Private placement insurance Idea

Home » Trend » Private placement insurance IdeaYour Private placement insurance images are available in this site. Private placement insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Private placement insurance files here. Download all royalty-free photos.

If you’re searching for private placement insurance pictures information related to the private placement insurance topic, you have visit the ideal blog. Our site frequently gives you hints for seeking the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

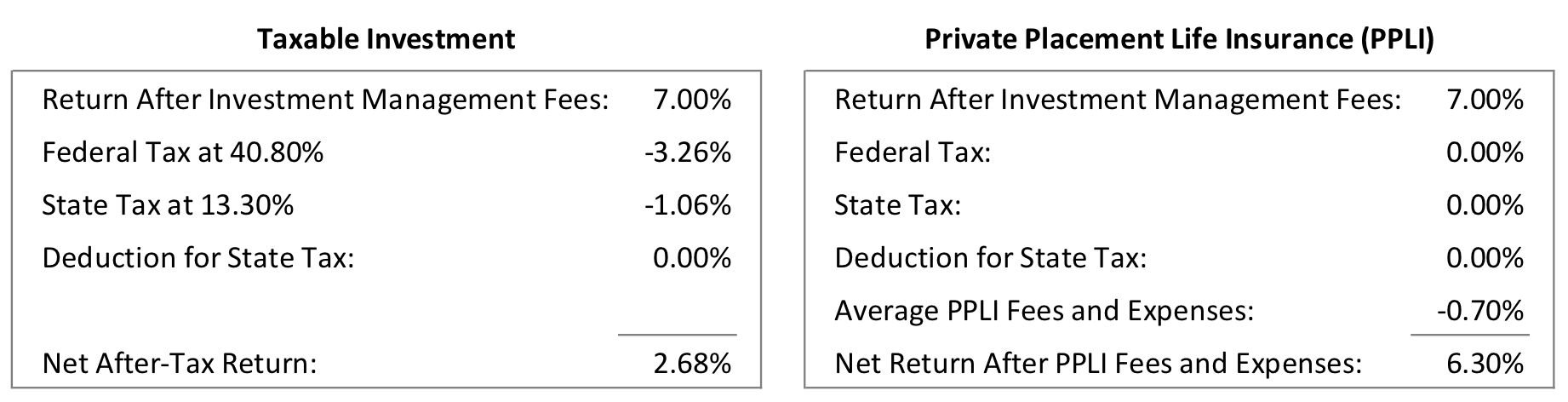

Private Placement Insurance. To reduce fee drag, the life insurance component is kept as low as possible; Allowing the policy’s cash value to. Private placement life insurance is an investment placed insurance that is dependent upon the investments within the policy and the monetary cash value placed on those investments. Private placement life insurance avails policyholders of the following 8 benefits:

Private Placement Life Insurance Colva From colvaservices.com

Private Placement Life Insurance Colva From colvaservices.com

That is designed to have a high cash value in comparison to a low death benefit. Private placement life insurance is an investment placed insurance that is dependent upon the investments within the policy and the monetary cash value placed on those investments. As an investment tool, both ppli and ppva enable access to sophisticated investment What is private placement life insurance? In time, however, the market migrated to the united states, and applicable irs regulations followed. Allowing the policy’s cash value to.

Private placement life insurance (ppli) is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit.

As the name suggests, a “private placement” is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital. It is offered by both domestic and foreign insurance companies and provides policy holders with sophisticated asset management choices, As the name suggests, a “private placement” is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital. Private placement life insurance (ppli), in contrast, is a privately negotiated life insurance contract between insurance carrier and policy owner. As such, private placement life insurance should only be presented to accredited investors or qualified purchasers as described by the securities act of 1933. Private placement life insurance (ppli) is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit.

Source: asia.lombardinternational.com

Source: asia.lombardinternational.com

Private placement life insurance (ppli) is a life insurance policy wrapped around an investment. Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public. Policy funds are held in segregated accounts that theoretically protect the funds against the carrier’s creditors. Private placement life insurance is an investment placed insurance that is dependent upon the investments within the policy and the monetary cash value placed on those investments. Private placement life insurance avails policyholders of the following 8 benefits:

Source: youtube.com

Source: youtube.com

Private placement life insurance (ppli) is a life insurance policy wrapped around an investment. As such, private placement life insurance should only be presented to accredited investors or qualified purchasers as described by the securities act of 1933. Private placement life insurance avails policyholders of the following 8 benefits: What is a private placement? Some key differences between private placement life insurance and traditional insurance policies are:

Source: wealthmanagement.com

Source: wealthmanagement.com

Private placement life insurance (ppli), in contrast, is a privately negotiated life insurance contract between insurance carrier and policy owner. As the name suggests, a “private placement” is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital. “private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit. It is offered by both domestic and foreign insurance companies and provides policy holders with sophisticated asset management choices, It combines the financial advantages of hedge funds with the tax benefits of life insurance.

Source: rafflesgroup.co

Source: rafflesgroup.co

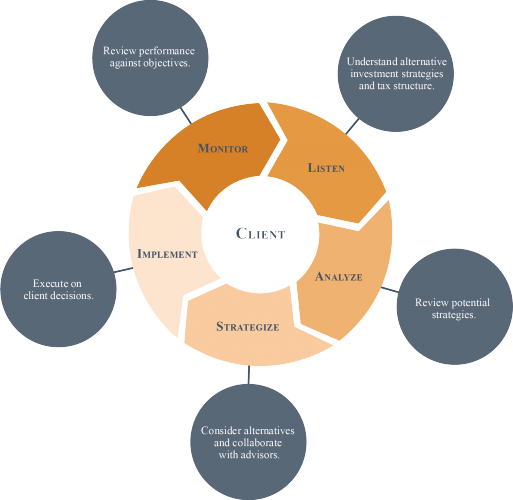

Allowing the policy’s cash value to. As such, private placement life insurance should only be presented to accredited investors or qualified purchasers as described by the securities act of 1933. It is offered by both domestic and foreign insurance companies and provides policy holders with sophisticated asset management choices, Placement variable life insurance) and private placement variable annuities (“ppva”), two core planning strategies that allow holistic advisors to address a wide variety of client needs. It is similar to a variable universal life insurance policy, but the investments owned by the policy are privately offered and meet very specific tax code requirements.

Source: colvaservices.com

Source: colvaservices.com

Many times, those for whom ppli was designed want to invest in hedge funds, but hedge funds can carry significant taxes: It has many advantages, but it also has limitations. As an investment tool, both ppli and ppva enable access to sophisticated investment Private placement life insurance avails policyholders of the following 8 benefits: Private placement life insurance (“ppli”) is a variable universal life insurance product designed for high net worth investors.

Source: lifeinsurancestrategiesgroup.com

Source: lifeinsurancestrategiesgroup.com

It is similar to a variable universal life insurance policy, but the investments owned by the policy are privately offered and meet very specific tax code requirements. At present, ppli policies are more often offered by banks, hedge. It is similar to a variable universal life insurance policy, but the investments owned by the policy are privately offered and meet very specific tax code requirements. To reduce fee drag, the life insurance component is kept as low as possible; Many times, those for whom ppli was designed want to invest in hedge funds, but hedge funds can carry significant taxes:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Private placement life insurance creates that structure that eliminates the tax consideration for the most part and allows investors to choose what they want to invest in in a more robust fashion. Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public. Many times, those for whom ppli was designed want to invest in hedge funds, but hedge funds can carry significant taxes: At present, ppli policies are more often offered by banks, hedge. Private placement life insurance (ppli) is a life insurance policy wrapped around an investment.

Source: winofphiladelphia.org

Source: winofphiladelphia.org

Private placement life insurance (ppli) is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit. Private placement life insurance is a variable universal life insurance policy that provides cash value by investing in a broader range of investments, some of which are not available to the general public. It is offered by both domestic and foreign insurance companies and provides policy holders with sophisticated asset management choices, As an investment tool, both ppli and ppva enable access to sophisticated investment As the name suggests, a “private placement” is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital.

Source: matthewledvina.com

Source: matthewledvina.com

Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public. It has many advantages, but it also has limitations. Private placement life insurance is a type of life insurance; What is private placement life insurance? Placement variable life insurance) and private placement variable annuities (“ppva”), two core planning strategies that allow holistic advisors to address a wide variety of client needs.

Source: youtube.com

Source: youtube.com

Private placement life insurance is a type of variable universal life insurance. In a private placement, both the offering and sale of debt or equity securities is made between a business, or issuer, and a select number of investors. 2) lower costs — typically, ppli offers lower fees. If the wealthy individual invests in them in their personal. The company usually determines its policy around a uniform offering without knowing the specifics of the client that they are representing.

Source: fdltd.com

Source: fdltd.com

Private placement life insurance creates that structure that eliminates the tax consideration for the most part and allows investors to choose what they want to invest in in a more robust fashion. It combines the financial advantages of hedge funds with the tax benefits of life insurance. If the wealthy individual invests in them in their personal. It is offered by both domestic and foreign insurance companies and provides policy holders with sophisticated asset management choices, As such, private placement life insurance should only be presented to accredited investors or qualified purchasers as described by the securities act of 1933.

Source: colvaservices.com

Source: colvaservices.com

However, there are some notable differences with private placement insurance verses the type of variable life insurance offered to the general public. 2) lower costs — typically, ppli offers lower fees. Private placement life insurance is a variable universal life insurance policy that provides cash value by investing in a broader range of investments, some of which are not available to the general public. Some key differences between private placement life insurance and traditional insurance policies are: If the wealthy individual invests in them in their personal.

Source: industryglobalnews24.com

Source: industryglobalnews24.com

To reduce fee drag, the life insurance component is kept as low as possible; Some key differences between private placement life insurance and traditional insurance policies are: Ppli offers several advantages compared to standard policies. Private placement life insurance (ppli) is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit. Many times, those for whom ppli was designed want to invest in hedge funds, but hedge funds can carry significant taxes:

Source: npa1.org

Source: npa1.org

If the wealthy individual invests in them in their personal. In a private placement, both the offering and sale of debt or equity securities is made between a business, or issuer, and a select number of investors. Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public. Private placement life insurance (ppli) is a life insurance policy wrapped around an investment. Private placement life insurance is a type of variable universal life insurance.

Source: troutman.com

Source: troutman.com

Only by working with a. “private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit. Ppli offers several advantages compared to standard policies. What is private placement life insurance? Allowing the policy’s cash value to.

![]() Source: aicpaconferences.com

Source: aicpaconferences.com

Private placement life insurance (ppli) is a life insurance policy wrapped around an investment. Private placement life insurance (ppli), in contrast, is a privately negotiated life insurance contract between insurance carrier and policy owner. Only by working with a. In addition to wanting to have exposure to these types of asset classes is generally going to be someone with a very high net worth. Private placement life insurance (“ppli”) is a variable universal life insurance product designed for high net worth investors.

Source: wealthmanagement.com

Source: wealthmanagement.com

It is offered by both domestic and foreign insurance companies and provides policy holders with sophisticated asset management choices, Private placement life insurance (“ppli”) is a variable universal life insurance product designed for high net worth investors. • private placement life insurance (ppli) is a variable life policy which is not registered with sec • ppli includes unregistered investment subaccount options in addition to registered investment subaccounts typically available in registered variable life (vul) policies In time, however, the market migrated to the united states, and applicable irs regulations followed. Private placement life insurance is a type of life insurance;

Source: expandedworldwideplanning.com

Source: expandedworldwideplanning.com

It is similar to a variable universal life insurance policy, but the investments owned by the policy are privately offered and meet very specific tax code requirements. Private placement life insurance avails policyholders of the following 8 benefits: At present, ppli policies are more often offered by banks, hedge. Private placement life insurance (ppli) is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit. Private placement life insurance is a type of variable universal life (vul) insurance1 that allows investments contained within the policy to grow with income and capital gains taxes deferred.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title private placement insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information