code provides that an entity is an employer for federal employment tax purposes if the entity has legal control of the payment of wages. Or if you’re already a member, please log in. In the simplest terms, the less your employees have experienced unemployment, the lower your tax rate will be for your unemployment insurance.

Source: bankersinsurance.net

Source: bankersinsurance.net

Here we explain what peo insurance is and the pros and cons of using a peo for employee insurance. Join today to get access to all of asa’s legal information and resources for members. Sorry, the content you’ve selected is for members only. What makes coadvantage peo stand out in our eyes are the great insurance savings you will get combined with best in class hr software. Private unemployment insurance is an insurance product that is designed to help supplement your state unemployment benefits if you lose your job.

Source: pinterest.com

Source: pinterest.com

The federal unemployment tax act (futa) was created to finance all administrative expenses of the federal/state unemployment insurance system and the federal costs involved in extended benefits. The business receives the benefit of its workers’ services without the paperwork and headache associated with payroll and taxes (e.g., 941 withholding and 940 unemployment). Our peo offers you the 0.6%. Asa publishes faqs on ppp loan forgiveness and sba audit issues m. Federal unemployment tax rates (known as futa) is a flat 6%.

Source: linnwealth.com

Source: linnwealth.com

Asa publishes faqs on ppp loan forgiveness and sba audit issues m. In the simplest terms, the less your employees have experienced unemployment, the lower your tax rate will be for your unemployment insurance. Current focus is the administration of the unemployment insurance claims management process for our clients and to provide service excellence in the cost protection, procedural rules applicable in ui proceedings, training,the appeals process, litigation strategy and best practices related to ui claims and claims management. Unemployment insurance is financed through both federal and state payroll taxes. Peo insurance is insurance administered by a professional employer organization (peo).

Source: youtube.com

Source: youtube.com

Current focus is the administration of the unemployment insurance claims management process for our clients and to provide service excellence in the cost protection, procedural rules applicable in ui proceedings, training,the appeals process, litigation strategy and best practices related to ui claims and claims management. Peos can ensure that employees receive the benefits that they are legally entitled to. Justworks will report unemployment taxes under the justworks unemployment account number. The claims team will provide the information required by the state on a weekly basis for the partial unemployment claims. However, if you have paid your state unemployment taxes on time, your futa tax is reduced to 0.6%.

Source: usnews.com

Source: usnews.com

Private unemployment insurance is an insurance product that is designed to help supplement your state unemployment benefits if you lose your job. The state requires a weekly report for each employee impacted. The peo pays your employees’ wages and. This often refers to employee health insurance, but could be any kind of insurance that benefits employees (such as unemployment insurance or life insurance). Peos often source and manage benefits for employees including, health insurance, retirement/pension contributions, workers’ compensation and unemployment insurance contributions.

Source: youtube.com

Source: youtube.com

This often refers to employee health insurance, but could be any kind of insurance that benefits employees (such as unemployment insurance or life insurance). With the services of a peo, where the peo becomes the “employer of record”, it is no longer the client’s responsibility to deal with unemployment issues (such as claims and ue taxes.) that all becomes “somebody else’s problem” (the peo’s) and the. Here we explain what peo insurance is and the pros and cons of using a peo for employee insurance. The kansas unemployment tax is used only for the payment of regular. The claims team will provide the information required by the state on a weekly basis for the partial unemployment claims.

Source: cashay.com

Current focus is the administration of the unemployment insurance claims management process for our clients and to provide service excellence in the cost protection, procedural rules applicable in ui proceedings, training,the appeals process, litigation strategy and best practices related to ui claims and claims management. To complete the partial unemployment process, we will need the following items: Justworks will report unemployment taxes under the justworks unemployment account number. Provides that a peo is responsible for the payment of contributions, penalties, and interest on wages paid by the peo to the peo’s covered employees during the term of the pe agreement; Our peo offers you the 0.6%.

Source: youtube.com

Source: youtube.com

This often refers to employee health insurance, but could be any kind of insurance that benefits employees (such as unemployment insurance or life insurance). It will be seamless, and any issues will be quickly resolved. Engage can assist with the partial unemployment process. Maybe it’s time to join! The business receives the benefit of its workers’ services without the paperwork and headache associated with payroll and taxes (e.g., 941 withholding and 940 unemployment).

Source: pgpbenefits.com

Source: pgpbenefits.com

Justworks will report unemployment taxes under the justworks unemployment account number. Peos have traditionally been considered the employer of record for remittance of federal income and unemployment taxes. Here we explain what peo insurance is and the pros and cons of using a peo for employee insurance. Or if you’re already a member, please log in. The business receives the benefit of its workers’ services without the paperwork and headache associated with payroll and taxes (e.g., 941 withholding and 940 unemployment).

Source: netprofitgrowth.com

Source: netprofitgrowth.com

However, if you have paid your state unemployment taxes on time, your futa tax is reduced to 0.6%. Section 3401 (d) of the internal revenue code provides that an entity is an employer for federal employment tax purposes if the entity has legal control of the payment of wages. The federal unemployment tax act (futa) was created to finance all administrative expenses of the federal/state unemployment insurance system and the federal costs involved in extended benefits. In the simplest terms, the less your employees have experienced unemployment, the lower your tax rate will be for your unemployment insurance. Please suspend or close your previous unemployment.

Source: slideserve.com

Source: slideserve.com

State unemployment charges will be invoiced by justworks; Provides that a peo is responsible for the payment of contributions, penalties, and interest on wages paid by the peo to the peo’s covered employees during the term of the pe agreement; The peo you ultimately choose can handle just the suta for you, or it can also assist with your experience rating. Your company’s sui rate no longer applies in new jersey. What makes coadvantage peo stand out in our eyes are the great insurance savings you will get combined with best in class hr software.

Source: alliancehrllc.com

Source: alliancehrllc.com

Peos can ensure that employees receive the benefits that they are legally entitled to. Unemployment insurance is financed through both federal and state payroll taxes. The peo pays your employees’ wages and. The peo you ultimately choose can handle just the suta for you, or it can also assist with your experience rating. Please suspend or close your previous unemployment.

Source: reazer.nammayelagiri.com

Source: reazer.nammayelagiri.com

Peos can ensure that employees receive the benefits that they are legally entitled to. The state requires a weekly report for each employee impacted. They are able to blend a large number of employees to lower the cost of health insurance and unemployment taxes we pay. The federal unemployment tax act (futa) was created to finance all administrative expenses of the federal/state unemployment insurance system and the federal costs involved in extended benefits. In the simplest terms, the less your employees have experienced unemployment, the lower your tax rate will be for your unemployment insurance.

Source: yunemplo.blogspot.com

Source: yunemplo.blogspot.com

Provides that a peo is responsible for the payment of contributions, penalties, and interest on wages paid by the peo to the peo’s covered employees during the term of the pe agreement; Peos can also keep your business informed of important federal and state labor laws that affect you if you have a remote workforce. If a company has an unemployment account open and their tax rate is under a certain threshold, justworks will report unemployment taxes under the justworks unemployment account number. Typically, the peo offering may include human resource consulting, safety and risk mitigation services, payroll processing, employer payroll tax filing, workers� compensation insurance, health benefits, employers� practice and liability insurance. The state requires a weekly report for each employee impacted.

Source: afacwa.org

Source: afacwa.org

Onboarding will be easy for yourself, your employees, and your managers, and will for the most part not disturb operations while it is going on. However, if you have paid your state unemployment taxes on time, your futa tax is reduced to 0.6%. What makes coadvantage peo stand out in our eyes are the great insurance savings you will get combined with best in class hr software. Onboarding will be easy for yourself, your employees, and your managers, and will for the most part not disturb operations while it is going on. Or if you’re already a member, please log in.

Source: slideshare.net

Source: slideshare.net

Engage can assist with the partial unemployment process. In the simplest terms, the less your employees have experienced unemployment, the lower your tax rate will be for your unemployment insurance. Your company’s sui rate no longer applies in new jersey. Peo insurance is insurance administered by a professional employer organization (peo). Your employees continue to work at your company locations (s).

Source: simplify.prismhr.com

Source: simplify.prismhr.com

However, if you have paid your state unemployment taxes on time, your futa tax is reduced to 0.6%. The federal unemployment tax act (futa) was created to finance all administrative expenses of the federal/state unemployment insurance system and the federal costs involved in extended benefits. The business receives the benefit of its workers’ services without the paperwork and headache associated with payroll and taxes (e.g., 941 withholding and 940 unemployment). Your employees continue to work at your company locations (s). Peos employ thousands of employees for different companies.

Source: youtube.com

Source: youtube.com

Engage can assist with the partial unemployment process. Unemployment insurance is financed through both federal and state payroll taxes. Peos can ensure that employees receive the benefits that they are legally entitled to. Asa publishes faqs on ppp loan forgiveness and sba audit issues m. The federal unemployment tax act (futa) was created to finance all administrative expenses of the federal/state unemployment insurance system and the federal costs involved in extended benefits.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title peo unemployment insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information