Perils and hazards of risk in insurance Idea

Home » Trend » Perils and hazards of risk in insurance IdeaYour Perils and hazards of risk in insurance images are available in this site. Perils and hazards of risk in insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Perils and hazards of risk in insurance files here. Get all royalty-free photos.

If you’re looking for perils and hazards of risk in insurance images information related to the perils and hazards of risk in insurance topic, you have come to the ideal blog. Our site frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

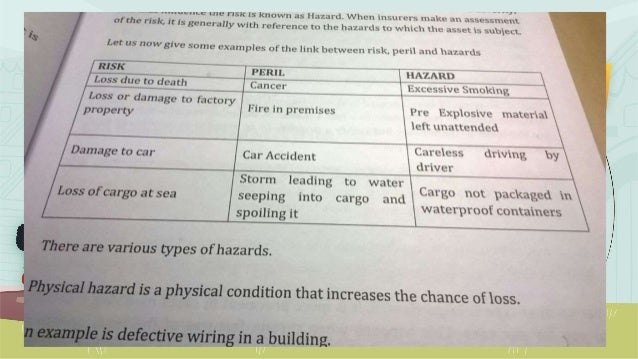

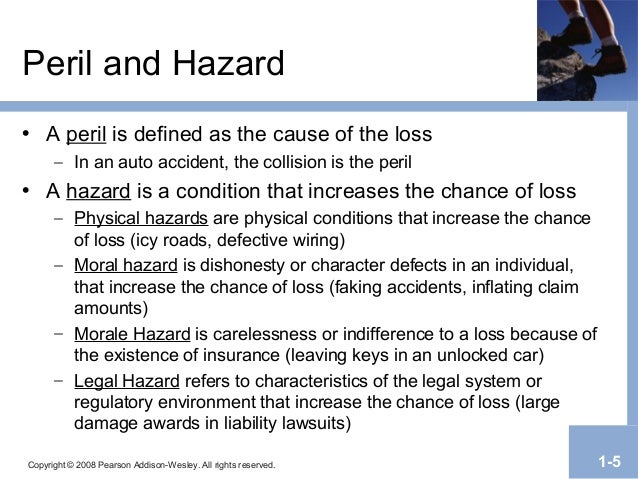

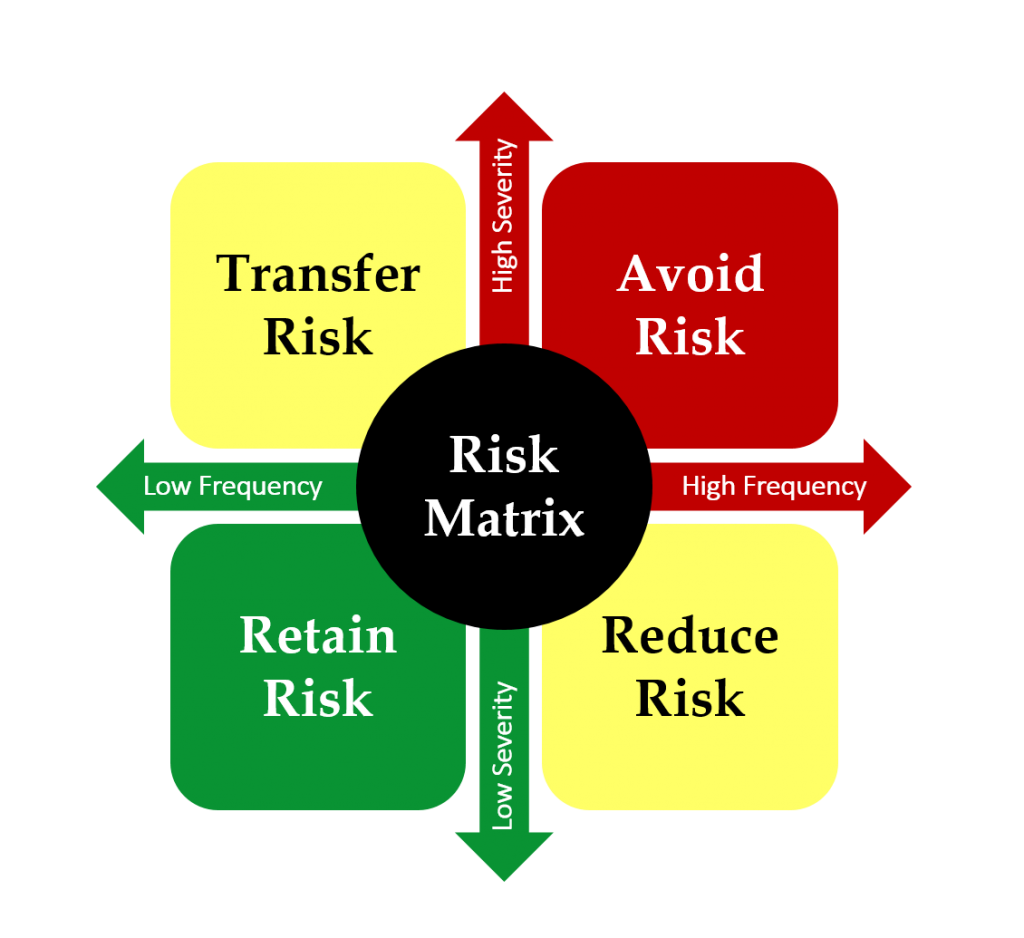

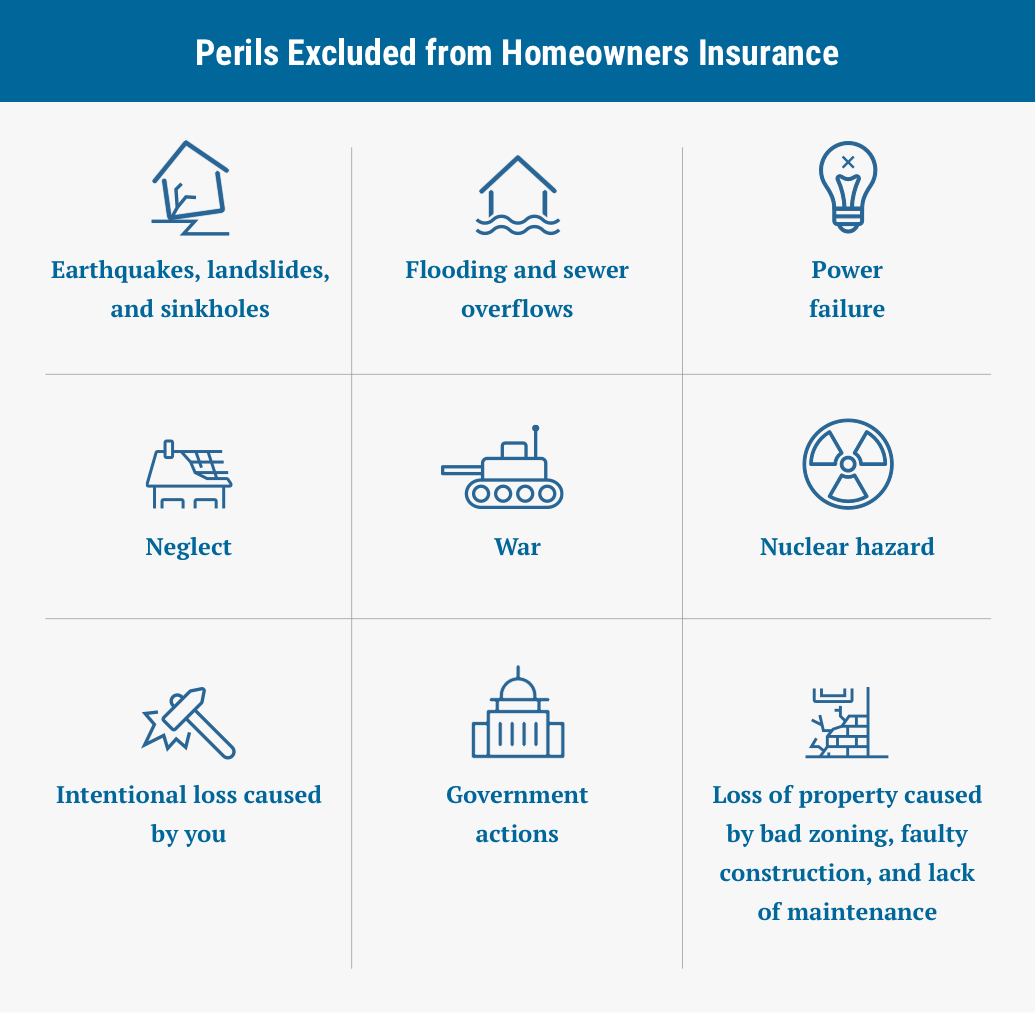

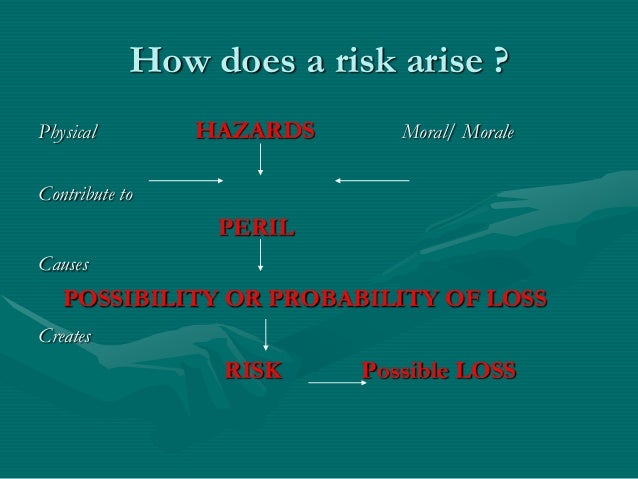

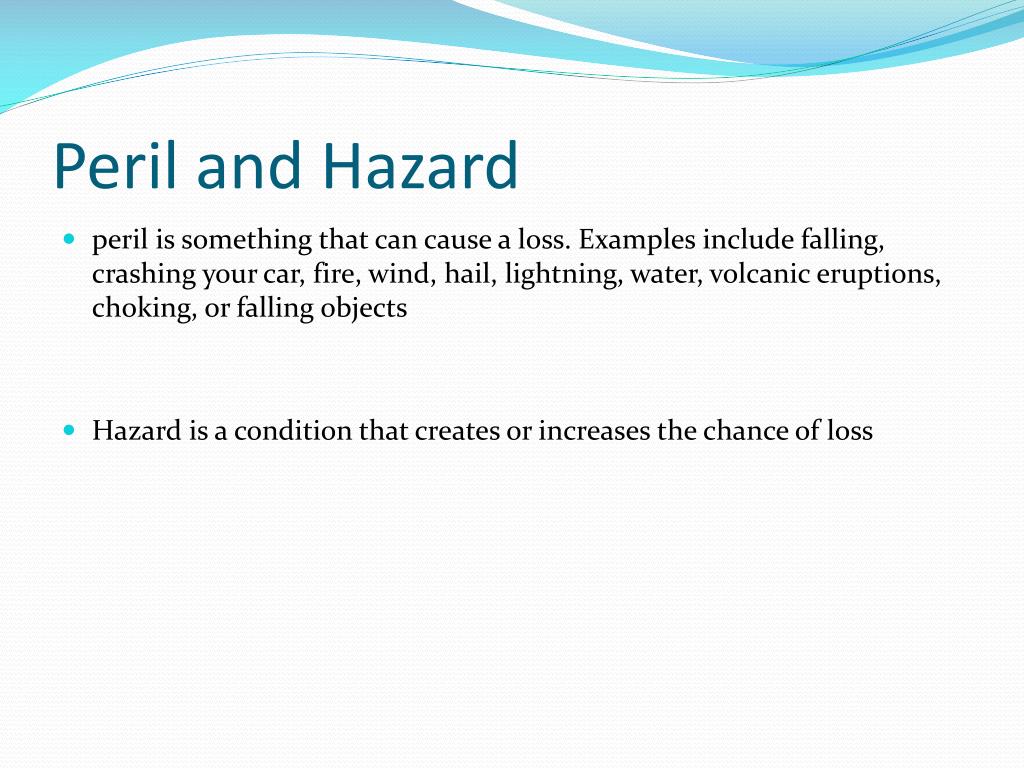

Perils And Hazards Of Risk In Insurance. Here are the 16 covered perils (commonly referred to as named perils) listed on basic homeowners insurance policies: Nature of insurance, risk, perils and hazards. According to the insurance information institute, the common perils covered in home hazard insurance policy are: A risk is simply the possibility of a loss, but a peril is a cause of loss.

Choosing Between All Risk and Peril Specific Commercial From avanteinsurance.com

Choosing Between All Risk and Peril Specific Commercial From avanteinsurance.com

The larger the number of individual risk combined into a group, the more certainty there is in predicting the degree or amount of loss that will be incurred in. Hazards risk professionals refer to hazards as. Named perils or open perils (also called all risk). For instance, fire is a peril because it causes losses, while a fireplace is a. A hazard is something that increases the possibility of a loss. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Many important risk transfer contracts (such as insurance contracts) use the word “peril” quite extensively to define inclusions and exclusions within contracts.

In general, a hazard can mean anything that increases the potential for risk, which is an unintended, unexpected occasion that damages an insured person or brings harm to property. The larger the number of individual risk combined into a group, the more certainty there is in predicting the degree or amount of loss that will be incurred in. Learn vocabulary, terms, and more with flashcards, games, and other study tools. For example, a person who takes 12 prescriptions is a poor risk. Risks to seek out insurance. The hazard is the underlying factor behind the peril that leads to the probability of a particular loss to the insurer.

Source: avanteinsurance.com

Source: avanteinsurance.com

A peril is the cause of the loss. Hazards • existing condition or possible (under current conditions) situation that has the potential to generate a disaster 4. Fire and smoke lightning wind and thunderstorms hail explosion theft vandalism vehicular accidents and collisions watar damage falling objects weight of ice, snow or sleet civil riots Perils can also be referred to as the accident itself. A peril is the cause of the loss.

Source: slideshare.net

Source: slideshare.net

For example, an insurer may decline to write a policy for perils that might threaten its own solvency (e.g., nuclear power plant liability) or those perils that might motivate insureds to cause a loss. If an insurer cannot compensate poor risks with better than average risks, then its loss experience will increase and its ability to pay claims may be compromised. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Fire and smoke lightning wind and thunderstorms hail explosion theft vandalism vehicular accidents and collisions watar damage falling objects weight of ice, snow or sleet civil riots Your policy will have hazards and perils included and hazard insurance is the piece that provides financial protection for your home and other personal belongings against those hazards and perils that are included in your policy.

Source: irdaic34.blogspot.com

Source: irdaic34.blogspot.com

Risks and hazards in insurance. Here are the 16 covered perils (commonly referred to as named perils) listed on basic homeowners insurance policies: For example, an insurer may decline to write a policy for perils that might threaten its own solvency (e.g., nuclear power plant liability) or those perils that might motivate insureds to cause a loss. Hazards • existing condition or possible (under current conditions) situation that has the potential to generate a disaster 4. Terms in this set (15) law of large numbers.

Source: youtube.com

Source: youtube.com

Hazards risk professionals refer to hazards as. Named perils or open perils (also called all risk). Many important risk transfer contracts (such as insurance contracts) use the word “peril” quite extensively to define inclusions and exclusions within contracts. The distinction is important because in modeling there is a difference between modeling risk and modeling a peril. When a building burns, fire is the peril.

Source: slideshare.net

Source: slideshare.net

Fire and smoke lightning wind and thunderstorms hail explosion theft vandalism vehicular accidents and collisions watar damage falling objects weight of ice, snow or sleet civil riots Hazards increase the risk of a specific peril. A risk is simply the possibility of a loss, but a peril is a cause of loss. Paristhiti hazard (condition) kaaran peril cause of risk and loss sambhavna risk exposure to hazard with suppot of peril 3. Your policy will have hazards and perils included and hazard insurance is the piece that provides financial protection for your home and other personal belongings against those hazards and perils that are included in your policy.

Source: embroker.com

Source: embroker.com

Hazards • existing condition or possible (under current conditions) situation that has the potential to generate a disaster 4. Paristhiti hazard (condition) kaaran peril cause of risk and loss sambhavna risk exposure to hazard with suppot of peril 3. Nature of insurance, risk, perils and hazards. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Hazards, perils and risk with reference to general insurance 2.

Source: youngalfred.com

Source: youngalfred.com

A hazard is something that increases the possibility of a loss. Risks and hazards in insurance. A hazard is something that increases the possibility of a loss. The hazard is the underlying factor behind the peril that leads to the probability of a particular loss to the insurer. According to the insurance information institute, the common perils covered in home hazard insurance policy are:

Source: definitionus.blogspot.com

In general, a hazard can mean anything that increases the potential for risk, which is an unintended, unexpected occasion that damages an insured person or brings harm to property. If you are ever forced to relocate because your home is damaged in a tornado, fire, or other unfortunate reason your home might be destroyed. Loss is the unintentional decrease in the value of an asset due to a peril. Hazards, perils and risk with reference to general insurance 2. Hazards risk professionals refer to hazards as.

Source: pinterest.com

Source: pinterest.com

Risks to seek out insurance. Hazards increase the risk of a specific peril. Your policy will have hazards and perils included and hazard insurance is the piece that provides financial protection for your home and other personal belongings against those hazards and perils that are included in your policy. Here are the 16 covered perils (commonly referred to as named perils) listed on basic homeowners insurance policies: The larger the number of individual risk combined into a group, the more certainty there is in predicting the degree or amount of loss that will be incurred in.

Source: quoteinspector.com

Source: quoteinspector.com

For example, an insurer may decline to write a policy for perils that might threaten its own solvency (e.g., nuclear power plant liability) or those perils that might motivate insureds to cause a loss. The distinction is important because in modeling there is a difference between modeling risk and modeling a peril. For example, an insurer may decline to write a policy for perils that might threaten its own solvency (e.g., nuclear power plant liability) or those perils that might motivate insureds to cause a loss. Smoking is considered a physical hazard because it. A risk is the possibility of a loss.

Source: pharesinsurance.com

Source: pharesinsurance.com

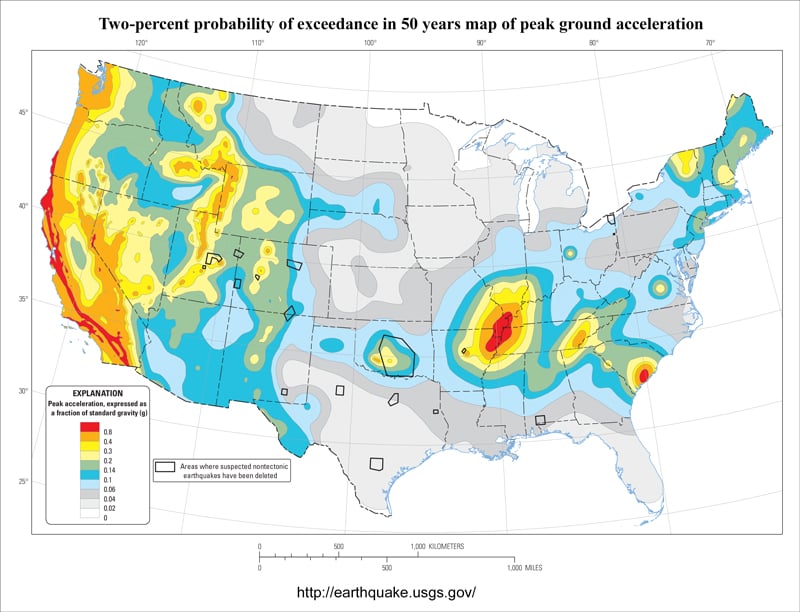

Town or community is exposed to risk. Hazards • existing condition or possible (under current conditions) situation that has the potential to generate a disaster 4. So hazards increase the risk of a specific peril. Hazards, perils and risk with reference to general insurance 2. Policies offer two types of coverage for perils:

Source: slideshare.net

Source: slideshare.net

This term can also be referred to as the accident itself. Hazard = condition that increases the probability of loss. Learn vocabulary, terms, and more with flashcards, games, and other study tools. If an insurer cannot compensate poor risks with better than average risks, then its loss experience will increase and its ability to pay claims may be compromised. Loss is the unintentional decrease in the value of an asset due to a peril.

Source: intermap.com

Source: intermap.com

A risk is simply the possibility of a loss, but a peril is a cause of loss. If you are ever forced to relocate because your home is damaged in a tornado, fire, or other unfortunate reason your home might be destroyed. Loss is the unintentional decrease in the value of an asset due to a peril. Fire or lightning windstorms and hail theft vandalism or malicious mischief explosions weight of ice, snow, and sleet falling objects riots or civil commotion smoke damage from aircraft damage from vehicles volcanic eruption A hazard is the source of danger.

Source: sageoakfinancial.com

Source: sageoakfinancial.com

There are conditions, which are more hazardous than others e.g., working, as an electrician is a more hazardous occupation than that of a banker as it is more This term can also be referred to as the accident itself. There are conditions, which are more hazardous than others e.g., working, as an electrician is a more hazardous occupation than that of a banker as it is more A peril is the immediate specific event causing loss and giving rise to risk. In general, a hazard can mean anything that increases the potential for risk, which is an unintended, unexpected occasion that damages an insured person or brings harm to property.

Source: money.com

Source: money.com

The larger the number of individual risk combined into a group, the more certainty there is in predicting the degree or amount of loss that will be incurred in. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Hazards are built into all models as a modifier to the chance of something happening. For example, an insurer may decline to write a policy for perils that might threaten its own solvency (e.g., nuclear power plant liability) or those perils that might motivate insureds to cause a loss. The hazard is the underlying factor behind the peril that leads to the probability of a particular loss to the insurer.

Source: slideshare.net

Source: slideshare.net

A peril is the immediate specific event causing loss and giving rise to risk. If you are ever forced to relocate because your home is damaged in a tornado, fire, or other unfortunate reason your home might be destroyed. Hazards risk professionals refer to hazards as. Hazards are built into all models as a modifier to the chance of something happening. Town or community is exposed to risk.

Source: slideshare.net

Source: slideshare.net

If an insurer cannot compensate poor risks with better than average risks, then its loss experience will increase and its ability to pay claims may be compromised. For example, an insurer may decline to write a policy for perils that might threaten its own solvency (e.g., nuclear power plant liability) or those perils that might motivate insureds to cause a loss. The distinction is important because in modeling there is a difference between modeling risk and modeling a peril. Details of risk, perils and hazard risks, perils, and hazards risk, peril, and hazard are terms used to indicate the possibility of loss, and are often used For example, an insurer may decline to write a policy for perils that might threaten its own solvency (e.g., nuclear power plant liability) or those perils that might motivate insureds to cause a loss.

Source: slideserve.com

Source: slideserve.com

Hazards • existing condition or possible (under current conditions) situation that has the potential to generate a disaster 4. Loss is the unintentional decrease in the value of an asset due to a peril. Town or community is exposed to risk. For example, an insurer may decline to write a policy for perils that might threaten its own solvency (e.g., nuclear power plant liability) or those perils that might motivate insureds to cause a loss. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title perils and hazards of risk in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information