Pro rata insurance formula Idea

Home » Trending » Pro rata insurance formula IdeaYour Pro rata insurance formula images are available. Pro rata insurance formula are a topic that is being searched for and liked by netizens now. You can Get the Pro rata insurance formula files here. Get all free images.

If you’re looking for pro rata insurance formula pictures information related to the pro rata insurance formula topic, you have visit the right site. Our site frequently gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Pro Rata Insurance Formula. The following examples illustrate how this is used in each of the three situations mentioned in the previous section: The pro rata premium due for this period is ($1,000 / 365) x 270 = $739.73. To calculate your share, divide your 30 shares by the 100 total shares to get 0.3. A pro rata liability clause is a stipulation in an insurance policy that obliges the insurance company to cover only a percentage of a loss if the insured has other policies from other companies covering the same risk.

![Correct spelling for pro rata [Infographic] Correct spelling for pro rata [Infographic]](https://d65im9osfb1r5.cloudfront.net/spellchecker.net/7956566-pro-rata.png) Correct spelling for pro rata [Infographic] From spellchecker.net

Correct spelling for pro rata [Infographic] From spellchecker.net

In the insurance industry, pro rata means that claims are only paid out in proportion to the insurance. A pro rata liability clause is a stipulation in an insurance policy that obliges the insurance company to cover only a percentage of a loss if the insured has other policies from other companies covering the same risk. Of days in march) = $22.58. Pro rata condition of average relates to the proportion of an asset that an insurance policy covers. Pro rata bills are generally calculated by dividing the total billing amount by the minimum billing unit (e.g., unit of electricity, number of days, gigabytes of data) and then multiplying the result by the number of billing units actually used to arrive at the amount to be charged. After the insurer covers that percentage, the other companies pay for the rest.

Of days in march) = $22.58.

More › see more result ›› It can also be used to work out equitable payments when more than one insurer provides coverage. The following examples illustrate how this is used in each of the three situations mentioned in the previous section: The general annualized premium can be obtained with: Support.north52.com p = e / d * a; To determine shared liability, divide the first carrier’s coverage amount by the total coverage amount from all sources.

Source: tide.co

Source: tide.co

Casepeer calculates the pro rata amount for you. You can also multiply the total settlement amount by 0.3333333 or 33% then divide it by the total amount of the medical bills. Uses for calculating pro rata amounts you may also need to figure pro rata amounts in your personal life, such as if you are allocating a vehicle. In the insurance industry, pro rata means that claims are only paid out in proportion to the insurance. So for the example above, this would look as follows:

Source: proquestyamaha.web.fc2.com

Source: proquestyamaha.web.fc2.com

In the insurance industry, pro rata means that claims are only paid out in proportion to the insurance. This is applicable to many insurance transactions, such as insurance payout or cancellation. A formula used to determine the amount of coverage each insurer pays when more than one source of insurance is available to handle a given loss. A pro rata liability clause is a stipulation in an insurance policy that obliges the insurance company to cover only a percentage of a loss if the insured has other policies from other companies covering the same risk. =b4/yearfrac(b3, b2, 1) assuming there�s no mandated convention for.

Source: sarah-louise-omoore.blogspot.com

=b4/yearfrac(b3, b2, 1) assuming there�s no mandated convention for. Short rate short rate (90% pro rata) pro rata. Your formula assumes annual policies. Take the coverage written by company a, divide that amount by the total coverage written by all sources and multiply the resulting percentage by the actual loss amount. You can use this formula if you would like to verify the calculations.

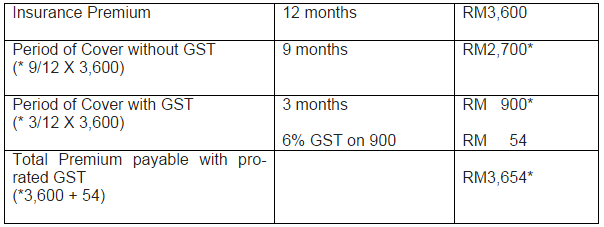

Source: tourismstyle.co

Source: tourismstyle.co

Support.north52.com p = e / d * a; To calculate your share, divide your 30 shares by the 100 total shares to get 0.3. You can also multiply the total settlement amount by 0.3333333 or 33% then divide it by the total amount of the medical bills. Take the coverage written by company a, divide that amount by the total coverage written by all sources and multiply the resulting percentage by the actual loss amount. =b4/yearfrac(b3, b2, 1) assuming there�s no mandated convention for.

Source: formconnections.com

Source: formconnections.com

You can also multiply the total settlement amount by 0.3333333 or 33% then divide it by the total amount of the medical bills. Calculating cancellation pro rata earned refund. Then, multiply 0.3 by $20,000 to find you get to keep $6,000 of the profits. Uses for calculating pro rata amounts you may also need to figure pro rata amounts in your personal life, such as if you are allocating a vehicle. After the insurer covers that percentage, the other companies pay for the rest.

Source: proquestyamaha.web.fc2.com

Source: proquestyamaha.web.fc2.com

Short rate short rate (90% pro rata) pro rata. The general annualized premium can be obtained with: I assume that b9 (total beginning budget) is =sum(b4:b8). A formula used to determine the amount of coverage each insurer pays when more than one source of insurance is available to handle a given loss. Calculating cancellation pro rata earned refund.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Of days of occupancy) = $361.28. Short rate short rate (90% pro rata) pro rata. It can also be used to work out equitable payments when more than one insurer provides coverage. Pro rata for interest rates pro rata calculations are also used to. Then, multiply 0.3 by $20,000 to find you get to keep $6,000 of the profits.

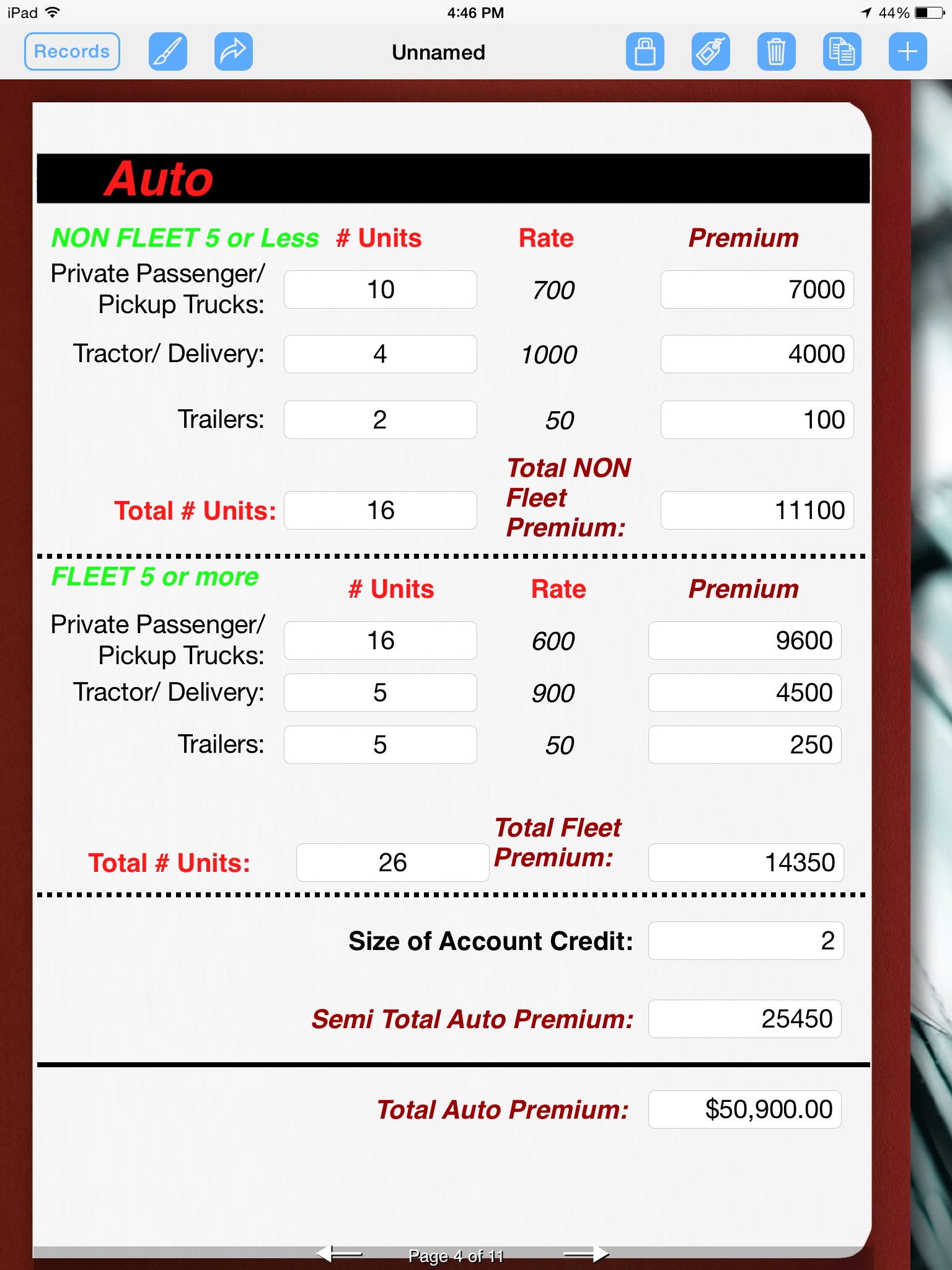

Source: autofreaks.com

Source: autofreaks.com

Per share dividend = total dividends / total number of outstanding shares you can then multiply the per share dividend amount by the total number of shares each shareholder possesses. A simple formula to calculate pro rata dividends is: Pro rata for interest rates pro rata calculations are also used to. To determine shared liability, divide the first carrier’s coverage amount by the total coverage amount from all sources. The simplest way to work out how much you’d be paid on a pro rata basis is dividing the annual salary by the number of full time hours, and then times this number by the pro rata hours.

Source: coursehero.com

Per share dividend = total dividends / total number of outstanding shares you can then multiply the per share dividend amount by the total number of shares each shareholder possesses. Support.north52.com p = e / d * a; So for the example above, this would look as follows: Although vertafore has made every effort to insure the accuracy of the calculator, vertafore does not guarantee the accuracy of the calculator or the suitability for a specific purpose. Pro rata bills are generally calculated by dividing the total billing amount by the minimum billing unit (e.g., unit of electricity, number of days, gigabytes of data) and then multiplying the result by the number of billing units actually used to arrive at the amount to be charged.

Source: retirementlc.com

Source: retirementlc.com

The general annualized premium can be obtained with: Pro rata bills are generally calculated by dividing the total billing amount by the minimum billing unit (e.g., unit of electricity, number of days, gigabytes of data) and then multiplying the result by the number of billing units actually used to arrive at the amount to be charged. Support.north52.com p = e / d * a; Uses for calculating pro rata amounts you may also need to figure pro rata amounts in your personal life, such as if you are allocating a vehicle. After the insurer covers that percentage, the other companies pay for the rest.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

You can use this formula if you would like to verify the calculations. So for the example above, this would look as follows: A formula used to determine the amount of coverage each insurer pays when more than one source of insurance is available to handle a given loss. You can use this formula if you would like to verify the calculations. Uses for calculating pro rata amounts you may also need to figure pro rata amounts in your personal life, such as if you are allocating a vehicle.

Source: learncbse.in

Source: learncbse.in

You can also multiply the total settlement amount by 0.3333333 or 33% then divide it by the total amount of the medical bills. To calculate your share, divide your 30 shares by the 100 total shares to get 0.3. A simple formula to calculate pro rata dividends is: Support.north52.com p = e / d * a; A claim will only be paid out on an asset based on.

Source: support.north52.com

Source: support.north52.com

Of days in march) = $22.58. Pro rata insurance is a kind of policy that upholds a standard of payout that the industry deems proportionate. A simple formula to calculate pro rata dividends is: So for the example above, this would look as follows: You can also multiply the total settlement amount by 0.3333333 or 33% then divide it by the total amount of the medical bills.

Source: slideserve.com

Source: slideserve.com

Pro rata bills are generally calculated by dividing the total billing amount by the minimum billing unit (e.g., unit of electricity, number of days, gigabytes of data) and then multiplying the result by the number of billing units actually used to arrive at the amount to be charged. Pro rata bills are generally calculated by dividing the total billing amount by the minimum billing unit (e.g., unit of electricity, number of days, gigabytes of data) and then multiplying the result by the number of billing units actually used to arrive at the amount to be charged. Pro rata insurance is a kind of policy that upholds a standard of payout that the industry deems proportionate. The simplest way to work out how much you’d be paid on a pro rata basis is dividing the annual salary by the number of full time hours, and then times this number by the pro rata hours. Casepeer calculates the pro rata amount for you.

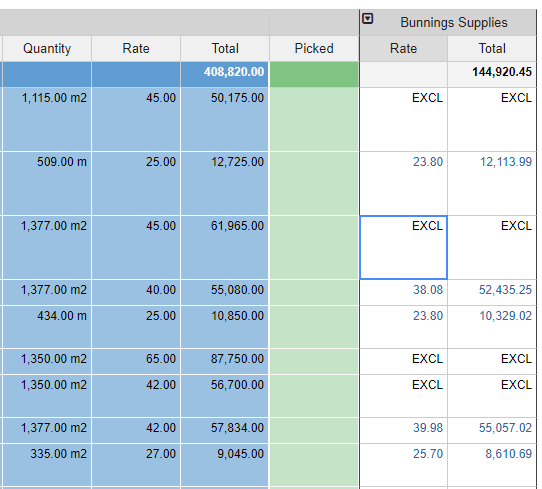

Source: bsoft.zendesk.com

Source: bsoft.zendesk.com

Although vertafore has made every effort to insure the accuracy of the calculator, vertafore does not guarantee the accuracy of the calculator or the suitability for a specific purpose. Casepeer calculates the pro rata amount for you. In the insurance industry, pro rata means that claims are only paid out in proportion to the insurance. Of days in march) = $22.58. The formula for computing pro rata coverage is a tool insurance companies use to determine equitable coverage rates.

Source: universulfiscal.ro

Source: universulfiscal.ro

You can use this formula if you would like to verify the calculations. Support.north52.com p = e / d * a; You can also multiply the total settlement amount by 0.3333333 or 33% then divide it by the total amount of the medical bills. In the insurance industry, pro rata means that claims are only paid out in proportion to the insurance. Uses for calculating pro rata amounts you may also need to figure pro rata amounts in your personal life, such as if you are allocating a vehicle.

![Correct spelling for pro rata [Infographic] Correct spelling for pro rata [Infographic]](https://d65im9osfb1r5.cloudfront.net/spellchecker.net/7956566-pro-rata.png) Source: spellchecker.net

Source: spellchecker.net

You can also multiply the total settlement amount by 0.3333333 or 33% then divide it by the total amount of the medical bills. 750 x 25 (pro rata hours) = £18,750. You can also multiply the total settlement amount by 0.3333333 or 33% then divide it by the total amount of the medical bills. =b4/yearfrac(b3, b2, 1) assuming there�s no mandated convention for. More › see more result ››

Source: proquestyamaha.web.fc2.com

Source: proquestyamaha.web.fc2.com

A simple formula to calculate pro rata dividends is: =b4/yearfrac(b3, b2, 1) assuming there�s no mandated convention for. Of days of occupancy) = $361.28. £30,000 (annual salary) ÷ 40 (full time hours) = 750. Per share dividend = total dividends / total number of outstanding shares you can then multiply the per share dividend amount by the total number of shares each shareholder possesses.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title pro rata insurance formula by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information