Pharmacist professional liability insurance information

Home » Trend » Pharmacist professional liability insurance informationYour Pharmacist professional liability insurance images are ready in this website. Pharmacist professional liability insurance are a topic that is being searched for and liked by netizens now. You can Get the Pharmacist professional liability insurance files here. Get all royalty-free photos and vectors.

If you’re searching for pharmacist professional liability insurance pictures information connected with to the pharmacist professional liability insurance interest, you have visit the right blog. Our site always provides you with suggestions for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

Pharmacist Professional Liability Insurance. Professional liability insurance for pharmacists provides financial protection against claims related to professional activities and business operations while fulfilling regulatory requirements. Joined sep 5, 2017 messages 10 reaction score 1. The policy of insurance must contain limits of a minimum of $2,000,000 per claim or per occurrence and $4,000,000 in the annual aggregate. Regulations pursuant to the pharmacy act (effective august 6, 2013) permit liability insurance coverage through other sources if the

(PDF) The Emerging Importance of Professional Liability From researchgate.net

(PDF) The Emerging Importance of Professional Liability From researchgate.net

The policy of insurance must contain limits of a minimum of $2,000,000 per claim or per occurrence and $4,000,000 in the annual aggregate. Like any healthcare professional with a significant hand in patient care delivery (and subsequent. The phrase “professional liability” is generally understood to be a responsibility to your patients or others for your acts as a pharmacist. Pharmacist professional liability insurance is coverage designed to protect pharmacists when a patient claims an actual or alleged error or omission within the scope of your practice. The policies also cover some or all of the cost in defending lawsuits related to such claims. Professional liability insurance for pharmacists.

Professional liability insurance is coverage that protects registrants against claims for mistakes or omissions made during the provision of professional pharmacy services which caused a patient to experience undue harm.

No pharmacist acts with the intent to harm patients. Professional liability insurance is coverage for a pharmacist that provides protection in the event a claim is made against a pharmacist involving an actual or alleged error or omission while carrying out his or her duties that are within the scope of practice for a pharmacist. Regulations pursuant to the pharmacy act (effective august 6, 2013) permit liability insurance coverage through other sources if the Talk to your broker about customizing your pharmacist liability insurance policy to include additional types of coverage. No pharmacist acts with the intent to harm patients. Your multifaceted role enables you to have a significant positive impact on patient health

Source: trustedchoice.com

Source: trustedchoice.com

Like any healthcare professional with a significant hand in patient care delivery (and subsequent. The phrase “professional liability” is generally understood to be a responsibility to your patients or others for your acts as a pharmacist. The pharmacy’s policy should say it is “primary,” so that it covers employees before their individual policies; It’s not just a policy, it’s an investment in you, your career, and your livelihood. Chances are your employer provides professional liability insurance, but there are oftentimes limitations and you may not.

Source: professionalchoices.blogspot.com

Source: professionalchoices.blogspot.com

As a healthcare professional, it’s important to cover all areas of liability. Pharmacist professional liability insurance is coverage designed to protect pharmacists when a patient claims an actual or alleged error or omission within the scope of your practice. Apr 1, 2018 #1 members don�t see this ad. Join over 100,000 businesses that have trusted us! As a pharmacist, you have worked hard to get where you’re at today and an unforeseen disciplinary action or malpractice lawsuit can have consequences on both your career and financial future.

Source: mccaslinhorne.com

Source: mccaslinhorne.com

Our pharmaguard professional liability policy for pharmacists and pharmacy technicians (also known as malpractice insurance) is one of the most comprehensive policies available on the market. The phrase “professional liability” is generally understood to be a responsibility to your patients or others for your acts as a pharmacist. Professional liability insurance is vital and necessary for practicing pharmacy professionals. Join over 100,000 businesses that have trusted us! Professional liability insurance as a requirement for registration/pli for pharmacists in four countries.

Source: cmfgroup.com

Source: cmfgroup.com

It’s not just a policy, it’s an investment in you, your career, and your livelihood. You may need other forms of business insurance if you own your own pharmacy. Start date apr 1, 2018; Pharmacy technicians, registered pharmacy students, interns and pharmacists who are listed in part a of the register must maintain personal professional liability insurance as follows: Professional liability insurance is coverage that protects registrants against claims for mistakes or omissions made during the provision of professional pharmacy services which caused a patient to experience undue harm.

Source: youtube.com

Source: youtube.com

Pharmacists are an integral part of the healthcare supply chain, dispensing medicines, compounding formulas, providing vaccinations, and providing critical patient consultations. What is professional liability insurance? As a pharmacist, you have worked hard to get where you’re at today and an unforeseen disciplinary action or malpractice lawsuit can have consequences on both your career and financial future. Hpso’s professional liability insurance is protection created with pharmacists in mind. Cm&f specializes in pharmacist liability insurance, also known as pharmacist malpractice insurance, that is tailored to your individual needs.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

What is professional liability insurance? This forum made possible through the generous support of sdn members, donors, and sponsors. Professional liability insurance is coverage that protects registrants against claims for mistakes or omissions made during the provision of professional pharmacy services which caused a patient to experience undue harm. What is professional liability insurance? The policy of insurance must contain limits of a minimum of $2,000,000 per claim or per occurrence and $4,000,000 in the annual aggregate.

Source: erguvan–erguvan.blogspot.com

Source: erguvan–erguvan.blogspot.com

No pharmacist acts with the intent to harm patients. It’s not just a policy, it’s an investment in you, your career, and your livelihood. This forum made possible through the generous support of sdn members, donors, and sponsors. As a healthcare professional, it’s important to cover all areas of liability. You may need other forms of business insurance if you own your own pharmacy.

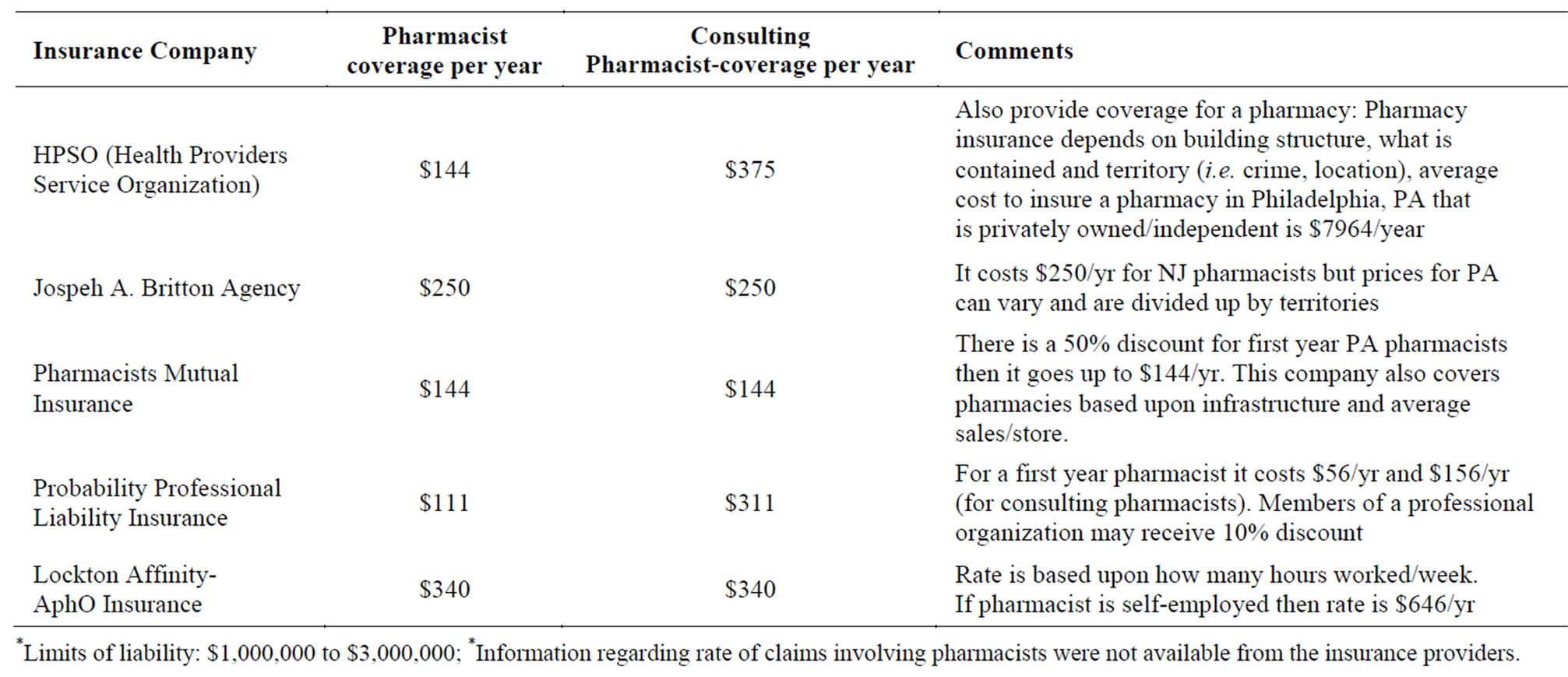

Source: researchgate.net

Source: researchgate.net

The phrase “professional liability” is generally understood to be a responsibility to your patients or others for your acts as a pharmacist. As a healthcare professional, it’s important to cover all areas of liability. Healthcare professional liability insurance policies, including those for dentists and pharmacists, protect covered professionals from liability associated with claims of bodily injury, medical expenses, or property damage as a result of wrongful practices. Professional liability insurance is coverage for a pharmacist that provides protection in the event a claim is made against a pharmacist involving No pharmacist acts with the intent to harm patients.

Source: erguvan–erguvan.blogspot.com

Professional liability insurance for pharmacists provides financial protection against claims related to professional activities and business operations while fulfilling regulatory requirements. A professional liability policy for an individual pharmacist or pharmacy technician should say that is “secondary” or “excess” coverage. Our pharmaguard professional liability policy for pharmacists and pharmacy technicians (also known as malpractice insurance) is one of the most comprehensive policies available on the market. As a healthcare professional, it’s important to cover all areas of liability. Duty of care and pharmacist’s liability.

Source: ctpharmacists.org

Source: ctpharmacists.org

Professional liability insurance for pharmacists provides financial protection against claims related to professional activities and business operations while fulfilling regulatory requirements. Professional liability insurance as a requirement for registration/pli for pharmacists in four countries. Hpso’s professional liability insurance is protection created with pharmacists in mind. Like any healthcare professional with a significant hand in patient care delivery (and subsequent. Professional liability insurance is vital and necessary for practicing pharmacy professionals.

Source: opatoday.com

Source: opatoday.com

Pharmacist professional liability insurance is coverage designed to protect pharmacists when a patient claims an actual or alleged error or omission within the scope of your practice. Historically, pharmacists in ns were obligated to purchase professional liability insurance through the pharmacy association of nova scotia (pans), as they offered the only policy that met nscp criteria. Talk to your broker about customizing your pharmacist liability insurance policy to include additional types of coverage. Cm&f specializes in pharmacist liability insurance, also known as pharmacist malpractice insurance, that is tailored to your individual needs. It�s a good idea to consider purchasing the.

Source: file.scirp.org

Source: file.scirp.org

Apr 1, 2018 #1 members don�t see this ad. Pharmacist professional liability insurance.pharmacy technicians, registered pharmacy students, interns and pharmacists who are listed in part a of the register must maintain personal professional liability insurance as follows: Historically, pharmacists in ns were obligated to purchase professional liability insurance through the pharmacy association of nova scotia (pans), as they offered the only policy that met nscp criteria. Professional liability insurance is vital and necessary for practicing pharmacy professionals. General liability insurance will cover accidents that happen at your pharmacy as well as claims of libel, slander, and false advertising.

Source: opatoday.com

Source: opatoday.com

It’s not just a policy, it’s an investment in you, your career, and your livelihood. Apr 1, 2018 #1 members don�t see this ad. If you work for a hospital, retail store, or other institution, however, you may not need professional liability insurance because your employer most likely. Our pharmaguard professional liability policy for pharmacists and pharmacy technicians (also known as malpractice insurance) is one of the most comprehensive policies available on the market. Chances are your employer provides professional liability insurance, but there are oftentimes limitations and you may not.

Source: opatoday.com

Source: opatoday.com

Start date apr 1, 2018; The phrase “professional liability” is generally understood to be a responsibility to your patients or others for your acts as a pharmacist. Joined sep 5, 2017 messages 10 reaction score 1. As a healthcare professional, it’s important to cover all areas of liability. The pharmacy’s policy should say it is “primary,” so that it covers employees before their individual policies;

Source: locktonmedicalliabilityinsurance.com

Source: locktonmedicalliabilityinsurance.com

Apr 1, 2018 #1 members don�t see this ad. Start date apr 1, 2018; This forum made possible through the generous support of sdn members, donors, and sponsors. Join over 100,000 businesses that have trusted us! Cm&f specializes in pharmacist liability insurance, also known as pharmacist malpractice insurance, that is tailored to your individual needs.

Source: mccaslinhorne.com

Source: mccaslinhorne.com

Historically, pharmacists in ns were obligated to purchase professional liability insurance through the pharmacy association of nova scotia (pans), as they offered the only policy that met nscp criteria. Chances are your employer provides professional liability insurance, but there are oftentimes limitations and you may not. Hpso’s professional liability insurance is protection created with pharmacists in mind. Our pharmaguard professional liability policy for pharmacists and pharmacy technicians (also known as malpractice insurance) is one of the most comprehensive policies available on the market. Pharmacist professional liability insurance is coverage designed to protect pharmacists when a patient claims an actual or alleged error or omission within the scope of your practice.

Source: hpso.com

The policy of insurance must contain limits of a minimum of $2,000,000 per claim or per occurrence and $4,000,000 in the annual aggregate. Professional liability insurance is coverage that protects registrants against claims for mistakes or omissions made during the provision of professional pharmacy services which caused a patient to experience undue harm. Talk to your broker about customizing your pharmacist liability insurance policy to include additional types of coverage. The pharmacy’s policy should say it is “primary,” so that it covers employees before their individual policies; A professional liability policy for an individual pharmacist or pharmacy technician should say that is “secondary” or “excess” coverage.

Source: bethanyins.com

Source: bethanyins.com

Joined sep 5, 2017 messages 10 reaction score 1. Like any healthcare professional with a significant hand in patient care delivery (and subsequent. Professional liability insurance is vital and necessary for practicing pharmacy professionals. Pharmacists are an integral part of the healthcare supply chain, dispensing medicines, compounding formulas, providing vaccinations, and providing critical patient consultations. You may need other forms of business insurance if you own your own pharmacy.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title pharmacist professional liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information