Primary secondary dental insurance information

Home » Trending » Primary secondary dental insurance informationYour Primary secondary dental insurance images are available in this site. Primary secondary dental insurance are a topic that is being searched for and liked by netizens now. You can Get the Primary secondary dental insurance files here. Find and Download all royalty-free vectors.

If you’re searching for primary secondary dental insurance images information connected with to the primary secondary dental insurance topic, you have pay a visit to the right site. Our website always gives you hints for seeking the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Primary Secondary Dental Insurance. What determines primary and secondary dental insurance? For example, if the fee for a crown is $700 from one insurance company, and $800 from another, then the patient is responsible for his or her portion only up to the lower fee of $700. The plan that pays first is considered the primary plan. The patient is responsible only for the fee up to the lower of the two insurances.

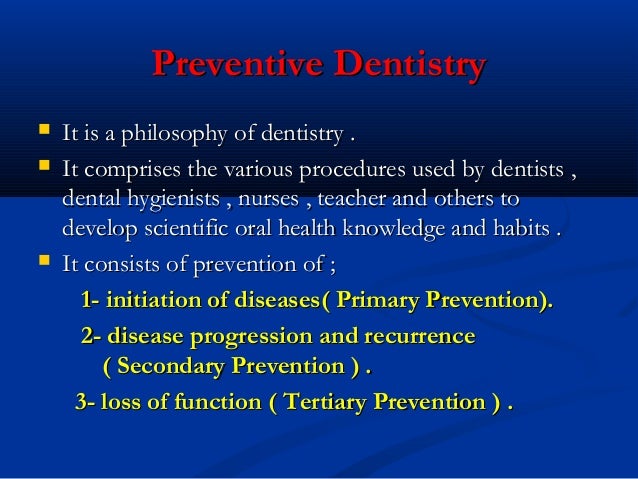

️ Levels of disease prevention primary secondary tertiary From keplarllp.com

️ Levels of disease prevention primary secondary tertiary From keplarllp.com

This means the primary insurance has covered everything it is obligated to pay under your policy and will not be covering additional services. If you have two jobs, then the primary carrier is the dental plan that has provided coverage for longer. It�s when the primary insurance leaves some of the medical bills unpaid that having two policies pays off. The general rule is that the plan that covers the patient as an enrollee is the primary plan and the plan which covers the patient as a dependent is the secondary plan. That leaves you with $1,500, but you can look. However, if the primary carrier only pays 50% of the dentist’s allowed fee, then the secondary carrier would reduce its payment by the amount paid by the primary plan and pay the difference.

If the primary carrier has paid more than the secondary carrier’s limit for the cost of.

There is one primary and one secondary insurance. Once your primary insurance has paid its share, the remaining bill goes to your “secondary” insurance, if you have more than one health plan. If you have multiple healthcare plans then one dental insurance plan is known as primary. Generally, the primary plan is the one in which the patient is the main policyholder. The plan that pays first is considered the primary plan. You may owe cost sharing.

Source: pinterest.com

Source: pinterest.com

If you have allowance table added to geha plan, you can. If you have allowance table added to geha plan, you can. Medical plans with embedded dental benefits have indicated that they will not require dentists to be credentialed under the medical plan(s). If you have multiple healthcare plans then one dental insurance plan is known as primary. The secondary plan is the plan that the patient is.

Source: researchgate.net

Source: researchgate.net

The insurance that pays first is your “primary” insurance, and this plan will pay up to coverage limits. The plan that pays first is considered the primary plan. This is determined by cob, which is usually dictated by state and government regulations. Medical plans with embedded dental benefits have indicated that they will not require dentists to be credentialed under the medical plan(s). Cob was established to guarantee that providers are not overpaid for claims if the patient is covered under multiple insurance plans.

Source: researchgate.net

Source: researchgate.net

In most cases, the secondary policy will not accept a claim until after the primary policy has paid for services according to the enrollee’s available benefits under that policy. Secondary dental insurance is a dental insurance policy that covers you in addition to your primary dental insurance. The insurance that pays first is your “primary” insurance, and this plan will pay up to coverage limits. However, if the primary carrier only pays 50% of the dentist’s allowed fee, then the secondary carrier would reduce its payment by the amount paid by the primary plan and pay the difference. The primary purpose of federal and state

Source: researchgate.net

Source: researchgate.net

Medicaid cannot be secondary insurance for any marketplace plans. If you are covered by two insurance carriers, your primary dental plan will be the one that covers you as the main policyholder and the secondary dental plan will be the one that covers you as a dependent. For example, if the fee for a crown is $700 from one insurance company, and $800 from another, then the patient is responsible for his or her portion only up to the lower fee of $700. There is one primary and one secondary insurance. For real though, the dental insurance plans set forth rules to determine which plan pays first, (primary) and which plan pays afterward (secondary).

Source: crosstalkingvc.substack.com

Source: crosstalkingvc.substack.com

According to the delta dental website, “the general rule is that the plan that covers [the patient] as an enrollee is the primary plan and the plan which covers [him or her] as a dependent is the secondary plan” (“if you are covered by two dental plans”). When cob applies, one dental plan is designated as primary and the other as secondary. The secondary payer then reviews the remaining bill and picks up its portion. In most cases, the secondary policy will not accept a claim until after the primary policy has paid for services according to the enrollee’s available benefits under that policy. You need to submit primary claim and secondary claims.

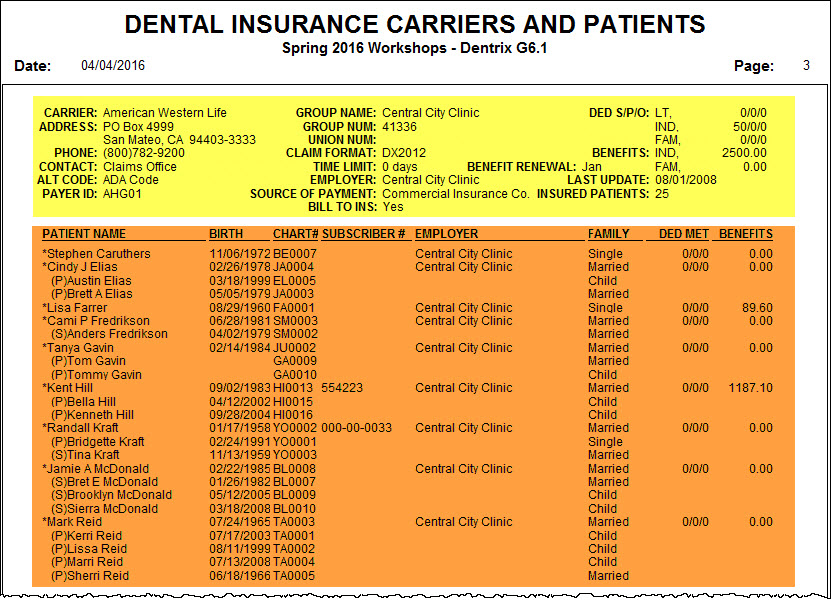

Source: dentrixtiptuesdays.blogspot.com

Source: dentrixtiptuesdays.blogspot.com

The primary insurance payer is the insurance company responsible for paying the claim first. Softdent will automatically calculate the adjustment to primary dental plan. The primary insurance payer is the insurance company responsible for paying the claim first. For example, you need physical therapy but your primary insurance only covers a limited number of sessions. Generally, the primary plan is the one in which the patient is the main policyholder.

Source: blog.seasondeals.store

Source: blog.seasondeals.store

It�s when the primary insurance leaves some of the medical bills unpaid that having two policies pays off. Insurance obtained elsewhere, such as through a retiree plan or your spouse�s plan, is considered your secondary insurance. If a dental office cannot determine which plan is primary, a call to the state insurance commissioner’s office could be made to determine primary versus secondary. You may owe cost sharing. It is a mandate that all dental insurance billing claims for primary and secondary claims must be applied.

Source: hba-training.co.uk

Source: hba-training.co.uk

The secondary payer then reviews the remaining bill and picks up its portion. That leaves you with $1,500, but you can look. However, if the primary carrier only pays 50% of the dentist’s allowed fee, then the secondary carrier would reduce its payment by the amount paid by the primary plan and pay the difference. The ins and outs of primary and secondary insurance coverage. To use two dental insurance plans, submit your dental claim to the primary carrier first.

Source: keplarllp.com

Source: keplarllp.com

Hopefully, in future versions of 17, this will be corrected. That leaves you with $1,500, but you can look. If you have two jobs, then the primary carrier is the dental plan that has provided coverage for longer. The general rule is that the plan that covers the patient as an enrollee is the primary plan and the plan which covers the patient as a dependent is the secondary plan. You need to submit primary claim and secondary claims.

Source: goldkeyconsultinginc.com

Source: goldkeyconsultinginc.com

The most common scenario for secondary dental is for members who carry primary dental insurance through their employer. Any insurance where you are the primary subscriber, and not a dependent, is your primary insurance plan. Dental insurance provided by your employer rather than your spouse’s). If you are covered by two insurance carriers, your primary dental plan will be the one that covers you as the main policyholder and the secondary dental plan will be the one that covers you as a dependent. However, if the primary carrier only pays 50% of the dentist’s allowed fee, then the secondary carrier would reduce its payment by the amount paid by the primary plan and pay the difference.

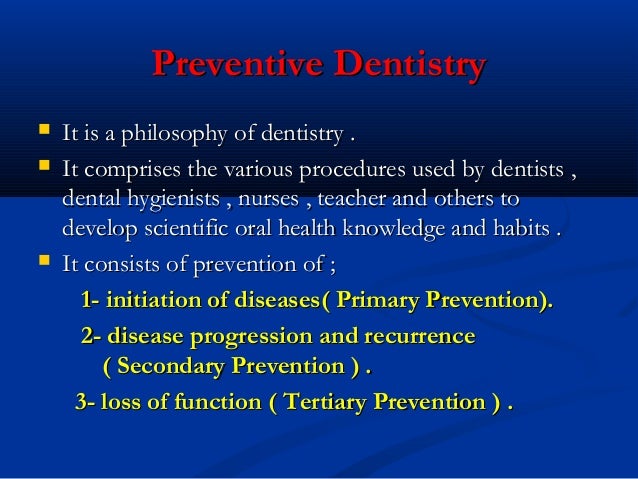

Source: slideshare.net

Source: slideshare.net

Hopefully, in future versions of 17, this will be corrected. For real though, the dental insurance plans set forth rules to determine which plan pays first, (primary) and which plan pays afterward (secondary). Cob was established to guarantee that providers are not overpaid for claims if the patient is covered under multiple insurance plans. Any insurance where you are the primary subscriber, and not a dependent, is your primary insurance plan. It is a mandate that all dental insurance billing claims for primary and secondary claims must be applied.

Source: insurance-canada.ca

Source: insurance-canada.ca

The insurance that pays first is your “primary” insurance, and this plan will pay up to coverage limits. The secondary payer then reviews the remaining bill and picks up its portion. If you are covered as a dependent under your spouse�s plan, his plan is your secondary insurance plan. As secondary insurance, medicaid can pay vision and dental benefits. There is one primary and one secondary insurance.

Source: thedentrixofficemanager.blogspot.com

Once your primary insurance has paid its share, the remaining bill goes to your “secondary” insurance, if you have more than one health plan. For real though, the dental insurance plans set forth rules to determine which plan pays first, (primary) and which plan pays afterward (secondary). As secondary insurance, medicaid can pay vision and dental benefits. There is one primary and one secondary insurance. But if you have employer coverage, sometimes medicaid as a secondary insurance can be very useful.31 mar 2016 is medicare my primary or secondary insurance?

Source: pinterest.com

Source: pinterest.com

This is determined by cob, which is usually dictated by state and government regulations. For example, you need physical therapy but your primary insurance only covers a limited number of sessions. If you have multiple healthcare plans then one dental insurance plan is known as primary. The secondary plan is the plan that the patient is. As per the american dental association (ada), it is necessary to submit your full fee for dental claims while filling the primary and the secondary insurance.dental practitioners need to.

Source: researchgate.net

Source: researchgate.net

Medicaid cannot be secondary insurance for any marketplace plans. If you are covered by two insurance carriers, your primary dental plan will be the one that covers you as the main policyholder and the secondary dental plan will be the one that covers you as a dependent. If you have two jobs, then the primary carrier is the dental plan that has provided coverage for longer. The insurance that pays first is your “primary” insurance, and this plan will pay up to coverage limits. Cob was established to guarantee that providers are not overpaid for claims if the patient is covered under multiple insurance plans.

Source: dentalplans.com

Source: dentalplans.com

Generally, the primary plan is the one in which the patient is the main policyholder. The secondary payer then reviews the remaining bill and picks up its portion. This means the primary insurance has covered everything it is obligated to pay under your policy and will not be covering additional services. For instance, a patient’s insurance plan from the employer is primary, while his or her spouse’s plan is. Instead, there are two plans;

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The primary carrier is the one for which you are covered as the member (i.e.; Cob was established to guarantee that providers are not overpaid for claims if the patient is covered under multiple insurance plans. The ins and outs of primary and secondary insurance coverage. Medical plans with embedded dental benefits have indicated that they will not require dentists to be credentialed under the medical plan(s). Your primary health coverage will pay its portion of a medical claim first.

Source: paperpkjobs.pk

Source: paperpkjobs.pk

The plan that pays first is considered the primary plan. If you have dental coverage through two jobs, the insurer you have been with the longest is your primary carrier. Cob was established to guarantee that providers are not overpaid for claims if the patient is covered under multiple insurance plans. In most cases, the secondary policy will not accept a claim until after the primary policy has paid for services according to the enrollee’s available benefits under that policy. Medicaid cannot be secondary insurance for any marketplace plans.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title primary secondary dental insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information