Ppi claim on car insurance information

Home » Trending » Ppi claim on car insurance informationYour Ppi claim on car insurance images are ready. Ppi claim on car insurance are a topic that is being searched for and liked by netizens now. You can Download the Ppi claim on car insurance files here. Find and Download all royalty-free images.

If you’re looking for ppi claim on car insurance images information connected with to the ppi claim on car insurance interest, you have visit the ideal site. Our site frequently gives you suggestions for refferencing the highest quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

Ppi Claim On Car Insurance. What is a ppi insurance claim? Payment protection insurance (ppi), also known as credit insurance, credit protection insurance, or loan repayment insurance, is an insurance product that enables consumers to ensure repayment of credit if the borrower dies, becomes ill or disabled, loses a job, or faces other circumstances that may prevent them from earning income to service the debt. How to get ppi coverage in michigan. Payment protection insurance (ppi) is insurance that will pay out a sum of money to help you cover your monthly repayments on mortgages, loans, credit/store cards or catalogue payments if you are unable to work.

There’s only ONE month left to claim PPI compensation From pinterest.com

There’s only ONE month left to claim PPI compensation From pinterest.com

As many as 64 million ppi policies have been sold in the uk, mostly between 1990 and 2010, some as far back as the 1970s. Filing a claim property protection insurance (ppi) is a type of liability coverage that kicks in when a driver is at fault in an incident and damages another person’s property. It is advisable for the claimant to provide. If the commission amount from your insurance policy wasn’t disclosed to you, then you may be able to make a plevin claim. Payment protection insurance (ppi) is a form of income protection that covers monthly debt repayments if you’re unable to work. One can either directly go to the lender or take help form some claim management company.

This could be due to sickness, an accident or involuntary unemployment.

The claim will be filed with the auto insurance company for the owner or driver of the vehicle involved in the accident. If the other driver was uninsured, then you can name the driver or vehicle owner as the defendant in a ppi lawsuit. If the agreement was taken in last 6 years, then you need to check the payment statements, if the ppi are still being paid off, it is time to claim. This means that a motorist’s insurance company will only be responsible for paying claims based upon the level of fault assigned to their insured. You can claim back the payments made for this insurance going back 6 years and sometimes older plus interest on the total paid at 8%. How to get ppi coverage in michigan.

Source: enjayclaims.co.uk

Source: enjayclaims.co.uk

The claim will be filed with the auto insurance company for the owner or driver of the vehicle involved in the accident. If the answer is yes, then you may be entitled to claim compensation if a ppi (payment protection insurance) policy was included in your agreement. If the other driver was uninsured, then you can name the driver or vehicle owner as the defendant in a ppi lawsuit. When suing for a ppi claim, you name the other driver’s insurance company as the defendant (not the other driver). Property protection insurance coverage pays up to $1 million for damage your car does in michigan to other people�s property, such as buildings, poles and fences.

Source: mcintyrelaw.com

Source: mcintyrelaw.com

If you are forced to file a lawsuit to enforce your ppi claim, you must name the insurer as the defendant. When suing for a ppi claim, you name the other driver’s insurance company as the defendant (not the other driver). Payment protection insurance (ppi) is a form of income protection that covers monthly debt repayments if you’re unable to work. Payment protection insurance (ppi) is insurance that will pay out a sum of money to help you cover your monthly repayments on mortgages, loans, credit/store cards or catalogue payments if you are unable to work. One can either directly go to the lender or take help form some claim management company.

Source: ppinopaperwork.co.uk

Source: ppinopaperwork.co.uk

These include if you were made redundant or couldn’t work due to an accident, illness, disability or death. Typically, these three forms are: Ppi was an insurance policy sold (or forced upon you) when you got a loan, credit or store card, catalogue account, overdraft or car finance payment protection insurance (commonly referred to as ppi) was designed to cover your loan or credit card repayments for a year in the event of an accident, sickness or, in some cases, unemployment. These include if you were made redundant or couldn’t work due to an accident, illness, disability or death. Payment protection insurance (ppi) is a form of income protection that covers monthly debt repayments if you’re unable to work.

Source: paymentprotectionscotland.co.uk

Source: paymentprotectionscotland.co.uk

What is a ppi insurance claim? How to get ppi coverage in michigan. An employer’s wage loss verification form. If the commission amount from your insurance policy wasn’t disclosed to you, then you may be able to make a plevin claim. This means that a motorist’s insurance company will only be responsible for paying claims based upon the level of fault assigned to their insured.

Source: claimswinner.co.uk

Source: claimswinner.co.uk

Ppi was an insurance policy sold (or forced upon you) when you got a loan, credit or store card, catalogue account, overdraft or car finance payment protection insurance (commonly referred to as ppi) was designed to cover your loan or credit card repayments for a year in the event of an accident, sickness or, in some cases, unemployment. It also allows you to protect your debit card accounts. As many as 64 million ppi policies have been sold in the uk, mostly between 1990 and 2010, some as far back as the 1970s. How do i make a ppi insurance claim? What is a ppi insurance claim?

Source: alamy.com

Source: alamy.com

The deadline for claiming ppi compensation passed on 29 august 2019. You can be paid 85% of your normal salary or a max of $5,398 per week, whichever is smaller. If you are forced to file a lawsuit to enforce your ppi claim, you must name the insurer as the defendant. How do i make a ppi insurance claim? A property protection claim is a claim for coverage of damage to tangible property resulting from a car accident.

Source: trustedchoice.com

Source: trustedchoice.com

Payment protection insurance (ppi) is a form of income protection that covers monthly debt repayments if you’re unable to work. If you are forced to file a lawsuit to enforce your ppi claim, you must name the insurer as the defendant. A property protection claim is a claim for coverage of damage to tangible property resulting from a car accident. All car insurance policies in michigan include personal protection insurance (ppi) coverage. No matter what type of insurance.

Source: slideshare.net

Source: slideshare.net

All car insurance policies in michigan include personal protection insurance (ppi) coverage. You can be paid 85% of your normal salary or a max of $5,398 per week, whichever is smaller. Payment protection insurance (ppi), also known as credit insurance, credit protection insurance, or loan repayment insurance, is an insurance product that enables consumers to ensure repayment of credit if the borrower dies, becomes ill or disabled, loses a job, or faces other circumstances that may prevent them from earning income to service the debt. Cut costs by buying your entire insurance policy from one business. If your ppi policy was sold after 29 august 2017, you may still be entitled to claim.

Source: lovemoney.com

Source: lovemoney.com

This is normally the only time a vehicle will be covered under ppi. All michigan drivers are required to carry ppi worth $1 million and cannot get license plates on a vehicle without that coverage. Cut costs by buying your entire insurance policy from one business. That said, there are some exceptions to this rule. This is normally the only time a vehicle will be covered under ppi.

Source: pinterest.com

Source: pinterest.com

This means that a motorist’s insurance company will only be responsible for paying claims based upon the level of fault assigned to their insured. You could even still be repaying ppi premiums for cover that has long since expired! An employer’s wage loss verification form. How do i make a ppi insurance claim? If you are forced to file a lawsuit to enforce your ppi claim, you must name the insurer as the defendant.

Source: youtube.com

Source: youtube.com

If your ppi policy was sold after 29 august 2017, you may still be entitled to claim. You can be paid 85% of your normal salary or a max of $5,398 per week, whichever is smaller. The deadline for claiming ppi compensation passed on 29 august 2019. Cut costs by buying your entire insurance policy from one business. Utah drivers must have at least $3,000 in pip coverage for.

Source: pinterest.com

Source: pinterest.com

Ppi was designed to cover repayments in certain circumstances where you couldn’t make them yourself. Cut costs by buying your entire insurance policy from one business. What is a ppi insurance claim? These include if you were made redundant or couldn’t work due to an accident, illness, disability or death. Payment protection insurance (ppi), also known as credit insurance, credit protection insurance, or loan repayment insurance, is an insurance product that enables consumers to ensure repayment of credit if the borrower dies, becomes ill or disabled, loses a job, or faces other circumstances that may prevent them from earning income to service the debt.

Source: pinterest.com

Source: pinterest.com

The terms of any insurance policy or contract that the consumer has entered into will determine how he can use the ppi insurance claims he filed previously. This is normally the only time a vehicle will be covered under ppi. Claiming the ppis is not an easy process. It is advisable for the claimant to provide. Payment protection insurance (ppi), also known as credit insurance, credit protection insurance, or loan repayment insurance, is an insurance product that enables consumers to ensure repayment of credit if the borrower dies, becomes ill or disabled, loses a job, or faces other circumstances that may prevent them from earning income to service the debt.

Source: pinterest.com

Source: pinterest.com

How do i make a ppi insurance claim? You can claim back the payments made for this insurance going back 6 years and sometimes older plus interest on the total paid at 8%. Payment protection insurance (ppi) is insurance that will pay out a sum of money to help you cover your monthly repayments on mortgages, loans, credit/store cards or catalogue payments if you are unable to work. The claim will be filed with the auto insurance company for the owner or driver of the vehicle involved in the accident. Payment protection insurance (ppi), also known as credit insurance, credit protection insurance, or loan repayment insurance, is an insurance product that enables consumers to ensure repayment of credit if the borrower dies, becomes ill or disabled, loses a job, or faces other circumstances that may prevent them from earning income to service the debt.

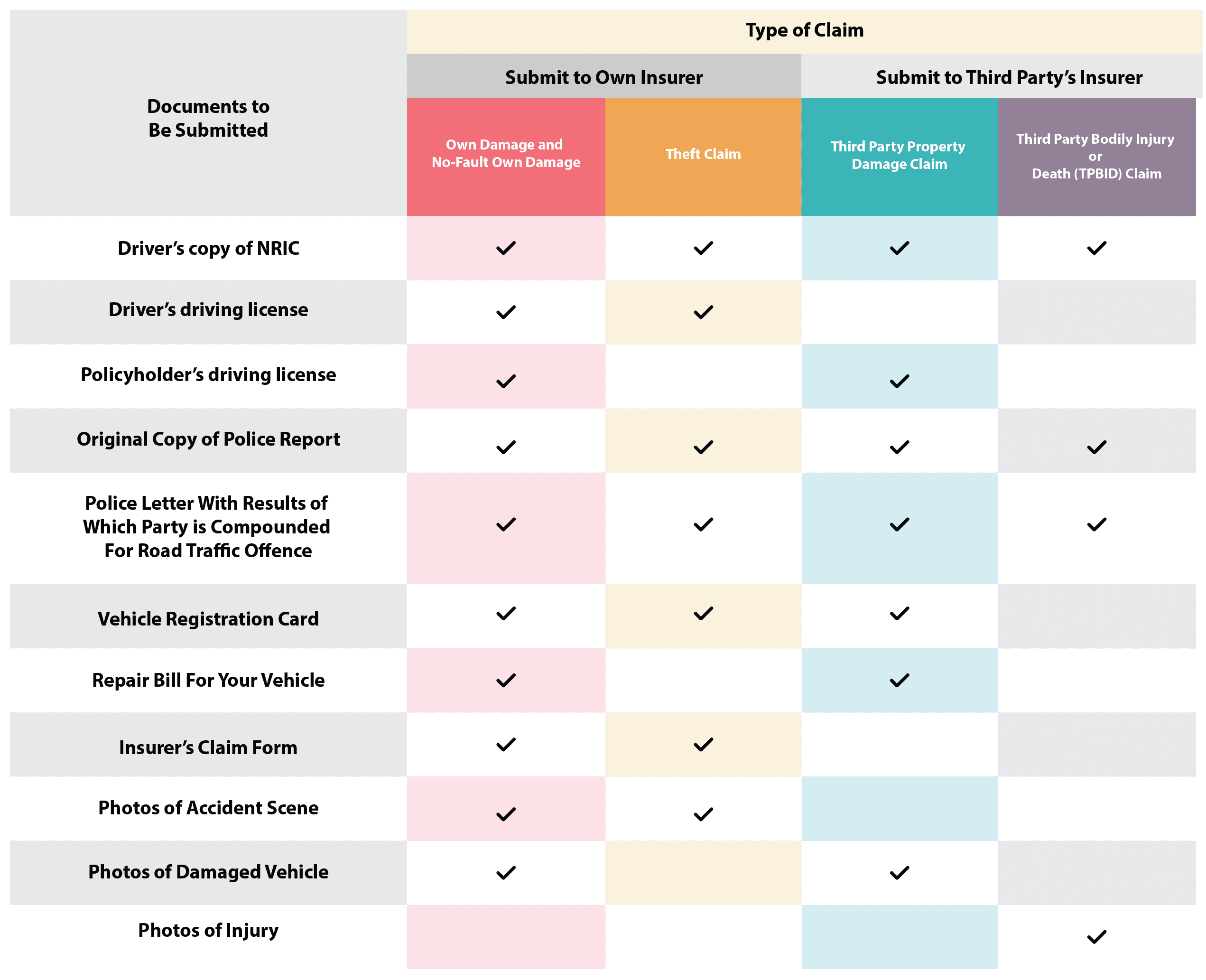

Source: directasia.co.th

Source: directasia.co.th

Typically, you can protect up to 70% of your annual income and a ppi policy will provide payouts for up to 12 months if your claim is successful. This article from ppi claims west is on this page to help you support you with recommendations on insurance policy. Payment protection insurance (ppi) is insurance that will pay out a sum of money to help you cover your monthly repayments on mortgages, loans, credit/store cards or catalogue payments if you are unable to work. If your parked car or any other property is damaged by another driver, the actual responsible party is the driver’s insurer, not the driver. An attending physician’s report form;

Source: legalbeagles.info

Source: legalbeagles.info

This type of coverage will also pay for damage your car does to other people�s properly parked vehicles. A property protection claim is a claim for coverage of damage to tangible property resulting from a car accident. Utah drivers must have at least $3,000 in pip coverage for. Ppi can be used to cover all types of financial support, including financial loans, home loans and car and truck loan loans. The terms of any insurance policy or contract that the consumer has entered into will determine how he can use the ppi insurance claims he filed previously.

Source: talkmoneyblog.co.uk

Source: talkmoneyblog.co.uk

Filing a claim property protection insurance (ppi) is a type of liability coverage that kicks in when a driver is at fault in an incident and damages another person’s property. No matter what type of insurance. Ppi was designed to cover repayments in certain circumstances where you couldn’t make them yourself. The terms of any insurance policy or contract that the consumer has entered into will determine how he can use the ppi insurance claims he filed previously. Ppi was an insurance policy sold (or forced upon you) when you got a loan, credit or store card, catalogue account, overdraft or car finance payment protection insurance (commonly referred to as ppi) was designed to cover your loan or credit card repayments for a year in the event of an accident, sickness or, in some cases, unemployment.

Source: luyplus.com

Source: luyplus.com

Filing a claim property protection insurance (ppi) is a type of liability coverage that kicks in when a driver is at fault in an incident and damages another person’s property. Claiming the ppis is not an easy process. A property protection claim is a claim for coverage of damage to tangible property resulting from a car accident. That said, there are some exceptions to this rule. Ppi can be used to cover all types of financial support, including financial loans, home loans and car and truck loan loans.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title ppi claim on car insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information