Professional liability insurance audit information

Home » Trend » Professional liability insurance audit informationYour Professional liability insurance audit images are available. Professional liability insurance audit are a topic that is being searched for and liked by netizens today. You can Download the Professional liability insurance audit files here. Get all free photos and vectors.

If you’re searching for professional liability insurance audit pictures information related to the professional liability insurance audit keyword, you have visit the ideal site. Our website frequently gives you hints for viewing the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

Professional Liability Insurance Audit. Insurance audit the insurance audit is a process common to the insurance industry. One of the most important coverages to have as an auditor, professional liability insurance, also known as errors & omissions insurance, protects your auditing business from potential client lawsuits due to dissatisfaction with your professional work. These lawsuits may stem from a number of allegations, including claims of negligence,. Making a calculation error on an audit, causing a client to have to pay higher penalties.

Preparing for a Workers� Compensation Audit Virginia From theandrewagency.com

Preparing for a Workers� Compensation Audit Virginia From theandrewagency.com

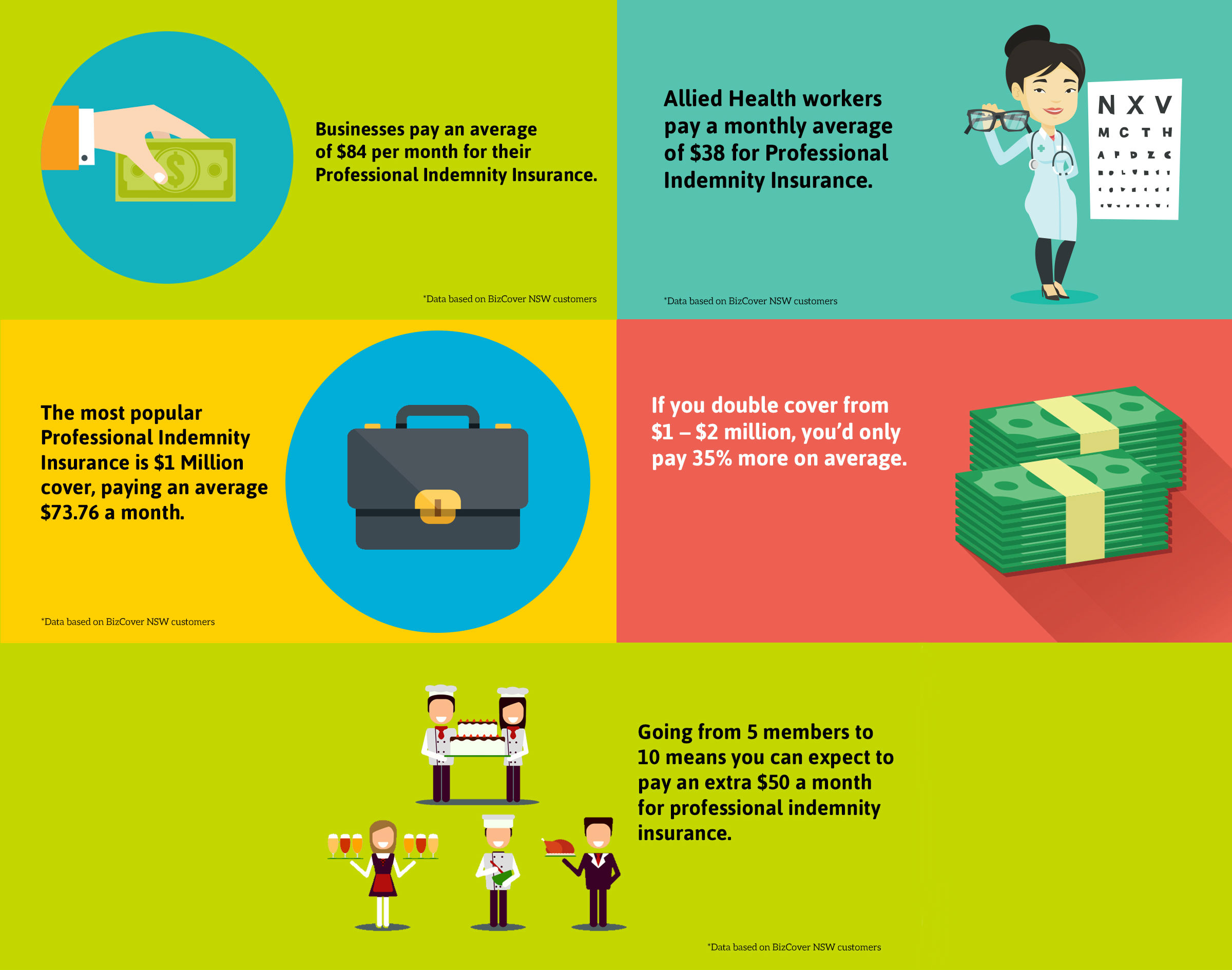

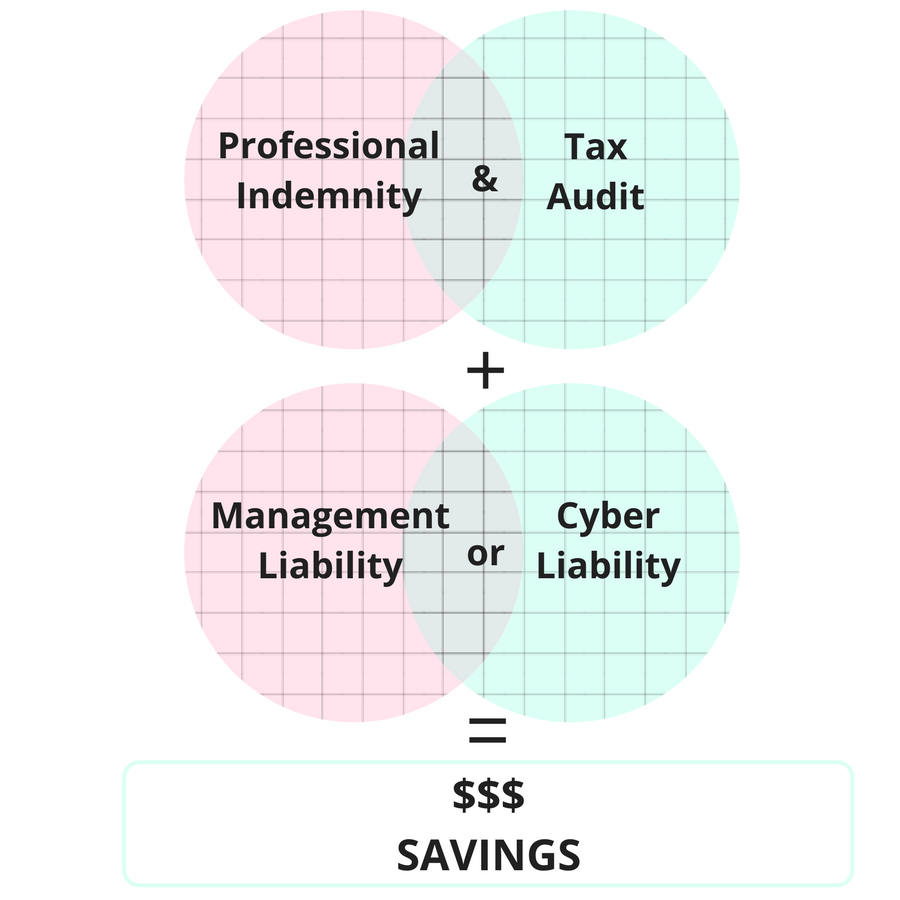

A general liability insurance audit examines your business’ payroll and risk exposure. Professional liability insurance can help cover you for scenarios like: Annual professional liability insurance (pli) audit march 18, 2021 in november, the college conducted the second annual audit of professional liability insurance (pli) to gauge compliance with bylaw #82. Entering data wrong in an audit, causing your client to face incorrect financial penalties. Professional liability insurance it is the contract lawyer or paralegal�s responsibility to ensure that his or her professional liability insurance practice coverage is in place and properly accommodates the contract lawyer or paralegal work. The insurance coverage in a professional liability insurance contract of an audit firm shall be at least ten times the amount of the fees of the two biggest client contracts of the last ended activity report period, but not less than 64,000 euros for one insured event and ten times the amount of the fees of the three biggest client contracts of the last ended activity report.

The policy provides coverage for damages and claim expenses because of a covered claim arising from the performance of professional accounting services within the scope of the policy that may include tax preparation and planning, accounting services,.

The effect of insurance and the law of joint and several liability has given rise to auditors (and other professionals) often being singled out as the sole target for legal action in proceedings for property damage and purely financial loss, even when the professional is only one of the parties involved. Entering data wrong in an audit, causing your client to face incorrect financial penalties. Professional liability insurance group offers your practice a unique strategic business protection product for medical billing audits. When your client finds out about the error, they sue your firm. Of the 364 registrants selected for the audit, 5% of the sample were found to have gaps or invalid insurance. We perform an audit to ensure you have paid no more or less than the appropriate premium for your exposure.

Source: cpapracticeadvisor.com

Source: cpapracticeadvisor.com

These lawsuits may stem from a number of allegations, including claims of negligence,. We perform an audit to ensure you have paid no more or less than the appropriate premium for your exposure. This factsheet provides guidance on the liability for professional negligence which members may incur because of an act or default by them (or by their employees or associates) which results in a financial loss to a client or a third party to whom a duty of care is owed. What does the auditor professional liability policy cover? An audit is an examination of your operation, records and books

Source: ltmonline.com

Source: ltmonline.com

Insurance audit the insurance audit is a process common to the insurance industry. The policy provides coverage for damages and claim expenses because of a covered claim arising from the performance of professional accounting services within the scope of the policy that may include tax preparation and planning, accounting services,. An accurate audit is a benefit to you and your business and could save you time and money. The aicpa professional liability insurance program will award a new premium credit to firms that are members of the center. This factsheet provides guidance on the liability for professional negligence which members may incur because of an act or default by them (or by their employees or associates) which results in a financial loss to a client or a third party to whom a duty of care is owed.

Source: cutcompcosts.com

Source: cutcompcosts.com

The professional liability insurance policy (accountants & auditors) is targeted towards accountants and auditors who are 18 years or over and holding the necessary qualifications and warrant to practice their profession in malta and who require professional liability cover for their profession and/or professional activities. Entering data wrong in an audit, causing your client to face incorrect financial penalties. Annual professional liability insurance (pli) audit march 18, 2021 in november, the college conducted the second annual audit of professional liability insurance (pli) to gauge compliance with bylaw #82. Professional liability insurance it is the contract lawyer or paralegal�s responsibility to ensure that his or her professional liability insurance practice coverage is in place and properly accommodates the contract lawyer or paralegal work. The professional liability insurance group’s website was created and intended to supply the working professional with general liability insurance information.

Source: bizcover.com.au

Source: bizcover.com.au

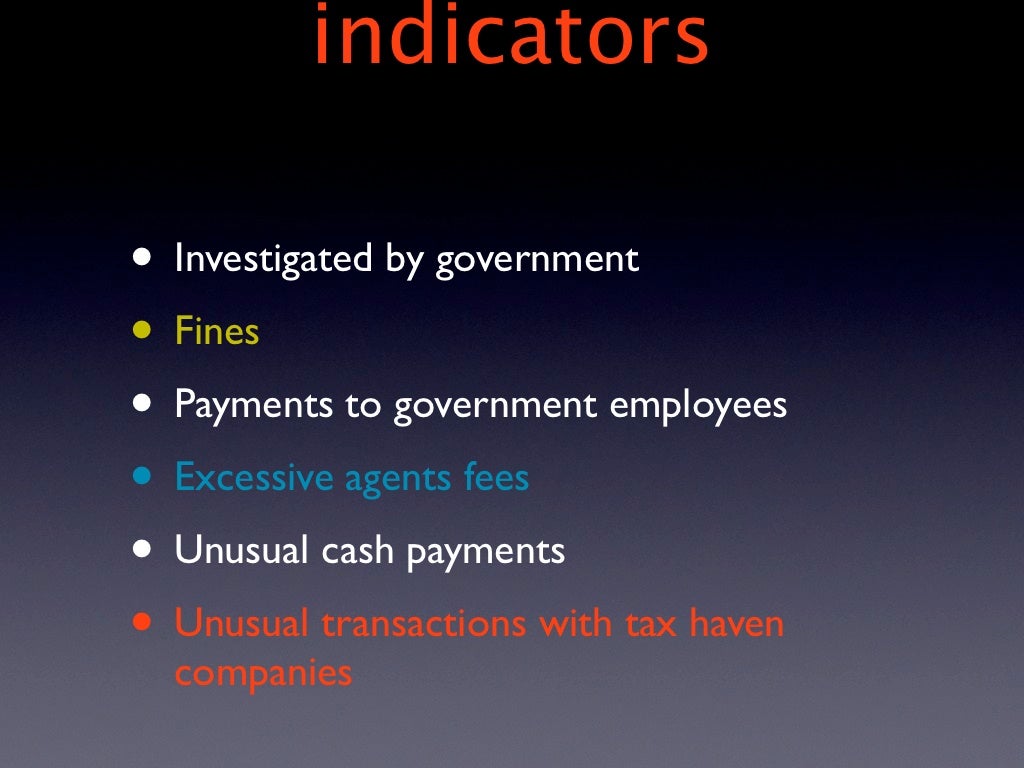

The former occur when individuals or organisations breach a government imposed law; Professional liability insurance audit february 28, 2022 in november 2021, the college conducted an annual audit of professional liability insurance (pli) to gauge compliance with bylaw 82. The professional liability policy will pay damages and claim expenses arising out of a covered negligent act, error or omission in rendering or failing to render professional services. Making a calculation error on an audit, causing a client to have to pay higher penalties. Next to professional liability coverage, general liability is one of the foundational coverages you need for your insurance policy.

Source: graceinsurance.com.au

Source: graceinsurance.com.au

Insurance audit the insurance audit is a process common to the insurance industry. Affordable professional liability quotes for accountants and auditors. The professional liability policy will pay damages and claim expenses arising out of a covered negligent act, error or omission in rendering or failing to render professional services. Types of liability auditors are potentially liable for both criminal and civil offences. Of the 364 registrants selected for the audit, 5% of the sample were found to have gaps or invalid insurance.

Source: sadlerco.com

Source: sadlerco.com

Types of liability auditors are potentially liable for both criminal and civil offences. Professional liability insurance group offers your practice a unique strategic business protection product for medical billing audits. The cost of professional liability insurance for accountants, cpas, and auditors is less than $45 per month, or $500 annually.also known as errors and omissions (e&o) or malpractice insurance, this policy covers legal costs if an accounting or auditing business is sued for substandard work. Civil law, in contrast, deals with disputes between individuals and/or organisations. Next to professional liability coverage, general liability is one of the foundational coverages you need for your insurance policy.

Source: slideshare.net

Source: slideshare.net

Professional liability insurance (pli)1 for auditors is designed to protect audit firms from bearing the cost of defending against a negligence claim made by investors and paying out damage awards from such civil lawsuits. For instance, if someone sues you because you made an error while auditing their business, professional liability insurance will help to cover the cost of any legal. A general liability insurance audit examines your business’ payroll and risk exposure. Professional liability insurance group offers your practice a unique strategic business protection product for medical billing audits. The former occur when individuals or organisations breach a government imposed law;

Source: cityscapeinsurance.com

Source: cityscapeinsurance.com

The aicpa employee benefit plan audit quality center (ebpaqc) is pleased to offer a new benefit to center members in recognition of your commitment to performing quality audits. You can get competitive quotes from one or more professional liability insurance companies by completing an online application form at the top of this page. Professional liability insurance (pli)1 for auditors is designed to protect audit firms from bearing the cost of defending against a negligence claim made by investors and paying out damage awards from such civil lawsuits. The effect of insurance and the law of joint and several liability has given rise to auditors (and other professionals) often being singled out as the sole target for legal action in proceedings for property damage and purely financial loss, even when the professional is only one of the parties involved. Of the 289 registrants selected for the audit, 7.6% were found to have gaps or invalid insurance, which is up slightly from last year.

Source: mcgowanprograms.com

Source: mcgowanprograms.com

Of the 364 registrants selected for the audit, 5% of the sample were found to have gaps or invalid insurance. Our goal, purpose and structure have been built upon the principal that the client comes first. An audit is an examination of your operation, records and books The effect of insurance and the law of joint and several liability has given rise to auditors (and other professionals) often being singled out as the sole target for legal action in proceedings for property damage and purely financial loss, even when the professional is only one of the parties involved. We perform an audit to ensure you have paid no more or less than the appropriate premium for your exposure.

Source: tdcpatax.com

Source: tdcpatax.com

Of the 364 registrants selected for the audit, 5% of the sample were found to have gaps or invalid insurance. We provide private medical practices with more than quality insurance carriers for medical billing audits (including rac audits) whom demonstrate professional expertise, sound risk management guidance, and first rate legal. For example, while performing an audit, you spill a. Of the 364 registrants selected for the audit, 5% of the sample were found to have gaps or invalid insurance. What does the auditor professional liability policy cover?

Source: hubinternational.com

Source: hubinternational.com

One of the most important coverages to have as an auditor, professional liability insurance, also known as errors & omissions insurance, protects your auditing business from potential client lawsuits due to dissatisfaction with your professional work. An audit is an examination of your operation, records and books The professional liability insurance group’s website was created and intended to supply the working professional with general liability insurance information. A general liability insurance audit examines your business’ payroll and risk exposure. These lawsuits may stem from a number of allegations, including claims of negligence,.

Source: interprac.com.au

Source: interprac.com.au

Rates for professional liability insurance for accountants and auditors are affordably priced. What does the auditor professional liability policy cover? The former occur when individuals or organisations breach a government imposed law; These lawsuits may stem from a number of allegations, including claims of negligence,. Our goal, purpose and structure have been built upon the principal that the client comes first.

Source: professionalinforme.blogspot.com

Source: professionalinforme.blogspot.com

The aicpa employee benefit plan audit quality center (ebpaqc) is pleased to offer a new benefit to center members in recognition of your commitment to performing quality audits. The cost of professional liability insurance for accountants, cpas, and auditors is less than $45 per month, or $500 annually.also known as errors and omissions (e&o) or malpractice insurance, this policy covers legal costs if an accounting or auditing business is sued for substandard work. Types of liability auditors are potentially liable for both criminal and civil offences. An audit makes sure you’re paying the correct amount for general liability insurance, and that you’re getting the right amount of coverage for your business. Professional liability insurance audit february 28, 2022 in november 2021, the college conducted an annual audit of professional liability insurance (pli) to gauge compliance with bylaw 82.

Source: theandrewagency.com

Source: theandrewagency.com

These lawsuits may stem from a number of allegations, including claims of negligence,. This factsheet provides guidance on the liability for professional negligence which members may incur because of an act or default by them (or by their employees or associates) which results in a financial loss to a client or a third party to whom a duty of care is owed. Professional liability insurance can help cover you for scenarios like: We provide private medical practices with more than quality insurance carriers for medical billing audits (including rac audits) whom demonstrate professional expertise, sound risk management guidance, and first rate legal. The aicpa professional liability insurance program will award a new premium credit to firms that are members of the center.

Source: slideshare.net

Source: slideshare.net

Civil law, in contrast, deals with disputes between individuals and/or organisations. Types of liability auditors are potentially liable for both criminal and civil offences. The effect of insurance and the law of joint and several liability has given rise to auditors (and other professionals) often being singled out as the sole target for legal action in proceedings for property damage and purely financial loss, even when the professional is only one of the parties involved. Professional liability insurance audit february 28, 2022 in november 2021, the college conducted an annual audit of professional liability insurance (pli) to gauge compliance with bylaw 82. Annual professional liability insurance (pli) audit march 18, 2021 in november, the college conducted the second annual audit of professional liability insurance (pli) to gauge compliance with bylaw #82.

Source: cpapracticeadvisor.com

Source: cpapracticeadvisor.com

Making a calculation error on an audit, causing a client to have to pay higher penalties. The cost of professional liability insurance for accountants, cpas, and auditors is less than $45 per month, or $500 annually.also known as errors and omissions (e&o) or malpractice insurance, this policy covers legal costs if an accounting or auditing business is sued for substandard work. Types of liability auditors are potentially liable for both criminal and civil offences. For instance, if someone sues you because you made an error while auditing their business, professional liability insurance will help to cover the cost of any legal. Professional liability insurance can help cover you for scenarios like:

Source: cpapracticeadvisor.com

Source: cpapracticeadvisor.com

Professional liability insurance can help cover you for scenarios like: This coverage protects you in the event of bodily injury or property damage claims. The professional liability policy will pay damages and claim expenses arising out of a covered negligent act, error or omission in rendering or failing to render professional services. We perform an audit to ensure you have paid no more or less than the appropriate premium for your exposure. Professional liability insurance (pli)1 for auditors is designed to protect audit firms from bearing the cost of defending against a negligence claim made by investors and paying out damage awards from such civil lawsuits.

Source: blog.plrisk.com

Source: blog.plrisk.com

What is the purpose of a general liability insurance audit? Next to professional liability coverage, general liability is one of the foundational coverages you need for your insurance policy. We perform an audit to ensure you have paid no more or less than the appropriate premium for your exposure. Professional liability insurance can help cover you for scenarios like: The aicpa employee benefit plan audit quality center (ebpaqc) is pleased to offer a new benefit to center members in recognition of your commitment to performing quality audits.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title professional liability insurance audit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information