Prepaid homeowners insurance at closing information

Home » Trending » Prepaid homeowners insurance at closing informationYour Prepaid homeowners insurance at closing images are ready in this website. Prepaid homeowners insurance at closing are a topic that is being searched for and liked by netizens today. You can Find and Download the Prepaid homeowners insurance at closing files here. Find and Download all royalty-free vectors.

If you’re searching for prepaid homeowners insurance at closing images information related to the prepaid homeowners insurance at closing keyword, you have pay a visit to the ideal blog. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

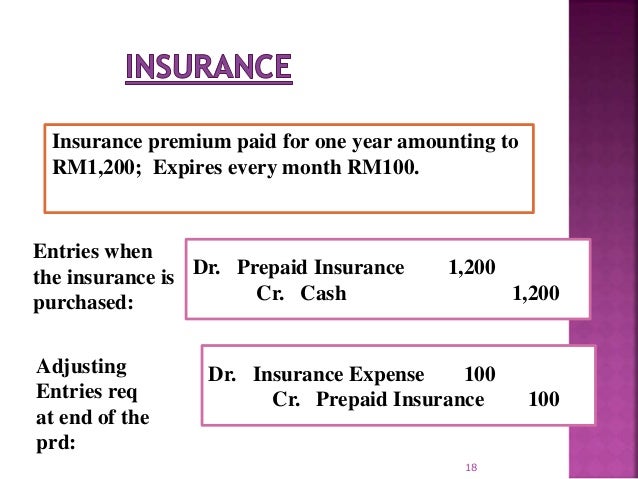

Prepaid Homeowners Insurance At Closing. Closing expenses are classified into three types: For example, you (and the lender) want a homeowner�s insurance policy in place when you close or settle with the seller. An additional cushion for homeowners insurance, along with property taxes, are collected and placed into an escrow account. Prepaid insurance is coverage you pay for in full before you receive its benefits.

Question 1.16 The entry to close the appropriate insurance From homeworklib.com

Question 1.16 The entry to close the appropriate insurance From homeworklib.com

Prepay homeowner�s insurance at closing. An additional cushion for homeowners insurance , along with property taxes, are collected and placed into an escrow account. Alternatively, some homeowners choose to pay this amount prior to closing. Prepaids are the upfront cash payments you make at closing for certain mortgage expenses before they’re actually due. They’re paid at closing, in advance of newly owning the home. Real estate taxes are also prepaid.

Paying homeowners insurance upfront or at closing.

Typically, one full year of homeowner’s insurance is collected and prepaid to your insurance company at closing. How do i know how much i’ll have to pay? An additional cushion for homeowners insurance , along with property taxes, are collected and placed into an escrow account. Homeowner’s insurance protects you and the lender in the event of an accident or disaster. Alternatively, some homeowners choose to pay this amount prior to closing. Initial escrow payment at closing includes homeowner�s insurance and property taxes.

Source: apictureisworthathousandwordies.blogspot.com

Source: apictureisworthathousandwordies.blogspot.com

Typically, one full year of homeowner�s insurance is collected and prepaid to your insurance company at closing. Alternatively, some homeowners choose to pay this amount prior to closing. Your mortgage lender will probably require you to purchase and prepay an insurance premium that covers the minimum coverage before they agree to loan to you. Does this mean my actual mortgage payment after closing. You pay a year’s insurance premium at closing, but you’ll also begin to make monthly payments on top of that.

Source: calfeeinsurance.com

Source: calfeeinsurance.com

Typically, one full year of homeowner’s insurance is collected and prepaid to your insurance company at closing. Within 3 days of your submitting a loan application, your lender will issue you a loan estimate (which used to be called a good faith estimate) of all your closing costs, including escrows and. Your mortgage lender will probably require you to purchase and prepay an insurance premium that covers the minimum coverage before they agree to loan to you. Closing expenses are classified into three types: Alternatively, some homeowners choose to pay this amount prior to closing.

Source: compass-insurance-agency.com

Source: compass-insurance-agency.com

The “prepaid” in prepaid costs doesn’t mean you’re paying them before closing. They’re paid at closing, in advance of newly owning the home. A flood insurance policy, if required, is also prepaid. Paying homeowners insurance upfront or at closing. Typically, one full year of homeowner�s insurance is collected and prepaid to your insurance company at closing.

Source: thetruthaboutlending.com

Source: thetruthaboutlending.com

Your homeowners insurance payment will typically fall into the prepaid costs category of your closing costs. So, as you’re closing on your house, you may see that you’re making monthly insurance payments to your escrow account even though you just paid for a year of insurance. Lenders require proof that you have homeowner’s insurance on the property. They’re paid at closing, in advance of newly owning the home. Prepaids can include taxes, hazard insurance, private mortgage insurance, and special assessments.

Source: articlecluster.com

Source: articlecluster.com

But this isn’t necessarily a bad thing; Prepaid items are the homeowner�s insurance, mortgage interest, and property taxes that you pay when you buy a home. Your mortgage lender will probably require you to purchase and prepay an insurance premium that covers the minimum coverage before they agree to loan to you. Initial escrow payment at closing includes homeowner�s insurance and property taxes. Alternatively, some homeowners choose to pay this amount prior to closing.

Source: francisnguyenblog.blogspot.com

Source: francisnguyenblog.blogspot.com

Typically, one full year of homeowner�s insurance is collected and prepaid to your insurance company at closing. Alternatively, some homeowners choose to pay this amount prior to closing. These costs increase the amount of money you need at closing. Tip wait until you are close to closing on the property to prepay. How do i know how much i’ll have to pay?

Source: slideshare.net

Source: slideshare.net

Prepay homeowner�s insurance at closing. The lender will deposit the insurance and tax portions of your payments into the escrow account and pay the bills when they are due. An additional cushion for homeowners insurance , along with property taxes, are collected and placed into an escrow account. Typically, one full year of homeowner�s insurance is collected and prepaid to your insurance company at closing. Your homeowners insurance payment will typically fall into the prepaid costs category of your closing costs.

Source: solveaccounting.blogspot.ca

Source: solveaccounting.blogspot.ca

Prepaid items are not directly related to the purchase of the home, but are usually a requirement of the group funding the loan and need to be paid in advance. This is also how prepaid homeowners insurance at closing works. Prepay homeowner�s insurance at closing. Prepaid items are not directly related to the purchase of the home, but are usually a requirement of the group funding the loan and need to be paid in advance. These costs increase the amount of money you need at closing.

Source: articlegrowth.com

Source: articlegrowth.com

Alternatively, some homeowners choose to pay this amount prior to closing. Prepaid items are the homeowner�s insurance, mortgage interest, and property taxes that you pay when you buy a home. The lender will deposit the insurance and tax portions of your payments into the escrow account and pay the bills when they are due. Typically, one full year of homeowner�s insurance is collected and prepaid to your insurance company at closing. Alternatively, some homeowners choose to pay this amount prior to closing.

Source: oncomie.blogspot.com

The cost of the homeowner�s insurance policy is said to be prepaid. Prepay homeowner�s insurance at closing. Typically, one full year of homeowner�s insurance is collected and prepaid to your insurance company at closing. Your homeowners insurance payment will typically fall into the prepaid costs category of your closing costs. Prepaids are expenses or items that the homebuyer pays at closing before they are technically due.

Source: mortgage.info

Source: mortgage.info

Homeowners insurance is generally more expensive when it’s paid monthly. Prepaids are the upfront cash payments you make at closing for certain mortgage expenses before they’re actually due. Prepaid items are the homeowner�s insurance, mortgage interest, and property taxes that you pay when you buy a home. One of the necessary evils of buying a house are closing costs. Typically, one full year of homeowner�s insurance is collected and prepaid to your insurance company at closing.

Source: jsignedesign.blogspot.com

Source: jsignedesign.blogspot.com

Prepaids are the upfront cash payments you make at closing for certain mortgage expenses before they’re actually due. Tip wait until you are close to closing on the property to prepay. This is also how prepaid homeowners insurance at closing works. The “prepaid” in prepaid costs doesn’t mean you’re paying them before closing. Initial escrow payment at closing includes homeowner�s insurance and property taxes.

Source: imoney.ph

Source: imoney.ph

The closing costs are just that, costs related to your mortgage and settlement with the seller. Your homeowners insurance payment will typically fall into the prepaid costs category of your closing costs. Unless you’re paying in full with cash, you will have to pay for homeowners insurance either before or during the closing process. So, as you’re closing on your house, you may see that you’re making monthly insurance payments to your escrow account even though you just paid for a year of insurance. Prepaid insurance is coverage you pay for in full before you receive its benefits.

Source: stephthelender.com

Source: stephthelender.com

Prepaids are the amounts you must pay prior to closing for insurance premiums and/or taxes that are due at or prior to closing. This is also how prepaid homeowners insurance at closing works. Alternatively, some homeowners choose to pay this amount prior to closing. But this isn’t necessarily a bad thing; The cost of the homeowner�s insurance policy is said to be prepaid.

Source: chegg.com

Source: chegg.com

Prepaid items are not directly related to the purchase of the home, but are usually a requirement of the group funding the loan and need to be paid in advance. These costs increase the amount of money you need at closing. Homeowner’s insurance protects you and the lender in the event of an accident or disaster. Closing expenses are classified into three types: One of the necessary evils of buying a house are closing costs.

Source: homeworklib.com

Source: homeworklib.com

Homeowner’s insurance protects you and the lender in the event of an accident or disaster. Alternatively, some homeowners choose to pay this amount prior to closing. An additional cushion for homeowners insurance, along with property taxes, are collected and placed into an escrow account. Does this mean my actual mortgage payment after closing. Prepaid items are the homeowner�s insurance, mortgage interest, and property taxes that you pay when you buy a home.

Source: francisnguyenblog.blogspot.com

Source: francisnguyenblog.blogspot.com

Homeowners insurance is generally more expensive when it’s paid monthly. These costs increase the amount of money you need at closing. An additional cushion for homeowners insurance, along with property taxes, are collected and placed into an escrow account. The closing costs are just that, costs related to your mortgage and settlement with the seller. Alternatively, some homeowners choose to pay this amount prior to closing.

Source: b4bpayments.com

Source: b4bpayments.com

Your homeowners insurance payment will typically fall into the prepaid costs category of your closing costs. Prepaids are the amounts you must pay prior to closing for insurance premiums and/or taxes that are due at or prior to closing. Prepaids are the upfront cash payments you make at closing for certain mortgage expenses before they’re actually due. They’re paid at closing, in advance of newly owning the home. Prepaid insurance is coverage you pay for in full before you receive its benefits.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title prepaid homeowners insurance at closing by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information