Personal guarantee insurance information

Home » Trend » Personal guarantee insurance informationYour Personal guarantee insurance images are available. Personal guarantee insurance are a topic that is being searched for and liked by netizens today. You can Get the Personal guarantee insurance files here. Get all royalty-free images.

If you’re searching for personal guarantee insurance images information linked to the personal guarantee insurance interest, you have visit the right site. Our website frequently provides you with hints for seeking the highest quality video and picture content, please kindly search and locate more enlightening video content and images that fit your interests.

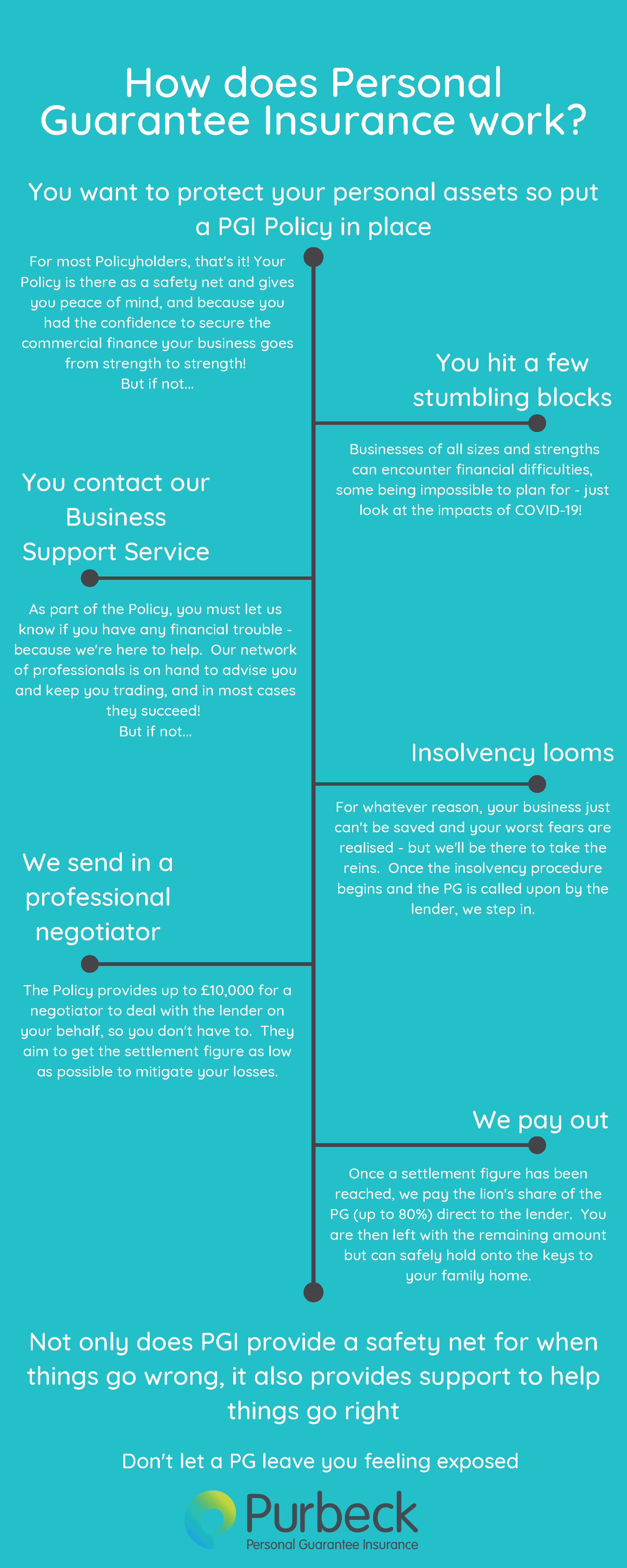

Personal Guarantee Insurance. You can insure yourself against this risk. Personal guarantee insurance helps out those who have signed a personal guarantee (usually company directors) on a new or existing loan, by providing them with cover. A personal guarantee is an agreement which is drawn up to provide security for the credit a lender or a supplier extends to a borrower. A personal guarantee insurance policy is designed to protect you, as a company owner or director, when you take out such a secured loan, giving you the confidence you need to grow your business.

Personal Guarantee Insurance From morpheusinsurance.co.uk

Personal Guarantee Insurance From morpheusinsurance.co.uk

But it does protect against the unforeseen. This annual insurance policy provides directors with cover in the event a business lender calls on the personal guarantee following an insolvency event thereby protecting them from loss of personal wealth. This is a claims made insurance which covers claims or potential claims notified within the period of insurance. If your business has no assets and you wish to apply for finance, the bank or finance provider is likely to request that a personal guarantee is signed. Pgi is often used on new loans though it. Personal guarantee insurance (pgi) provides insurance for directors who have been required to sign a personal guarantee to a lender in support of a business loan facility.

Guarantor in the event there is a formal call by a lender on a personal guarantee.

Many business owners take out loans with personal guarantees to fund starting or growing a business. Guarantor in the event there is a formal call by a lender on a personal guarantee. Personal guarantee insurance (pgi) provides insurance for individuals (usually directors) who have given a personal guarantee to a lender in respect of the borrowings of the limited company. This is a claims made insurance which covers claims or potential claims notified within the period of insurance. Personal guarantee insurance (pgi) provides insurance cover for individuals who have given a personal guarantee on a loan. Competitive premiums and cover available across a wide range of business loans.

Source: parachutelaw.co.uk

Source: parachutelaw.co.uk

You can insure yourself against this risk. You can insure yourself against this risk. It can be used for either new finance, or for loans already in place. It protects the guarantor in the case of the loan being called in. Generally speaking personal guarantees are provided by directors of limited companies.

Source: pdffiller.com

Source: pdffiller.com

Personal guarantee insurance (pgi) provides insurance cover for individuals who have given a personal guarantee on a loan. Insurance companies will usually cover 80% of lenders’ claims up to some maximum level of cover e.g. What is a personal guarantee? Personal guarantee insurance helps out those who have signed a personal guarantee (usually company directors) on a new or existing loan, by providing them with cover. It is designed to give directors the confidence to do business, focus on growth objectives.

Usually signed by a company director, this means that the loan is. This is a claims made insurance which covers claims or potential claims notified within the period of insurance. Personal guarantee insurance is an annual insurance policy that provides directors with cover in the event the business lender calls on their personal guarantee following insolvency. Pgi is often used on new loans though it. A personal guarantee insurance policy is designed to protect you, as a company owner or director, when you take out such a secured loan, giving you the (5).

Source: allstarfunding.co.uk

Source: allstarfunding.co.uk

If your business is seeking investment for growth, you may be called upon as a personal guarantor if sufficient business assets are not available as security. This annual insurance policy provides directors with cover in the event a business lender calls on the personal guarantee following an insolvency event thereby protecting them from loss of personal wealth. Usually, these individuals are (4). Pgi is often used on new loans though it. Personal guarantee insurance provides peace of mind for a company director, a business partner or.

Source: blog.purbeckinsurance.co.uk

Source: blog.purbeckinsurance.co.uk

Pgi is often used on new loans though it. Generally speaking personal guarantees are provided by directors of limited companies. If your business has no assets and you wish to apply for finance, the bank or finance provider is likely to request that a personal guarantee is signed. Personal guarantee insurance (pgi) provides insurance for directors who have been required to sign a personal guarantee to a lender in support of a business loan facility. The insurance policy indemnifies the individual (director) in the event that the limited company becomes insolvent and the personal guarantee is called upon by.

Source: yourmovemagazine.com

Source: yourmovemagazine.com

Personal guarantee insurance provides insurance cover for those who have signed a personal guarantee on a new, or existing loan. But it does protect against the unforeseen. It’s a legally binding contract. Guarantor in the event there is a formal call by a lender on a personal guarantee. What is personal guarantee insurance (pgi)?

Source: youtube.com

Source: youtube.com

Typically, the loan is guaranteed by the individuals’ personal assets i.e. Usually signed by a company director, this means that the loan is. Pgi gives cover to individuals with a personal guarantee. Pgi is often used on new loans though it. Personal guarantee insurance therefore provides directors with cover in the event that their business become insolvent.

Source: gemstonelegal.co.uk

Source: gemstonelegal.co.uk

It can be used for either new finance, or for loans already in place. A personal guarantee insurance policy is designed to protect you, as a company owner or director, when you take out such a secured loan, giving you the confidence you need to grow your business. Insurer pays £40,000 and the policyholder pays £10,000. It can be used for either new finance, or for loans already in place. Many business owners take out loans with personal guarantees to fund starting or growing a business.

Source: purbeckinsurance.co.uk

Source: purbeckinsurance.co.uk

Pgi is often used on new loans though it. Personal guarantee insurance (pgi) provides insurance for individuals (usually directors) who have given a personal guarantee to a lender. Personal guarantee insurance provides insurance cover for those who have signed a personal guarantee on a new, or existing loan. It can be used for either new finance, or for loans already in place. It is designed to give directors the confidence to do business, focus on growth objectives.

Personal guarantee insurance pays a percentage of the liability if the business owner defaults on a loan. But it does protect against the unforeseen. The insurance policy indemnifies the individual (director) in the event the business becomes insolvent and the personal guarantee is called upon by the lender. It is designed to give directors the confidence to do business, focus on growth objectives. Personal guarantee insurance helps out those who have signed a personal guarantee (usually company directors) on a new or existing loan, by providing them with cover.

Source: pgexpert.co.uk

Source: pgexpert.co.uk

Brought to you by insured creativity pty limited. A personal guarantee is an unsecured ‘promise’ from a business owner or director to guarantee that payment for a loan will be made by them in the event that their business is not able to pay. Personal guarantee insurance provides insurance cover for those who have signed a personal guarantee on a new, or existing loan. Insurer agrees a settlement of £50,000 with the lender. Brought to you by insured creativity pty limited.

Source: morpheusinsurance.co.uk

Source: morpheusinsurance.co.uk

Personal guarantee insurance (pgi) provides insurance for individuals (usually directors) who have given a personal guarantee to a lender. Competitive premiums and cover available across a wide range of business loans. Personal guarantee insurance (pgi) is an insurance policy which covers individuals who are required to provide personal guarantees as part of a lending package. Pgi is often used on new loans though it. Insurer pays £40,000 and the policyholder pays £10,000.

Source: morpheusinsurance.co.uk

Source: morpheusinsurance.co.uk

Personal guarantee insurance provides peace of mind for a company director, a business partner or. What is personal guarantee insurance (pgi)? Personal guarantee insurance (pgi) provides insurance for individuals (usually directors) who have given a personal guarantee to a lender in respect of the borrowings of the limited company. Insurer pays £40,000 and the policyholder pays £10,000. The insurance policy indemnifies the individual (director) in the event that the limited company becomes insolvent and the personal guarantee is called upon by.

Source: authorstream.com

Source: authorstream.com

Generally speaking personal guarantees are provided by directors of limited companies. A personal guarantee insurance policy is designed to protect you, as a company owner or director, when you take out such a secured loan, giving you the (5). If you’ve ever given personal guarantees for loans, then that guarantee could one day be called upon leading to significant costs to you. Personal guarantee insurance protects a percentage of business owners� personal assets if they default on a loan with a personal guarantee. It’s a legally binding contract.

Source: youtube.com

Source: youtube.com

Many business owners take out loans with personal guarantees to fund starting or growing a business. It’s easy to get a quote and get covered for new or existing personal guarantees: Personal guarantee insurance therefore provides directors with cover in the event that their business become insolvent. It is designed to give directors the confidence to do business, focus on growth objectives. Contact us 0203 475 0434 opening hours

Source: prizmsolutions.co.uk

Source: prizmsolutions.co.uk

Personal guarantee insurance provides peace of mind for a company director, a business partner or. Personal guarantee insurance is an annual insurance policy that provides directors with cover in the event the business lender calls on their personal guarantee following insolvency. Personal guarantee insurance provides peace of mind for a company director, a business partner or. What is a personal guarantee? Personal guarantee insurance (pgi) provides insurance for individuals (usually directors) who have given a personal guarantee to a lender.

Source: bee-sure.co.uk

Source: bee-sure.co.uk

Personal guarantee insurance has been designed to give business owners and directors the confidence to focus on their business’ growth objectives without worrying about personal risk. Personal guarantee insurance has been designed to give business owners and directors the confidence to focus on their business’ growth objectives without worrying about personal risk. Competitive premiums and cover available across a wide range of business loans. Personal guarantee insurance (pgi) provides insurance for individuals (usually directors) who have given a personal guarantee to a lender. The contract is drawn up by the supplier/lender, which comes with the legal implications that the borrower is accepting personal responsibility for debts which their company cannot repay to the lender/supplier.

Source: colmoreinsurance.co.uk

Source: colmoreinsurance.co.uk

Personal guarantee insurance (pgi) provides insurance cover for individuals who have given a personal guarantee on a loan. Personal guarantee insurance protects a percentage of business owners� personal assets if they default on a loan with a personal guarantee. This annual insurance policy provides directors with cover in the event a business lender calls on the personal guarantee following an insolvency event thereby protecting them from loss of personal wealth. A personal guarantee is an unsecured ‘promise’ from a business owner or director to guarantee that payment for a loan will be made by them in the event that their business is not able to pay. Typically, the loan is guaranteed by the individuals’ personal assets i.e.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title personal guarantee insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information