Premium financing life insurance Idea

Home » Trend » Premium financing life insurance IdeaYour Premium financing life insurance images are ready in this website. Premium financing life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Premium financing life insurance files here. Find and Download all royalty-free vectors.

If you’re searching for premium financing life insurance images information connected with to the premium financing life insurance keyword, you have pay a visit to the right blog. Our website always gives you hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

Premium Financing Life Insurance. Leveraging assets with life insurance and premium financing purchasing life insurance is an ideal way to help you provide a legacy to your family or favorite charity. But it can be used for other business or individual planning purposes. Given its title, life insurance premium financing is associated with life insurance, specifically universal life insurance. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Premium Financing Plans Allmerits Financial From allmerits.com

Premium Financing Plans Allmerits Financial From allmerits.com

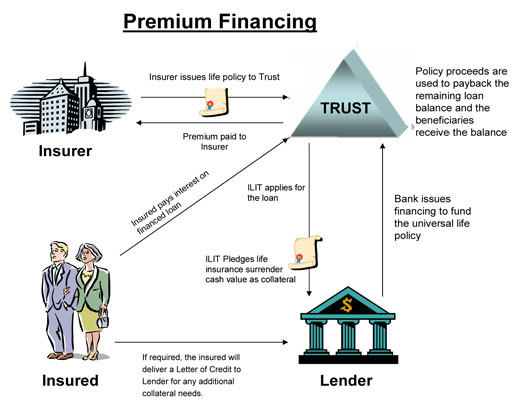

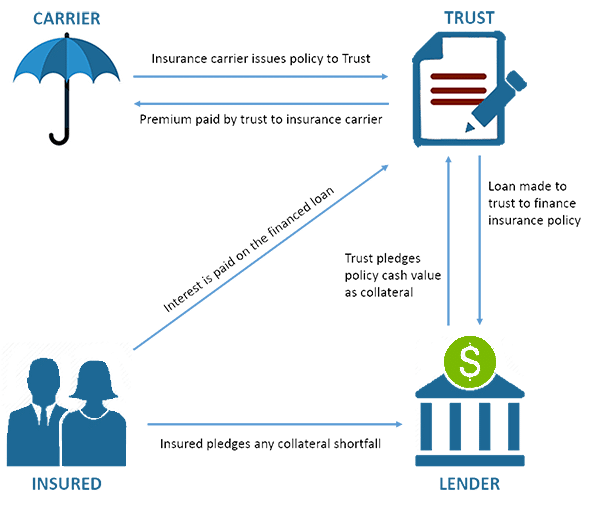

Life insurance premium financing can help you maximize wealth to your heirs and keep your legacy intact. Premium financing is often used when a life insurance policy is owned by an entity—for example, an irrevocable life insurance trust (ilit)—which may not have enough cash or assets to make large premium payments. Simply, it is the maximum crediting rate allowed based on the actuarial guideline #49 (ag49 for short). For example, premium financing and premium financing companies have been regulated in the state of new york as far back as 1960 and in florida as early as 1963. We provide premium finance for high net worth clients of life insurance brokers, private banks and wealth managers. Premium financing for life insurance policies.

We provide premium finance for high net worth clients of life insurance brokers, private banks and wealth managers.

With a premium financing arrangement, the business owner only has to make an interest payment on that $164,000. A way to plan for estate taxes. Simply, it is the maximum crediting rate allowed based on the actuarial guideline #49 (ag49 for short). Although premium financing may seem like a simple concept, it actually involves complex transactions—and risk. Here’s how premium financing works in practice: Life insurance premium financing works by allowing you to take a loan to pay for most of the cost, known as the premium, to buy your life policy.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Premium financing for life insurance policies. This is an index universal life (iul) product whose crediting rate at the time it was run was 5.67%. This practice is widely accepted amongst insurance companies. This is a complex topic. Premium financing for life insurance policies.

Source: dailymoss.com

Source: dailymoss.com

Although premium financing may seem like a simple concept, it actually involves complex transactions—and risk. Leveraging assets with life insurance and premium financing purchasing life insurance is an ideal way to help you provide a legacy to your family or favorite charity. But, what does that really mean? A way to plan for estate taxes. Here’s how premium financing works in practice:

Source: insuranceandestates.com

Source: insuranceandestates.com

What is premium financing for life insurance? Simply, it is the maximum crediting rate allowed based on the actuarial guideline #49 (ag49 for short). Life insurance premium financing strategy is a strategy used by many wealthy individuals and business owners to finance premiums for large life insurance policies for estate planning or business purposes. Life insurance premium financing can help you maximize wealth to your heirs and keep your legacy intact. How does life insurance premium financing work?

Source: youtube.com

Source: youtube.com

It is borrowing money from a third party to pay the policy premiums. There are a few fundamentals with premium financing. Consider a situation where a wealthy individual discovers that he needs $30 million in life insurance coverage and the per year premium cost of such a policy is $900,000. I know this sounds strange, but there is a perfectly good reason behind the idea. Premium financing is a process of borrowing money to pay life insurance premiums.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

How does life insurance premium financing work? A way to plan for estate taxes. Life insurance premium financing strategy is a strategy used by many wealthy individuals and business owners to finance premiums for large life insurance policies for estate planning or business purposes. Leveraging assets with life insurance and premium financing purchasing life insurance is an ideal way to help you provide a legacy to your family or favorite charity. How does life insurance premium financing work?

Source: insurancedoctor.us

Source: insurancedoctor.us

As their policy outlines, the annual premium cost is $164,000. Premium financing for life insurance policies. I know this sounds strange, but there is a perfectly good reason behind the idea. The individual makes a down payment against the policy premium, and the lender pays the balance. Life insurance premium financing works by allowing you to take a loan to pay for most of the cost, known as the premium, to buy your life policy.

Source: consultwithedmond.com

Source: consultwithedmond.com

It is borrowing money from a third party to pay the policy premiums. We provide premium finance for high net worth clients of life insurance brokers, private banks and wealth managers. But there are many lifetime benefits of using the cash value in life insurance policies to help fund your retirement plans. Here’s how premium financing works in practice: Life insurance premium financing works by allowing you to take a loan to pay for most of the cost, known as the premium, to buy your life policy.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Private banks and premium financing life insurance lenders offer loans to high net worth individuals. I�ll forewarn you, however, that this good idea only takes flight among those with substantial assets. Say a business owner takes out a $5 million life insurance policy and pays for it for the next 15 years. It is borrowing money from a third party to pay the policy premiums. Premium financing is often used when a life insurance policy is owned by an entity—for example, an irrevocable life insurance trust (ilit)—which may not have enough cash or assets to make large premium payments.

Source: kublerfinancial.com

Source: kublerfinancial.com

Simply, it is the maximum crediting rate allowed based on the actuarial guideline #49 (ag49 for short). Leveraging assets with life insurance and premium financing purchasing life insurance is an ideal way to help you provide a legacy to your family or favorite charity. Permanent life insurance offers specific benefits that improve the premium financing picture. But, what does that really mean? Simply, it is the maximum crediting rate allowed based on the actuarial guideline #49 (ag49 for short).

Source: suqutrainvest.com

Source: suqutrainvest.com

The individual makes a down payment against the policy premium, and the lender pays the balance. One is that someone financing life insurance should actually have a need or desire for the life insurance in the first place. The practice of premium finance is not new. A way to plan for estate taxes. But, what does that really mean?

![[Case Study] Life Insurance Premium Financing for the [Case Study] Life Insurance Premium Financing for the](https://mericleco.com/wp-content/uploads/2016/10/premium-financing-design-1.png) Source: mericleco.com

Source: mericleco.com

The interest payments for the loan are much lower than the policy premiums. It is borrowing money from a bank to pay the premiums for a very large life insurance policy. Premium financing is often used when a life insurance policy is owned by an entity—for example, an irrevocable life insurance trust (ilit)—which may not have enough cash or assets to make large premium payments. Given its title, life insurance premium financing is associated with life insurance, specifically universal life insurance. Once the policy generates enough surplus cash value in later years, the owner of.

Source: allmerits.com

Source: allmerits.com

The practice of premium finance is not new. It is borrowing money from a bank to pay the premiums for a very large life insurance policy. The individual makes a down payment against the policy premium, and the lender pays the balance. Once the policy generates enough surplus cash value in later years, the owner of. For example, premium financing and premium financing companies have been regulated in the state of new york as far back as 1960 and in florida as early as 1963.

Source: chamberlinfinancial.com

Source: chamberlinfinancial.com

A way to plan for estate taxes. Once the policy generates enough surplus cash value in later years, the owner of. Premium financing is often used when a life insurance policy is owned by an entity—for example, an irrevocable life insurance trust (ilit)—which may not have enough cash or assets to make large premium payments. The practice of premium finance is not new. Consider a situation where a wealthy individual discovers that he needs $30 million in life insurance coverage and the per year premium cost of such a policy is $900,000.

Source: bankingtruths.com

Source: bankingtruths.com

The practice of premium finance is not new. This is a complex topic. Leveraging assets with life insurance and premium financing purchasing life insurance is an ideal way to help you provide a legacy to your family or favorite charity. The interest payments for the loan are much lower than the policy premiums. But it can be used for other business or individual planning purposes.

Source: mericleco.com

Source: mericleco.com

I know this sounds strange, but there is a perfectly good reason behind the idea. But there are many lifetime benefits of using the cash value in life insurance policies to help fund your retirement plans. Permanent life insurance offers specific benefits that improve the premium financing picture. The practice of premium finance is not new. Life insurance premium financing strategy is a strategy used by many wealthy individuals and business owners to finance premiums for large life insurance policies for estate planning or business purposes.

Source: hklaw.com

Source: hklaw.com

With a premium financing arrangement, the business owner only has to make an interest payment on that $164,000. What is premium financing for life insurance? I know this sounds strange, but there is a perfectly good reason behind the idea. Premium financing comes up when someone has a substantial need for life insurance, and the cost of that life insurance is always considerable. This is a complex topic.

Source: veritegroupllc.com

Source: veritegroupllc.com

As their policy outlines, the annual premium cost is $164,000. Life insurance premium financing can help you maximize wealth to your heirs and keep your legacy intact. How does life insurance premium financing work? We provide premium finance for high net worth clients of life insurance brokers, private banks and wealth managers. With a premium financing arrangement, the business owner only has to make an interest payment on that $164,000.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title premium financing life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information