Professional liability insurance vs general liability Idea

Home » Trend » Professional liability insurance vs general liability IdeaYour Professional liability insurance vs general liability images are available. Professional liability insurance vs general liability are a topic that is being searched for and liked by netizens now. You can Get the Professional liability insurance vs general liability files here. Get all free photos and vectors.

If you’re searching for professional liability insurance vs general liability images information related to the professional liability insurance vs general liability keyword, you have pay a visit to the right blog. Our site frequently provides you with hints for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that match your interests.

Professional Liability Insurance Vs General Liability. General liability and professional liability insurance serve different purposes. General liability insurance and professional liability insurance can both protect businesses in case of lawsuits. This can include professional negligence, omission, and anything under that category. That said, there are a lot of differences as well.

General Liability vs. Professional Liability Insurance From embroker.com

General Liability vs. Professional Liability Insurance From embroker.com

That said, there are a lot of differences as well. General liability and professional liability help alleviate the financial burden these incidents cause, so your business feels minimal impact following a claim. Professional liability is usually written on a claims made basis. Think of professional liability insurance (also called errors & omissions) as an insurance policy for people who make a living off their expertise. There are a lot of similarities between general liability and professional liability insurance, such as: Coverage for unforeseen and unintentional damage.

General liability and professional liability insurance are both designed to:

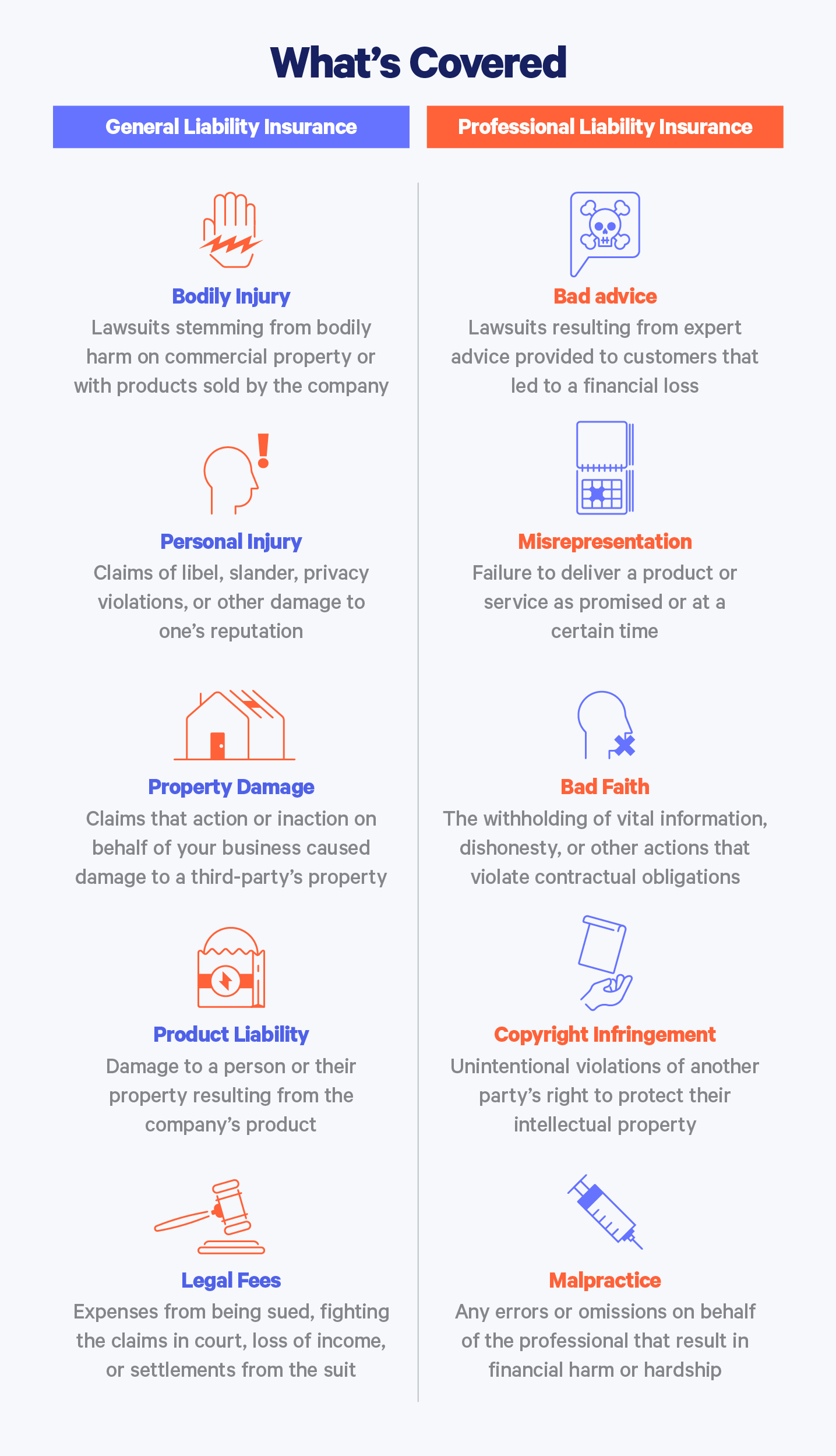

The main difference between general liability and professional liability is in the types of risks they each cover. Coverage for unforeseen and unintentional damage. General liability insurance covers physical risk, which includes property damage and injuries. Professional liability insurance covers things like negligence, omissions, and errors. Now let’s go through where the coverage diverges. That said, there are a lot of differences as well.

Source: insurecherokee.com

Source: insurecherokee.com

But they cover different types of risks: This policy will cover the legal fees and costs associated with your legal defense, settlements, and medical payments. Professional liability covers your legal expenses if you are found to have been negligent with your client. Unlike general liability insurance, professional liability does not typically cover. The primary difference between general liability and professional liability is the type of risks each coverage.

Source: berryinsurance.com

Coverage for unforeseen and unintentional damage. The former covers claims for bodily injury and property damage, while the latter covers claims for financial losses resulting from your professional negligence, errors, or omissions. But they cover different types of risks: Professional liability covers your legal expenses if you are found to have been negligent with your client. There’s a lot of confusion among people over the difference between general liability insurance and professional liability insurance.

Source: nohassleins.net

Source: nohassleins.net

In contrast to general liability, professional liability is more specific. General liability mainly covers the. There’s a lot of confusion among people over the difference between general liability insurance and professional liability insurance. Both general liability and professional liability insurance cover a variety of common business risks.though similar in nature, the primary dividing line between the two coverages is physical damage. General liability insurance and professional liability insurance can both protect businesses in case of lawsuits.

Source: embroker.com

Source: embroker.com

In other words, professional liability insurance protects your business financially if a client alleges that the work you’ve done is unsatisfactory, incomplete, or was done improperly and it leads to a loss other than those types covered under a general liability policy. Professional liability is usually written on a claims made basis. Let’s break these terms down. Professional liability insurance covers things like negligence, omissions, and errors. Timing and when events happen.

Source: everquote.com

Source: everquote.com

In contrast to general liability, professional liability is more specific. Specifically, it covers liabilities that your specific professional practice might have caused. Meanwhile, general liability is usually written on an occurrence basis. Now let’s go through where the coverage diverges. There are a lot of similarities between general liability and professional liability insurance, such as:

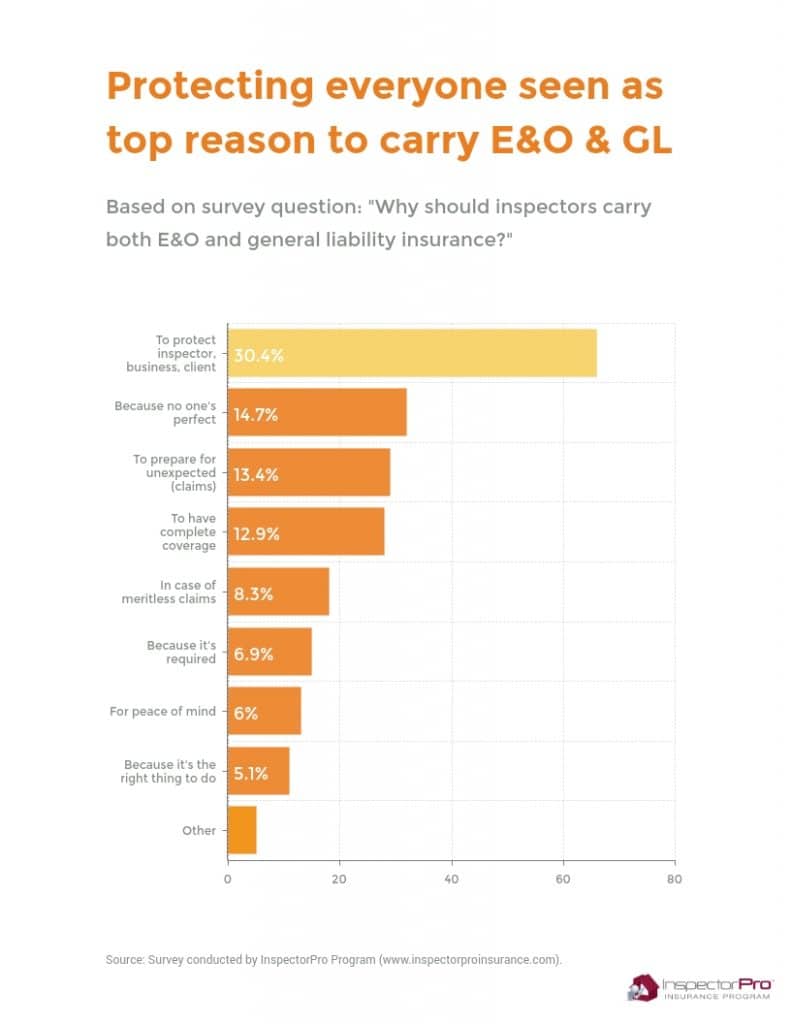

Source: inspectorproinsurance.com

Source: inspectorproinsurance.com

Now let’s go through where the coverage diverges. General liability and professional liability help alleviate the financial burden these incidents cause, so your business feels minimal impact following a claim. But they cover different types of risks: Let’s break these terms down. In contrast to general liability, professional liability is more specific.

Source: apogeeinsgroup.com

Source: apogeeinsgroup.com

A general liability policy typically insures against claims of bodily or personal injury. Unlike general liability insurance, professional liability does not typically cover. With this kind of insurance, the costs involved in defending the claim including legal fees are taken care of as well as any potential compensation and damages if you are found guilty. This can include professional negligence, omission, and anything under that category. General liability and professional liability insurance serve different purposes.

Source: embroker.com

Source: embroker.com

To put it simply, both. General liability and professional liability help alleviate the financial burden these incidents cause, so your business feels minimal impact following a claim. Professional liability insurance covers claims of negligence related to professional advice or services. General liability insurance provides coverage for these areas of your business: In contrast to general liability, professional liability is more specific.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

This can include professional negligence, omission, and anything under that category. Think of professional liability insurance (also called errors & omissions) as an insurance policy for people who make a living off their expertise. Protection against the reputation of your medical practice. General liability is for claims based on. There are times when one type of policy will provide additional types of coverage, but business owners will need both types of coverage if their enterprise is open for.

Source: businessinsurancequotes.com

Source: businessinsurancequotes.com

Timing and when events happen. There are a lot of similarities between general liability and professional liability insurance, such as: There are times when one type of policy will provide additional types of coverage, but business owners will need both types of coverage if their enterprise is open for. Professional liability insurance covers claims of negligence related to professional advice or services. General liability insurance protects the insured from lawsuits over physical damage, like slipping and falling, while professional liability.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Professional liability insurance covers things like negligence, omissions, and errors. What are the differences between general liability vs. Both general liability and professional liability insurance cover a variety of common business risks.though similar in nature, the primary dividing line between the two coverages is physical damage. Only general liability insurance can spare your business from lawsuits over a visitor slipping and falling on your commercial property. The former covers claims for bodily injury and property damage, while the latter covers claims for financial losses resulting from your professional negligence, errors, or omissions.

Source: embroker.com

Source: embroker.com

With this kind of insurance, the costs involved in defending the claim including legal fees are taken care of as well as any potential compensation and damages if you are found guilty. According to the international risk management institute (irmi), professional liability coverage seeks to indemnify, or “make whole,” third parties who suffer economic or financial loss as a result of services provided by accountants, attorneys, consultants, brokers and other professionals. Meanwhile, general liability is usually written on an occurrence basis. Unlike general liability insurance, professional liability does not typically cover. And only professional liability insurance can shield you from the high cost of alleged professional mistakes that cause a third party financial losses.

Source: embroker.com

Source: embroker.com

General liability and professional liability insurance are both designed to: Both general liability and professional liability insurance cover a variety of common business risks.though similar in nature, the primary dividing line between the two coverages is physical damage. General liability and professional liability help alleviate the financial burden these incidents cause, so your business feels minimal impact following a claim. Timing and when events happen. Think of professional liability insurance (also called errors & omissions) as an insurance policy for people who make a living off their expertise.

Source: youtube.com

Source: youtube.com

Think of professional liability insurance (also called errors & omissions) as an insurance policy for people who make a living off their expertise. And only professional liability insurance can shield you from the high cost of alleged professional mistakes that cause a third party financial losses. The main difference between general liability and professional liability is in the types of risks they each cover. General liability and professional liability help alleviate the financial burden these incidents cause, so your business feels minimal impact following a claim. What are the differences between general liability vs.

Source: accidentlawyersfirm.com

Source: accidentlawyersfirm.com

General liability and professional liability insurance are both designed to: Now let’s go through where the coverage diverges. General liability insurance typically covers events that could happen to any business, hence the name “general” liability. Protection against the reputation of your medical practice. This can include professional negligence, omission, and anything under that category.

Source: gunnmowery.com

Source: gunnmowery.com

Financial coverage for you and your patients. Both general liability and professional liability insurance cover a variety of common business risks.though similar in nature, the primary dividing line between the two coverages is physical damage. With this kind of insurance, the costs involved in defending the claim including legal fees are taken care of as well as any potential compensation and damages if you are found guilty. Whereas general liability insurance covers mishaps that can happen to any business owner, professional liability insurance covers the unique lawsuits that experts may face. In contrast to general liability, professional liability is more specific.

Source: embroker.com

Source: embroker.com

General liability insurance covers physical risk, which includes property damage and injuries. Let’s break these terms down. General liability is for claims based on. According to the international risk management institute (irmi), professional liability coverage seeks to indemnify, or “make whole,” third parties who suffer economic or financial loss as a result of services provided by accountants, attorneys, consultants, brokers and other professionals. Both general liability and professional liability insurance cover a variety of common business risks.though similar in nature, the primary dividing line between the two coverages is physical damage.

Source: youtube.com

Source: youtube.com

Professional liability is usually written on a claims made basis. Think of professional liability insurance (also called errors & omissions) as an insurance policy for people who make a living off their expertise. General liability and professional liability insurance are both designed to: In contrast to general liability, professional liability is more specific. But they cover different types of risks:

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title professional liability insurance vs general liability by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information