Primary insurance amount Idea

Home » Trending » Primary insurance amount IdeaYour Primary insurance amount images are available. Primary insurance amount are a topic that is being searched for and liked by netizens today. You can Find and Download the Primary insurance amount files here. Get all royalty-free images.

If you’re searching for primary insurance amount pictures information connected with to the primary insurance amount interest, you have visit the ideal site. Our website always gives you suggestions for seeking the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Primary Insurance Amount. Following provides an example of an individual retiring in 2019. Generally, the more a person pays into social security during their lifetime, the higher their pia will be. The primary insurance amount (pia) is the result of a calculation used to determine the social security benefits amount that would be paid out to. Though most people never dig deeper than the benefit amount they will receive at any given age, the fact is that your social security benefit is based upon one number which is the foundation for computing your payment, regardless of which age you claim.

Social Security Earning Work Credits & Primary Insurance From carrwealth.com

Social Security Earning Work Credits & Primary Insurance From carrwealth.com

The primary insurance amount (pia) is the result of a calculation used to determine the social security benefits amount that would be paid out to. The primary insurance amount is based on the aime (average indexed monthly earnings). Latest news your “primary insurance amount”; The “primary insurance amount” (pia) is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. The primary insurance amount (pia) is the benefit (before rounding down to next lower whole dollar) a person would receive if they elect to begin receiving retirement benefits at their normal retirement age. For people born between 1943 and 1954, as in our example, the fra is age 66.

Generally, the more a person pays into social security during their lifetime, the higher their pia will be.

Typically the pia is a function of average indexed monthly earnings (aime). The primary insurance amount is based on the aime (average indexed monthly earnings). The amount of your aime from the first bend point to the second bend point is multiplied by 32%; Social security replacement rates pia $450 $1020 $1653 % replacement 90% 51% 41% aime $500 $2000. A person’s primary insurance amount (pia) is the amount of their monthly retirement benefit, if they file for that benefit exactly at their full retirement age. Primary policies are usually relevant to property, liability, or health coverage.

Source: investopedia.com

Source: investopedia.com

Primary insurance amount (pia) is a component of social security. Steps in the computation follows:… The “primary insurance amount” (pia) is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. The first policy to pay the financial loss is the primary insurance. Your primary insurance amount is the monthly benefit you receive if you are found to be medically disabled.

Source: researchgate.net

Source: researchgate.net

Secondary or excess insurance pays for the amount that remains when the primary policy�s coverage has been exhausted. (i) having worked for at least 10 (noncontiguous) years and (ii) having paid the federal insurance contributions act (fica) tax up to a maximum taxable earnings threshold. Generally, the more a person pays into social security during their lifetime, the higher their pia will be. The primary insurance amount (pia) is the result of a calculation used to determine the social security benefits amount that would be paid out to. Primary insurance amount (pia) is a component of social security.

Source: socialsecurityweekly.com

Source: socialsecurityweekly.com

Following provides an example of an individual retiring in 2019. The amount of your aime up to the first bend point is multiplied by 90%; The amount of your aime from the first bend point to the second bend point is multiplied by 32%; Eligibility for receiving social security benefits is contingent upon the recipient: The primary insurance amount (pia) is the basic figure ssa uses to determine the monthly benefit amount payable to a claimant and his/her family.

Source: youtube.com

Source: youtube.com

The formula we use depends on the year of first eligibility (the year a person attains age 62 in retirement cases). The primary insurance amount (pia) is the result of a calculation used to determine the social security benefits amount that would be paid out to. Payment under title ii, called primary insurance amount (pia), is based on your average indexed monthly earnings (aime). Typically the pia is a function of average indexed monthly earnings (aime). The first policy to pay the financial loss is the primary insurance.

Source: simplywise.com

Source: simplywise.com

What is primary insurance amounthow did citizens united changed campaign finance laws Though most people never dig deeper than the benefit amount they will receive at any given age, the fact is that your social security benefit is based upon one number which is the foundation for computing your payment, regardless of which age you claim. Typically the pia is a function of average indexed monthly earnings (aime). The primary insurance amount (pia) is the basic figure ssa uses to determine the monthly benefit amount payable to a claimant and his/her family. This figure is plugged into a formula which includes an upper bend point and a lower bend point, as well as a.

Source: researchgate.net

Source: researchgate.net

What is primary insurance amounthow did citizens united changed campaign finance laws Sometimes it is called your full retirement benefit amount. In that case, your primary insurance amount would be $2,562, or 34% of your aime: If you are eligibile to receive social security disability insurance (ssdi) benefits, your monthly benefit amount will be based on your primary insurance amount (pia). Following provides an example of an individual retiring in 2019.

Source: researchgate.net

Source: researchgate.net

It is computed as your lifetime average earnings. Typically the pia is a function of average indexed monthly earnings (aime). The first policy to pay the financial loss is the primary insurance. Sometimes it is called your full retirement benefit amount. The amount of your aime from the first bend point to the second bend point is multiplied by 32%;

Source: knowsocialsecurity.com

Source: knowsocialsecurity.com

And the amount above the second bend point up to your total aime is. If you file for your retirement benefit prior to your full retirement age, your monthly retirement benefit will be less than your primary insurance amount. Payment under title ii, called primary insurance amount (pia), is based on your average indexed monthly earnings (aime). This is the amount you will get if you start benefits at your full retirement age (fra). Secondary or excess insurance pays for the amount that remains when the primary policy�s coverage has been exhausted.

Source: researchgate.net

Source: researchgate.net

And the amount above the second bend point up to your total aime is. (i) having worked for at least 10 (noncontiguous) years and (ii) having paid the federal insurance contributions act (fica) tax up to a maximum taxable earnings threshold. We determine the pia by applying a pia formula to aime. And the amount above the second bend point up to your total aime is. This is the amount you will get if you start benefits at your full retirement age (fra).

Source: researchgate.net

Source: researchgate.net

Your fra can vary, depending on the year you were born. The primary insurance amount (pia) is the result of a calculation used to determine the social security benefits amount that would be paid out to. The amount of your aime up to the first bend point is multiplied by 90%; Social security replacement rates pia $450 $1020 $1653 % replacement 90% 51% 41% aime $500 $2000. Payment under title ii, called primary insurance amount (pia), is based on your average indexed monthly earnings (aime).

Source: youtube.com

Source: youtube.com

Secondary or excess insurance pays for the amount that remains when the primary policy�s coverage has been exhausted. The amount of your aime from the first bend point to the second bend point is multiplied by 32%; The “primary insurance amount” (pia) is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. Typically the pia is a function of average indexed monthly earnings (aime). For people born between 1943 and 1954, as in our example, the fra is age 66.

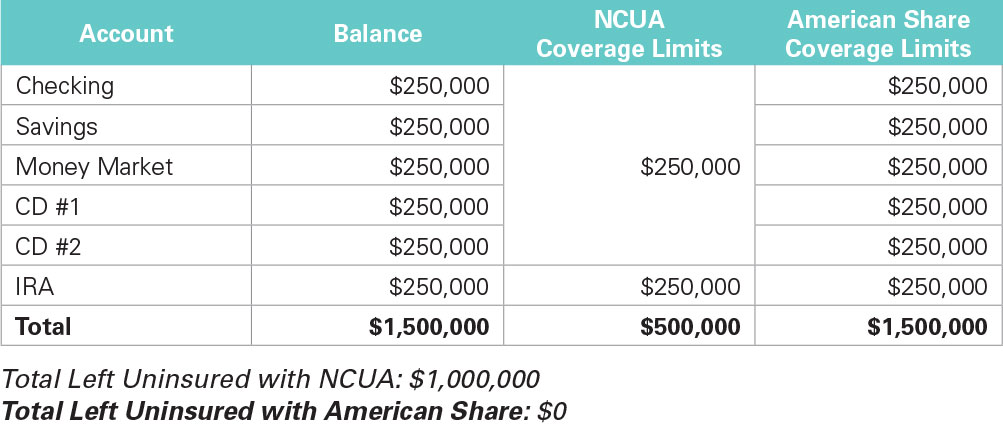

Source: americanshare.com

Source: americanshare.com

The primary insurance amount (pia) is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. Primary policies are usually relevant to property, liability, or health coverage. Your primary insurance amount is the monthly benefit you receive if you are found to be medically disabled. The basis of your benefit posted on july 1, 2018. The primary insurance amount (pia) is the basic figure ssa uses to determine the monthly benefit amount payable to a claimant and his/her family.

Source: abbreviationfinder.org

Source: abbreviationfinder.org

Sometimes it is called your full retirement benefit amount. Eligibility for receiving social security benefits is contingent upon the recipient: Generally, the more a person pays into social security during their lifetime, the higher their pia will be. This figure is plugged into a formula which includes an upper bend point and a lower bend point, as well as a. Primary insurance amount or pia is the payment amount you will receive as retirement benefit if you start receiving these benefits at full retirement age.

Source: researchgate.net

Source: researchgate.net

(i) having worked for at least 10 (noncontiguous) years and (ii) having paid the federal insurance contributions act (fica) tax up to a maximum taxable earnings threshold. The primary insurance amount (pia) is the result of a calculation used to determine the social security benefits amount that would be paid out to. Secondary or excess insurance pays for the amount that remains when the primary policy�s coverage has been exhausted. The first policy to pay the financial loss is the primary insurance. The primary insurance amount is based on the aime (average indexed monthly earnings).

Source: escolabressolelrial.blogspot.com

Source: escolabressolelrial.blogspot.com

The amount of your aime up to the first bend point is multiplied by 90%; The primary insurance amount (pia) is the result of a calculation used to determine the social security benefits amount that would be paid out to. The primary insurance amount, commonly referred to as pia, is the full monthly benefit that you receive if. The primary insurance amount (pia) is the result of a calculation used to determine the social security benefits amount that would be paid out to. If you file for your retirement benefit prior to your full retirement age, your monthly retirement benefit will be less than your primary insurance amount.

Source: 2ndactlives.com

Source: 2ndactlives.com

Primary insurance amount (pia) is a component of social security. The primary insurance amount is based on the aime (average indexed monthly earnings). The primary insurance amount (pia) is the basic figure ssa uses to determine the monthly benefit amount payable to a claimant and his/her family. The primary insurance amount (pia) is the result of a calculation used to determine the social security benefits amount that would be paid out to. At this age, the benefit is neither reduced for early retirement nor increased for delayed retirement.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Though most people never dig deeper than the benefit amount they will receive at any given age, the fact is that your social security benefit is based upon one number which is the foundation for computing your payment, regardless of which age you claim. At this age, the benefit is neither reduced for early retirement nor increased for delayed retirement. The primary insurance amount (pia) is the basic figure ssa uses to determine the monthly benefit amount payable to a claimant and his/her family. For people born between 1943 and 1954, as in our example, the fra is age 66. Secondary or excess insurance pays for the amount that remains when the primary policy�s coverage has been exhausted.

Source: gethomesready.com

Source: gethomesready.com

This figure is plugged into a formula which includes an upper bend point and a lower bend point, as well as a. Generally, the more a person pays into social security during their lifetime, the higher their pia will be. One of the most basic factors in determining one’s social security benefit is the primary insurance amount (pia), a number resulting from analysis of your cumulative work history. The “primary insurance amount” (pia) is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. Primary insurance amount or pia is the payment amount you will receive as retirement benefit if you start receiving these benefits at full retirement age.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title primary insurance amount by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information