Physical and moral hazards in fire insurance information

Home » Trending » Physical and moral hazards in fire insurance informationYour Physical and moral hazards in fire insurance images are ready in this website. Physical and moral hazards in fire insurance are a topic that is being searched for and liked by netizens today. You can Download the Physical and moral hazards in fire insurance files here. Download all royalty-free photos.

If you’re searching for physical and moral hazards in fire insurance images information related to the physical and moral hazards in fire insurance keyword, you have come to the ideal site. Our site always provides you with suggestions for downloading the maximum quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

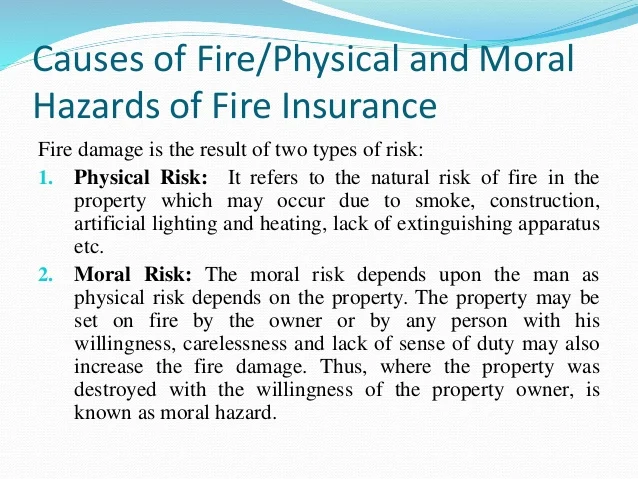

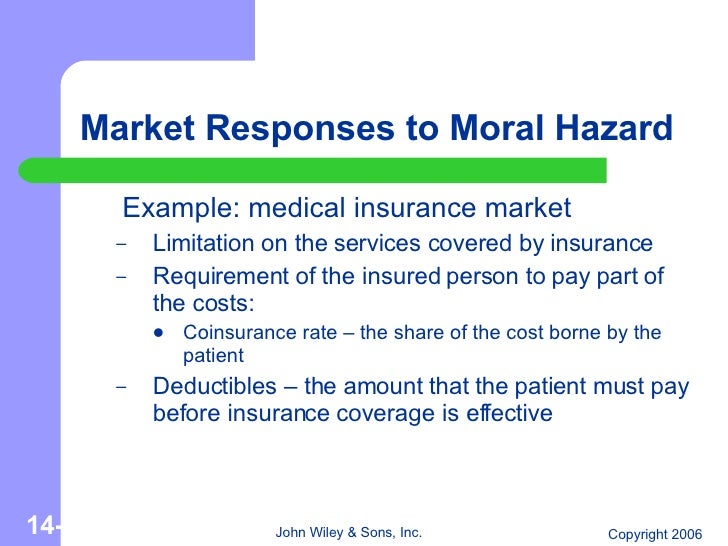

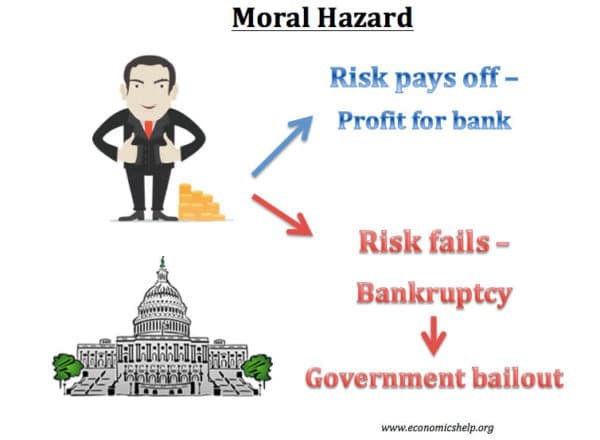

Physical And Moral Hazards In Fire Insurance. The insurance industry commonly divides hazards into three categories: A moral hazard is a situation where someone has limited responsibility for the risks they take. Check out our flood insurance information and get a quote physical hazards a physical hazard increases the likelihood of a loss occurring due to inadequacies in the condition, structure, or operation of an insured or insured property. The moral hazard depends upon the man as physical hazard depends on the property.

PPT Justice and End of Life Care PowerPoint Presentation From slideserve.com

PPT Justice and End of Life Care PowerPoint Presentation From slideserve.com

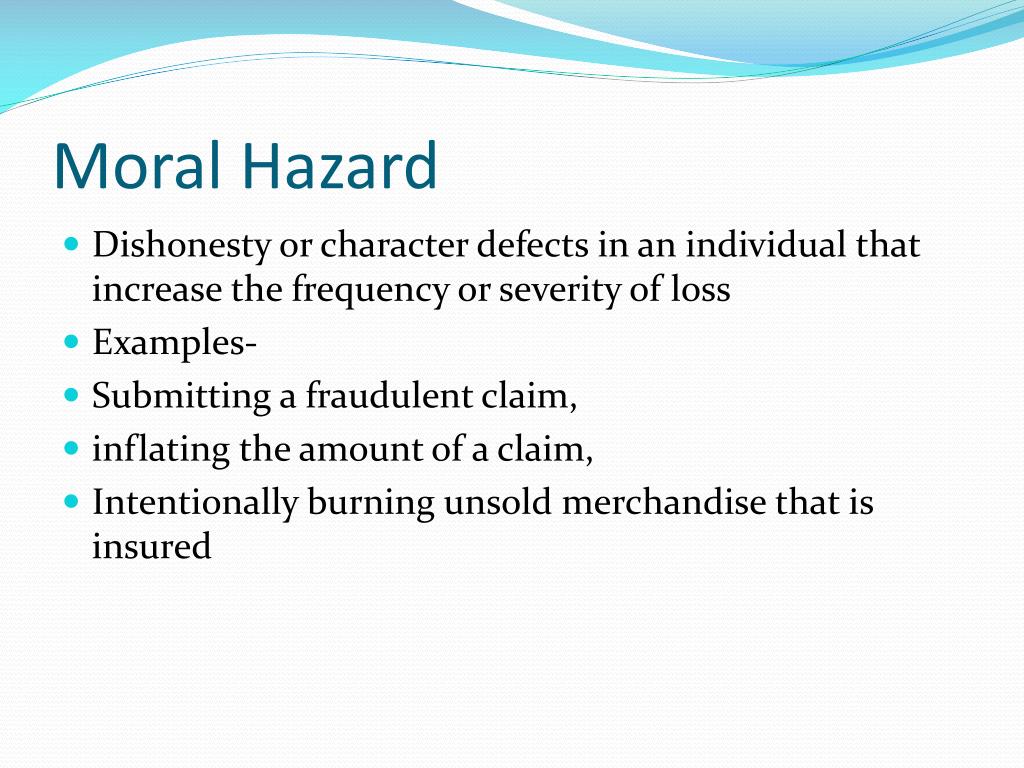

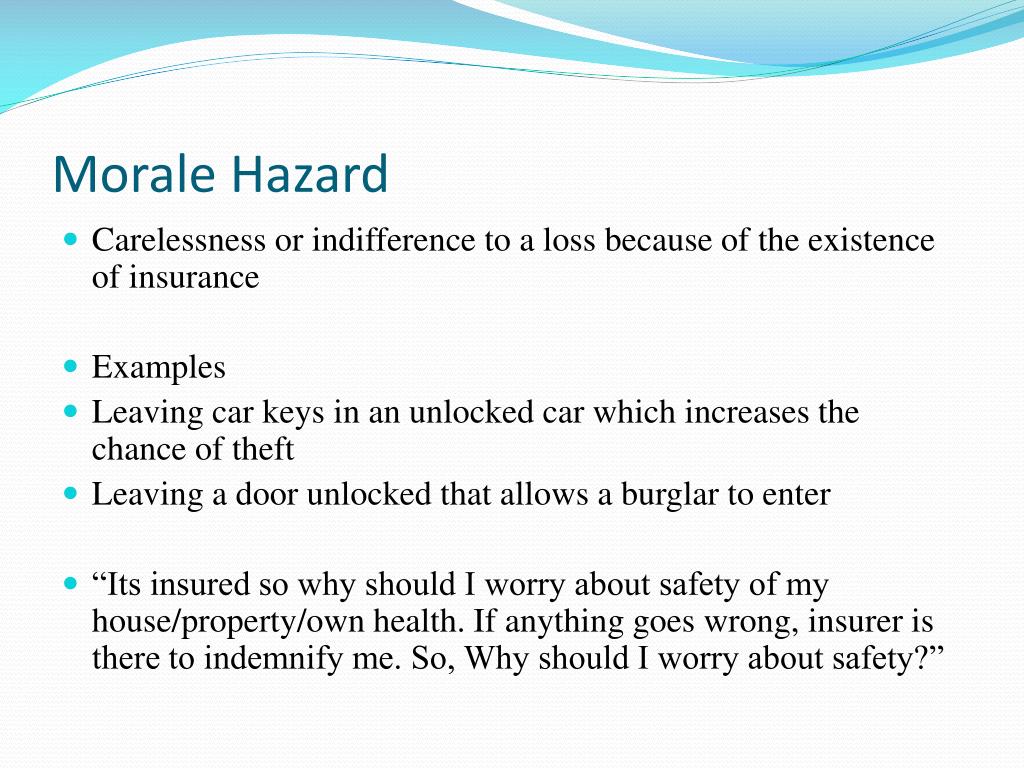

Moral hazards are invisible and hard to assess. 2 types of insurance hazards are physical (36). Moral hazards are intentional claims with bad intent like projecting higher than actual loss, intentionally burning poor crop to claim insurance etc. Physical hazard can be seen, assessed and rated accordingly, but moral hazards cannot be seen, assessed or rated accordingly. Carelessness and lack of sense of duty may also increase the fire waste. Such physical hazards create or increase the opportunity for injury or damage caused due to fire.

These physical hazards can include any material, structural, or operational features of the business.

Physical hazards are tangible features of the risk which will affect the safety of the property in case of. Physical hazards are actions, behaviors, or conditions that cause or contribute to peril. For example driving recklessly, living near the forest that catches fire every summer, bad intentions to claim insurance are examples of different types of hazards. Thus, smoking is a physical hazard that increases the likelihood of a house fire and illness. A physical hazard is visible to the eyes, can be assessed and rated accordingly. If a risk with poor moral and physical hazard is given the same policy, at the.

Source: slideshare.net

Source: slideshare.net

2 types of insurance hazards are physical (36). Physical hazard can be seen, assessed and rated accordingly, but moral hazards cannot be seen, assessed or rated accordingly. Moral hazards are intentional claims with bad intent like projecting higher than actual loss, intentionally burning poor crop to claim insurance etc. Consequently, that person or organization may have an incentive to take on more risks than they otherwise would because they don’t need to pay for them. The distinction between physical and moral hazards:

Source: slideserve.com

Source: slideserve.com

In the case of moral. A moral hazard is a situation in which one party gets involved in the risky situation or ignores safety measures, knowing that is safeguarded against the risk and there is the other party who will incur all the losses. Physical hazards are tangible features of the risk which will affect the safety of the property in case of. The insurance industry commonly divides hazards into three categories: Thus, smoking is a physical hazard that increases the likelihood of a house fire and illness.

Because insurance is all about fairness, about equity. These physical hazards can include any material, structural, or operational features of the business. Thus, insurance companies suffer losses because of fraudulent or inflated claims. For example driving recklessly, living near the forest that catches fire every summer, bad intentions to claim insurance are examples of different types of hazards. Thus, smoking is a physical hazard that increases the likelihood of a house fire and illness.

Source: slideshare.net

Source: slideshare.net

Morale hazards are which increase the risk due to unsafe acts of. The moral risk depends upon the man as physical risk depends on the property. Physical and moral hazards in fire insurance / adverse selection and moral hazard in the finance and supply of healt….building locations affect their susceptibility to loss by fire, flood, earthquake generally, moral hazards exist when a person can gain from the occurrence of a loss. N the eighteenth century, business relations were characterized by There is a physical hazard and a moral hazard;

Source: opic.texas.gov

Source: opic.texas.gov

N the eighteenth century, business relations were characterized by Thus, insurance companies suffer losses because of fraudulent or inflated claims. The moral risk depends upon the man as physical risk depends on the property. The property may be set on fire by the owner or by any person with his willingness, carelessness and lack of sense of duty may also increase the fire damage. Morale hazards are which increase the risk due to unsafe acts of.

Source: slideserve.com

Source: slideserve.com

The property may be set on fire by the owner or by any person with his willingness, carelessness and lack of sense of duty may also increase the fire damage. Hazards can be categorised as physical or moral. The concept of a moral hazard is essential for insurance because people may be inclined towards. Physical hazards in fire insurance mean any physical condition that increases the possibility of a loss. The moral hazard depends upon the man as physical hazard depends on the property.

Source: slideshare.net

Source: slideshare.net

Basically, there are two types of hazards in insurance, viz. If a risk with poor moral and physical hazard is given the same policy, at the. Physical hazard can be seen, assessed and rated accordingly, but moral hazards cannot be seen, assessed or rated accordingly. Consequently, that person or organization may have an incentive to take on more risks than they otherwise would because they don’t need to pay for them. It also is considered a physical hazard in regard to health insurance because it increases the probability of severe illness.

Source: lamudi.com.ph

Source: lamudi.com.ph

On the other hand moral hazard relates to the character, integrity and mental attitude of the insured. Physical and moral hazards in fire insurance / adverse selection and moral hazard in the finance and supply of healt….building locations affect their susceptibility to loss by fire, flood, earthquake generally, moral hazards exist when a person can gain from the occurrence of a loss. For example driving recklessly, living near the forest that catches fire every summer, bad intentions to claim insurance are examples of different types of hazards. A moral hazard is a situation in which one party gets involved in the risky situation or ignores safety measures, knowing that is safeguarded against the risk and there is the other party who will incur all the losses. Carelessness and lack of sense of duty may also increase the fire waste.

Source: slideserve.com

Source: slideserve.com

Thus, insurance companies suffer losses because of fraudulent or inflated claims. Here we are talking about moral hazards in fire insurance, which is as follows. Physical hazards can also be handled by applying an excess, a loading, exclusions or other terms and conditions. Moral and physical hazard are taken into account by underwriters for one very important reason: The distinction between physical and moral hazards:

Moral hazards are those tendencies individuals have that increase the chance of suffering a peril, such as how the habit of smoking can lead to emphysema, or. The moral risk depends upon the man as physical risk depends on the property. What is a physical hazard in insurance? Hazards can be categorised as physical or moral. Physical hazard can be seen, assessed and rated accordingly whereas moral hazards are not visible and cannot be assessed.

Source: iedunote.com

Source: iedunote.com

A moral hazard is a situation where someone has limited responsibility for the risks they take. A moral hazard is a situation in which one party gets involved in the risky situation or ignores safety measures, knowing that is safeguarded against the risk and there is the other party who will incur all the losses. Moral hazard refers to behavioral changes that might occur and increase the risk of loss when a person knows that insurance will provide coverage. Physical hazard can be seen, assessed and rated accordingly whereas moral hazards are not visible and cannot be assessed. Insurance hazard means the conditions or situations that increase the chances of a loss arising from a peril.

Source: pinterest.com

Source: pinterest.com

Here we are talking about moral hazards in fire insurance, which is as follows. Physical hazards can also be handled by applying an excess, a loading, exclusions or other terms and conditions. A moral hazard is a situation in which one party gets involved in the risky situation or ignores safety measures, knowing that is safeguarded against the risk and there is the other party who will incur all the losses. Insurance hazard means the conditions or situations that increase the chances of a loss arising from a peril. Because insurance is all about fairness, about equity.

Source: slideshare.net

Source: slideshare.net

Moral hazards are losses that results from dishonesty. N the eighteenth century, business relations were characterized by What is a physical hazard in insurance? The property may be set on fire by the owner or by any person with his willingness, carelessness and lack of sense of duty may also increase the fire damage. The concept of a moral hazard is essential for insurance because people may be inclined towards.

Source: harrisclaimsservices.com

Source: harrisclaimsservices.com

Physical hazards physical hazards are actions, behaviors, or conditions that cause or contribute. On the other hand moral hazard relates to the character, integrity and mental attitude of the insured. The property may be set on fire by the owner or by any person with his willingness, carelessness and lack of sense of duty may also increase the fire damage. Moral hazards are invisible and hard to assess. Physical hazards are tangible features of the risk which will affect the safety of the property in case of.

Moral and physical hazard are taken into account by underwriters for one very important reason: The moral hazard depends upon the man as physical hazard depends on the property. Here we are talking about moral hazards in fire insurance, which is as follows. If a risk with poor moral and physical hazard is given the same policy, at the. And fire insurance offices to assess both physical and moral hazard and postulates a relationship between the two.

Source: slideshare.net

Source: slideshare.net

Moral hazards are those tendencies individuals have that increase the chance of suffering a peril, such as how the habit of smoking can lead to emphysema, or. Physical hazards are actions, behaviors, or conditions that cause or contribute to peril. The concept of a moral hazard is essential for insurance because people may be inclined towards. Such physical hazards create or increase the opportunity for injury or damage caused due to fire. And fire insurance offices to assess both physical and moral hazard and postulates a relationship between the two.

![Chapter 1[definition and nature of insurance] Chapter 1[definition and nature of insurance]](https://image.slidesharecdn.com/chapter1definitionandnatureofinsurance-150912031826-lva1-app6891/95/chapter-1definition-and-nature-of-insurance-11-638.jpg?cb=1442027945) Source: slideshare.net

Source: slideshare.net

Physical hazards and moral hazards. The distinction between physical and moral hazards: Because insurance is all about fairness, about equity. Morale hazards are which increase the risk due to unsafe acts of. These physical hazards can include any material, structural, or operational features of the business.

Source: economicshelp.org

Source: economicshelp.org

Physical hazard can be seen, assessed and rated accordingly whereas moral hazards are not visible and cannot be assessed. The distinction between physical and moral hazards: Carelessness and lack of sense of duty may also increase the fire waste. Moral hazard refers to behavioral changes that might occur and increase the risk of loss when a person knows that insurance will provide coverage. Physical hazards are tangible features of the risk which will affect the safety of the property in case of.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title physical and moral hazards in fire insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information