Progressive offer gap insurance information

Home » Trend » Progressive offer gap insurance informationYour Progressive offer gap insurance images are available. Progressive offer gap insurance are a topic that is being searched for and liked by netizens now. You can Download the Progressive offer gap insurance files here. Find and Download all free images.

If you’re searching for progressive offer gap insurance pictures information linked to the progressive offer gap insurance keyword, you have come to the ideal site. Our website frequently provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

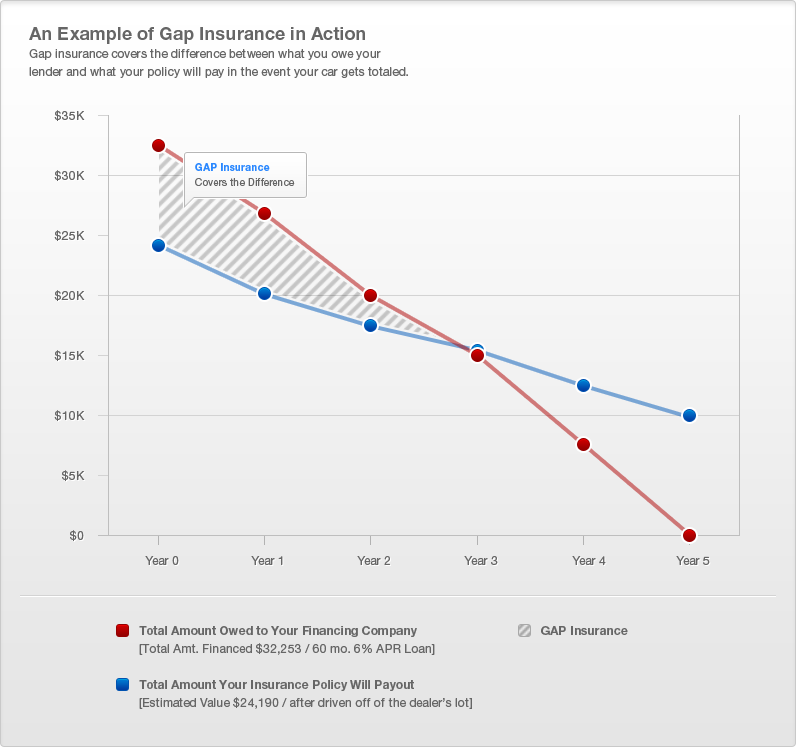

Progressive Offer Gap Insurance. Progressive calls it loan/lease payoff, but what they offer is indeed gap insurance. Progressive’s gap insurance is limited to 125% of your vehicle’s actual cash value. This product covers the difference between your car’s value and what you owe on your car lease or loan. Progressive does not currently offer commercial auto insurance for the following vehicle uses, regardless of the business or vehicle type:

Gap Insurance Florida Geico npa1 From npa1.org

Gap Insurance Florida Geico npa1 From npa1.org

Be careful when you see the term loan/lease payoff because it can sometimes refer to true gap insurance. It covers up to 25 percent of the actual cash value of your car. Like most other carriers, you must purchase both collision comprehensive and collision coverage to buy gap insurance from progressive. With a gap insurance policy, esurance will pay up to 25% of your car’s value if it’s stolen or totaled in an accident. Also known as gap insurance, this can cover the difference between what you owe on your car and what it’s currently worth (up to 25% of the cash value) Alternatively, progressive offers gap insurance, which pays for the difference between the value of a car at the time it’s totaled or stolen and the balance of its loan or lease.

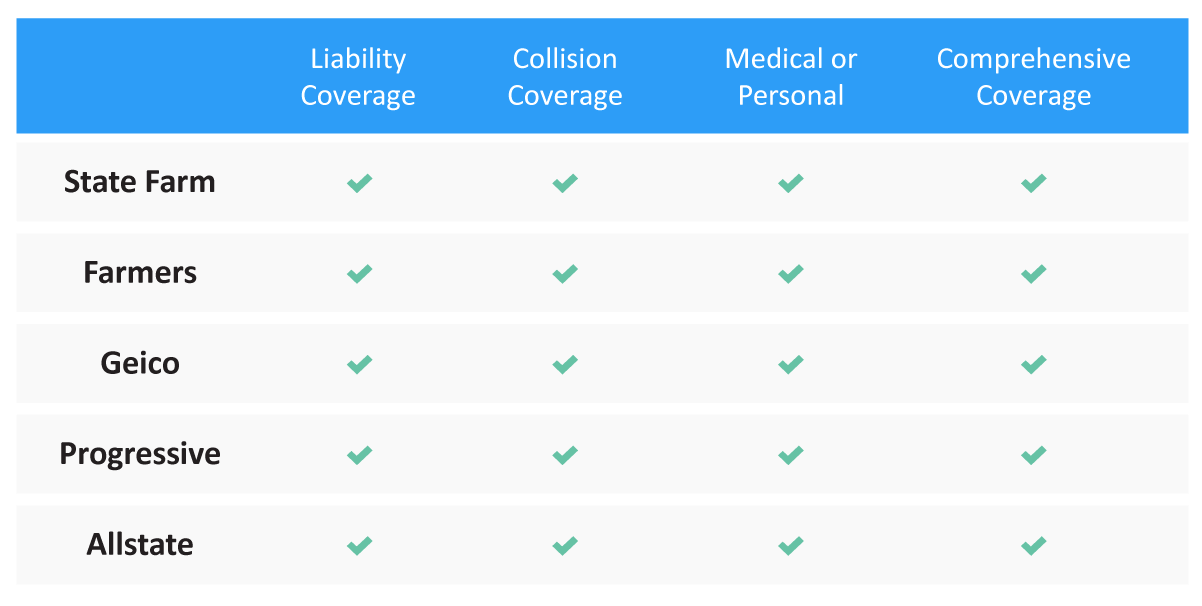

State farm, aaa, and usaa and some other insurance companies offer gap insurance on vehicles which have been financed through their financing companies.

Progressive’s gap insurance is limited to 125% of your vehicle’s actual cash value. Be careful when you see the term loan/lease payoff because it can sometimes refer to true gap insurance. Get free progressive quotes >> allstate the cheapest insurance is not always the best. If your car is totaled, progressive�s gap insurance, also called loan/lease payoff coverage, covers the difference between your loan balance and what your car is worth, minus your deductible. They’ll forgive our remaining balance on the loan if the car were to be totaled. With a gap insurance policy, esurance will pay up to 25% of your car’s value if it’s stolen or totaled in an accident.

Source: eliteass.blogspot.com

Source: eliteass.blogspot.com

With a gap insurance policy, esurance will pay up to 25% of your car’s value if it’s stolen or totaled in an accident. Vehicles that are open to the public, including: Dealerships offer gap insurance policies. Yes, progressive offers gap insurance for about $5 per month, on average. Tow trucks that derive more than 25 percent of their revenue from repossession;

Source: eliteass.blogspot.com

Source: eliteass.blogspot.com

Progressive offers loan or lease payoff coverage which is like gap insurance. It covers up to 25 percent of the actual cash value of your car. Progressive boasts that its gap insurance only adds about $5 a month to your premium and covers the difference between the value of your car and the amount you owe on your loan. Like many insurance providers, it calls it loan/lease coverage instead of gap. Some insurance companies offer alternatives to gap insurance, such as loan/lease coverage.

Source: eliteass.blogspot.com

Source: eliteass.blogspot.com

Progressive does not offer gap insurance, so we purchased gap coverage from our lender (dcu). Yes, progressive offers gap insurance for about $5 per month, on average. Progressive does not offer gap insurance, so we purchased gap coverage from our lender (dcu). Esurance allstate owns esurance, so they�re listed together. Progressive offers loan or lease payoff coverage which is like gap insurance.

Source: eliteass.blogspot.com

Source: eliteass.blogspot.com

Like many insurance providers, it calls it loan/lease coverage instead of gap. Progressive offers insurance that can cover anything from a classic car to a boat or golf cart. The company also provides home, health,. Before we tackle specific questions, like does progressive’s auto insurance include gap insurance, you might be wondering, what is gap coverage? Progressive boasts that its gap insurance only adds about $5 a month to your premium and covers the difference between the value of your car and the amount you owe on your loan.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

It covers up to 25 percent of the actual cash value of your car. Check with your carrier to determine the exact coverage offered. Standalone gap insurance cost is more expensive than gap insurance from insurers that�s usually an additional option to car insurance , as well as gap insurance that is provided by car loan, lease and refinance companies. Get free progressive quotes >> allstate the cheapest insurance is not always the best. The main difference is that the payout for loan/lease payoff coverage is limited to no more than 25% of your vehicle�s value, though the exact limit varies by state.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Get free progressive quotes >> allstate the cheapest insurance is not always the best. Progressive does not currently offer commercial auto insurance for the following vehicle uses, regardless of the business or vehicle type: If another driver was at fault, gap insurance can cover the difference between their insurance company’s settlement offer and the outstanding loan, as. Be careful when you see the term loan/lease payoff because it can sometimes refer to true gap insurance. The main difference is that the loan or lease payoff coverage is limited to.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Under this coverage, progressive pays up to 25% above the value of your car if it’s totaled, to cover a loan or lease balance. Progressive calls it loan/lease payoff, but what they offer is indeed gap insurance. Details are available on their website at www.progressive.com. Progressive offers loan/lease payoff coverage, which is similar to gap coverage. Also known as gap insurance, this can cover the difference between what you owe on your car and what it’s currently worth (up to 25% of the cash value)

Source: sudimage.org

Source: sudimage.org

Before we tackle specific questions, like does progressive’s auto insurance include gap insurance, you might be wondering, what is gap coverage? With a gap insurance policy, esurance will pay up to 25% of your car’s value if it’s stolen or totaled in an accident. The company also offers guaranteed asset protection, commonly known as gap insurance. Dealerships offer gap insurance policies. Like most other carriers, you must purchase both collision comprehensive and collision coverage to buy gap insurance from progressive.

Source: npa1.org

Source: npa1.org

Standalone gap insurance cost is more expensive than gap insurance from insurers that�s usually an additional option to car insurance , as well as gap insurance that is provided by car loan, lease and refinance companies. They’ll forgive our remaining balance on the loan if the car were to be totaled. Yes, progressive offers gap insurance for about $5 per month, on average. Vehicles used as a residence or living facility ; Check with your carrier to determine the exact coverage offered.

Source: pinterest.com

Source: pinterest.com

Vehicles used as a residence or living facility ; Tow trucks that derive more than 25 percent of their revenue from repossession; Some insurance companies offer alternatives to gap insurance, such as loan/lease coverage. Dealerships offer gap insurance policies. Be careful when you see the term loan/lease payoff because it can sometimes refer to true gap insurance.

Source: eliteass.blogspot.com

Source: eliteass.blogspot.com

Progressive offers loan or lease payoff coverage which is like gap insurance. With a gap insurance policy, esurance will pay up to 25% of your car’s value if it’s stolen or totaled in an accident. Vehicles used as a residence or living facility ; Also known as gap insurance, this can cover the difference between what you owe on your car and what it’s currently worth (up to 25% of the cash value) The company also provides home, health,.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

Like most other carriers, you must purchase both collision comprehensive and collision coverage to buy gap insurance from progressive. Check with your carrier to determine the exact coverage offered. The company also offers guaranteed asset protection, commonly known as gap insurance. Vehicles used as a residence or living facility ; Get free progressive quotes >> allstate the cheapest insurance is not always the best.

Source: eliteass.blogspot.com

Source: eliteass.blogspot.com

Vehicles used as a residence or living facility ; The main difference is that the payout for loan/lease payoff coverage is limited to no more than 25% of your vehicle�s value, though the exact limit varies by state. Details are available on their website at www.progressive.com. Progressive offers loan/lease payoff coverage, which is similar to gap coverage. Vehicles that are open to the public, including:

Source: totallossgap.co.uk

Under this coverage, progressive pays up to 25% above the value of your car if it’s totaled, to cover a loan or lease balance. Drivers can easily add gap insurance to their collision and comprehensive coverage. Like most other carriers, you must purchase both collision comprehensive and collision coverage to buy gap insurance from progressive. Progressive calls it loan/lease payoff, but what they offer is indeed gap insurance. Both protect new and used vehicles financed or valued up to $100,000.

Source: carsurance.net

Source: carsurance.net

Both protect new and used vehicles financed or valued up to $100,000. This additional policy pays the difference between the actual cash value of your car and your outstanding loan balance in the event of a total loss when you have negative. Esurance allstate owns esurance, so they�re listed together. Before we tackle specific questions, like does progressive’s auto insurance include gap insurance, you might be wondering, what is gap coverage? Dealerships offer gap insurance policies.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Alternatively, progressive offers gap insurance, which pays for the difference between the value of a car at the time it’s totaled or stolen and the balance of its loan or lease. Alternatively, progressive offers gap insurance, which pays for the difference between the value of a car at the time it’s totaled or stolen and the balance of its loan or lease. Progressive’s gap insurance is limited to 125% of your vehicle’s actual cash value. Vehicles used as a residence or living facility ; The company also offers guaranteed asset protection, commonly known as gap insurance.

Source: esloseguido.blogspot.com

Source: esloseguido.blogspot.com

Alternatively, progressive offers gap insurance, which pays for the difference between the value of a car at the time it’s totaled or stolen and the balance of its loan or lease. Under this coverage, progressive pays up to 25% above the value of your car if it’s totaled, to cover a loan or lease balance. The company also provides home, health,. If another driver was at fault, gap insurance can cover the difference between their insurance company’s settlement offer and the outstanding loan, as. The company offers gap insurance, although it’s sometimes advertised as “loan/lease payoff insurance”.

Source: quote.com

Source: quote.com

Drivers can easily add gap insurance to their collision and comprehensive coverage. Also known as gap insurance, this can cover the difference between what you owe on your car and what it’s currently worth (up to 25% of the cash value) State farm, aaa, and usaa and some other insurance companies offer gap insurance on vehicles which have been financed through their financing companies. Progressive offers a variant of gap insurance called the loan/lease payoff coverage to its customers. The main difference is that the loan or lease payoff coverage is limited to.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title progressive offer gap insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information