Premium for 1 million life insurance Idea

Home » Trend » Premium for 1 million life insurance IdeaYour Premium for 1 million life insurance images are ready. Premium for 1 million life insurance are a topic that is being searched for and liked by netizens now. You can Get the Premium for 1 million life insurance files here. Find and Download all royalty-free images.

If you’re searching for premium for 1 million life insurance pictures information connected with to the premium for 1 million life insurance interest, you have pay a visit to the ideal blog. Our site always provides you with suggestions for downloading the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

Premium For 1 Million Life Insurance. Usually, the rates are lower for. Here�s a list of the top sbi term plans available: Life insurance is actually cheaper than most people think. Best life insurance rates , life insurance.

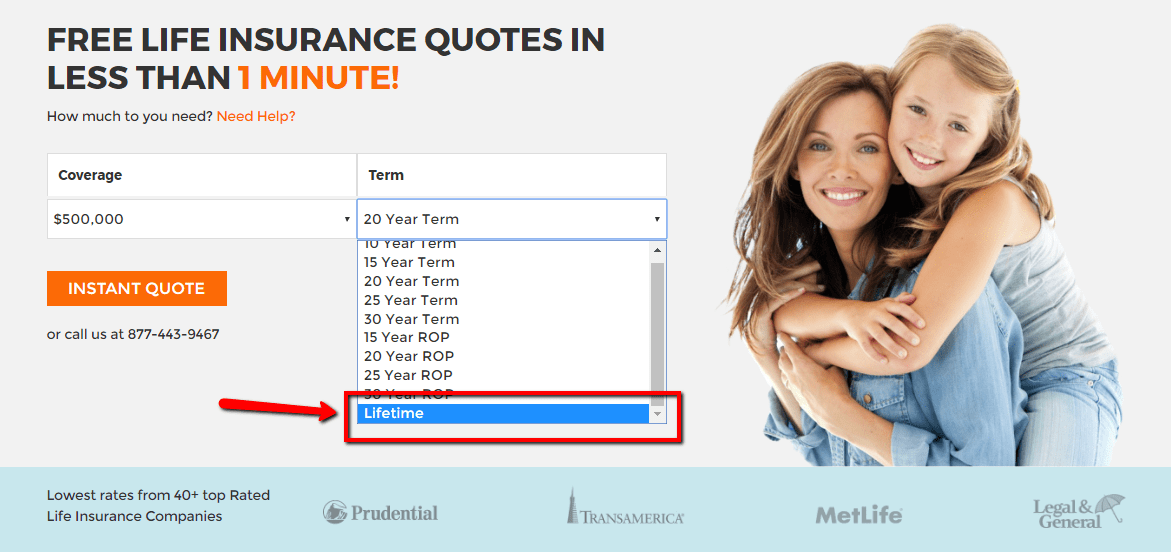

Best Quotes 1 Million to 2 Million of Term Life Insurance From insuranceblogbychris.com

Best Quotes 1 Million to 2 Million of Term Life Insurance From insuranceblogbychris.com

A $1 million life insurance policy sounded more like a plot device in a movie than anything that could apply to my real life. Depending on state and whether it’s public or private, the average total cost can range from $154,400 to $535,660. Minimum age is 18 years as at last birthday and maximum age is 65 years as at last birthday. The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. Understandably, if you have a medical condition like heart disease, cancer, diabetes, etc. A one million dollar life insurance policy may seem like a lot at first blush but when you think about how far a dollar can go nowadays, $1,000,000 of life insurance coverage might just be what you need.

For example, if you apply for a $1 million policy, but you already have a $500,000 life insurance policy, the insurance company may come back with an offer of only $500,000.

Factors that affect your rate: If you have any health issues, this will also increase the premium you pay. Cost for 1 million life insurance policy vs 500k. However your rate will vary according to the following factors. The cost of a 1 million term life insurance policy is very affordable under the age of 50. Because this type of whole life is paid upfront, many companies will not require a medical exam.

Source: pinnaclequote.com

Source: pinnaclequote.com

Premium for 1 million life insurance. How much will a $1 million life insurance policy cost? For example, if you apply for a $1 million policy, but you already have a $500,000 life insurance policy, the insurance company may come back with an offer of only $500,000. Best life insurance rates , life insurance. If you are in the market for a one million dollar term life insurance policy you probably are protecting income or a mortgage.

Source: infopoint16.blogspot.com

Source: infopoint16.blogspot.com

Term policies are significantly more affordable. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Term policies are significantly more affordable. Depending on state and whether it’s public or private, the average total cost can range from $154,400 to $535,660. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

This refers to the face value of your policy. The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. Term policies are significantly more affordable. Here�s a list of the top sbi term plans available: Keep reading for price estimates.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

1 million dollar life insurance policy premium. This refers to the face value of your policy. If you have any health issues, this will also increase the premium you pay. Minimum term 5 years and maximum term 30 years. However your rate will vary according to the following factors.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

A million dollar life insurance policy covers both needs: Life insurance is actually cheaper than most people think. A million dollar life insurance policy covers both needs: Minimum term 5 years and maximum term 30 years. But having a $1 million policy doesn�t necessarily mean you will pay double the premium of a $500,000 one.

Source: youtube.com

Source: youtube.com

Your age your health your gender your hobbies your coverage amount and policy term where to start? The policy takes effect when the first premium is received and remains in force as long as you pay the premiums. Understandably, if you have a medical condition like heart disease, cancer, diabetes, etc. Minimum age is 18 years as at last birthday and maximum age is 65 years as at last birthday. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: elijahsblog1.blogspot.com

Source: elijahsblog1.blogspot.com

Here�s a list of the top sbi term plans available: A million dollar life insurance policy covers both needs: The cost of a $1 million life insurance policy, like any other coverage amount, comes down to a range of factors such as your age, gender, health, hobbies, occupation and whether you smoke. Here�s a list of the top sbi term plans available: This refers to the face value of your policy.

Source: npa1.org

Source: npa1.org

A $1 million life insurance policy sounded more like a plot device in a movie than anything that could apply to my real life. A $1 million policy will be more expensive than a $250,000 or $500,000 policy. The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. For me that would be an additional $500,000 to $1 million dollars of life insurance on a 30 year term policy. Life insurance is actually cheaper than most people think.

Source: youtube.com

Source: youtube.com

Guaranteed issue life insurance $1m cost A quick glance at prudential life insurance / prudential life insurance overview average costs: Experts suggest having a life insurance policy equal to 10 times your annual income or more.that means that if you earn $60,000 a year (the median household income reported by the u.s. Understandably, if you have a medical condition like heart disease, cancer, diabetes, etc. Minimum term 5 years and maximum term 30 years.

Source: mediafeed.org

Source: mediafeed.org

Life insurance is actually cheaper than most people think. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. $100,000 to $1 million for simplyterm life insurance So this way you will be able to get a $1,000,000 whole life insurance without a medical exam. Since term life insurance provides protection for a limited time, it costs six to 10 times less than permanent policies like whole life, based on our analysis of life insurance rates.

Source: pinterest.com

Source: pinterest.com

Because this type of whole life is paid upfront, many companies will not require a medical exam. $100,000 to $1 million for simplyterm life insurance Your age your health your gender your hobbies your coverage amount and policy term where to start? The cost of a $1 million life insurance policy, like any other coverage amount, comes down to a range of factors such as your age, gender, health, hobbies, occupation and whether you smoke. Depending on state and whether it’s public or private, the average total cost can range from $154,400 to $535,660.

Source: youtube.com

Source: youtube.com

The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. Term policies are significantly more affordable. Age at maturity is 70 years. Guaranteed issue life insurance $1m cost Your premiums may be prohibitively expensive, or you may be denied coverage.

Source: blogpirate.org

Source: blogpirate.org

In fact, most americans think a term life policy costs triple or more the actual cost. Your premiums may be prohibitively expensive, or you may be denied coverage. Because this type of whole life is paid upfront, many companies will not require a medical exam. A one million dollar life insurance policy may seem like a lot at first blush but when you think about how far a dollar can go nowadays, $1,000,000 of life insurance coverage might just be what you need. If you are in the market for a one million dollar term life insurance policy you probably are protecting income or a mortgage.

Source: abinsura.blogspot.com

Source: abinsura.blogspot.com

A one million dollar life insurance policy may seem like a lot at first blush but when you think about how far a dollar can go nowadays, $1,000,000 of life insurance coverage might just be what you need. Your premiums may be prohibitively expensive, or you may be denied coverage. Best life insurance rates , life insurance. $100,000 to $1 million for simplyterm life insurance Minimum age is 18 years as at last birthday and maximum age is 65 years as at last birthday.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

For example, if you apply for a $1 million policy, but you already have a $500,000 life insurance policy, the insurance company may come back with an offer of only $500,000. This refers to the face value of your policy. The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. $100,000 to $1 million for simplyterm life insurance Factors that affect your rate:

Source: trustedchoice.com

Source: trustedchoice.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. To do this, he requires a. Top sbi life insurance plans. Minimum term 5 years and maximum term 30 years. 1 million dollar life insurance policy premium.

Source: youtube.com

Source: youtube.com

In fact, most americans think a term life policy costs triple or more the actual cost. The cost of a $1 million life insurance policy, like any other coverage amount, comes down to a range of factors such as your age, gender, health, hobbies, occupation and whether you smoke. Since term life insurance provides protection for a limited time, it costs six to 10 times less than permanent policies like whole life, based on our analysis of life insurance rates. Guaranteed issue life insurance $1m cost $1,000,000 single premium whole life another option, if you have the funds, is to do a single premium whole life.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title premium for 1 million life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information