Premium financed life insurance problems information

Home » Trending » Premium financed life insurance problems informationYour Premium financed life insurance problems images are ready. Premium financed life insurance problems are a topic that is being searched for and liked by netizens now. You can Get the Premium financed life insurance problems files here. Get all royalty-free images.

If you’re looking for premium financed life insurance problems pictures information linked to the premium financed life insurance problems topic, you have pay a visit to the right site. Our website frequently gives you hints for seeing the highest quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

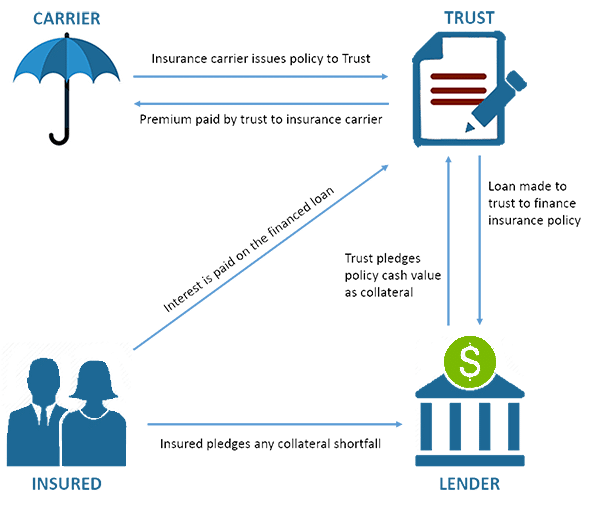

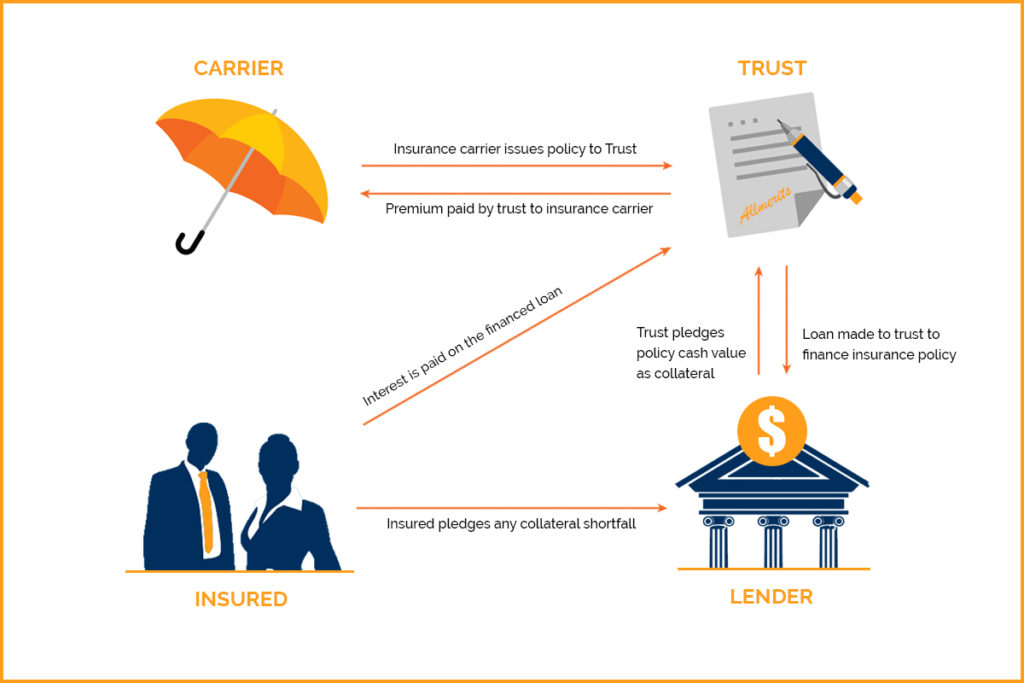

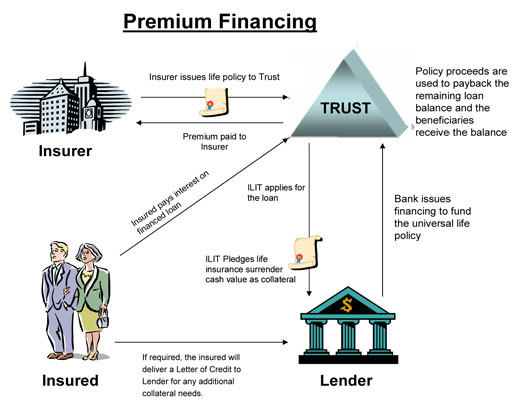

Premium Financed Life Insurance Problems. Premium financing of life insurance is a simple financial strategy to separate your life insurance benefits from the total of your estate. Premium financing plans between a financial institution and an irrevocable life insurance trust (ilit) can be very complicated and risky arrangements. Banks have denied certain types of. Familiarizing yourself with these problems can help you, and your financial planners, determine safeguards to avoid premium financing risks.

3 misconceptions about life insurance premium financing From globalfd.com

3 misconceptions about life insurance premium financing From globalfd.com

Most of the time a premium finance loan will have a. Currently, interest rates are still low. Premium financing plans between a financial institution and an irrevocable life insurance trust (ilit) can be very complicated and risky arrangements. Premium financing is often used when a life insurance policy is owned by an entity—for example, an irrevocable life insurance trust (ilit)—which may not have enough cash or assets to make large premium payments. Does not want to use their existing capital to pay the premiums. Even sophisticated individuals who are familiar with leveraged transactions need to be cautious about borrowing to pay life insurance premiums.

The right way and the wrong way.

With a premium financing arrangement, the business owner only has to make an interest payment on that $164,000. This is a complex topic. Even sophisticated individuals who are familiar with leveraged transactions need to be cautious about borrowing to pay life insurance premiums. Premium financing is not a tool used to allow people to buy life insurance they cannot otherwise afford to own. Satisfies the insurance carriers’ underwriting guidelines. Does not want to use their existing capital to pay the premiums.

Source: geniuszone.biz

Source: geniuszone.biz

Recent articles have appeared to claim that premium financed indexed universal life insurance (iul) is a risky bet with odds that favor the insurance companies and banks rather than the policyholders. What are the risks of life insurance premium financing? Because the premium financing may last for a long period of time (for example, until the insured dies). Premium financing programs are subject to various risks including: Needs a substantial amount of life insurance for estate planning, wealth accumulation, liquidity at death, asset protection, or business purposes.

Source: blog.highlandbrokerage.com

Source: blog.highlandbrokerage.com

Allows qualifying people to beaqueth on millions of usd to their family at very low finance risk. Our success is based on our ability to offer flexible, personalized service. We choose not to mention any carrier or product by name in this oneidea, as is our custom. Premium financing is often used when a life insurance policy is owned by an entity—for example, an irrevocable life insurance trust (ilit)—which may not have enough cash or assets to make large premium payments. What are the risks of life insurance premium financing?

Source: mericleco.com

Source: mericleco.com

The right way and the wrong way. Premium financing is often used when a life insurance policy is owned by an entity—for example, an irrevocable life insurance trust (ilit)—which may not have enough cash or assets to make large premium payments. Currently, interest rates are still low. With a premium financing arrangement, the business owner only has to make an interest payment on that $164,000. Premium financing can be an attractive option for anyone who:

Source: bankingtruths.com

Source: bankingtruths.com

Currently, interest rates are still low. There are three main risks that need to be considered before making any decision. Needs a substantial amount of life insurance for estate planning, wealth accumulation, liquidity at death, asset protection, or business purposes. Premium financing plans between a financial institution and an irrevocable life insurance trust (ilit) can be very complicated and. Although premium financing may seem like a simple concept, it actually involves complex transactions—and risk.

Source: kublerfinancial.com

Source: kublerfinancial.com

Lifesource direct life insurance premium finance has the tools to make financing insurance premiums easy and expedient. There are many individuals who don’t understand the true value of premium financing. Premium financing was developed to help minimize those challenges. Premium financing can be an attractive option for anyone who: The right way and the wrong way.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Our goal is to help both brokers and clients build profitable relationships through exceptional client value. “the issue is that many people who buy premium financed life insurance end up or will likely end up with a life insurance strategy that does not. Because the premium financing may last for a long period of time (for example, until the insured dies). Often, the policy is sold on the theory that the market gains in the underlying accounts on the policy will serve to cover the cost of the premium financing. The right way and the wrong way.

Source: bylinebank.com

Source: bylinebank.com

Familiarizing yourself with these problems can help you, and your financial planners, determine safeguards to avoid premium financing risks. Most of the time a premium finance loan will have a. Our goal is to help both brokers and clients build profitable relationships through exceptional client value. Collateral risk with premium financed life insurance there is always the potential risk that a premium finance borrower will have to produce more collateral if the value or quality of their collateral declines. Premium financing can be an attractive option for anyone who:

Source: hklaw.com

Source: hklaw.com

Our goal is to help both brokers and clients build profitable relationships through exceptional client value. As the industry’s leading provider of premium financed life insurance solutions for. Like any other problems with anything after you die. This raises an interesting question. Premium financing plans between a financial institution and an irrevocable life insurance trust (ilit) can be very complicated and.

Source: altus-ins.com

Source: altus-ins.com

Collateral risk with premium financed life insurance there is always the potential risk that a premium finance borrower will have to produce more collateral if the value or quality of their collateral declines. With a premium financing arrangement, the business owner only has to make an interest payment on that $164,000. Premium financing plans between a financial institution and an irrevocable life insurance trust (ilit) can be very complicated and. Premium financing can be an attractive option for anyone who: Only individuals who are comfortable with.

Source: cpsinsurance.com

Source: cpsinsurance.com

May desire to borrow money to pay large premiums for insurance owned by an ilit to offset federal estate taxes. Wealthy individuals who are familiar with leveraged financial risk. “the issue is that many people who buy premium financed life insurance end up or will likely end up with a life insurance strategy that does not. However, if the policy performs more poorly than illustrated there is the risk that the policy cash value will be insufficient to repay the loan. Thus, the lender may want to renegotiate the terms of the loan.

Source: insurancedoctor.us

Source: insurancedoctor.us

Life insurance premium financing services. Like any other problems with anything after you die. One of the challenges we encountered during the process was that the product already included a cap rate change and had some assumptions that were impossible to recreate exactly. We choose not to mention any carrier or product by name in this oneidea, as is our custom. With a premium financing arrangement, the business owner only has to make an interest payment on that $164,000.

Source: globalfd.com

Source: globalfd.com

Our goal is to help both brokers and clients build profitable relationships through exceptional client value. Premium financing for life insurance avoids incurring capital gains tax and liquidating investments to cover these life insurance premiums. There are three main risks that need to be considered before making any decision. Currently, interest rates are still low. We choose not to mention any carrier or product by name in this oneidea, as is our custom.

Source: bankingtruths.com

Source: bankingtruths.com

Allows qualifying people to beaqueth on millions of usd to their family at very low finance risk. Typically, in this situation the Satisfies the insurance carriers’ underwriting guidelines. Premium financing for life insurance avoids incurring capital gains tax and liquidating investments to cover these life insurance premiums. Often, the policy is sold on the theory that the market gains in the underlying accounts on the policy will serve to cover the cost of the premium financing.

Source: pinterest.com

Source: pinterest.com

Our goal is to help both brokers and clients build profitable relationships through exceptional client value. Although premium financing may seem like a simple concept, it actually involves complex transactions—and risk. If someone had the money to pay a $900,000 life insurance premium providing a $30 million death benefit, does he really need life insurance? Needs a substantial amount of life insurance for estate planning, wealth accumulation, liquidity at death, asset protection, or business purposes. There are three main risks that need to be considered before making any decision.

Source: consultwithedmond.com

Source: consultwithedmond.com

This raises an interesting question. Only individuals who are comfortable with. If someone had the money to pay a $900,000 life insurance premium providing a $30 million death benefit, does he really need life insurance? Typically, in this situation the Premium financing loans are collateralized primarily by the cash surrender value of the life insurance policy.

Source: abramsinc.com

Source: abramsinc.com

Lifesource direct life insurance premium finance has the tools to make financing insurance premiums easy and expedient. Most of the time a premium finance loan will have a. Collateral risk with premium financed life insurance there is always the potential risk that a premium finance borrower will have to produce more collateral if the value or quality of their collateral declines. As the industry’s leading provider of premium financed life insurance solutions for. Premium financing for life insurance avoids incurring capital gains tax and liquidating investments to cover these life insurance premiums.

Source: chamberlinfinancial.com

Source: chamberlinfinancial.com

Say a business owner takes out a $5 million life insurance policy and pays for it for the next 15 years. However, if the policy performs more poorly than illustrated there is the risk that the policy cash value will be insufficient to repay the loan. Such obstacles include a drain on current capital or cash flows to make premium payments, potential gift taxes, and liquidation of high performing assets. Premium financing programs are subject to various risks including: Premium financing plans between a financial institution and an irrevocable life insurance trust (ilit) can be very complicated and risky arrangements.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title premium financed life insurance problems by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information