Pip insurance coverage texas Idea

Home » Trending » Pip insurance coverage texas IdeaYour Pip insurance coverage texas images are available. Pip insurance coverage texas are a topic that is being searched for and liked by netizens today. You can Get the Pip insurance coverage texas files here. Find and Download all free photos.

If you’re looking for pip insurance coverage texas images information linked to the pip insurance coverage texas keyword, you have pay a visit to the ideal blog. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

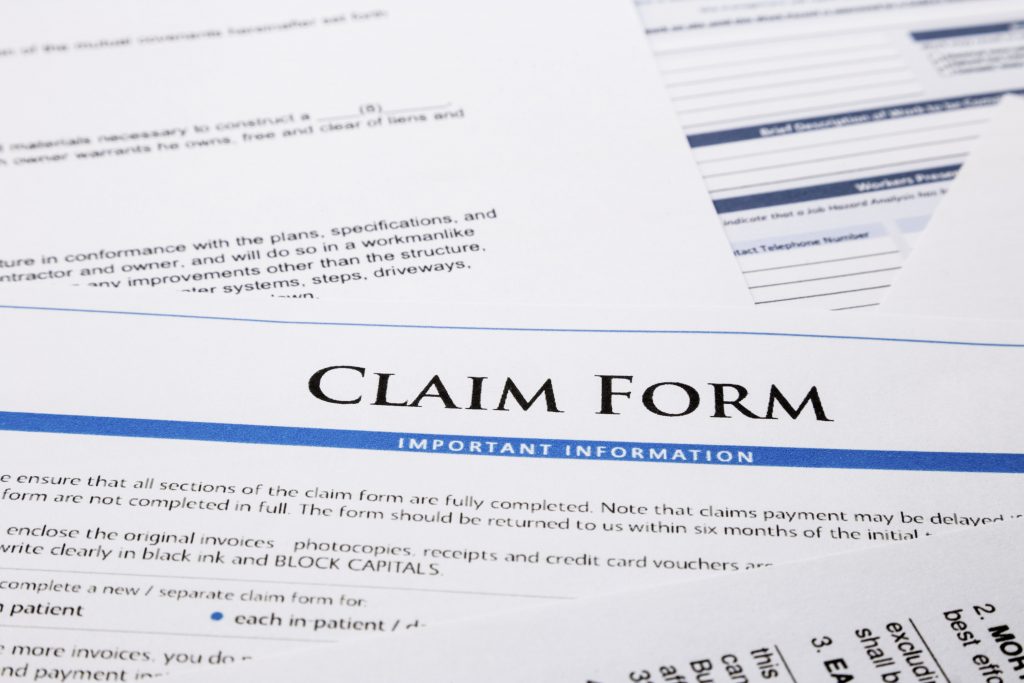

Pip Insurance Coverage Texas. In texas, pip insurance is mandatory, unless you sign a waiver declining the coverage. Pip is not subject to subrogation, under the texas insurance code. When looking for what is pip insurance coverage in texas chandler ross. Pip will also cover the same costs for your passengers if a car crash hurts them.

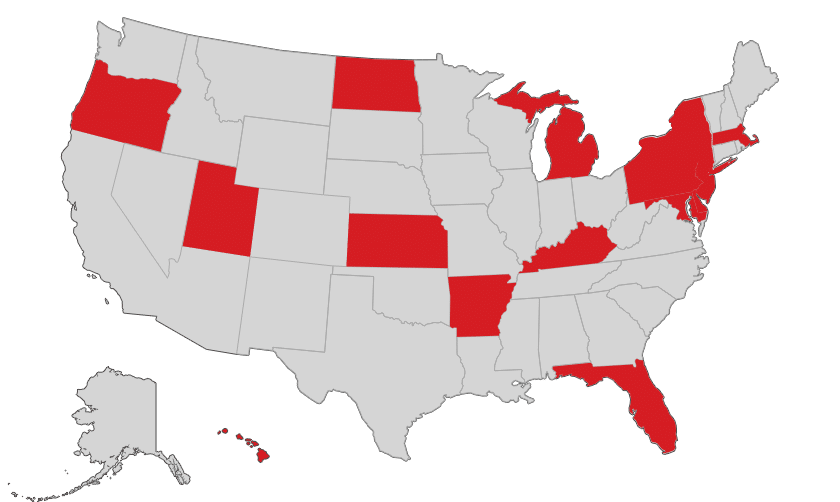

What is No Fault Insurance? PIP Insurance? and Costs From ratesforinsurance.com

What is No Fault Insurance? PIP Insurance? and Costs From ratesforinsurance.com

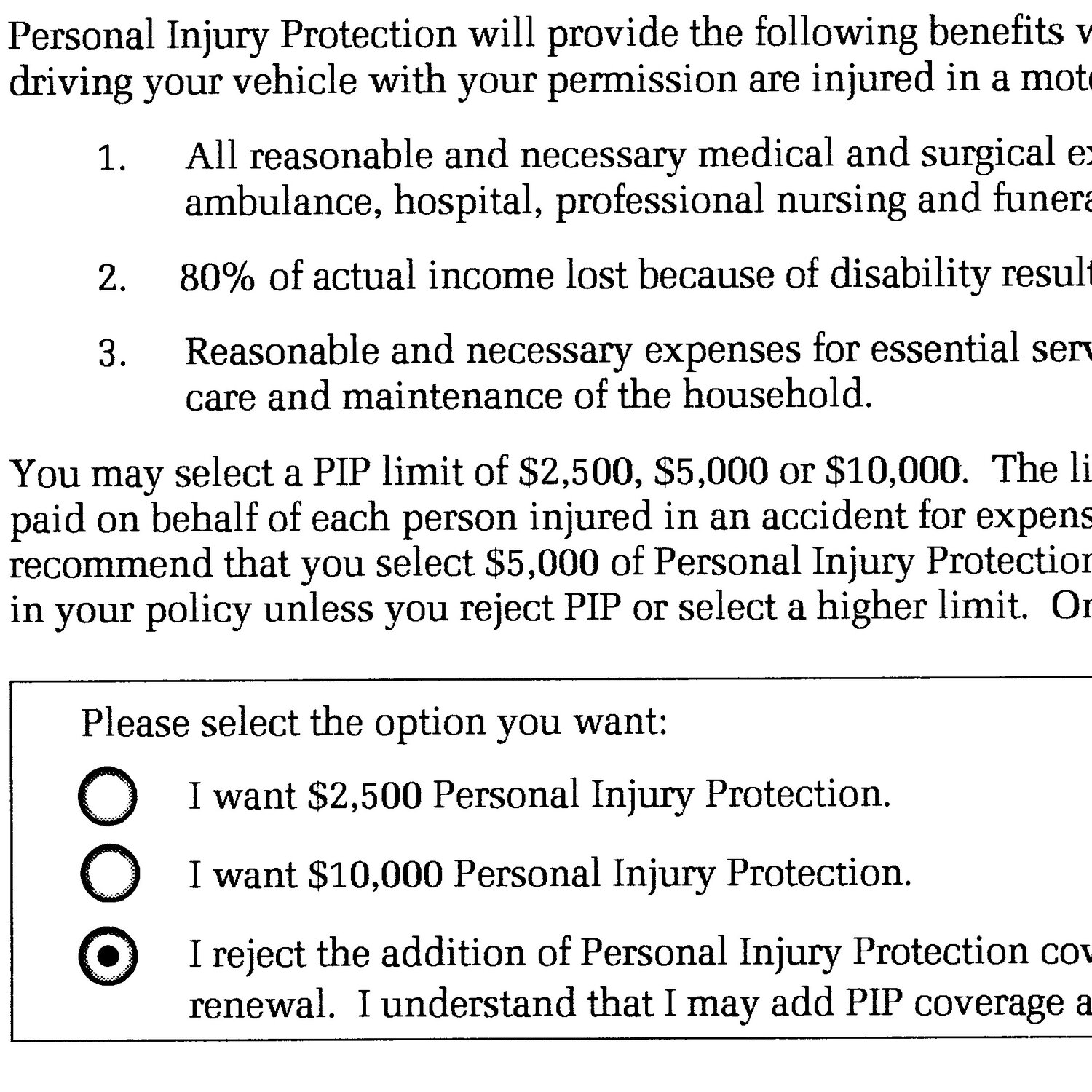

The mandate is there to protect drivers in the event of an accident of their own fault or if the other driver has no coverage. “all texas auto insurance policies include personal injury protection (pip) by default, so you must tell your carrier in writing if you wish to opt out. Texas law requires that insurers offer a minimum of $2,500 in coverage. Pip coverage pays for lost wages an individual incurs while off of work. The exception is available because in many situations, these injuries are covered by an individual’s health insurance coverage. Although opting out can seem like an easy way to cut down your insurance bill, we can say from experience that doing so might cost you much more later — and at the worst possible time.”

Ad see new 2022 insurance to see if you could save in texas.

October 5, 2017 auto accidents very important. It pays your and your passengers’ medical bills. Pip is not subject to subrogation, under the texas insurance code. If you currently lack pip coverage, you can add such coverage at any time by signing a form indicating that you want pip coverage and by paying a little extra for your coverage. If you do not reject it. The exception is available because in many situations, these injuries are covered by an individual’s health insurance coverage.

Source: injuryrelief.com

Source: injuryrelief.com

The texas insurance commission has valuable resources for learning about car insurance coverage in texas. But it also pays for things like lost wages and other nonmedical costs. Pip stands for personal injury protection. It�s designed to kick in when you�ve been hurt and incurred medical bills and/or lost wages as a result of a car accident. Ad see new 2022 insurance to see if you could save in texas.

Source: bankrate.com

Source: bankrate.com

If you cause an accident, you will have to pay for damages. Pip will also cover the same costs for your passengers if a car crash hurts them. But it also pays for things like lost wages and other nonmedical costs. If your carried $2,500 in pip benefits, and $30,000 in um benefits, then the total amount of coverage that is available for your bodily injury claim is $32,500. When looking for what is pip insurance coverage in texas chandler ross.

Source: 1800lionlaw.com

Source: 1800lionlaw.com

If you do not reject it. Pip coverage pays for lost wages an individual incurs while off of work. It�s designed to kick in when you�ve been hurt and incurred medical bills and/or lost wages as a result of a car accident. Pip is not subject to subrogation, under the texas insurance code. But it also pays for things like lost wages and other nonmedical costs.

Source: joinroot.com

Source: joinroot.com

The texas insurance commission has valuable resources for learning about car insurance coverage in texas. If you do not reject it. Although opting out can seem like an easy way to cut down your insurance bill, we can say from experience that doing so might cost you much more later — and at the worst possible time.” October 5, 2017 auto accidents very important. The texas state minimum for pip coverage is $2,500, but it’s highly advisable that if you can afford it, you buy additional pip coverage.

Source: injuryattorneyofdallas.com

Source: injuryattorneyofdallas.com

You may reject the coverage, but your rejection must be in a signed writing to the insurance company. The francis firm highly recommends pip coverage as a way to protect you and your family in the event of an accident. Medical expenses from a car accident. You may reject the coverage, but your rejection must be in a signed writing to the insurance company. Pip will also cover the same costs for your passengers if a car crash hurts them.

Source: tedsmithlawgroup.com

Source: tedsmithlawgroup.com

In the state of texas, it is required to have personal injury protection coverage with your insurance plan. You may reject the coverage, but your rejection must be in a signed writing to the insurance company. The mandate is there to protect drivers in the event of an accident of their own fault or if the other driver has no coverage. 2 rows texas requires that every driver is offered at least $2,500 of pip insurance. Pip insurance pays for your medical expenses, lost wages, and other expenses if you are injured in an automobile accident.

Source: ratesforinsurance.com

Source: ratesforinsurance.com

If you do not reject it. Although opting out can seem like an easy way to cut down your insurance bill, we can say from experience that doing so might cost you much more later — and at the worst possible time.” The texas state minimum for pip coverage is $2,500, but it’s highly advisable that if you can afford it, you buy additional pip coverage. However, less than half of drivers in texas have pip insurance. It is worth looking into additional pip insurance beyond the minimum coverage provided by texas insurance policies due to rising medical costs in the united states, increased road traffic, […]

Source: pinterest.com

Source: pinterest.com

If you cause an accident, you will have to pay for damages. October 5, 2017 auto accidents very important. It pays your and your passengers’ medical bills. The nitty gritty details can be found in sec. Section 1952.152 (a) of texas law states that your insurance company must “offer” you pip (personal injury protection) when you purchase any automobile liability insurance policy in texas.

Source: anderson-cummings.com

Source: anderson-cummings.com

Personal injury protection (pip) is a type of mandatory. Pip insurance pays for your medical expenses, lost wages, and other expenses if you are injured in an automobile accident. Texas law requires that insurers offer a minimum of $2,500 in coverage. Personal injury protection insurance in texas author: Personal injury protection (pip) is a type of mandatory.

Source: insuranceonline.com

Although opting out can seem like an easy way to cut down your insurance bill, we can say from experience that doing so might cost you much more later — and at the worst possible time.” Medical expenses from a car accident. Pip stands for personal injury protection. The requirement for personal injury protection in texas is for insurance companies to offer at least $2,500 to their policyholders. Coverage starting at midnight, care as soon as tomorrow.

Source: jonesfamilyins.com

Source: jonesfamilyins.com

If your carried $2,500 in pip benefits, and $30,000 in um benefits, then the total amount of coverage that is available for your bodily injury claim is $32,500. Pip coverage pays for lost wages an individual incurs while off of work. It pays your and your passengers’ medical bills. What pip covers in texas. It is worth looking into additional pip insurance beyond the minimum coverage provided by texas insurance policies due to rising medical costs in the united states, increased road traffic, […]

Source: sigmonlawpllc.com

Source: sigmonlawpllc.com

The mandate is there to protect drivers in the event of an accident of their own fault or if the other driver has no coverage. Ad see new 2022 insurance to see if you could save in texas. Personal injury protection (pip) is a type of car insurance that covers expenses, like medical. Personal injury protection (pip) is a type of mandatory. It�s designed to kick in when you�ve been hurt and incurred medical bills and/or lost wages as a result of a car accident.

Source: i-lawsuit.com

Source: i-lawsuit.com

Texas law on pip insurance coverage. Personal injury protection (pip) coverage is similar to medical payments coverage. If your carried $2,500 in pip benefits, and $30,000 in um benefits, then the total amount of coverage that is available for your bodily injury claim is $32,500. But it also pays for things like lost wages and other nonmedical costs. The mandate is there to protect drivers in the event of an accident of their own fault or if the other driver has no coverage.

Source: tophoustoninjurylawyer.com

Source: tophoustoninjurylawyer.com

In texas, pip insurance is mandatory, unless you sign a waiver declining the coverage. Pip insurance pays for your medical expenses, lost wages, and other expenses if you are injured in an automobile accident. Texas law requires that insurers offer a minimum of $2,500 in coverage. Personal injury protection (pip) coverage is similar to medical payments coverage. Pip will also cover the same costs for your passengers if a car crash hurts them.

Source: harlingencarcrashattorney.com

Source: harlingencarcrashattorney.com

Texas law requires that insurers offer a minimum of $2,500 in coverage. It pays your and your passengers’ medical bills. Pip will also cover the same costs for your passengers if a car crash hurts them. Personal injury protection (pip) coverage is similar to medical payments coverage. The exception is available because in many situations, these injuries are covered by an individual’s health insurance coverage.

Source: ratesforinsurance.com

Source: ratesforinsurance.com

Under texas law, personal injury protection coverage must be offered in all auto insurance policies. Medical expenses from a car accident. Personal injury protection (pip) is a type of mandatory. “all texas auto insurance policies include personal injury protection (pip) by default, so you must tell your carrier in writing if you wish to opt out. Personal injury protection provides compensation for medical bills and other costs associated with car accidents.

Source: carsurance.net

Source: carsurance.net

Personal injury protection (pip) is a type of car insurance that covers expenses, like medical. 1952.152 in the texas insurance code. However, less than half of drivers in texas have pip insurance. But it also pays for things like lost wages and other nonmedical costs. The requirement for personal injury protection in texas is for insurance companies to offer at least $2,500 to their policyholders.

Source: montgomeryfirm.com

Source: montgomeryfirm.com

If you do not reject it. It is worth looking into additional pip insurance beyond the minimum coverage provided by texas insurance policies due to rising medical costs in the united states, increased road traffic, […] You may reject the coverage, but your rejection must be in a signed writing to the insurance company. Pip will also cover the same costs for your passengers if a car crash hurts them. Pip is not subject to subrogation, under the texas insurance code.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title pip insurance coverage texas by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information