Physical hazard insurance information

Home » Trending » Physical hazard insurance informationYour Physical hazard insurance images are available in this site. Physical hazard insurance are a topic that is being searched for and liked by netizens today. You can Get the Physical hazard insurance files here. Download all free vectors.

If you’re looking for physical hazard insurance pictures information linked to the physical hazard insurance keyword, you have pay a visit to the ideal site. Our website frequently provides you with hints for seeking the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that fit your interests.

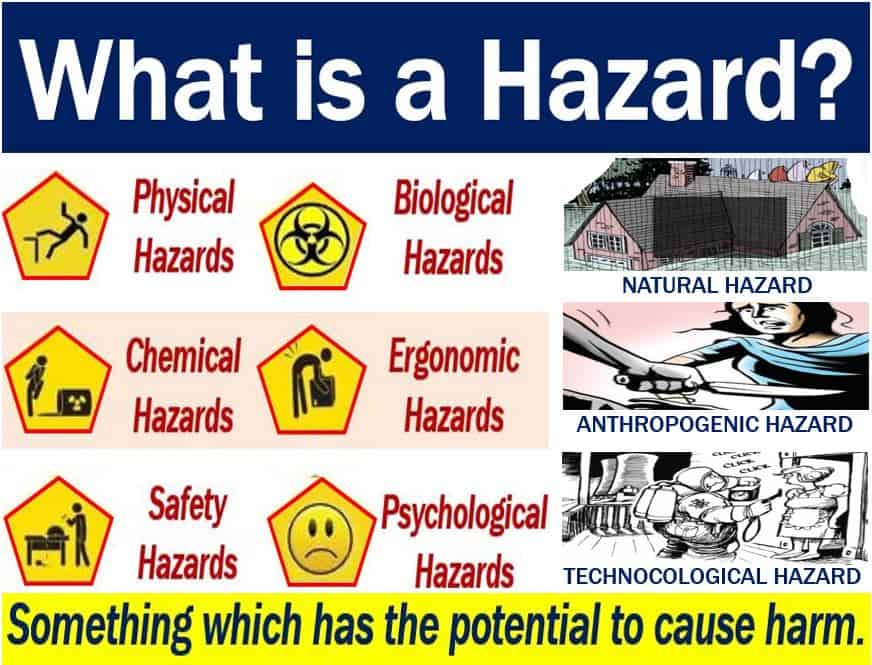

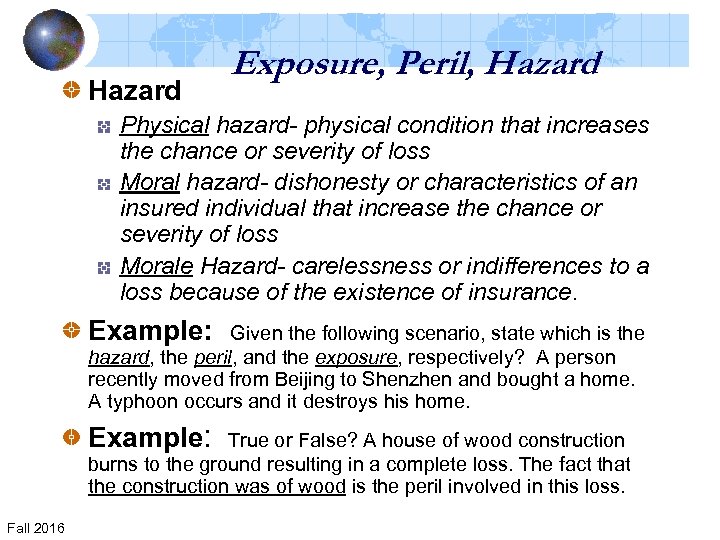

Physical Hazard Insurance. Homeowners insurance policies include hazard insurance. These can comprise any material, structural, or operational features of the business. A physical hazard is an action or condition that can cause a peril to occur. In liability insurance, the nature, construction, occupation of the premises and history of past liability are all instances of physical hazards.

Physical Hazard Definition Insurance PHYSICN From physicn.blogspot.com

Physical Hazard Definition Insurance PHYSICN From physicn.blogspot.com

An example of a physical hazard could be a roof that accumulates large amounts of snow and could cause the roof to collapse or a broken boiler, which could explode. Physical hazards indicate those dangers of the subject matter of insurance which can be ascertained or identified by mere inspection of the risk. Physical hazard — the material, structural, or operational features of a business that may create or increase the opportunity for injury or. These physical hazards can include any material, structural, or operational features of the business. It also is considered a physical hazard in regard to health insurance because it increases the probability of severe illness. As long as the specific weather event is covered.

In liability insurance, the nature, construction, occupation of the premises and history of past liability are all instances of physical hazards.

The insurance industry commonly divides hazards into three categories: A physical hazard is a physical condition that increases the possibility of a loss. Such physical hazards create or increase the opportunity for injury or damage caused due to fire. If a risk with poor moral and physical hazard is given the same policy, at the same. Physical hazard can be seen, assessed and rated accordingly whereas moral hazards are not visible and cannot be assessed. A condition stemming from the material characteristics of an object, e.g., wet or icy street (increa

The insurance company must have the proper knowledge of the physical hazard while underwriting the policy and deciding whether to accept the risk. A physical hazard is a physical condition that increases the possibility of a loss. Thus, smoking is a physical hazard that increases the likelihood of a house fire and illness. In liability insurance, the nature, construction, occupation of the premises and history of past liability are all instances of physical hazards. A condition stemming from the material characteristics of an object, e.g., wet or icy street (increa

Source: phisyla.blogspot.com

Source: phisyla.blogspot.com

If a risk with poor moral and physical hazard is given the same policy, at the same. A physical hazard is a physical condition that increases the possibility of a loss. Other articles where physical hazard is discussed: Physical hazards exist physically like higher sugar level in a person, loose brakes of a vehicle, worn out tires, faulty wiring are. These can comprise any material, structural, or operational features of the business.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

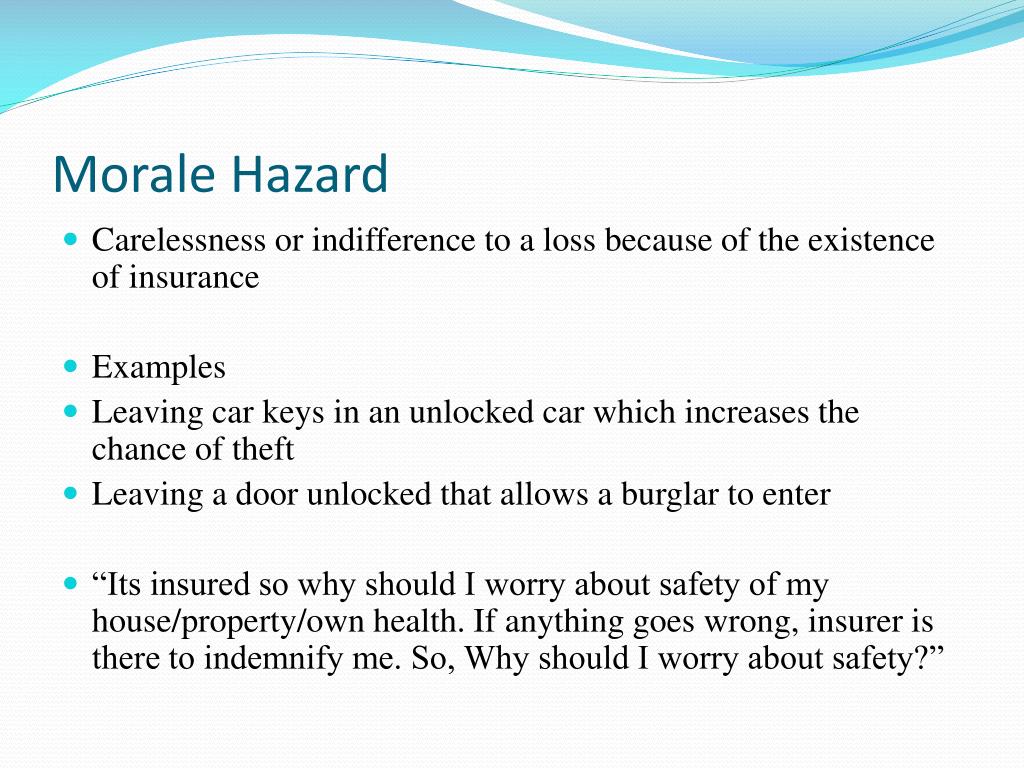

Thus, insurance companies suffer losses because of fraudulent or inflated claims. If you have poor housekeeping at your building then that is a moral hazard. Smoking is considered a physical hazard because it increases the chance of a fire occurring. These physical hazards can include any material, structural, or operational features of the business. The moral hazard is judged by the reputation and fairness in dealings.

Source: phisla.blogspot.com

Source: phisla.blogspot.com

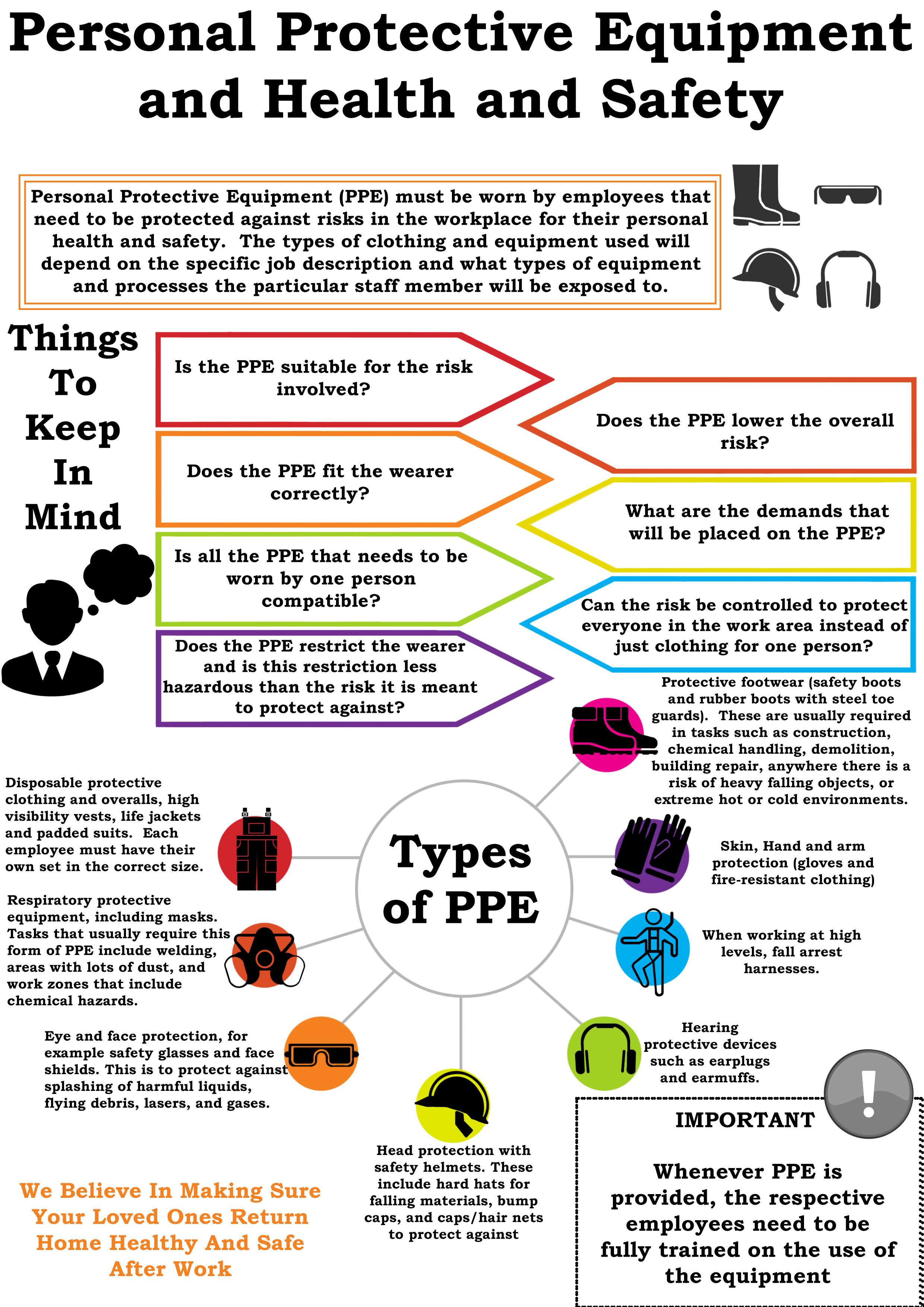

Such physical hazards create or increase the opportunity for injury or damage caused due to fire. What is a physical hazard in insurance? As with chemical hazards, having good awareness of these hazards, good preplanning, use of personal protective equipment and following basic safety rules can go a long way in preventing. Physical hazards in fire insurance mean any physical condition that increases the possibility of a loss. The moral hazard occurs due to intention of the insured whereas the physical hazard is beyond his approach.

A physical hazard is a physical condition that increases the possibility of a loss. This covers the damage to your home from hail, fire and other natural disasters. Physical hazards are actions, behaviors, or conditions that cause or contribute to peril. Physical hazards exist physically like higher sugar level in a person, loose brakes of a vehicle, worn out tires, faulty wiring are. What is a physical hazard in insurance?

Source: thetruthaboutinsurance.com

Source: thetruthaboutinsurance.com

This covers the damage to your home from hail, fire and other natural disasters. As with chemical hazards, having good awareness of these hazards, good preplanning, use of personal protective equipment and following basic safety rules can go a long way in preventing. Any physical condition that increases the possibility of peril is referred to as a physical hazard in fire insurance. Physical hazards can also be handled by applying an excess, a loading, exclusions or other terms and conditions. The moral hazard is judged by the reputation and fairness in dealings.

Source: definitionus.blogspot.com

Source: definitionus.blogspot.com

Physical hazards are conditions surrounding property or persons that increase the danger of loss. Any physical condition that increases the possibility of peril is referred to as a physical hazard in fire insurance. Because insurance is all about fairness, about equity. Physical hazard can be seen, assessed and rated accordingly whereas moral hazards are not visible and cannot be assessed. Such physical hazards create or increase the opportunity for injury or damage caused due to fire.

Source: matic.com

Source: matic.com

Hazard insurance is coverage that protects a property owner against damage caused by fires, severe storms, hail/sleet, or other natural events. These can comprise any material, structural, or operational features of the business. Physical hazards in fire insurance mean any physical condition that increases the possibility of a loss. Morale hazards arise out of an insured’s indifference to the risk involved. It also is considered a physical hazard in regard to health insurance because it increases the probability of severe illness.

Source: physicn.blogspot.com

Source: physicn.blogspot.com

Physical hazards can also be handled by applying an excess, a loading, exclusions or other terms and conditions. Physical hazards indicate those dangers of the subject matter of insurance which can be ascertained or identified by mere inspection of the risk. Hazard insurance is coverage that protects a property owner against damage caused by fires, severe storms, hail/sleet, or other natural events. A physical hazard increases the likelihood of a loss occurring due to inadequacies in the condition, structure, or operation of an insured or insured property. Some examples in the various branches of.

Source: physciq.blogspot.com

Source: physciq.blogspot.com

In personal accident insurance, physical hazard relates to age, occupation, health, and physical condition etc, of the proposer. If you have poor housekeeping at your building then that is a moral hazard. Thus, smoking is a physical hazard that increases the likelihood of a house fire and illness. This covers the damage to your home from hail, fire and other natural disasters. For example driving recklessly, trying to run on slippery road, not following traffic rules etc are some examples of the morale hazards.

Source: slideserve.com

Source: slideserve.com

For example driving recklessly, trying to run on slippery road, not following traffic rules etc are some examples of the morale hazards. Lenders often use the term “hazard insurance”, which refers to coverage for your home’s structure. Physical hazard can be seen, assessed and rated accordingly whereas moral hazards are not visible and cannot be assessed. Thus, insurance companies suffer losses because of fraudulent or inflated claims. Physical hazards in fire insurance mean any physical condition that increases the possibility of a loss.

Source: franceiearn.blogspot.com

Source: franceiearn.blogspot.com

As long as the specific weather event is covered. Physical hazard can be seen, assessed and rated accordingly whereas moral hazards are not visible and cannot be assessed. What is a physical hazard in insurance? Physical hazards are actions, behaviors, or conditions that cause or contribute to peril. Hazard insurance is coverage that protects a property owner against damage caused by fires, severe storms, hail/sleet, or other natural events.

Source: iedunote.com

Source: iedunote.com

In personal accident insurance, physical hazard relates to age, occupation, health, and physical condition etc, of the proposer. Physical hazards exist physically like higher sugar level in a person, loose brakes of a vehicle, worn out tires, faulty wiring are. Hazard insurance is coverage that protects a property owner against damage caused by fires, severe storms, hail/sleet, or other natural events. What is a physical hazard in insurance? Physical hazards physical hazards are actions, behaviors, or conditions that cause or contribute.

Source: physciq.blogspot.com

Source: physciq.blogspot.com

Hazard insurance is coverage that protects a property owner against damage caused by fires, severe storms, hail/sleet, or other natural events. What is a physical hazard in insurance? This covers the damage to your home from hail, fire and other natural disasters. This type of insurance is usually not available on its own. Physical hazard can be seen, assessed and rated accordingly whereas moral hazards are not visible and cannot be assessed.

Source: youtube.com

Source: youtube.com

Thus, smoking is a physical hazard that increases the likelihood of a house fire and illness. The insurance company must have the proper knowledge of the physical hazard while underwriting the policy and deciding whether to accept the risk. Thus, smoking is a physical hazard that increases the likelihood of a house fire and illness. Lenders often use the term “hazard insurance”, which refers to coverage for your home’s structure. As long as the specific weather event is covered.

These can comprise any material, structural, or operational features of the business. Morale hazards arise out of an insured’s indifference to the risk involved. Because insurance is all about fairness, about equity. Lenders often use the term “hazard insurance”, which refers to coverage for your home’s structure. Physical hazards in fire insurance mean any physical condition that increases the possibility of a loss.

A physical hazard is a physical condition that increases the possibility of a loss. Physical hazard — the material, structural, or operational features of a business that may create or increase the opportunity for injury or. A physical hazard is a physical condition that increases the possibility of a loss. Physical hazards are conditions surrounding property or persons that increase the danger of loss. A condition stemming from the material characteristics of an object, e.g., wet or icy street (increa

Source: entangledbydesire.blogspot.com

Source: entangledbydesire.blogspot.com

Physical hazards physical hazards are actions, behaviors, or conditions that cause or contribute. Thus, smoking is a physical hazard that increases the likelihood of a house fire and illness. The moral hazard is judged by the reputation and fairness in dealings. Physical hazard for commercial insurance is a condition that increases the chance or creates the opportunity for a loss. The moral hazard occurs due to intention of the insured whereas the physical hazard is beyond his approach.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title physical hazard insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information