Pet insurance deductible information

Home » Trend » Pet insurance deductible informationYour Pet insurance deductible images are available in this site. Pet insurance deductible are a topic that is being searched for and liked by netizens today. You can Get the Pet insurance deductible files here. Get all free photos and vectors.

If you’re looking for pet insurance deductible pictures information linked to the pet insurance deductible keyword, you have pay a visit to the right site. Our site always provides you with hints for seeing the highest quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

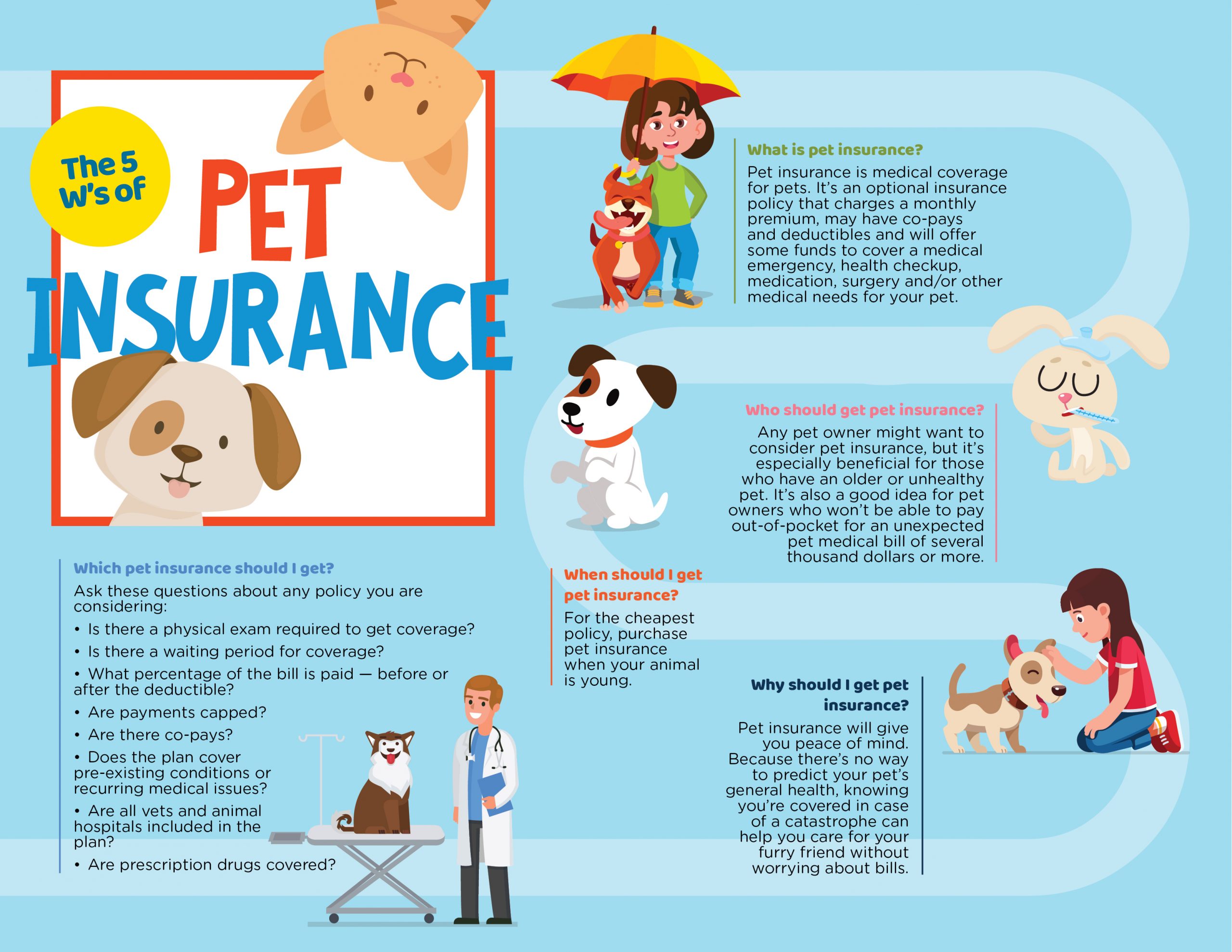

Pet Insurance Deductible. The amount of pet insurance deductibles can vary widely. For example, if your annual deductible is $1,000, you’ll need to pay for $1,000 in veterinary costs each year before you can start. Pet policies typically allow you. An annual deductible is the fixed amount per policy period that needs to be met before we would begin to pay benefits for covered claims, at the elected reimbursement amount.

Pet Protection Preferred Pet care business, Dog From pinterest.com

Pet Protection Preferred Pet care business, Dog From pinterest.com

The amount of pet insurance deductibles can vary widely. An annual deductible is the fixed amount per policy period that needs to be met before we would begin to pay benefits for covered claims, at the (8). When your dog needs care that is covered by your policy, you will pay a deductible, which is stated in your policy. The vet bill for that costs $500. What is are pet insurance deductibles? For example, if your annual deductible is $1,000, you’ll need to pay for $1,000 in veterinary costs each year before you can start.

Pet policies typically allow you to choose a deductible of between $100 and $1,000.

The amount of deductible varies and depends on the plan that you purchased. Your deductible will reset when your policy renews each year. How pet insurance works · deductible: Looks like pet expenses can be a line item on your taxes after all. If your policy has a $300 annual deductible, then $300 would be deducted off the top (that you pay), and the insurance company would reimburse on the remainder of the bill. The most frequent options are deductibles of $250, or thereabouts, and $500.

Source: localler12344.blogspot.com

Source: localler12344.blogspot.com

When you enroll in a pet insurance policy, you first decide which deductible amount that you want to pay. Here are details on the deductibles offered, company by company, along with advice on how to decide on the deductible that suits your pet and your budget. After your deductible, your dog insurance company will typically work with the licensed veterinarian to pay their portion of the cost of care. What is are pet insurance deductibles? Most plans come with an annual deductible.

Source: heptatum.blogspot.com

Source: heptatum.blogspot.com

The deductible is the portion of the bill you’re responsible for before you can start being reimbursed for veterinary costs. Your deductible could be as little as $100 or as high as $1,000 depending on the policy you choose and the age of your pet. If your pet incurs a serious injury or a critical illness, the best way to maintain your pet’s wellbeing while protecting yourself financially is by getting your pet insured. The best deductible for pet insurance companies is up to the discretion of the pet owner. You can have either an annual deductible or a per incident deductible.

![The 5 Best Pet Insurance Companies [2021 Review] The 5 Best Pet Insurance Companies [2021 Review]](https://i0.wp.com/www.officialtop5review.com/wp-content/uploads/2019/12/Pet-Insurance-Companies-Embrace-Main-788x417.jpg) Source: officialtop5review.com

Source: officialtop5review.com

Looks like pet expenses can be a line item on your taxes after all. Pet policies typically allow you to choose a deductible of between $100 and $1,000. Policy holders pay a portion of each eligible claim, usually between 10% and 30%. Only covered claims will be applied to your annual deductible. The lower your deductible, the quicker you can cover it and the sooner you’ll get paid back.

Source: wpetq.blogspot.com

The deductible amounts can vary from plan to plan and from pet health insurance company to company as can the deductible periods for which those deductibles apply. The most frequent options are deductibles of $250, or thereabouts, and $500. The deductible is the portion of the bill you’re responsible for before you can start being reimbursed for veterinary costs. Your deductible will reset when your policy renews each year. The deductible is how much you pay out of pocket before you see reimbursement from your pet insurance company.

Source: pinterest.com

Source: pinterest.com

Outlying amounts can go as low as $50 or as high as $1,000. Looks like pet expenses can be a line item on your taxes after all. Pet policies typically allow you. If you choose a pet insurance policy with an annual deductible, that means you have to meet your deductible only once per term. The amount of pet insurance deductibles can vary widely.

Source: wayangpets.com

Source: wayangpets.com

The vet bill for that costs $500. The amount of pet insurance deductibles can vary widely. How pet insurance works · deductible: Pet insurance can reimburse you for 80% or more of the vet bill after your annual deductible is met, which can be a literal life (and wallet) saver as serious health issues can easily cost thousands to treat. If your policy has a $300 annual deductible, then $300 would be deducted off the top (that you pay), and the insurance company would reimburse on the remainder of the bill.

Source: doggotalko.com

Source: doggotalko.com

What is are pet insurance deductibles? The amount of pet insurance deductibles can vary widely. For example, if your annual deductible is $1,000, you’ll need to pay for $1,000 in veterinary costs each year before you can start. Most plans, like healthy paws and embrace , give you a wide range of deductible choices so you can choose and budget accordingly. Your deductible could be as little as $100 or as high as $1,000 depending on the policy you choose and the age of your pet.

Source: utxcu.com

Source: utxcu.com

What is a good deductible for pet insurance? Check out the leading pet insurers in the usa below: Becoming a foster owner of a pet is considered a charitable act, and related expenses such as food or insurance are therefore eligible for deduction. Pet policies typically allow you to choose a deductible of between $100 and $1,000. Policy holders pay a portion of each eligible claim, usually between 10% and 30%.

Source: money.com

Source: money.com

Except in situations like those outlined in this article, medical expenses related to your pet will not be tax deductible. However, a lower deductible can also lead to a higher premium. For example, if your annual deductible is $1,000, you’ll need to pay for $1,000 in veterinary costs each year before you can start. The deductible amounts can vary from plan to plan and from pet health insurance company to company as can the deductible periods for which those deductibles apply. If your pet incurs a serious injury or a critical illness, the best way to maintain your pet’s wellbeing while protecting yourself financially is by getting your pet insured.

Source: pinterest.com

Source: pinterest.com

Except in situations like those outlined in this article, medical expenses related to your pet will not be tax deductible. The best deductible for pet insurance companies is up to the discretion of the pet owner. Pet insurance can reimburse you for 80% or more of the vet bill after your annual deductible is met, which can be a literal life (and wallet) saver as serious health issues can easily cost thousands to treat. When is pet insurance deductible? Policy holders pay a portion of each eligible claim, usually between 10% and 30%.

Source: entreaspas-pi.blogspot.com

Source: entreaspas-pi.blogspot.com

How does a pet insurance deductible work? Pet policies typically allow you to choose a deductible of between $100 and $1,000. An annual deductible is the fixed amount per policy period that needs to be met before we would begin to pay benefits for covered claims, at the (8). Outlying amounts can go as low as $50 or as high as $1,000. The most frequent options are deductibles of $250, or thereabouts, and $500.

Source: wheatstateinsurance.com

Source: wheatstateinsurance.com

The lower your deductible, the quicker you can cover it and the sooner you’ll get paid back. The best deductible for pet insurance companies is up to the discretion of the pet owner. If you choose a pet insurance policy with an annual deductible, that means you have to meet your deductible only once per term. Outlying amounts can go as low as $50 or as high as $1,000. The deductible amounts can vary from plan to plan and from pet health insurance company to company as can the deductible periods for which those deductibles apply.

Source: annarboranimalhospital.com

Source: annarboranimalhospital.com

Deductibles can start as low as $50 and go as high as $1,500. The most frequent options are deductibles of $250, or thereabouts, and $500. The pet insurance deductible, or the amount you must pay for vet treatment before the plan begins to pay, is the amount you must pay before the plan begins to pay. However, be careful to keep track of expenses and. Most plans, like healthy paws and embrace , give you a wide range of deductible choices so you can choose and budget accordingly.

Source: wpetq.blogspot.com

Source: wpetq.blogspot.com

If your pet incurs a serious injury or a critical illness, the best way to maintain your pet’s wellbeing while protecting yourself financially is by getting your pet insured. Outlying amounts can go as low as $50 or as high as $1,000. Pet insurance plan deductibles usually come in two flavors i) annual and ii) incident. You can have either an annual deductible or a per incident deductible. Deductibles can start as low as $50 and go as high as $1,500.

Source: insuranceranked.com

Source: insuranceranked.com

After your deductible, your dog insurance company will typically work with the licensed veterinarian to pay their portion of the cost of care. What is are pet insurance deductibles? How pet insurance works · deductible: The vet bill for that costs $500. Outlying amounts can go as low as $50 or as high as $1,000.

Source: alignable.com

Source: alignable.com

Outlying amounts can go as low as $50 or as high as $1,000. Looks like pet expenses can be a line item on your taxes after all. However, a lower deductible can also lead to a higher premium. Pet insurance plan deductibles usually come in two flavors i) annual and ii) incident. Pet policies typically allow you to choose a deductible of between $100 and $1,000.

Source: wagwalking.com

Source: wagwalking.com

Once you’ve met the deductible, only the copay gets subtracted from reimbursement claims until you renew the. The best deductible for pet insurance companies is up to the discretion of the pet owner. Outlying amounts can go as low as $50 or as high as $1,000. What is are pet insurance deductibles? The vet bill for that costs $500.

Source: tekportal.net

Source: tekportal.net

This sum is the amount you must pay before coverage kicks in — either per year or incident — and usually (11). Outlying amounts can go as low as $50 or as high as $1,000. Once you’ve met the deductible, only the copay gets subtracted from reimbursement claims until you renew the. What is a good deductible for pet insurance? Policy holders pay a portion of each eligible claim, usually between 10% and 30%.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title pet insurance deductible by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information