Principles of life insurance in india Idea

Home » Trending » Principles of life insurance in india IdeaYour Principles of life insurance in india images are ready in this website. Principles of life insurance in india are a topic that is being searched for and liked by netizens today. You can Find and Download the Principles of life insurance in india files here. Get all free photos.

If you’re searching for principles of life insurance in india pictures information related to the principles of life insurance in india topic, you have pay a visit to the right blog. Our site frequently provides you with suggestions for seeking the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

Principles Of Life Insurance In India. They both should reveal all material information and facts regarding contract to each other accurately and honestly. Insurance contract and indian market conditions 4. When you place your order with our writing service, you can rely on us to get a legitimate essay with premium quality. However, during the same period, the

Basics of �Indian Contract Act, 1872 & �Principles Of From slideshare.net

Basics of �Indian Contract Act, 1872 & �Principles Of From slideshare.net

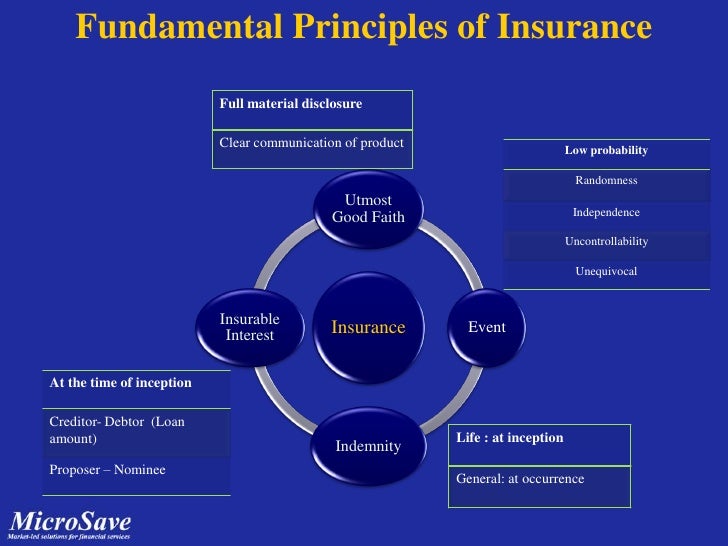

Principles of insurance 1] utmost good faith. General principles and concepts of insurance 3. Insurance scenario in india classification of insurance industry in india in life insurance business, india ranked 9th among the 156 countries, for which data are published by swiss re. As above said insurance is a contract and all fundamental principles of a valid contract under the indian contract act, 1872 are applicable for the formation of life insurance contract. 5.2 demonstrate the relevance of experience monitoring to a life insurance company. They both should reveal all material information and facts regarding contract to each other accurately and honestly.

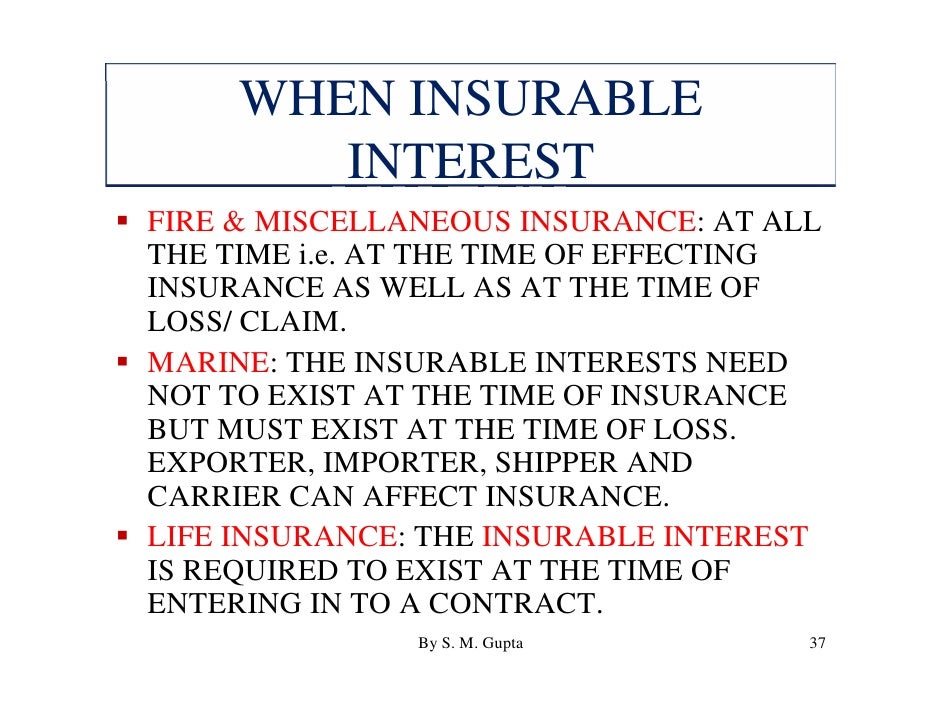

If there is no insurable interest, an insurance company will not issue a policy.

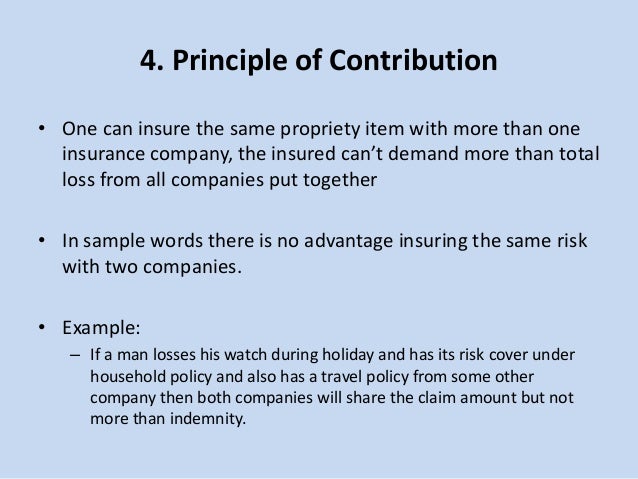

Fundamental elements of insurance 1) utmost good faith 2) indemnity 3) insurable interest 4) causa proxima 5) risk must attach 6) mitigation of loss 7) contribution 8) subrogation 9) period of insurance premium return of premium reinsurance & double insurance. Term life insurance is a type of life insurance that provides a death benefit to the beneficiary only if the insured dies during a specified period. Pay death benefits only whenever it occurs. Under this principle of insurance, the insured must have interest in the subject matter of the insurance. Life insurance specialist principles page 7 of 7 embedded value. However, during the same period, the

Source: slideshare.net

Source: slideshare.net

However, during the same period, the Life insurance organization chapter 2: Linked life insurance policies chapter 7: A contract of insurance must be made based on utmost good faith ( a contract of uberrimate fidei). The insurance plays a role in the economic development of the country in following ways _____.

Source: slideshare.net

Source: slideshare.net

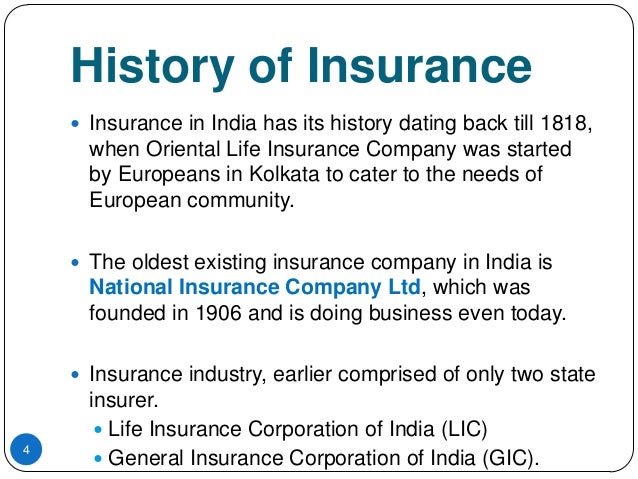

Life insurance corporation act, 1956 104 unit 7: General principles of insurance law 23 unit 3: The principle of insurable interest this principle is related to a level of interest the person is expected to have in that certain policy. An insurable interest must exist at the time of the purchase of the insurance. The life insurance corporation (“lic”) was formed in sept ember 1956 by the life insurance corporation act, 1956 (“lic act”) which granted lic the exclusive pr ivilege to conduct life insurance business in india.

Source: slideshare.net

Source: slideshare.net

This means that the insurer must have some pecuniary interest in the subject. The insurance plays a role in the economic development of the country in following ways _____. Prepare a chart showing various principles being followed in life and non life insurance classroom teaching Life insurance corporation act, 1956 104 unit 7: Specific principles of insurance law 41 unit 4:

Source: slideshare.net

Source: slideshare.net

Term plans in uk and india: Life insurance corporation act, 1956 104 unit 7: Principle of utmost good faith Plans of life insurance chapter 4: Term plans in uk and india:

Source: slideshare.net

Source: slideshare.net

However, an exception was made in the case of any company, firm or General principles and concepts of insurance 3. Life insurance corporation act, 1956 104 unit 7: Fundamental elements of insurance 1) utmost good faith 2) indemnity 3) insurable interest 4) causa proxima 5) risk must attach 6) mitigation of loss 7) contribution 8) subrogation 9) period of insurance premium return of premium reinsurance & double insurance. Life insurance specialist principles page 7 of 7 embedded value.

Source: commerceiets.com

Source: commerceiets.com

However, an exception was made in the case of any company, firm or Principles of life insurance principles of insurance 48 would as a proximity cause, involve the assured in the loss or diminution of any right recognised by law or in any legal liability there is an insurable interest in the happening of that event to the extent of the possible loss or liability.” This means that the insurer must have some pecuniary interest in the subject. Life insurance specialist principles page 7 of 7 embedded value. Principles of insurance principle of utmost good faith it states that both the parties to contract must enter into a contract in good faith.

Source: anjanibooks.com

Source: anjanibooks.com

Insurance contract and indian market conditions 4. Life insurance organization chapter 2: To ensure the proper functioning of an insurance contract, the insurer and the insured have to uphold the 7 principles of insurances mentioned below: Under this principle of insurance, the insured must have interest in the subject matter of the insurance. Linked life insurance policies chapter 7:

Source: slideshare.net

Source: slideshare.net

They both should reveal all material information and facts regarding contract to each other accurately and honestly. Life insurance corporation act, 1956 104 unit 7: What are the major insurance principles applied in india? Life insurance organization chapter 2: Under this principle of insurance, the insured must have interest in the subject matter of the insurance.

Premiums and bonuses chapter 3: Life insurance operates on some basic principles that are common for many individuals. Prepare a chart showing various principles being followed in life and non life insurance classroom teaching Discuss the core concept of all the principles of insurance 3. 5.2.2 describe how the actual mortality, persistency, expense and

Source: comparepolicy.com

Source: comparepolicy.com

A contract of insurance must be made based on utmost good faith ( a contract of uberrimate fidei). If the policyholder survives until the end of the period, or term, the insurance coverage ceases without value. Linked life insurance policies chapter 7: Life insurance operates on some basic principles that are common for many individuals. Insurance contract and indian market conditions 4.

Source: en.frenchpdf.com

Source: en.frenchpdf.com

General principles of insurance law 23 unit 3: Principle of utmost good faith Insurance contract and indian market conditions 4. Principles of life insurance principles of insurance 48 would as a proximity cause, involve the assured in the loss or diminution of any right recognised by law or in any legal liability there is an insurable interest in the happening of that event to the extent of the possible loss or liability.” Life insurance operates on some basic principles that are common for many individuals.

Source: slideshare.net

Source: slideshare.net

Principles of insurance 1] utmost good faith. Term life insurance is a type of life insurance that provides a death benefit to the beneficiary only if the insured dies during a specified period. If the policyholder survives until the end of the period, or term, the insurance coverage ceases without value. “ life insurance business” means the business of effecting contracts of insurance upon human life, including any contract whereby the payment of money is assured on death (except death by accident only) or the happening of any contingency dependent upon.</p> However, an exception was made in the case of any company, firm or

Source: slideshare.net

Source: slideshare.net

Life insurance specialist principles page 7 of 7 embedded value. Life insurance corporation act, 1956 104 unit 7: When you place your order with our writing service, you can rely on us to get a legitimate essay with premium quality. The insurance plays a role in the economic development of the country in following ways _____. Linked life insurance policies chapter 7:

Source: slideshare.net

Source: slideshare.net

Term life insurance is a type of life insurance that provides a death benefit to the beneficiary only if the insured dies during a specified period. However, an exception was made in the case of any company, firm or The principle of insurable interest this principle is related to a level of interest the person is expected to have in that certain policy. This occurs when a person states a fact in the belief or expectation that it is right but it turns out to be wrong. Life insurance specialist principles page 7 of 7 embedded value.

Source: slideshare.net

Source: slideshare.net

Term plans in uk and india: Principles of life insurance principles of insurance 48 would as a proximity cause, involve the assured in the loss or diminution of any right recognised by law or in any legal liability there is an insurable interest in the happening of that event to the extent of the possible loss or liability.” Premiums and bonuses chapter 3: Applications and acceptance chapter 8: 5.2 demonstrate the relevance of experience monitoring to a life insurance company.

Source: snapdeal.com

Source: snapdeal.com

5.2.1 explain why it is important for a life insurance company to monitor its experience. They both should reveal all material information and facts regarding contract to each other accurately and honestly. Principles of insurance 1] utmost good faith. In india, life insurance business is defined under section 2 (11) of insurance act, 1938, which reads : Linked life insurance policies chapter 7:

Source: slideshare.net

Source: slideshare.net

Principles and practices of life insurance in india|ashraf imam writers at myperfectwords.com are experts, along with years of experience in their specific field. Insurance contract and indian market conditions 4. Absence of insurance makes the contract null and void. Life insurance operates on some basic principles that are common for many individuals. Term plans in uk and india:

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

However, during the same period, the This occurs when a person states a fact in the belief or expectation that it is right but it turns out to be wrong. Utmost good faith proximate cause insurable interest indemnity subrogation contribution loss minimization let us understand each principle of insurance with an example. Absence of insurance makes the contract null and void. 5.2.1 explain why it is important for a life insurance company to monitor its experience.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title principles of life insurance in india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information