Ppli insurance information

Home » Trending » Ppli insurance informationYour Ppli insurance images are ready in this website. Ppli insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Ppli insurance files here. Get all royalty-free photos.

If you’re looking for ppli insurance pictures information related to the ppli insurance topic, you have pay a visit to the right site. Our website always gives you hints for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

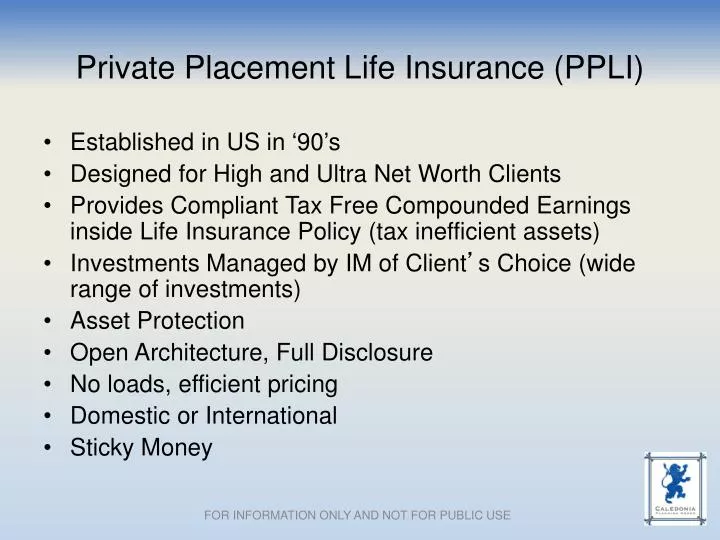

Ppli Insurance. In some cases, ppli life insurance assets are held offshore — placing these assets out of the reach of u.s. Policy funds are held in segregated accounts that theoretically protect the funds against the carrier’s creditors. Private placement life insurance & variable annuities forum is where the ppli and va industry meets. The only annual gathering for private placement life insurance professionals meet.

Is Private Placement Life Insurance (PPLI) a Fit? From lifeinsurancestrategiesgroup.com

Is Private Placement Life Insurance (PPLI) a Fit? From lifeinsurancestrategiesgroup.com

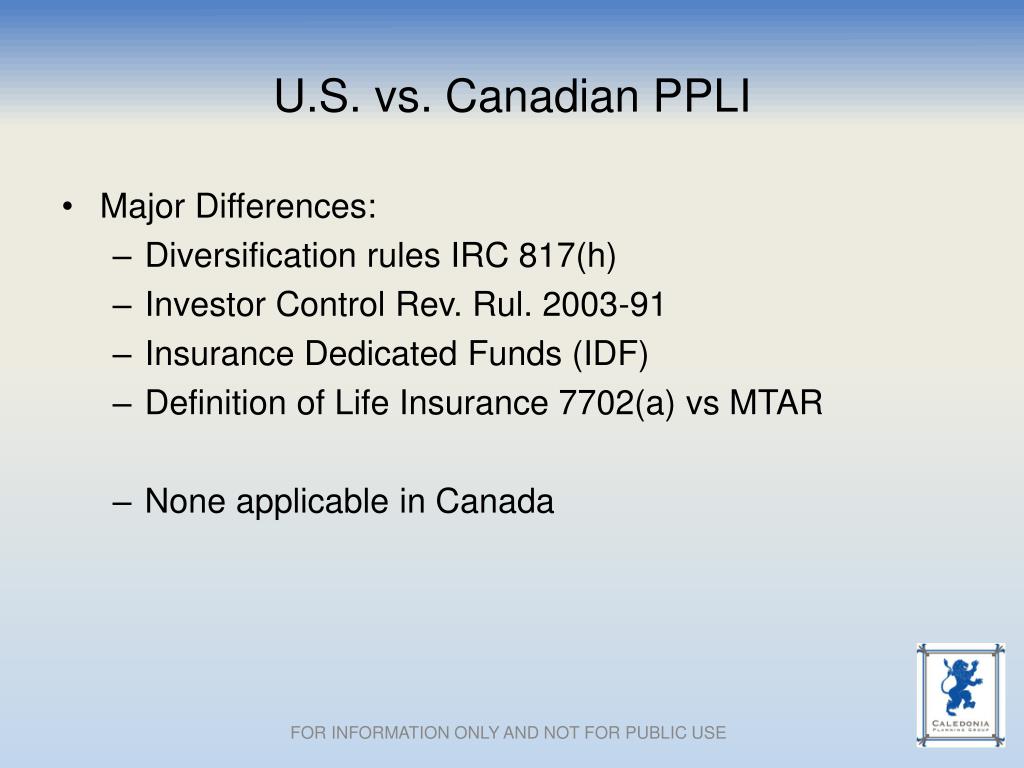

Private placement life insurance (ppli), in contrast, is a privately negotiated life insurance contract between insurance carrier and policy owner. A niche strategy called private placement life insurance, or ppli, was already gaining popularity among the very rich for its ability to shield fortunes from taxes. In the case of hedge funds, for example, a highly effective way to mitigate taxes is to use private placement life insurance (often referred to by it’s initials: Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public. Tailored to each client, therefore, it is known as private placement. The ppli contract makes available various investment fund options (referred to as “insurance dedicated funds” in the case of private investment funds or “variable insurance trusts” in the case of.

Private placement life insurance (ppli), in contrast, is a privately negotiated life insurance contract between insurance carrier and policy owner.

It is based on life insurance and annuity policies that allow for bespoke tailored and internationally diversified. A niche strategy called private placement life insurance, or ppli, was already gaining popularity among the very rich for its ability to shield fortunes from taxes. It�s the only event that brings together the entire private placement value chain. Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public. Ppli is a variable universal life insurance policy, a type of permanent life insurance, that provides cash value by investing in a broader range of investments, some of which are not available to the general public. Ppli offers several advantages compared to standard policies.

Source: lifeinsurancestrategiesgroup.com

Source: lifeinsurancestrategiesgroup.com

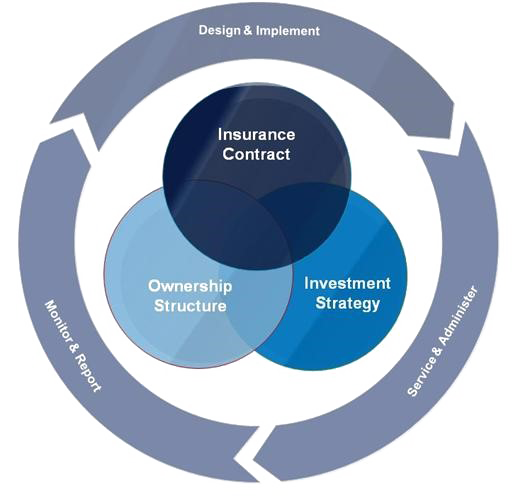

The product is called private placement life insurance, or ppli, and like some other types of life insurance policies, a portion of the premiums paid by a. As such, private placement life insurance should only be presented to accredited investors or qualified purchasers as described by the securities act of 1933. We advise client�s of the ways ppli and private placement variable annuities (ppva) and the entities that own them can be structured. Ppli is similar to a traditional retail variable universal life insurance contract supported by a segregated asset account (separate account). To minimize fee drag, the life insurance component is kept as low as possible, allowing the cash value of the policy to ultimately drive death benefit.

Source: blog.michaelmalloy.solutions

Source: blog.michaelmalloy.solutions

The only annual gathering for private placement life insurance professionals meet. Visit the site to book tickets, see the event agenda and learn about our keynote speakers. In some cases, ppli life insurance assets are held offshore — placing these assets out of the reach of u.s. In the case of hedge funds, for example, a highly effective way to mitigate taxes is to use private placement life insurance (often referred to by it’s initials: Tailored to each client, therefore, it is known as private placement.

Source: thismountainisman.blogspot.com

Source: thismountainisman.blogspot.com

It is similar to a variable universal life insurance policy, but the investments owned by the policy are privately offered and meet very specific tax code requirements. The only annual gathering for private placement life insurance professionals meet. It is based on life insurance and annuity policies that allow for bespoke tailored and internationally diversified. Visit the site to book tickets, see the event agenda and learn about our keynote speakers. 3 minutes private placement life insurance (ppli) is a life insurance policy wrapped around an investment.

Source: abbreviationfinder.org

Source: abbreviationfinder.org

Not for use with the public traditional vul ppvul surrender charges generally, yes no As such, private placement life insurance should only be presented to accredited investors or qualified purchasers as described by the securities act of 1933. Ppli has its roots in the development of variable universal life. Ppli offers several advantages compared to standard policies. A niche strategy called private placement life insurance, or ppli, was already gaining popularity among the very rich for its ability to shield fortunes from taxes.

Source: slideserve.com

Source: slideserve.com

Not for use with the public traditional vul ppvul surrender charges generally, yes no Not for use with the public traditional vul ppvul surrender charges generally, yes no Ppli is a special type of life insurance structured to have a high cash value compared to a relatively low death benefit. Policy funds are held in segregated accounts that theoretically protect the funds against the carrier’s creditors. Ppli has its roots in the development of variable universal life.

Source: blog.michaelmalloy.solutions

Source: blog.michaelmalloy.solutions

Cash value life insurance is a proven way to shelter assets from creditors. Ppli is a variable universal life insurance policy, a type of permanent life insurance, that provides cash value by investing in a broader range of investments, some of which are not available to the general public. In the case of hedge funds, for example, a highly effective way to mitigate taxes is to use private placement life insurance (often referred to by it’s initials: The product is called private placement life insurance, or ppli, and like some other types of life insurance policies, a portion of the premiums paid by a. 3 minutes private placement life insurance (ppli) is a life insurance policy wrapped around an investment.

Source: bfi-consulting.com

Source: bfi-consulting.com

Unlike some traditional life insurance that emphasizes the size of the death benefit, ppli is designed to have a low death benefit relative to the cash value, to reduce policy fees and promote underlying asset growth. The ppli contract makes available various investment fund options (referred to as “insurance dedicated funds” in the case of private investment funds or “variable insurance trusts” in the case of. Cash value life insurance is a proven way to shelter assets from creditors. A niche strategy called private placement life insurance, or ppli, was already gaining popularity among the very rich for its ability to shield fortunes from taxes. Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public.

Source: winofphiladelphia.org

Source: winofphiladelphia.org

As such, private placement life insurance should only be presented to accredited investors or qualified purchasers as described by the securities act of 1933. As with traditional vul insurance, ppli builds cash value to support the policy’s death benefit. Policy funds are held in segregated accounts that theoretically protect the funds against the carrier’s creditors. It is similar to a variable universal life insurance policy, but the investments owned by the policy are privately offered and meet very specific tax code requirements. Ppli has its roots in the development of variable universal life.

Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public. An optimal ppli contract will generally be structured as a variable universal life insurance policy. The ppli contract makes available various investment fund options (referred to as “insurance dedicated funds” in the case of private investment funds or “variable insurance trusts” in the case of. Private placement life insurance (ppli), in contrast, is a privately negotiated life insurance contract between insurance carrier and policy owner. Ppli offers several advantages compared to standard policies.

Source: blog.michaelmalloy.solutions

Source: blog.michaelmalloy.solutions

Now some advisers to the top 0. Private placement life insurance & variable annuities forum is where the ppli and va industry meets. Ppli is similar to a traditional retail variable universal life insurance contract supported by a segregated asset account (separate account). In some cases, ppli life insurance assets are held offshore — placing these assets out of the reach of u.s. The ppli contract makes available various investment fund options (referred to as “insurance dedicated funds” in the case of private investment funds or “variable insurance trusts” in the case of.

Source: industryglobalnews24.com

Source: industryglobalnews24.com

Unlike traditional life insurance policies, it’s designed to maximize cash value account and minimize the death benefit. Tailored to each client, therefore, it is known as private placement. Private placement life insurance (ppli) is an unregistered securities product and is not subject to the same regulatory requirements as registered p roducts. A niche strategy called private placement life insurance, or ppli, was already gaining popularity among the very rich for its ability to shield fortunes from taxes. An optimal ppli contract will generally be structured as a variable universal life insurance policy.

Source: transomconsulting.com

Source: transomconsulting.com

Unlike some traditional life insurance that emphasizes the size of the death benefit, ppli is designed to have a low death benefit relative to the cash value, to reduce policy fees and promote underlying asset growth. Private placement life insurance (ppli), in contrast, is a privately negotiated life insurance contract between insurance carrier and policy owner. A niche strategy called private placement life insurance, or ppli, was already gaining popularity among the very rich for its ability to shield fortunes from taxes. Policy funds are held in segregated accounts that theoretically protect the funds against the carrier’s creditors. The only annual gathering for private placement life insurance professionals meet.

Source: expandedworldwideplanning.com

Source: expandedworldwideplanning.com

Ppli has its roots in the development of variable universal life. It is similar to a variable universal life insurance policy, but the investments owned by the policy are privately offered and meet very specific tax code requirements. Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public. It�s the only event that brings together the entire private placement value chain. Held in chicago in nov.

Source: excelsiorgp.com

Source: excelsiorgp.com

Now some advisers to the top 0. Ppli is a variable universal life insurance policy, a type of permanent life insurance, that provides cash value by investing in a broader range of investments, some of which are not available to the general public. Private placement life insurance (ppli) is an unregistered securities product and is not subject to the same regulatory requirements as registered p roducts. The product is called private placement life insurance, or ppli, and like some other types of life insurance policies, a portion of the premiums paid by a. Unlike some traditional life insurance that emphasizes the size of the death benefit, ppli is designed to have a low death benefit relative to the cash value, to reduce policy fees and promote underlying asset growth.

Source: pinterest.com.mx

Source: pinterest.com.mx

Unlike some traditional life insurance that emphasizes the size of the death benefit, ppli is designed to have a low death benefit relative to the cash value, to reduce policy fees and promote underlying asset growth. Now some advisers to the top 0. Policy funds are held in segregated accounts that theoretically protect the funds against the carrier’s creditors. Private placement life insurance & variable annuities forum is where the ppli and va industry meets. Held in chicago in nov.

Source: slideserve.com

Source: slideserve.com

Comparison of ppli to traditional vul • the primary advantage of ppli is the ability to design a life insurance policy to look less like a traditional life insurance policy that is unattractive to hnw clients for advisor use only; Life insurance and annuities enjoy substantial asset protection in every state, and in some states, like florida and texas, creditor protection is unlimited. Now some advisers to the top 0. A niche strategy called private placement life insurance, or ppli, was already gaining popularity among the very rich for its ability to shield fortunes from taxes. Tailored to each client, therefore, it is known as private placement.

Source: lifeinsurancestrategiesgroup.com

Source: lifeinsurancestrategiesgroup.com

It is similar to a variable universal life insurance policy, but the investments owned by the policy are privately offered and meet very specific tax code requirements. Unlike traditional life insurance policies, it’s designed to maximize cash value account and minimize the death benefit. It is based on life insurance and annuity policies that allow for bespoke tailored and internationally diversified. A niche strategy called private placement life insurance, or ppli, was already gaining popularity among the very rich for its ability to shield fortunes from taxes. An optimal ppli contract will generally be structured as a variable universal life insurance policy.

![]() Source: aicpaconferences.com

Source: aicpaconferences.com

An optimal ppli contract will generally be structured as a variable universal life insurance policy. We advise client�s of the ways ppli and private placement variable annuities (ppva) and the entities that own them can be structured. Private placement life insurance (ppli), in contrast, is a privately negotiated life insurance contract between insurance carrier and policy owner. Unlike some traditional life insurance that emphasizes the size of the death benefit, ppli is designed to have a low death benefit relative to the cash value, to reduce policy fees and promote underlying asset growth. It�s the only event that brings together the entire private placement value chain.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title ppli insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information