Private health insurance rebate reduction information

Home » Trend » Private health insurance rebate reduction informationYour Private health insurance rebate reduction images are ready in this website. Private health insurance rebate reduction are a topic that is being searched for and liked by netizens today. You can Get the Private health insurance rebate reduction files here. Download all royalty-free vectors.

If you’re searching for private health insurance rebate reduction pictures information related to the private health insurance rebate reduction topic, you have visit the right site. Our website always provides you with hints for refferencing the highest quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

Private Health Insurance Rebate Reduction. If you are eligible for the private health insurance rebate reduction there are two ways you can claim it: If you have an existing private health insurance policy and want to reduce your premiums using the rebate, you can contact your health fund to authorise them to do so or submit a medicare rebate claim form. The tax rebate has the potential to make health cover more affordable with the option of the rebate taken as either a. In 2021 this will reduce to a 24.608% rebate.

Why it�s time to remove private health insurance rebates From theconversation.com

Why it�s time to remove private health insurance rebates From theconversation.com

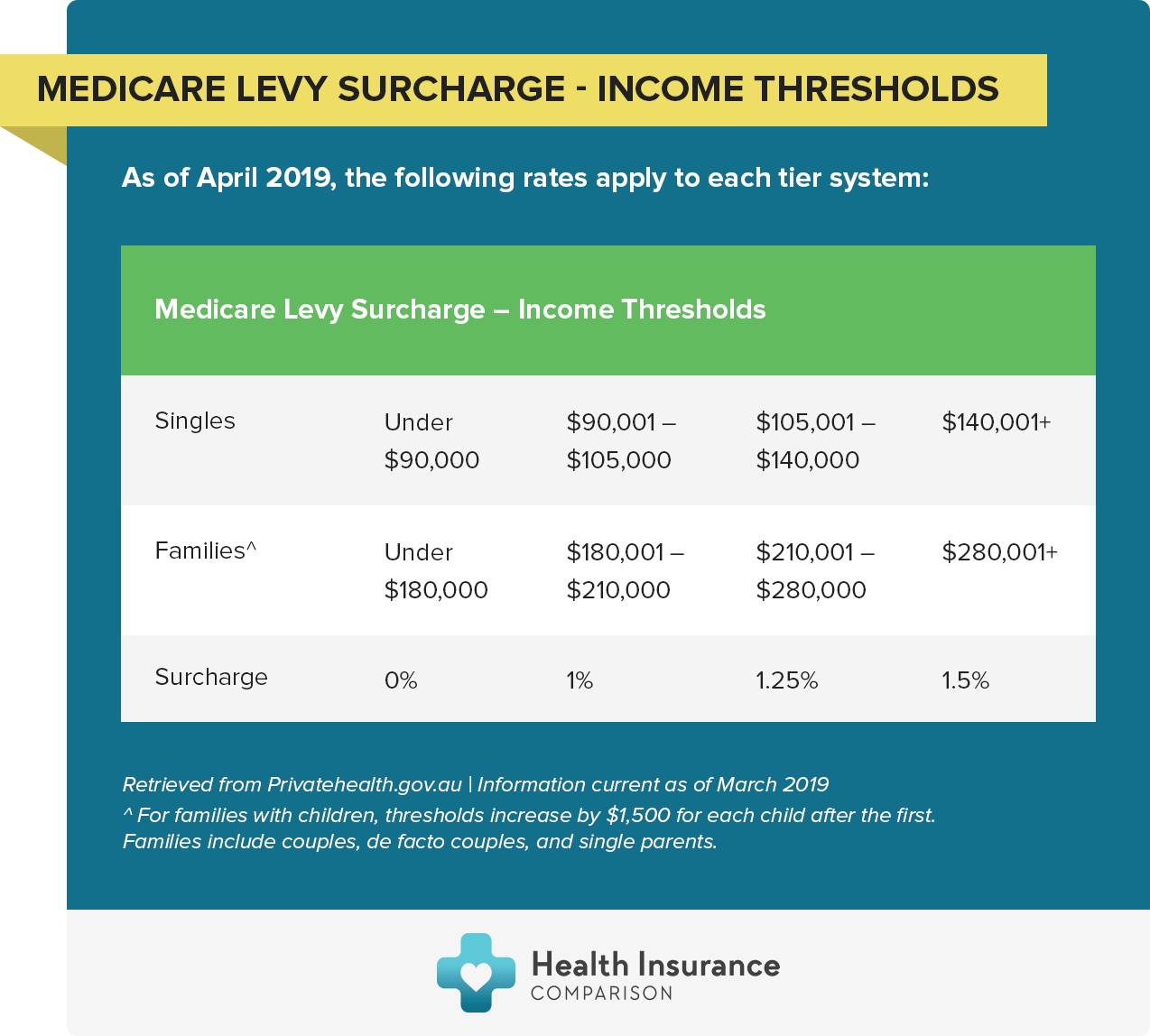

Your rebate, whether full or reduced, depends on how old you are; This increases her 2021 premium by 0.62% on top of the price increase of her cover. On 1 july 2020, toby nominated to receive 29.236% private health insurance rebate as a premium reduction to the cost of his policy. 4 rows you can use the table above or the private health insurance rebate calculator on the ato. On 1 april 2021, the rebate percentage was adjusted by the government. Different thresholds apply depending on whether you have a single income or a family income.

Who can apply for the agr?

This may result in you receiving a private health insurance tax offset or a liability, depending on: Different thresholds apply depending on whether you have a single income or a family income. Similar (or greater) reduction in rebate costs incurred. What is the private health insurance rebate? The private health insurance rebate is an amount the government contributes towards the cost of your private health insurance premiums. Some of the leading insurers in the private healthcare market advised that they were looking into introducing measures to ensure that they will not make any undue profit in the event of a reduction.

Source: theconversation.com

Source: theconversation.com

For instance, if you are older, you will get a higher rebate. What is the private health insurance rebate? How you claim your rebate. Premium reduction, which lowers the policy price charged by your insurer. Claiming with your tax return.

Source: privatehealthpublicbenefit.com.au

Source: privatehealthpublicbenefit.com.au

Alternatively, your highview accountant will calculate your private health insurance rebate when you lodge your tax return. 4 rows you can use the table above or the private health insurance rebate calculator on the ato. You can receive the rebate as a premium reduction through your private health insurer, which means you pay less upfront b. We’ll pay the rebate to your health insurer and they’ll reduce the cost of your premium. The rebate is income tested which means your eligibility depends on your income for surcharge purposes.

Source: gscpa.com.au

Source: gscpa.com.au

In 2021 this will reduce to a 24.608% rebate. Different policies have different levels of private hospital. This reduction in tax comes in the form of the private health insurance rebate, which is an amount the federal government contributes towards the cost of your hospital premiums. The rebate thresholds applicable from 1 april 2021 to 31 march 2022* are: They�ll give you a form to fill in or tell you what you need to do.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

In 2021 this will reduce to a 24.608% rebate. From your health insurer you can claim the rebate as an upfront reduction to your private health insurance premium. You can claim your private health insurance rebate as a: We’ll pay the rebate to your health insurer and they’ll reduce the cost of your premium. Depending on income thresholds, you may be entitled to a reduced rebate.

Source: studentedge.org

Source: studentedge.org

In 2021 this will reduce to a 24.608% rebate. The australian government rebate on private health insurance provides a reduction in the premium cost of private healthcare. You can receive the rebate as a premium reduction through your private health insurer, which means you pay less upfront b. Different thresholds apply depending on whether you have a single income or a family income. • an explicit reduction in the percentage rebate (e.g.

They�ll give you a form to fill in or tell you what you need to do. They�ll give you a form to fill in or tell you what you need to do. The rebate thresholds applicable from 1 april 2021 to 31 march 2022* are: If you have an existing private health insurance policy and want to reduce your premiums using the rebate, you can contact your health fund to authorise them to do so or submit a medicare rebate claim form. 4 rows you can use the table above or the private health insurance rebate calculator on the ato.

Source: comparehealthinsurance.online

Source: comparehealthinsurance.online

How you claim your rebate. The private health insurance rebate is an australian government initiative designed to help you cover the costs of your premiums. The tax rebate has the potential to make health cover more affordable with the option of the rebate taken as either a. You can claim the rebate in your tax return as a refundable tax offset (this option does not require you to nominate a tier), or c. The rebate is income tested which means your eligibility depends on your income for surcharge purposes.

Source: healthinsurancecomparison.com.au

Source: healthinsurancecomparison.com.au

In 2020 she was entitled to a 25.059% rebate. The tax rebate has the potential to make health cover more affordable with the option of the rebate taken as either a. On 1 april 2021, the rebate percentage was adjusted by the government. In 2020 she was entitled to a 25.059% rebate. Your rebate, whether full or reduced, depends on how old you are;

Source: westcourt.com.au

Source: westcourt.com.au

Your entitlement is also based on the age of the oldest person covered by the policy. On 1 april 2021, the rebate percentage was adjusted by the government. • an explicit reduction in the percentage rebate (e.g. The rebate thresholds applicable from 1 april 2021 to 31 march 2022* are: How you claim your rebate.

Source: finance-review.com

Source: finance-review.com

It is recognition by the australian government that australians with private healthcare are making a substantial financial contribution not only to their own healthcare but also to australia’s healthcare system. The private health insurance rebate is one of three policy incentives introduced by the howard government in the late 1990s. Depending on income thresholds, you may be entitled to a reduced rebate. • an explicit reduction in the percentage rebate (e.g. It also factors your single or family status, how many children you may have, and your age.

Source: doctorshealthfund.com.au

Who can apply for the agr? You can receive a direct payment from the government through your local medicare office. They�ll give you a form to fill in or tell you what you need to do. You can claim your private health insurance rebate as a: We’ll pay the rebate to your health insurer and they’ll reduce the cost of your premium.

Source: theconversation.com

Source: theconversation.com

Your entitlement is also based on the age of the oldest person covered by the policy. Refundable tax offset through your tax return. If you are eligible for the private health insurance rebate reduction there are two ways you can claim it: You can claim your private health insurance rebate as a: They�ll give you a form to fill in or tell you what you need to do.

Source: theconversation.com

Source: theconversation.com

If you are eligible for the private health insurance rebate reduction there are two ways you can claim it: Designed to make private health insurance more accessible and affordable for australians, the health insurance tax rebate you’re entitled to depends on things like age, income and number of. In 2020 she was entitled to a 25.059% rebate. From your health insurer you can claim the rebate as an upfront reduction to your private health insurance premium. • an explicit reduction in the percentage rebate (e.g.

Source: totumhealth.com.au

Source: totumhealth.com.au

Some of the leading insurers in the private healthcare market advised that they were looking into introducing measures to ensure that they will not make any undue profit in the event of a reduction. The australian government rebate on private health insurance provides a reduction in the premium cost of private healthcare. If you�ve claimed too much private health insurance rebate, as a premium reduction or through medicare, the ato may seek to recover the amount. The private health insurance rebate is one of three policy incentives introduced by the howard government in the late 1990s. Some of the leading insurers in the private healthcare market advised that they were looking into introducing measures to ensure that they will not make any undue profit in the event of a reduction.

Source: robertgoldman.com.au

Source: robertgoldman.com.au

The rebate is income tested which means your eligibility depends on your income for surcharge purposes. What is private health insurance rebate. Your rebate, whether full or reduced, depends on how old you are; If your taxable income exceeds $90,000, but up to $140,000 annually (as a single) or over $190,000 but under $280,000 as a family, you will be placed under tier 1 or 2 and be eligible for a reduced rebate. Your entitlement is also based on the age of the oldest person covered by the policy.

Source: finance-review.com

Source: finance-review.com

If you�ve claimed too much private health insurance rebate, as a premium reduction or through medicare, the ato may seek to recover the amount. The australian government rebate (agr) is an amount that the government puts towards your health cover to make it more affordable. You can receive a direct payment from the government through your local medicare office. The private health insurance rebate is an amount the government contributes towards the cost of your private health insurance premiums. We’ll pay the rebate to your health insurer and they’ll reduce the cost of your premium.

Source: privatehealthinsuranceseitei.blogspot.com

Source: privatehealthinsuranceseitei.blogspot.com

Some of the leading insurers in the private healthcare market advised that they were looking into introducing measures to ensure that they will not make any undue profit in the event of a reduction. You can receive a direct payment from the government through your local medicare office. The private health insurance rebate is an amount the government contributes towards the cost of your private hospital health insurance premiums. Some of the leading insurers in the private healthcare market advised that they were looking into introducing measures to ensure that they will not make any undue profit in the event of a reduction. The level of rebate you claim for your.

Source: melbournehandtherapy.com.au

Source: melbournehandtherapy.com.au

On 1 april 2021, the rebate percentage was adjusted by the government. Alternatively, your highview accountant will calculate your private health insurance rebate when you lodge your tax return. How you claim your rebate. • an explicit reduction in the percentage rebate (e.g. We’ll pay the rebate to your health insurer and they’ll reduce the cost of your premium.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title private health insurance rebate reduction by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information