Personal accident insurance income tax benefit information

Home » Trending » Personal accident insurance income tax benefit informationYour Personal accident insurance income tax benefit images are ready. Personal accident insurance income tax benefit are a topic that is being searched for and liked by netizens now. You can Get the Personal accident insurance income tax benefit files here. Get all royalty-free photos.

If you’re searching for personal accident insurance income tax benefit images information related to the personal accident insurance income tax benefit keyword, you have pay a visit to the ideal site. Our site always provides you with hints for seeking the maximum quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

Personal Accident Insurance Income Tax Benefit. This insurance protects your income if you fall ill and can’t work. Any benefits received from your employer while injured are considered salary or wages and taxable as ordinary income. Personal accident insurance income tax benefit. The section 80d of the income tax act provides for tax deduction from total taxable income for a payment of health insurance premium paid by an individual (or a huf).

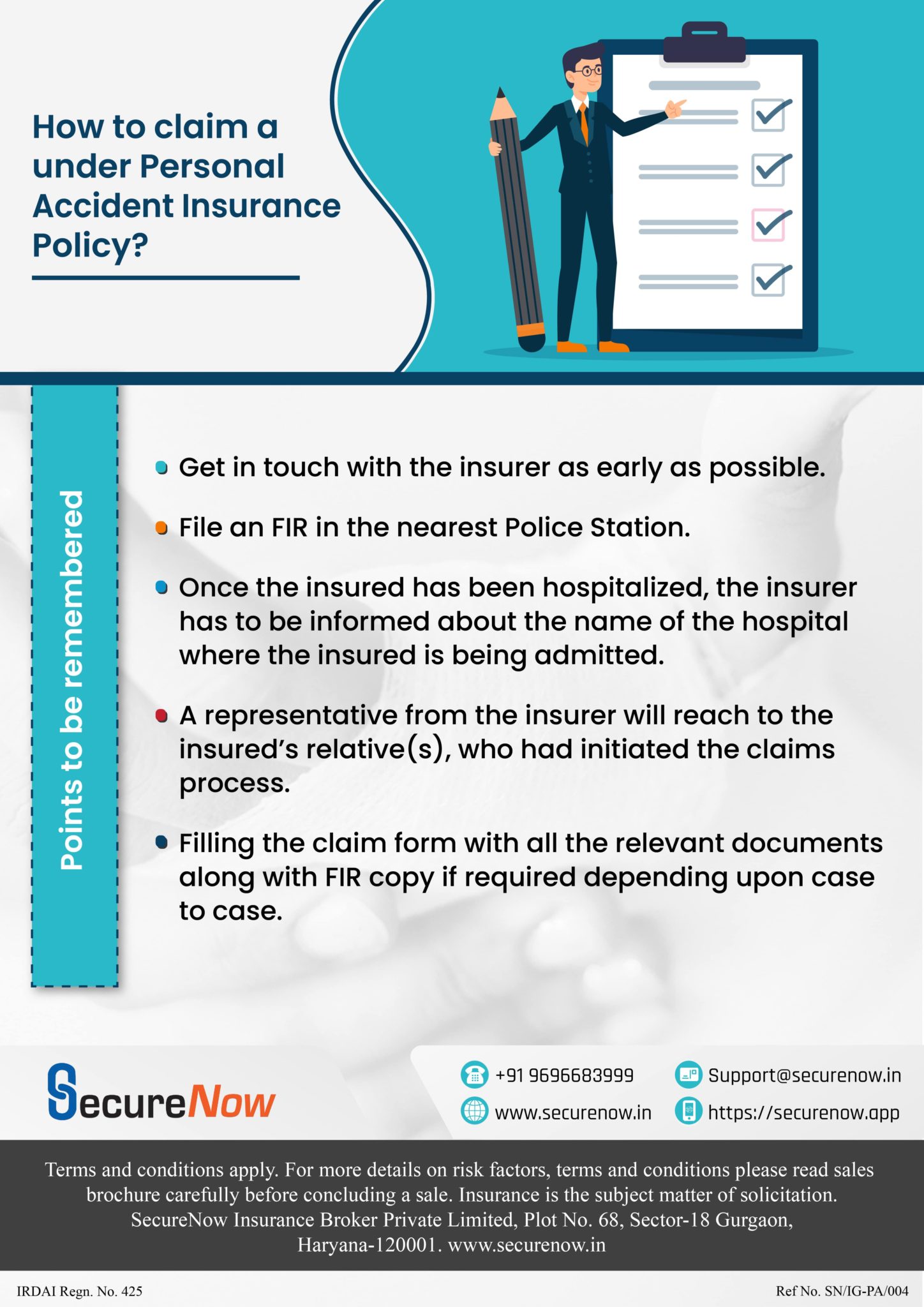

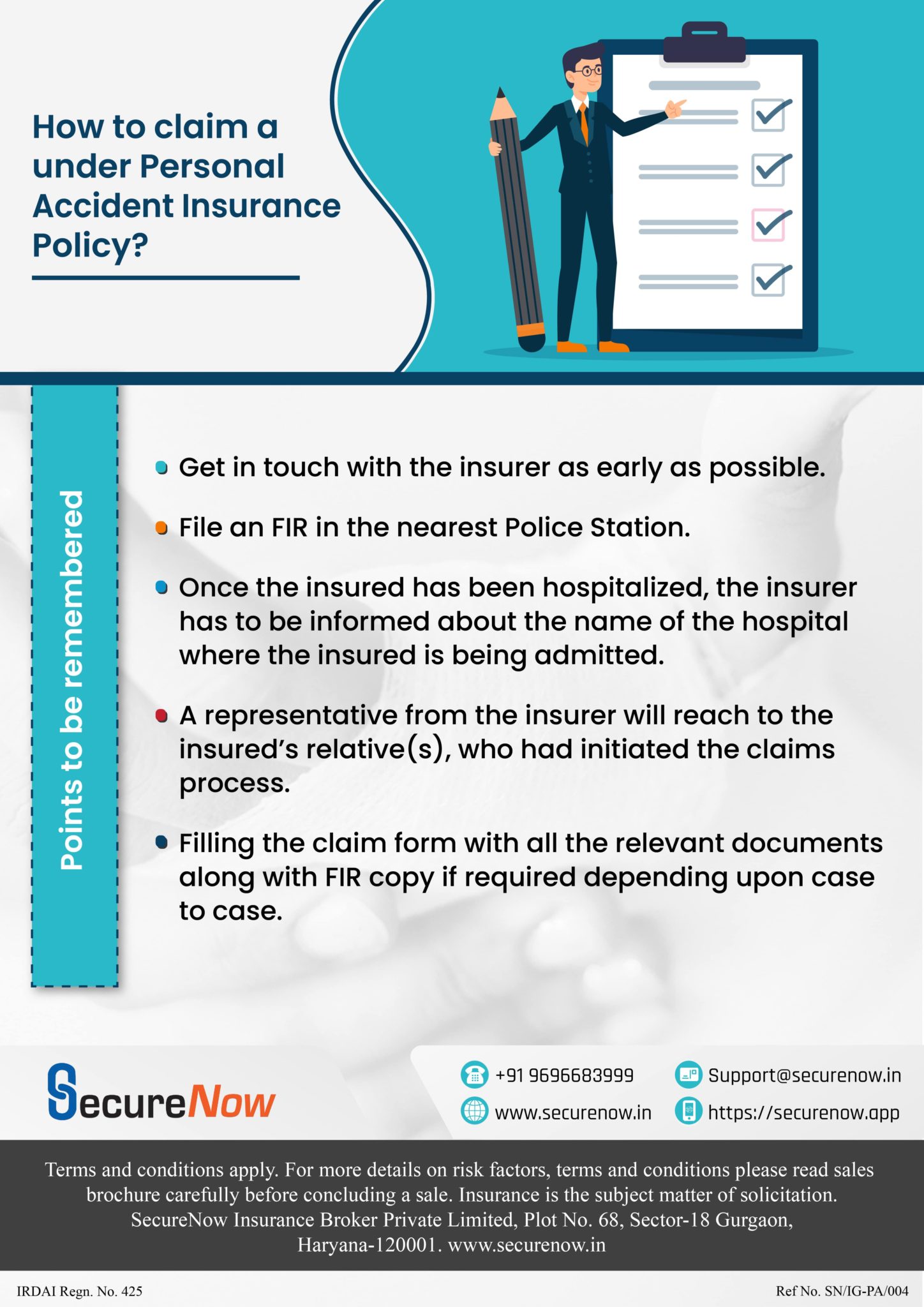

Personal Accident insurance Claims process (Infographic From securenow.in

Personal Accident insurance Claims process (Infographic From securenow.in

Insurance premium, payment of health insurance premium and expenditure on medical treatment. This is known as income protection of continuing salary cover. 07 january 2011 premium paid for pa is not allowed as deduction. Amounts that are not income under ordinary concepts will not be subject to tax. 07 january 2011 that income may be taxable under the head income from other sources. Only the premiums you pay to protect your income are deductible.

This is known as income protection of continuing salary cover.

You can�t claim a deduction, if the policy One can enjoy the advantage of tax deduction on the policy if they successfully demonstrate that the insurance premium is paid to protect their taxable income. · up to rm7,000 for life insurance public servants. When it comes to insurance policies, these are the claimable tax reliefs offered for malaysia personal income tax: Personal sickness or accident insurance policies will be income only if they are income under ordinary concepts (s ca 1(2)). If you are senior citizen than maximum deduction can go upto rs.

Source: comparepolicy.com

Source: comparepolicy.com

Only the premiums you pay to protect your income are deductible. Section 80d of the income tax act 1961 does not provide any tax benefit for the premium paid for personal accident insurance plans that offer protection against any physical disability, dismemberment or accidental demise. If you are senior citizen than maximum deduction can go upto rs. To arrive at taxable income, one has to deduct from gti, the deductions allowable under chapter via (i.e., under section 80c to 80u). A personal accident (pa) insurance is an annual policy which provides compensation in the event of injuries, disability or death caused solely by an accident.

Thus, personal accident insurance can be tax deductible for the small businessmen or traders who pay the premium to secure their earning. Unlike life and health insurance policies which offer the policyholder some amount of tax rebate under various sections of the income tax act, personal accident policies do not have any tax benefits. Thus, personal accident insurance can be tax deductible for the small businessmen or traders who pay the premium to secure their earning. 07 january 2011 premium paid for pa is not allowed as deduction. Tax benefits under section 80d can also be claimed for premiums paid toward health insurance riders and critical illness insurance policies.

Source: securenow.in

Source: securenow.in

Thus, personal accident insurance can be tax deductible for the small businessmen or traders who pay the premium to secure their earning. Find out how we can help you if you have a complaint about income protection insurance. This is known as income protection of continuing salary cover. You can take advantage of tax deduction, if you can successfully demonstrate that the premium is paid to protect your taxable income. You must include any payment you receive under an income protection policy in your tax return.

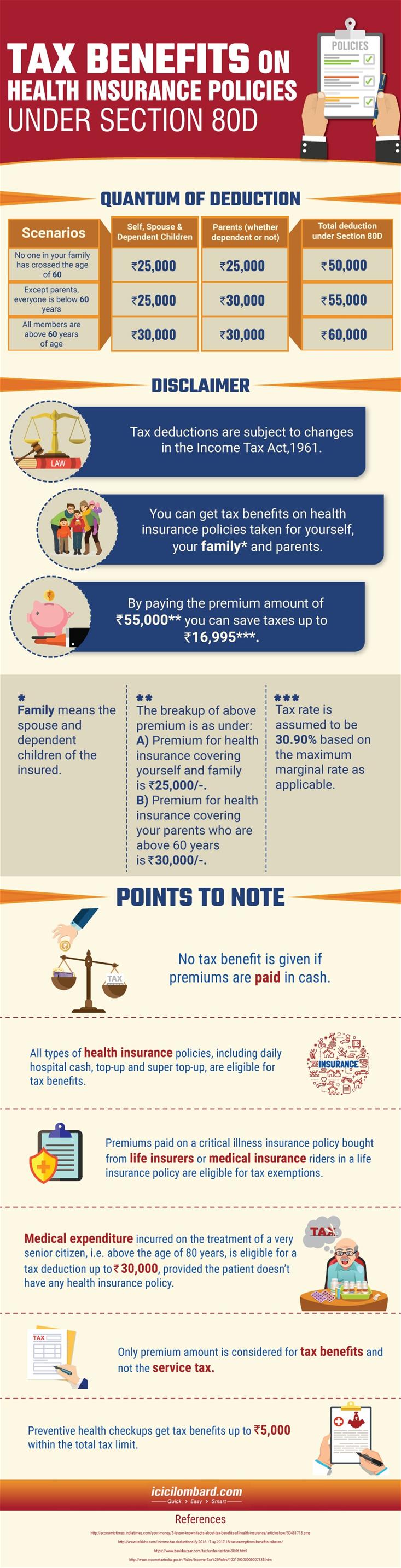

Source: icicilombard.com

Source: icicilombard.com

Qb 18/05 considers the income tax treatment of a personal sickness or accident insurance policy that is taken out by an employer for the benefit of an employee. Personal accident insurance income tax benefit. Accidental insurance payouts are taxable if the employer paid for the insurance plan. Only the premiums you pay to protect your income are deductible. Therefore, you can claim a deduction up to rs.

Source: gi.azay.co.th

Source: gi.azay.co.th

07 january 2011 that income may be taxable under the head income from other sources. 07 january 2011 that income may be taxable under the head income from other sources. To arrive at taxable income, one has to deduct from gti, the deductions allowable under chapter via (i.e., under section 80c to 80u). The section 80d of the income tax act provides for tax deduction from total taxable income for a payment of health insurance premium paid by an individual (or a huf). Sum insured for dependent children, dependant parents, parents in law and non working.

Source: moneyvisual.com

Source: moneyvisual.com

You can�t claim a deduction, if the policy Personal sickness or accident insurance policies will be income only if they are income under ordinary concepts (s ca 1(2)). The premium paid for personal accident section, except for accidental hospitalisation section, is not considered for tax exemption. Personal accident insurance income tax benefit. If you are senior citizen than maximum deduction can go upto rs.

Source: pradhanmantriyojana.co.in

Source: pradhanmantriyojana.co.in

Amounts that are income under s ce 11 or s ca 1(2) will be exempt income if they are payments: 07 january 2011 that income may be taxable under the head income from other sources. Sum insured for dependent children, dependant parents, parents in law and non working. One can enjoy the advantage of tax deduction on the policy if they successfully demonstrate that the insurance premium is paid to protect their taxable income. Total income from all the heads of income is called as “gross total income” (gti).

Source: iiflinsurance.com

Source: iiflinsurance.com

To arrive at taxable income, one has to deduct from gti, the deductions allowable under chapter via (i.e., under section 80c to 80u). Total income from all the heads of income is called as “gross total income” (gti). 30000 on your taxable income, and if your parents are senior citizens, the deductible amount goes up to rs. Specifically, section 80d of the income tax act 1961 does not provide any tax benefit for the premium paid for personal accident insurance plans. If you are senior citizen than maximum deduction can go upto rs.

Source: michiganautolaw.com

Source: michiganautolaw.com

A personal accident (pa) insurance is an annual policy which provides compensation in the event of injuries, disability or death caused solely by an accident. If you are a small business owner, and are paying the insurance premium to secure your earning capacity, you. You must include any payment you receive under an income protection policy in your tax return. The premium paid for personal accident section, except for accidental hospitalisation section, is not considered for tax exemption. The guidelines to claim insurance premium as a tax benefit are very intricate.

Source: beshak.org

Source: beshak.org

See group insurance premium paid by employers (below). Qb 18/05 considers the income tax treatment of a personal sickness or accident insurance policy that is taken out by an employer for the benefit of an employee. If you are a small business owner, and are paying the insurance premium to secure your earning capacity, you. Amounts that are income under s ce 11 or s ca 1(2) will be exempt income if they are payments: The section 80d of the income tax act provides for tax deduction from total taxable income for a payment of health insurance premium paid by an individual (or a huf).

Source: lawnn.com

Source: lawnn.com

If you paid all or part of the premiums on this type of income protection policy then tax will be levied, in the same proportion, on any benefits paid for example if you paid 50% of the monthly premium then you will be taxed on 50% of the benefits paid Unlike life and health insurance policies which offer the policyholder some amount of tax rebate under various sections of the income tax act, personal accident policies do not have any tax benefits. Tax benefit is only one of the reasons to opt for motor insurance. · up to rm7,000 for life insurance public servants. When it comes to insurance policies, these are the claimable tax reliefs offered for malaysia personal income tax:

Source: strategic-benefits.com

Source: strategic-benefits.com

Tax benefits under section 80d can also be claimed for premiums paid toward health insurance riders and critical illness insurance policies. When it comes to insurance policies, these are the claimable tax reliefs offered for malaysia personal income tax: The section 80d of the income tax act provides for tax deduction from total taxable income for a payment of health insurance premium paid by an individual (or a huf). To arrive at taxable income, one has to deduct from gti, the deductions allowable under chapter via (i.e., under section 80c to 80u). Personal sickness or accident insurance policies will be income only if they are income under ordinary concepts (s ca 1(2)).

Source: moneyexcel.com

Source: moneyexcel.com

If you paid all or part of the premiums on this type of income protection policy then tax will be levied, in the same proportion, on any benefits paid for example if you paid 50% of the monthly premium then you will be taxed on 50% of the benefits paid When it comes to insurance policies, these are the claimable tax reliefs offered for malaysia personal income tax: This is known as income protection of continuing salary cover. To arrive at taxable income, one has to deduct from gti, the deductions allowable under chapter via (i.e., under section 80c to 80u). If the employer subsequently disburses the insurance payout to its employees, the payout is taxable as additional remuneration, unless it is received by way of death gratuity or as compensation for death or injuries (namely, bodily injuries caused by accidents).

Source: insurerelaxinfo.blogspot.com

Source: insurerelaxinfo.blogspot.com

· up to rm7,000 for life insurance public servants. When a person is sick and gets claim amount of personal accident, will he/she be liable to pay income tax. If you are senior citizen than maximum deduction can go upto rs. You must include any payment you receive under an income protection policy in your tax return. Only the premiums you pay to protect your income are deductible.

Source: savingnspending.com

Source: savingnspending.com

Any benefits received from your employer while injured are considered salary or wages and taxable as ordinary income. The premium paid for personal accident section, except for accidental hospitalisation section, is not considered for tax exemption. You can take advantage of tax deduction, if you can successfully demonstrate that the premium is paid to protect your taxable income. Sum insured for dependent children, dependant parents, parents in law and non working. You must include any payment you receive under an income protection policy in your tax return.

Source: myinsuranceclub.com

Source: myinsuranceclub.com

This is known as income protection of continuing salary cover. · up to rm7,000 for life insurance public servants. Tax benefits with personal accident insurance policies: 30000 on your taxable income, and if your parents are senior citizens, the deductible amount goes up to rs. 07 january 2011 that income may be taxable under the head income from other sources.

Source: alankitinsurance.com

Source: alankitinsurance.com

It must however, be noted that premiums paid for personal accident policies or personal accident riders. Find out how we can help you if you have a complaint about income protection insurance. Personal sickness or accident insurance policies will be income only if they are income under ordinary concepts (s ca 1(2)). This is known as income protection of continuing salary cover. Insurance premium, payment of health insurance premium and expenditure on medical treatment.

Source: techmirror.in

Source: techmirror.in

If you are a small business owner, and are paying the insurance premium to secure your earning capacity, you. You can�t claim a deduction, if the policy Tax benefits with personal accident insurance policies: You must include any payment you receive under an income protection policy in your tax return. One can enjoy the advantage of tax deduction on the policy if they successfully demonstrate that the insurance premium is paid to protect their taxable income.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title personal accident insurance income tax benefit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information