Principle of insurance interest Idea

Home » Trend » Principle of insurance interest IdeaYour Principle of insurance interest images are ready in this website. Principle of insurance interest are a topic that is being searched for and liked by netizens today. You can Download the Principle of insurance interest files here. Download all free photos.

If you’re searching for principle of insurance interest images information related to the principle of insurance interest topic, you have pay a visit to the right blog. Our website frequently provides you with hints for refferencing the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

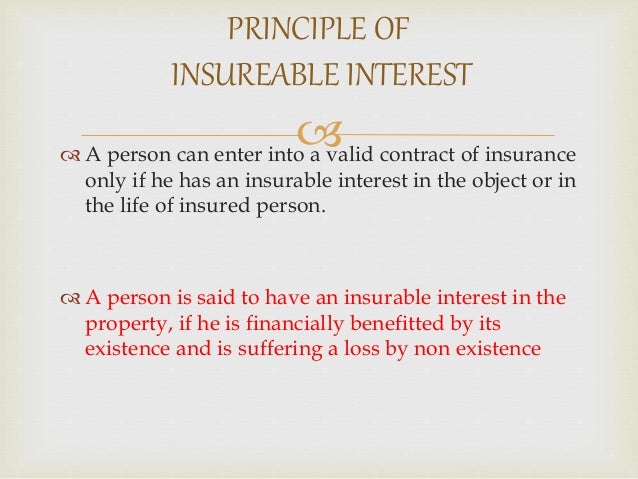

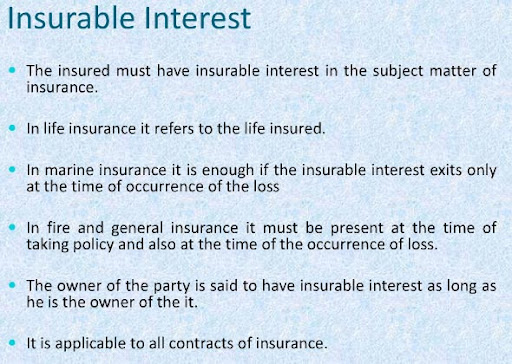

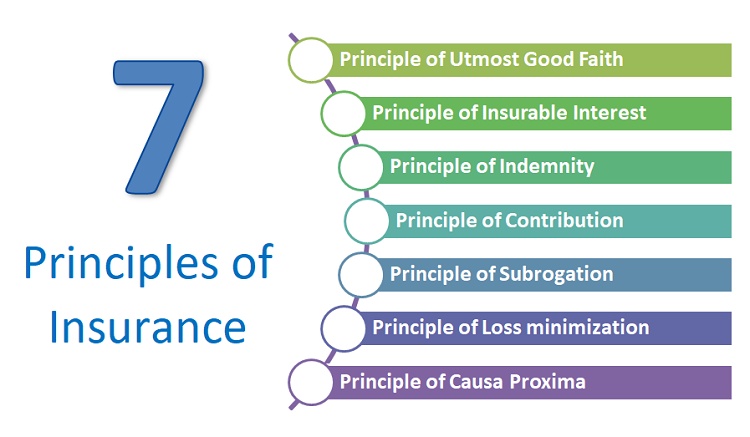

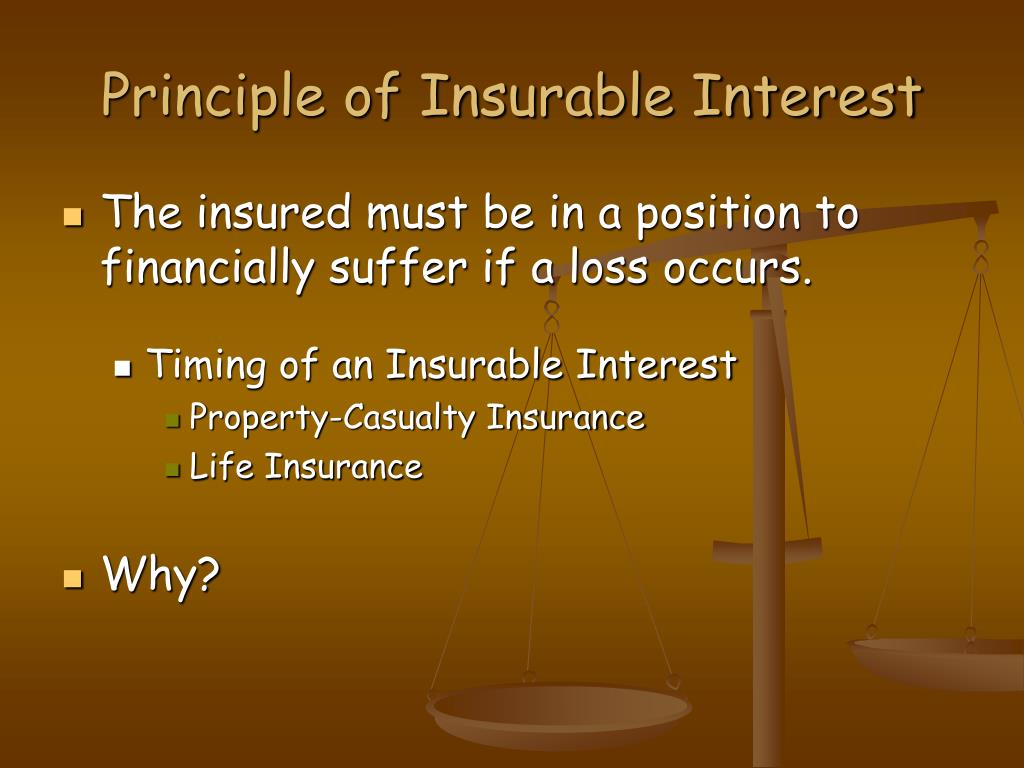

Principle Of Insurance Interest. An insurable interest must exist at the time of the purchase of the insurance. Under law terms, insurable interest means; Utmost good faith (‘uberrima fides’) opposite of ‘caveat emptor’ (let the buyer beware) is fundamental to the buying and selling of insurance. Insurable interest is a core principle in insurance.

Principles of Insurance From slideshare.net

Principles of Insurance From slideshare.net

- principle of insurable interest insured must have the insurable interest on the subject matter in case of life insurance spouse and dependents have insurable interest in the life of a person. A pe rson has an insurable interest w hen. Insurable interest is a core principle in insurance. The financial stake that you have in insuring something you own—for instance, your car—is termed ‘insurable interest�. Principle of insurable interest this principle states that insurance policy holder must have insurable interest in the subject matter of insurance. The principle of insurable interest meaning explains that it is essential for a policyholder to have an insurable.

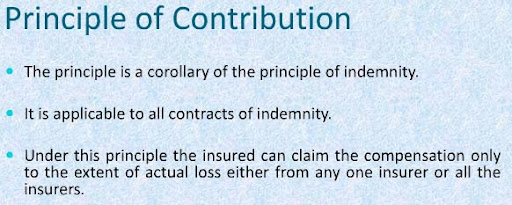

The principle of indemnity and insurable interest the indemnification principle holds that insurance policies should compensate a policyholder.

Insurable interest in the ob ject of insurance. Absence of insurance makes the contract null and void. Insurable interest in the ob ject of insurance. The insurable interest principle applies in different ways to property insurance and life insurance. A person offers an insurable interest in something once damage or lost might result in suffering financial loss. Principle of insurable interest insurable interest means a cover mentioned in insurance agreement should provide a financial gain by its existence.

Source: youtube.com

Source: youtube.com

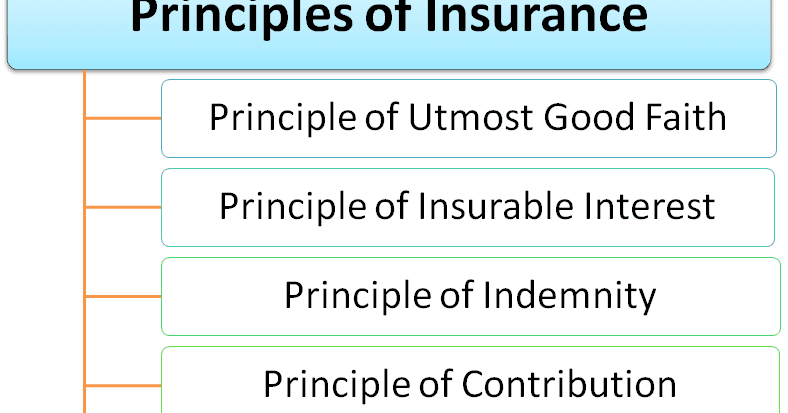

Principle of insurable interest denotes that only the person who has insurable interest on a subject matter of insurance can insure that particular subject matter. 2) principle of insurable interest insured must have the insurable interest on the subject matter in case of life insurance spouse and dependents have insurable interest in the life of a person. It means that the person wishing to take out insurance must be legally entitled to insure the article, or the event, or the life. The assured should have an actual interest, called insurable interest in the subject matter of insurance. There are six principles in insurance:

Source: youtube.com

Source: youtube.com

The principle of insurable interest meaning explains that it is essential for a policyholder to have an insurable. The principle of insurable interest says that a party which wants to get the insurance policy must have some interest in the property or life that insured. Insurable interest is a fundamental principle of insurance. In simple words, there are no financial gains and losses if you do not have ownership of that assets. The insurable interest principle applies in different ways to property insurance and life insurance.

Source: peterperfectsports.blogspot.com

Source: peterperfectsports.blogspot.com

If there is no insurable interest, an insurance company will not issue a policy. The principle of insurable interest states that the person getting insured must have insurable interest in the object of insurance. Mostly ownership, direct relationship or possession is recognize under insurable interest. The principle of indemnity and insurable interest the indemnification principle holds that insurance policies should compensate a policyholder. The person getting insure d must have.

Source: slideshare.net

Source: slideshare.net

It means that the person wishing to take out insurance must be legally entitled to insure the article, or the event, or the life. In simple words, there are no financial gains and losses if you do not have ownership of that assets. Principle of insurable interest denotes that only the person who has insurable interest on a subject matter of insurance can insure that particular subject matter. The principle of insurable interest on life insurance is that a person or organization can obtain an insurance policy on the life of another person if the person or organization obtaining the insurance values the life of the insured more than the amount of the policy. An insurable interest must exist at the time of the purchase of the insurance.

Source: ensuresit.com

Source: ensuresit.com

The happening of the event insured against or death of the life insured must cause the policyholder financial loss. Peter principle principle of insurable interest a principle that states that an insured may not collect more than its own financial interest in property that is damaged or destroyed. Insurable interest is a core principle in insurance. The principle of insurable interest insurable interest just means that the subject matter of the contract must provide some financial gain by existing for the insured (or policyholder) and would lead to a financial loss if damaged, destroyed, stolen, or lost. Principle of insurable interest denotes that only the person who has insurable interest on a subject matter of insurance can insure that particular subject matter.

Source: kalyan-city.blogspot.com

Source: kalyan-city.blogspot.com

Peter principle principle of insurable interest a principle that states that an insured may not collect more than its own financial interest in property that is damaged or destroyed. Absence of insurance makes the contract null and void. It is not possible to affect an insurance policy on a subject matter by someone who has got no insurable interest on that subject matter. To ensure the proper functioning of an insurance contract, the insurer and the insured have to uphold the 7 principles of insurances mentioned below: It is defined as the concern of an individual towards obtaining an insurance policy for an item or an individual against any type of unforeseen events such as losses or death.

Source: slideshare.net

Source: slideshare.net

Under this principle of insurance, the insured must have interest in the subject matter of the insurance. An insurable interest must exist at the time of the purchase of the insurance. A pe rson has an insurable interest w hen. The assured should have an actual interest, called insurable interest in the subject matter of insurance. Utmost good faith (‘uberrima fides’) opposite of ‘caveat emptor’ (let the buyer beware) is fundamental to the buying and selling of insurance.

Source: jagoinvestor.com

Source: jagoinvestor.com

Insurable interest is a fundamental principle of insurance. The principle of insurable interest states that the person getting insured must have insurable interest in the object of insurance. Peter principle principle of insurable interest a principle that states that an insured may not collect more than its own financial interest in property that is damaged or destroyed. The insurable interest principle applies in different ways to property insurance and life insurance. The assured should have an actual interest, called insurable interest in the subject matter of insurance.

Source: kalyan-city.blogspot.com

Source: kalyan-city.blogspot.com

The principle of insurable interest or insurable interest is one of the fundamental principles of insurance. It is not possible to affect an insurance policy on a subject matter by someone who has got no insurable interest on that subject matter. A pe rson has an insurable interest w hen. Absence of insurance makes the contract null and void. Mostly ownership, direct relationship or possession is recognize under insurable interest.

Source: insuregrams.com

Source: insuregrams.com

Principle of insurable interest this principle states that insurance policy holder must have insurable interest in the subject matter of insurance. The principle of indemnity and insurable interest the indemnification principle holds that insurance policies should compensate a policyholder. An insurable interest must exist at the time of the purchase of the insurance. Corporations also have insurable interests in the life of it�s employees It is not possible to affect an insurance policy on a subject matter by someone who has got no insurable interest on that subject matter.

Source: authorstream.com

Source: authorstream.com

Mostly ownership, direct relationship or possession is recognize under insurable interest. In this way, insurance can compensate for loss. The principle of insurable interest says that a party which wants to get the insurance policy must have some interest in the property or life that insured. The principle of insurable interest states that the person getting insured must have insurable interest in the object of insurance. Principle of insurable interest denotes that only the person who has insurable interest on a subject matter of insurance can insure that particular subject matter.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

Absence of insurance makes the contract null and void. The principle of insurable interest meaning explains that it is essential for a policyholder to have an insurable. Under this principle of insurance, the insured must have interest in the subject matter of the insurance. The principle of insurable interest states t h a t. It is defined as the concern of an individual towards obtaining an insurance policy for an item or an individual against any type of unforeseen events such as losses or death.

Source: slideserve.com

Source: slideserve.com

In simple words, there are no financial gains and losses if you do not have ownership of that assets. Insurable interest is a core principle in insurance. The principle of insurable interest states t h a t. Interest here is a term of art used in insurance law, & is an essential requirement. Corporations also have insurable interests in the life of it�s employees

Source: youtube.com

Source: youtube.com

Absence of insurance makes the contract null and void. The application of the concept was first seen in the marine insurance act of 1745 to halt the practice of people with no. Insurable interest is said to exist when an insured person is. Mostly ownership, direct relationship or possession is recognize under insurable interest. The principle of insurable interest or insurable interest is one of the fundamental principles of insurance.

Source: slideshare.net

Source: slideshare.net

The assured should have an actual interest, called insurable interest in the subject matter of insurance. If there is no insurable interest, an insurance company will not issue a policy. The principle of insurable interest states that the person getting insured must have insurable interest in the object of insurance. Principle of insurable interest what is insurable interest? Under law terms, insurable interest means;

Source: kalyan-city.blogspot.com

Source: kalyan-city.blogspot.com

Insurable interest in the ob ject of insurance. Absence of insurance makes the contract null and void. A pe rson has an insurable interest w hen. Insurable interest is a fundamental principle of insurance. Insurable interest is said to exist when an insured person is.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

It is not possible to affect an insurance policy on a subject matter by someone who has got no insurable interest on that subject matter. The principle of insurable interest in case of life insurance states that a person or organization can draw an insurance policy on the life of another person if the person or the organization values the life of that person more than the amount of the policy. Principle of insurable interest what is insurable interest? The happening of the event insured against or death of the life insured must cause the policyholder financial loss. The principle of insurable interest says that a party which wants to get the insurance policy must have some interest in the property or life that insured.

Source: slideshare.net

Source: slideshare.net

I n t er es t. In insurance law, you can only buy insurance for something or someone in which you have an insurable interest. Corporations also have insurable interests in the life of it�s employees Principle of insurable interest this principle states that insurance policy holder must have insurable interest in the subject matter of insurance. It is not possible to affect an insurance policy on a subject matter by someone who has got no insurable interest on that subject matter.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title principle of insurance interest by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information