Personal excess liability insurance information

Home » Trending » Personal excess liability insurance informationYour Personal excess liability insurance images are available. Personal excess liability insurance are a topic that is being searched for and liked by netizens now. You can Get the Personal excess liability insurance files here. Find and Download all free vectors.

If you’re looking for personal excess liability insurance images information related to the personal excess liability insurance interest, you have come to the ideal blog. Our site always provides you with hints for seeking the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that match your interests.

Personal Excess Liability Insurance. Personal excess liability coverage highlights. The term “excess liability” is often interchanged with “umbrella. The term “excess liability” is often interchanged with “umbrella. Serious protection at an affordable price.

Excess Liability Insurance Program From hnagency.com

Excess Liability Insurance Program From hnagency.com

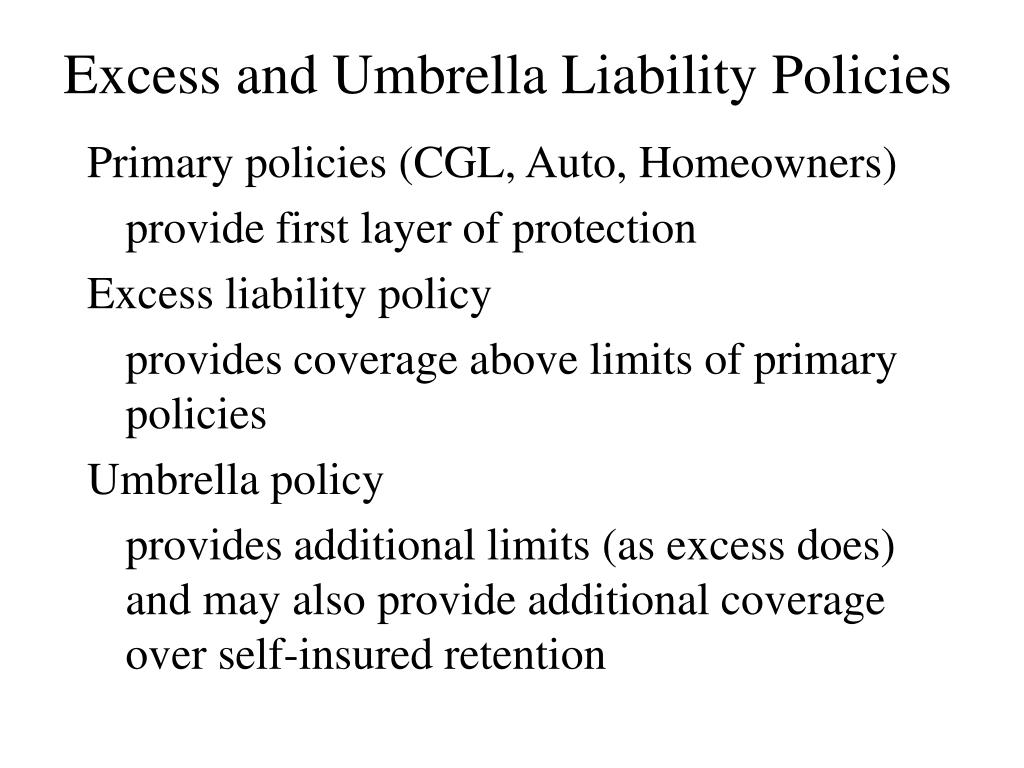

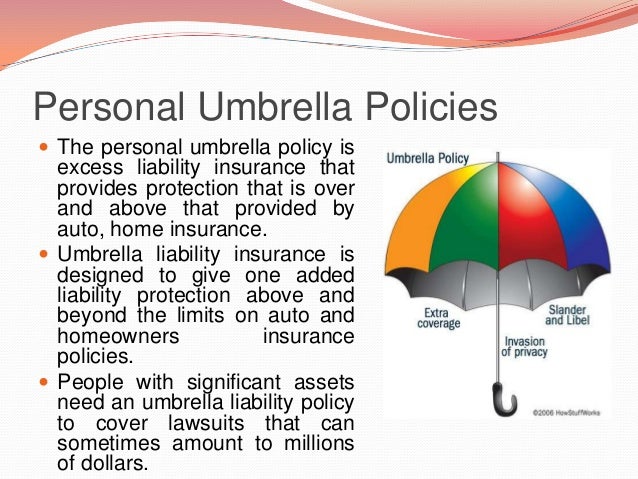

Insurance companies themselves won’t typically advise their insureds as to appropriate amounts of umbrella coverage, telling them instead to “speak to. 1 in 8 people in the u.s. It does not broaden the stated coverage, but will provide higher limits on top of the original policy. Some insurers use the distinction that umbrella insurance can cover some risks and situations not covered by the standard policy, while excess liability insurance simply adds on a higher payout limit. The excess policy then kicks in to pay any remaining costs. Personal excess liability insurance is often equated with umbrella insurance.

The purpose of excess liability insurance is to close any gaps in coverage and provide an extra layer of protection should the primary insurance, such as a general liability policy, be exhausted.

The excess policy then kicks in to pay any remaining costs. 1 in 8 people in the u.s. The excess policy then kicks in to pay any remaining costs. Pricing that better aligns with risk. While both provide coverage beyond the liability policy�s limit, personal excess liability insurance does not provide the broader protection that umbrella insurance affords. This means an excess liability policy is less likely to pay out than a standard policy, in turn meaning the premium costs are comparatively lower.

Source: interviewsandwriter.blogspot.com

Source: interviewsandwriter.blogspot.com

1 in 8 people in the u.s. The term “excess liability” is often interchanged with “umbrella. This means an excess liability policy is less likely to pay out than a standard policy, in turn meaning the premium costs are comparatively lower. The excess policy then kicks in to pay any remaining costs. The term “excess liability” is often interchanged with “umbrella.

Source: issuu.com

Source: issuu.com

With that said, when inquiring for an excess liability policy, one must already provide the current. The difference between excess liability and umbrella insurance. The more assets you own, the more vulnerable you could be. This means an excess liability policy is less likely to pay out than a standard policy, in turn meaning the premium costs are comparatively lower. One of the most common insurance gaps we encounter is with families who have multiple homes and more than one auto policy but only the primary home and.

Source: escolaidalinaalvorada.blogspot.com

Source: escolaidalinaalvorada.blogspot.com

Legal defense costs are covered and do not reduce the amount available to pay damages. The term “excess liability” is often interchanged with “umbrella” and the distinction between the two can be blurry. The more assets you own, the more vulnerable you could be. The excess policy then kicks in to pay any remaining costs. Insurance companies themselves won’t typically advise their insureds as to appropriate amounts of umbrella coverage, telling them instead to “speak to.

Source: grundy.com

Source: grundy.com

Our pricing for personal excess liability coverage is logical and doesn’t discourage those who need higher limits from selecting the right amount. This means an excess liability policy is less likely to pay out than a standard policy, in turn meaning the premium costs are comparatively lower. This means an excess liability policy is less likely to pay out than a standard policy, in turn meaning the premium costs are comparatively lower. The difference between excess liability and umbrella insurance. Personal excess liability coverage highlights.

Source: slideserve.com

Source: slideserve.com

The difference between excess liability and umbrella insurance. Coverage applies in the event that you are liable for someone being injured on your property. 1 in 8 people in the u.s. The purpose of excess liability insurance is to close any gaps in coverage and provide an extra layer of protection should the primary insurance, such as a general liability policy, be exhausted. Get a price estimate based on your lifestyle and personal risk factors, not simply a flat rate.

Source: privateclientgroupinsurance.net

Source: privateclientgroupinsurance.net

Some insurers use the distinction that umbrella insurance can cover some risks and situations not covered by the standard policy, while excess liability simply adds on. The purpose of excess liability insurance is to close any gaps in coverage and provide an extra layer of protection should the primary insurance, such as a general liability policy, be exhausted. The term “excess liability” is often interchanged with “umbrella” and the distinction between the two can be blurry. The term “excess liability” is often interchanged with “umbrella” and the distinction between the two can be blurry. Some insurers use the distinction that umbrella insurance can cover some risks and situations not covered by the standard policy, while excess liability insurance simply adds on a higher payout limit.

Source: slideshare.net

Source: slideshare.net

Excess liability insurance is a type of insurance policy that provides higher coverage limits when placed on top of an original, primary policy. Excess liability insurance is a type of policy that provides limits that exceed the underlying liability policy. The primary purpose of excess liability insurance is to close coverage gaps and to offer an added layer of protection in case the. An excess liability policy provides additional liability coverage, including defense coverage, above the limits of your homeowner’s, auto and boat insurance policies. The difference between excess liability and umbrella insurance.

Source: vipbluegroup.com

Source: vipbluegroup.com

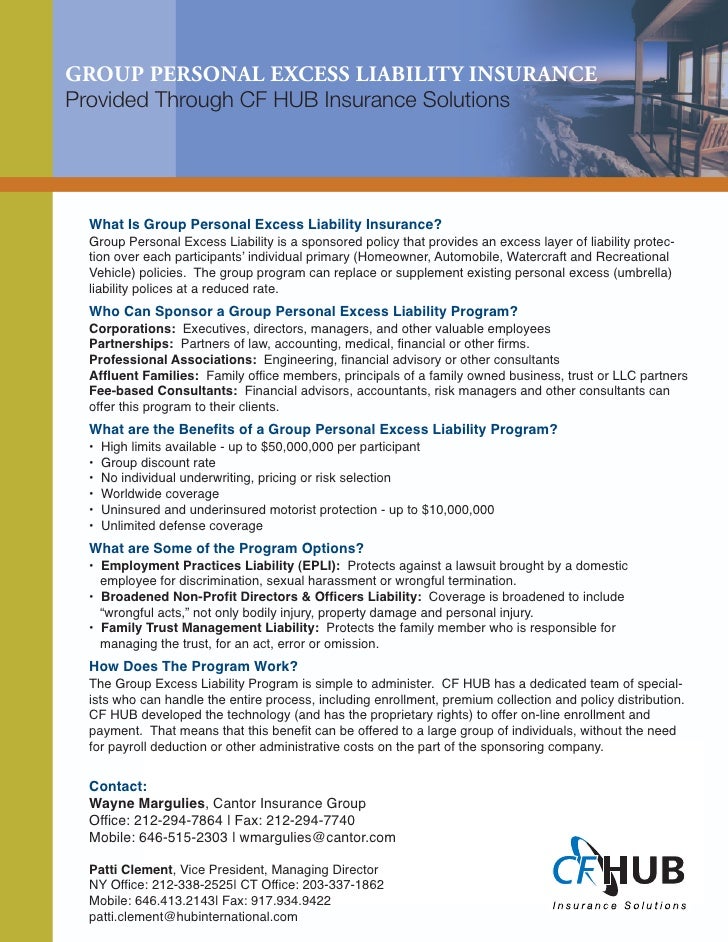

This includes claims of bodily injury, defamation, libel, slander, wrongful. The biggest difference between the two is that excess liability insurance extends the policy limits of your existing liability policies, tends to offer very high maximums of its own, and can be commercial or personal. Group personal excess liability insurance is, as the name implies, it is insurance for additional liability. Get a price estimate based on your lifestyle and personal risk factors, not simply a flat rate. Some insurers use the distinction that umbrella insurance can cover some risks and situations not covered by the standard policy, while excess liability insurance simply adds on a higher payout limit.

Source: metlife.com

Source: metlife.com

The term “excess liability” is often interchanged with “umbrella. 1 in 8 people in the u.s. Property damage and bodily injury: Some insurers use the distinction that umbrella insurance can cover some risks and situations not covered by the standard policy, while excess liability simply adds on. It does not broaden the stated coverage, but will provide higher limits on top of the original policy.

Source: liveworkgermany.com

Source: liveworkgermany.com

Coverage applies in the event that you are liable for someone being injured on your property. This means an excess liability policy is less likely to pay out than a standard policy, in turn meaning the premium costs are comparatively lower. The more assets you own, the more vulnerable you could be. Insurance companies themselves won’t typically advise their insureds as to appropriate amounts of umbrella coverage, telling them instead to “speak to. With so much at stake, it�s important to maintain adequate limits of personal excess liability coverage (also known as umbrella coverage) to protect your financial future.

Source: cannabishempinsurance.com

Source: cannabishempinsurance.com

The term “excess liability” is often interchanged with “umbrella. The difference between excess liability and umbrella insurance. This means an excess liability policy is less likely to pay out than a standard policy, in turn meaning the premium costs are comparatively lower. This protection is designed to kick in when the liability on the underlying policies is exhausted. Pricing that better aligns with risk.

Source: orchidinsurance.com

Source: orchidinsurance.com

Excess liability insurance is a type of insurance policy that provides higher coverage limits when placed on top of an original, primary policy. This type of coverage responds when the underlying limits of your other insurance policies, such as home, auto and watercraft, aren’t enough to cover the cost of an unexpected lawsuit or accident. An excess liability policy provides additional liability coverage, including defense coverage, above the limits of your homeowner’s, auto and boat insurance policies. Get a price estimate based on your lifestyle and personal risk factors, not simply a flat rate. Property damage and bodily injury:

Source: hnagency.com

Source: hnagency.com

Some insurers use the distinction that umbrella insurance can cover some risks and situations not covered by the standard policy, while excess liability insurance simply adds on a higher payout limit. This important coverage applies to situations such as lawsuits involving accusations of libel, slander, or negligent infliction of bodily injury. One of the most common insurance gaps we encounter is with families who have multiple homes and more than one auto policy but only the primary home and. Excess liability insurance is a type of insurance policy that provides higher coverage limits when placed on top of an original, primary policy. The term “excess liability” is often interchanged with “umbrella.

Source: chernoffdiamond.com

Source: chernoffdiamond.com

This means an excess liability policy is less likely to pay out than a standard policy, in turn meaning the premium costs are comparatively lower. The term “excess liability” is often interchanged with “umbrella” and the distinction between the two can be blurry. The excess policy then kicks in to pay any remaining costs. This means an excess liability policy is less likely to pay out than a standard policy, in turn meaning the premium costs are comparatively lower. This means an excess liability policy is less likely to pay out than a standard policy, in turn meaning the premium costs are comparatively lower.

Source: noyeshallallen.com

Source: noyeshallallen.com

An excess liability policy provides additional liability coverage, including defense coverage, above the limits of your homeowner’s, auto and boat insurance policies. The term “excess liability” is often interchanged with “umbrella. This means an excess liability policy is less likely to pay out than a standard policy, in turn meaning the premium costs are comparatively lower. The term “excess liability” is often interchanged with “umbrella. Even if a lawsuit is.

Source: youtube.com

Source: youtube.com

Personal excess liability coverage highlights. This insurance is basically private insurance, but it covers your underlying policies, employee policy, auto policy, and much more. Get a price estimate based on your lifestyle and personal risk factors, not simply a flat rate. This means an excess liability policy is less likely to pay out than a standard policy, in turn meaning the premium costs are comparatively lower. The difference between excess liability and umbrella insurance.

Source: fundera.com

Source: fundera.com

Group personal excess liability insurance is, as the name implies, it is insurance for additional liability. This includes claims of bodily injury, defamation, libel, slander, wrongful. An excess liability policy provides additional liability coverage, including defense coverage, above the limits of your homeowner’s, auto and boat insurance policies. The purpose of excess liability insurance is to close any gaps in coverage and provide an extra layer of protection should the primary insurance, such as a general liability policy, be exhausted. Insurance companies themselves won’t typically advise their insureds as to appropriate amounts of umbrella coverage, telling them instead to “speak to.

Source: slideshare.net

Source: slideshare.net

The term “excess liability” is often interchanged with “umbrella. Personal excess liability coverage highlights. The biggest difference between the two is that excess liability insurance extends the policy limits of your existing liability policies, tends to offer very high maximums of its own, and can be commercial or personal. An excess liability policy provides additional liability coverage, including defense coverage, above the limits of your homeowner’s, auto and boat insurance policies. The primary purpose of excess liability insurance is to close coverage gaps and to offer an added layer of protection in case the.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title personal excess liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information