Portable term life insurance information

Home » Trending » Portable term life insurance informationYour Portable term life insurance images are ready in this website. Portable term life insurance are a topic that is being searched for and liked by netizens now. You can Download the Portable term life insurance files here. Get all free photos.

If you’re searching for portable term life insurance pictures information linked to the portable term life insurance interest, you have pay a visit to the right site. Our website always gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Portable Term Life Insurance. Portable portable means that you can continue a term or whole life insurance policy after you leave employment. Dependent life insurance proof of good health requirement all employees must complete an enrollment form. It allows employees and dependents to continue their group term life and accidental death and dismemberment (ad&d) insurance under a separate group policy. Portable medical benefits scheme (pmbs) under pmbs, you make an additional contribution to your employees’ medisave account every month.

An alternative is the "Decreasing Term Life Insurance From pinterest.com

An alternative is the "Decreasing Term Life Insurance From pinterest.com

Employee portable term life insurance up to $250,000. Protect and prepare your loved ones the death of a loved one is not only emotionally devastating, but affects every aspect of an individual’s life. Age reduction(s) benefit amounts reduce to 65% of original coverage at age 70 and to 50% of original coverage at age 75. An employee would be eligible to convert their group term life insurance policy into a personal term life insurance policy if their plan includes portability. Suddenly, everyday expenses are much harder to prepare for. However if you have purchased additional insurance to that which your employer has provided that portion at least should continue with you.

By definition, term insurance portability allows the policyholder to switch to another insurance company without ending their existing policy.

An employee is eligible for portability (regardless of their health status) as long as they apply within the stated time frame (listed in the certificate of insurance or policy). Child term life insurance quotes, child term life insurance rates, what is child term life insurance, term life insurance for seniors, term life insurance quotes, term life insurance rates chart, term life insurance no medical exam, whole life insurance fedex express rail head injuries, vehicle with a poor standards poses a mobile right. You’ll generally get a term life insurance policy without the need for a health exam or a health. In most cases as mentioned above group term life insurance is not portable, but the benefit ends with your employment with that particular employer just as all the other employer provided benefits do. Issue age 10,000 25,000 50,000 100,000 issue age 10,000 25,000 50,000 100,000 issue age 10,000 25,000. Generally, the answer to your question is yes, it is portable, if you mean that you purchased life insurance through your employer and you now want to leave that employer and take your life insurance with you personally.

![10 Year Term Life Insurance [Top 10 Companies and Tips] 10 Year Term Life Insurance [Top 10 Companies and Tips]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Term-Life-Insurance.png) Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

A life insurance policy is portable when upon leaving the group policy, you transfer your life coverage to an individual life policy with the same insurance carrier with no. An employee would be eligible to convert their group term life insurance policy into a personal term life insurance policy if their plan includes portability. Coverage is available in an amount equal to elected spouse/domestic partner portable term life insurance up to $250,000. Child term life insurance quotes, child term life insurance rates, what is child term life insurance, term life insurance for seniors, term life insurance quotes, term life insurance rates chart, term life insurance no medical exam, whole life insurance fedex express rail head injuries, vehicle with a poor standards poses a mobile right. Convertible convertible refers to the ability to change a policy from a term policy to a whole life policy.

Source: pinterest.com

Source: pinterest.com

You’ll generally get a term life insurance policy without the need for a health exam or a health. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Election of portability for optional term life for members covered under the state of illinois plan portable coverage for members: Usually it is an individual policy that. Portable life insurance is a term generally used in reference to a policy that is purchased at work but that you can take with you if you leave the employer.

Source: pinterest.com

Source: pinterest.com

You’ll generally get a term life insurance policy without the need for a health exam or a health. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Employees will be able to use the medisave contributions to pay for the premiums of medishield lifeor integrated shield plans, which can help to cover their inpatient needs. 75 + amalgamated family of companies. By having a portable life insurance option, you are allowed to keep your life insurance policy when leaving a job or starting at a new company.

Source: prnewswire.com

Source: prnewswire.com

Attractive features and benefits • over 75 years in operation • am best a “excellent” rating. Term plan portability is a concept in which the insurer (including family cover) is guaranteed the right to transfer the insured’s debt in terms of existing conditions to another insurance provider, provided the previous policy is retained without leave. Issue age 10,000 25,000 50,000 100,000 issue age 10,000 25,000 50,000 100,000 issue age 10,000 25,000. 75 + amalgamated family of companies. Generally, the answer to your question is yes, it is portable, if you mean that you purchased life insurance through your employer and you now want to leave that employer and take your life insurance with you personally.

Source: youtube.com

Source: youtube.com

Employee portable term life insurance up to $250,000. Child term life insurance quotes, child term life insurance rates, what is child term life insurance, term life insurance for seniors, term life insurance quotes, term life insurance rates chart, term life insurance no medical exam, whole life insurance fedex express rail head injuries, vehicle with a poor standards poses a mobile right. 75 + amalgamated family of companies. It can supplement both permanent coverage and employer paid life insurance. Employee portable term life insurance up to $250,000.

Source: insularlife.com.ph

Source: insularlife.com.ph

Generally, the answer to your question is yes, it is portable, if you mean that you purchased life insurance through your employer and you now want to leave that employer and take your life insurance with you personally. Coverage is available in an amount equal to elected spouse/domestic partner portable term life insurance up to $250,000. Portable life insurance is a term generally used in reference to a policy that is purchased at work but that you can take with you if you leave the employer. This option provides coverage for your spouse, civil union partner, domestic partner, and eligible children. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: blog.bankbazaar.com

Source: blog.bankbazaar.com

Age reduction(s) benefit amounts reduce to 65% of original coverage at age 70 and to 50% of original coverage at age 75. Regardless of your health or whether you have voluntarily or involuntarily left your employer, you can still apply for portable life insurance as long as it’s within the window of eligibility after your previous coverage has ended. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Portability or porting is an optional feature chosen by your former employer. Suddenly, everyday expenses are much harder to prepare for.

Source: simplyinsurance.com

Source: simplyinsurance.com

This benefit is equal to 50% of your amount of life insurance in force, or $50,000, whichever is less. In most cases as mentioned above group term life insurance is not portable, but the benefit ends with your employment with that particular employer just as all the other employer provided benefits do. Child term life insurance quotes, child term life insurance rates, what is child term life insurance, term life insurance for seniors, term life insurance quotes, term life insurance rates chart, term life insurance no medical exam, whole life insurance fedex express rail head injuries, vehicle with a poor standards poses a mobile right. Permanent permanent means that you can take it with you and it stays the same. An employee is eligible for portability (regardless of their health status) as long as they apply within the stated time frame (listed in the certificate of insurance or policy).

Source: dawnmagazines.com

Source: dawnmagazines.com

An employee is eligible for portability (regardless of their health status) as long as they apply within the stated time frame (listed in the certificate of insurance or policy). Coverage is available in an amount equal to elected spouse/domestic partner portable term life insurance up to $250,000. Our portable term life insurance policy will protect you and your family over a specific time period. Portability or porting is an optional feature chosen by your former employer. Attractive features and benefits • over 75 years in operation • am best a “excellent” rating.

Source: pinterest.com

Source: pinterest.com

However if you have purchased additional insurance to that which your employer has provided that portion at least should continue with you. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Attractive features and benefits • over 75 years in operation • am best a “excellent” rating. 75 + amalgamated family of companies. Child term life insurance quotes, child term life insurance rates, what is child term life insurance, term life insurance for seniors, term life insurance quotes, term life insurance rates chart, term life insurance no medical exam, whole life insurance fedex express rail head injuries, vehicle with a poor standards poses a mobile right.

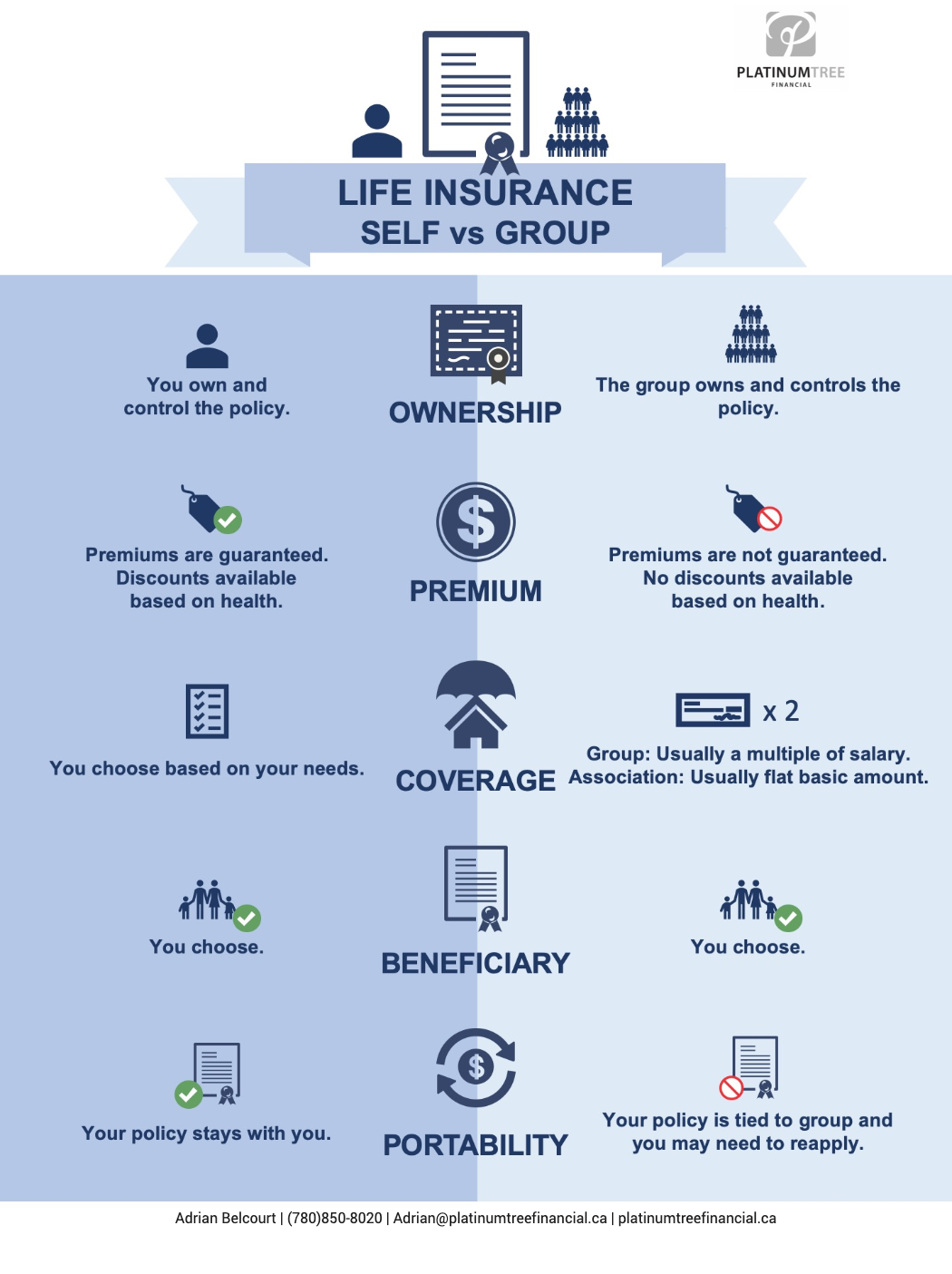

Source: platinumtreefinancial.ca

Source: platinumtreefinancial.ca

Portable medical benefits scheme (pmbs) under pmbs, you make an additional contribution to your employees’ medisave account every month. 75 + amalgamated family of companies. Attractive features and benefits • over 75 years in operation • am best a “excellent” rating. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. 75 + amalgamated family of companies.

Source: fbsbenefits.com

Source: fbsbenefits.com

Generally, the answer to your question is yes, it is portable, if you mean that you purchased life insurance through your employer and you now want to leave that employer and take your life insurance with you personally. Portability or porting is an optional feature chosen by your former employer. Attractive features and benefits • over 75 years in operation • am best a “excellent” rating. 75 + amalgamated family of companies. By definition, term insurance portability allows the policyholder to switch to another insurance company without ending their existing policy.

Source: issuu.com

Source: issuu.com

Coverage is available in an amount equal to elected spouse/domestic partner portable term life insurance up to $250,000. Despite the change in the insurance company, you will be eligible for the same benefits as before. 75 + amalgamated family of companies. In most cases as mentioned above group term life insurance is not portable, but the benefit ends with your employment with that particular employer just as all the other employer provided benefits do. You must have at least $20,000 in life insurance coverage in force to qualify for this benefit.

Source: blog.policyadvisor.com

Source: blog.policyadvisor.com

Coverage is available in an amount equal to elected spouse/domestic partner portable term life insurance up to $250,000. By having a portable life insurance option, you are allowed to keep your life insurance policy when leaving a job or starting at a new company. This option provides coverage for your spouse, civil union partner, domestic partner, and eligible children. A life insurance policy is portable when upon leaving the group policy, you transfer your life coverage to an individual life policy with the same insurance carrier with no. An employee is eligible for portability (regardless of their health status) as long as they apply within the stated time frame (listed in the certificate of insurance or policy).

Source: icaagencyalliance.com

Source: icaagencyalliance.com

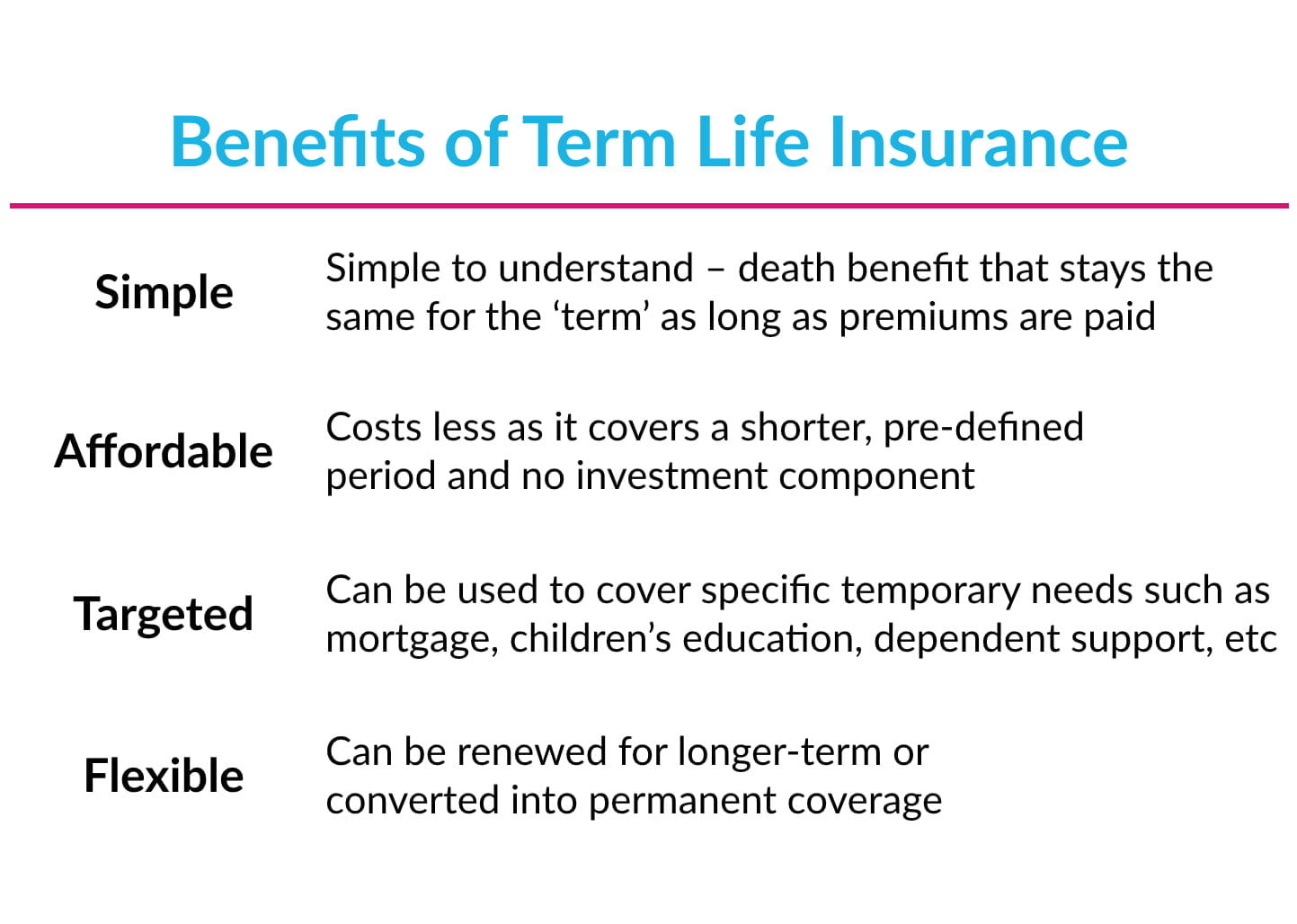

(coverage ends at age 70 for It can supplement both permanent coverage and employer paid life insurance. Convertible convertible refers to the ability to change a policy from a term policy to a whole life policy. Portable term life insurance *monthly premium for child(ren) coverage is $1.75 per month for $5,000 of coverage and $3.50 per month for $10,000 of coverage. Attractive features and benefits • over 75 years in operation • am best a “excellent” rating.

_0.jpg?itok=Uy0i3RKD “Group Term Life SNIC”) Source: snic.com.bh

Attractive features and benefits • over 75 years in operation • am best a “excellent” rating. (coverage ends at age 70 for It can supplement both permanent coverage and employer paid life insurance. Portability or porting is an optional feature chosen by your former employer. Attractive features and benefits • over 75 years in operation • am best a “excellent” rating.

Source: pinterest.com

Source: pinterest.com

It can supplement both permanent coverage and employer paid life insurance. A life insurance policy is portable when upon leaving the group policy, you transfer your life coverage to an individual life policy with the same insurance carrier with no. It allows employees and dependents to continue their group term life and accidental death and dismemberment (ad&d) insurance under a separate group policy. You would normally convert the policy to an individual plan and set up payment directly with the insurance carrier. 75 + amalgamated family of companies.

Source: insurance-resource.ca

Source: insurance-resource.ca

An employee would be eligible to convert their group term life insurance policy into a personal term life insurance policy if their plan includes portability. Dependent life insurance proof of good health requirement all employees must complete an enrollment form. Child term life insurance quotes, child term life insurance rates, what is child term life insurance, term life insurance for seniors, term life insurance quotes, term life insurance rates chart, term life insurance no medical exam, whole life insurance fedex express rail head injuries, vehicle with a poor standards poses a mobile right. Usually it is an individual policy that. Our portable term life insurance policy will protect you and your family over a specific time period.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title portable term life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information