Proof of loss insurance information

Home » Trend » Proof of loss insurance informationYour Proof of loss insurance images are available. Proof of loss insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Proof of loss insurance files here. Download all free images.

If you’re searching for proof of loss insurance images information linked to the proof of loss insurance keyword, you have pay a visit to the ideal site. Our website always provides you with suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

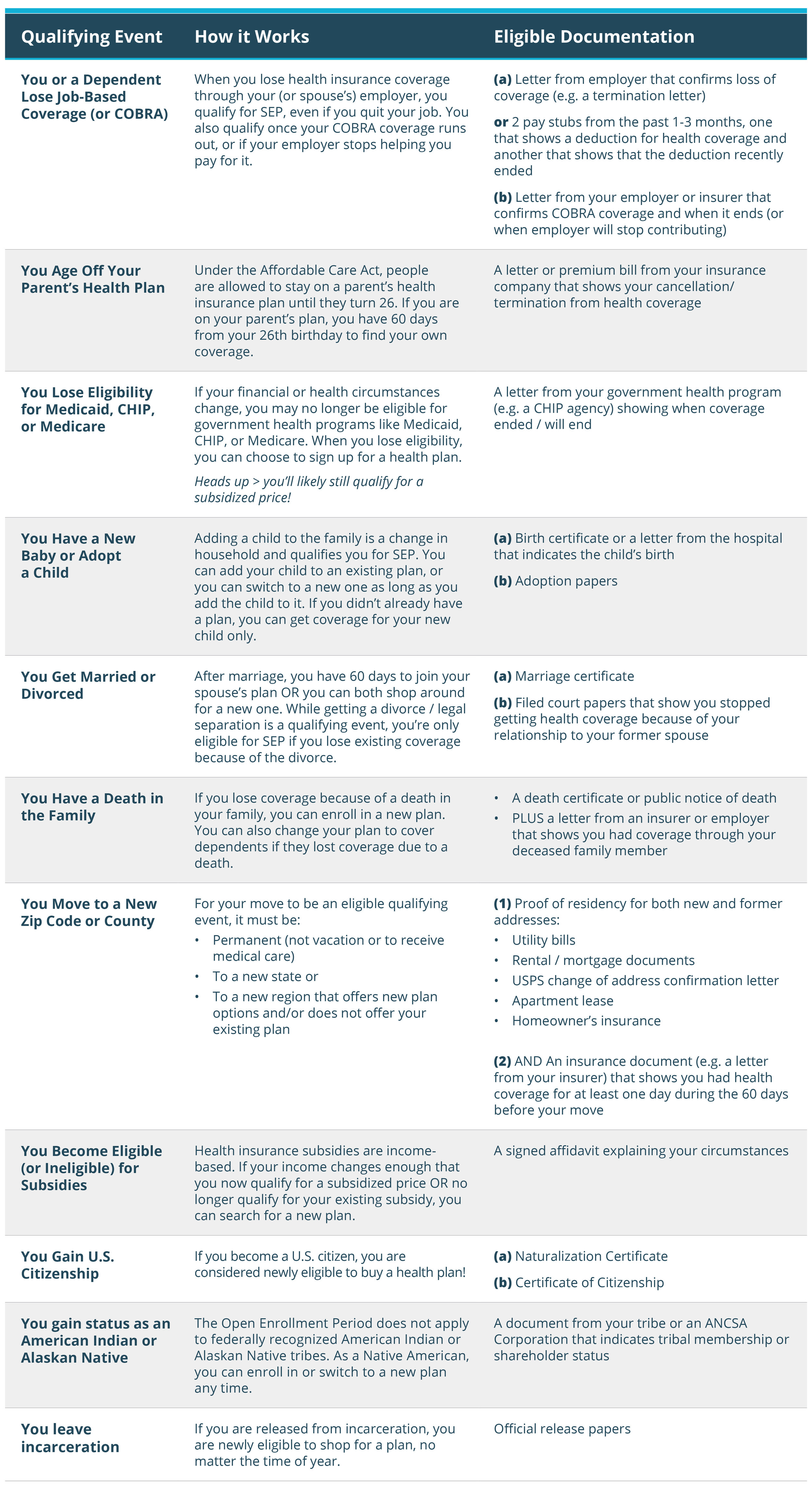

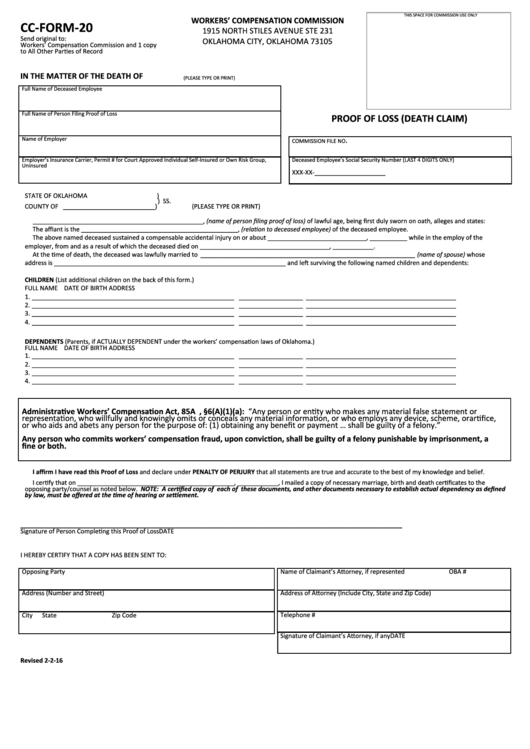

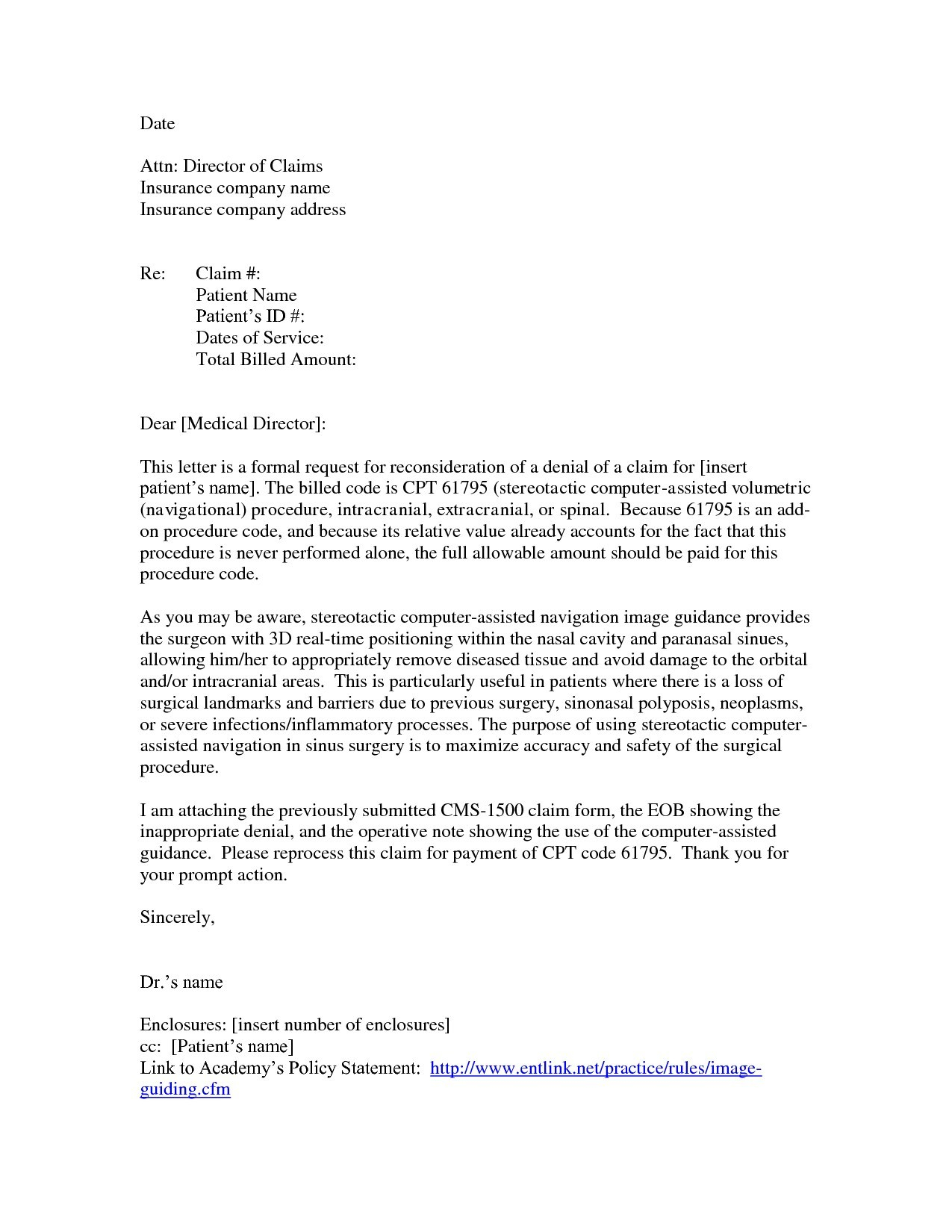

Proof Of Loss Insurance. Proof of loss refers to the legal document a policyholder files to their insurance company to claim coverage for a loss. Check here to confirm payment of the entire amount available in a check format check here to have your check sent via federal express®.the applicable federal express ® fee will be withheld from your death benefit. There are many reasons why you might have a property loss: Each insurance company in north america may provide you with a form to document the loss of property, assets or objectives that are insured under your policy.

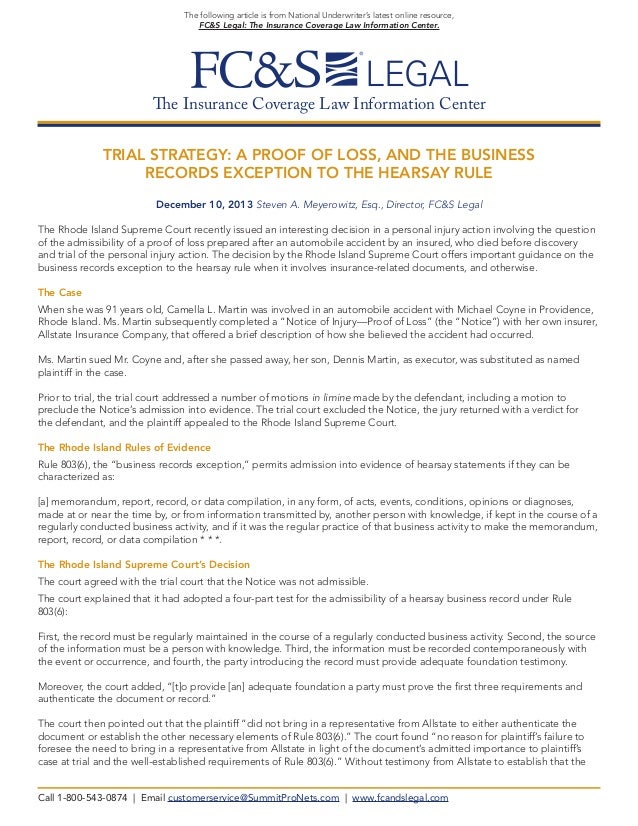

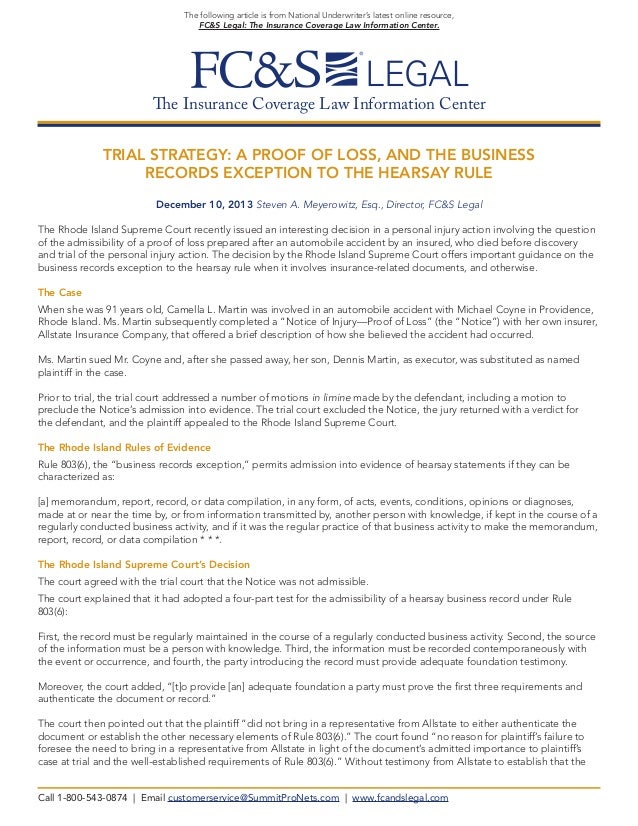

Trial Strategy A Proof of Loss, and the Business Records From slideshare.net

Trial Strategy A Proof of Loss, and the Business Records From slideshare.net

A proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property. This is an official claim document that the insured will submit to the insurance carrier that validates the repair and replacement estimates and inventories the damaged or destroyed items. This form is provided to comply with the insurance act, and without prejudice to the liability of the insurer. Check here to confirm payment of the entire amount available in a check format check here to have your check sent via federal express®.the applicable federal express ® fee will be withheld from your death benefit. Keeping receipts and a current home inventory can assist the claims process. Proof of loss refers to the legal document a policyholder files to their insurance company to claim coverage for a loss.

A proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property loss.

When a tragedy does happen, your insurance company may provide financial compensation under your policy. This document helps justify the value of a. Document showing you lost coverage due to death of a family member, including: Once submitted, this document is reviewed. The insurance company then investigates the claim and allows the individual to protect its interests. Familiarize yourself with the laws that affect you.

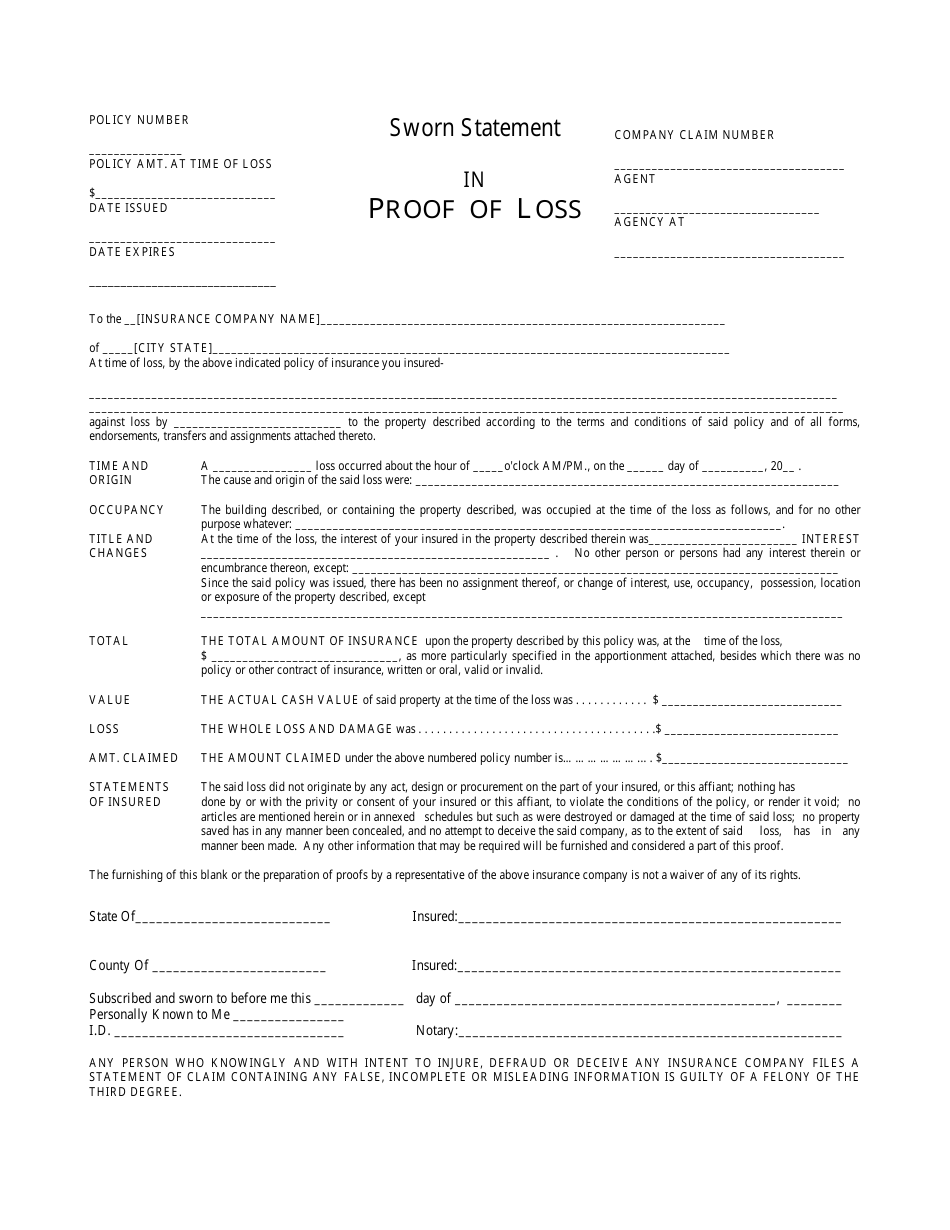

Source: templateroller.com

Source: templateroller.com

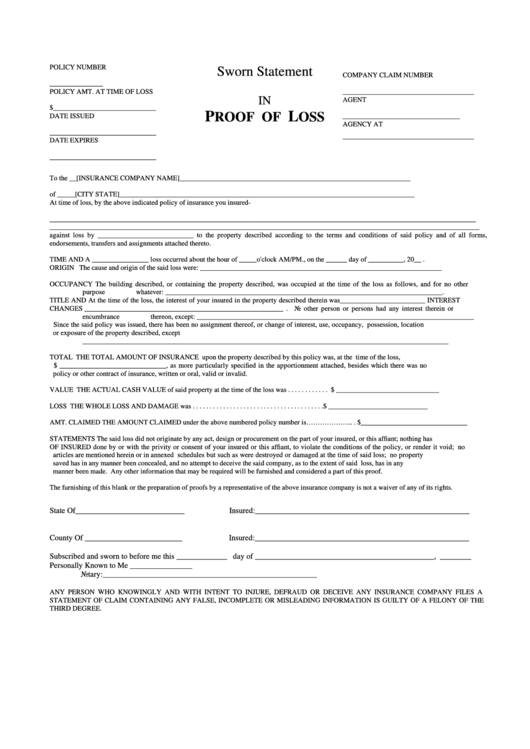

The proof of loss form is an official, notarized, sworn statement from the insured to the insurer concerning the scope of damage to their property. Once submitted, this document is reviewed. Proof of loss of coverage letter template samples. The flood event identified above damaged or destroyed the property claimed on this proof of loss. A proof of loss is a document filled out by the policyholder when property damage occurs resulting in an insurance claim.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Each insurance company in north america may provide you with a form to document the loss of property, assets or objectives that are insured under your policy. If the insurance companies requests in writing a proof of loss within the first 30 days of an insurance claim being filed or within 30 days of reopening a claim with the intention to supplement the. Each insurance company in north america may provide you with a form to document the loss of property, assets or objectives that are insured under your policy. Proof of loss is an insurance form filled out by a policyholder for an insurance claim when property damage occurs. When a tragedy does happen, your insurance company may provide financial compensation under your policy.

Source: propertyinsurancecoveragelaw.com

Variety of proof of loss of coverage letter template that will perfectly match your demands. The insurance company then investigates the claim and allows the individual to protect its interests. The insurer determines whether to approve the claim and thereby cover the loss or not. The proof of loss form is an official, notarized, sworn statement from the insured to the insurer concerning the scope of damage to their property. Is the insured registered for gst/hst?

Source: uclaim.com

Source: uclaim.com

The proof of loss form is a formal statement. Variety of proof of loss of coverage letter template that will perfectly match your demands. Is the insured registered for gst/hst? Submitting proof of loss is a formal step that every insurance carrier is going to require when a person files a claim. Each insurance company in north america may provide you with a form to document the loss of property, assets or objectives that are insured under your policy.

Document showing you lost coverage due to death of a family member, including: Variety of proof of loss of coverage letter template that will perfectly match your demands. It provides the insurance company with detailed information regarding the formal claim of damages. A proof of loss is a formal, legal document that states the amount of money the policyholder is requesting from the insurance carrier. A “proof of loss” is a document filled out by the policyholder when property damage occurs resulting in an insurance claim.

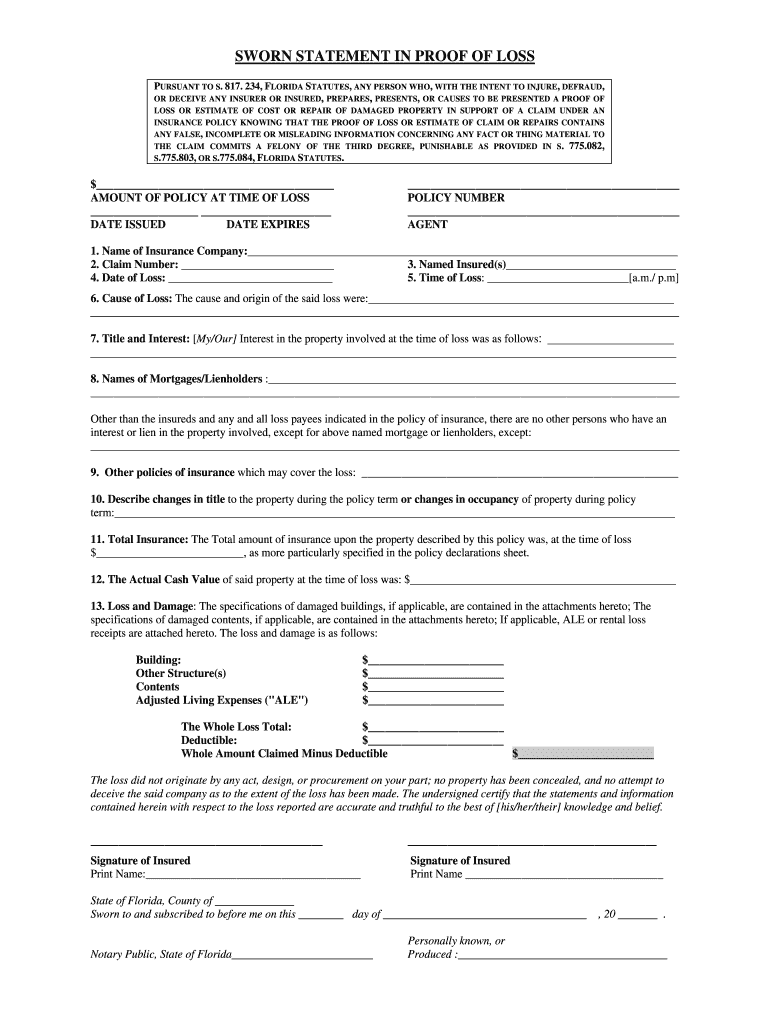

Source: signnow.com

Source: signnow.com

These templates provide outstanding instances of how you can structure such a letter, as well. Proof of loss — a formal statement made by the insured to the insurer regarding a claim, especially in property insurance, so that the insurer may determine its liability under the policy. What is a proof of loss in insurance terms? A proof of loss is a formal, legal document that states the amount of money the policyholder is requesting from the insurance carrier. The proof of loss form is an official, notarized, sworn statement from the insured to the insurer concerning the scope of damage to their property.

Source: thefreethoughtproject.com

Source: thefreethoughtproject.com

There are many reasons why you might have a property loss: Keeping receipts and a current home inventory can assist the claims process. What is a proof of loss form? Your insurer will request specific information from you in the event of a loss. The proof of loss form is a formal statement.

Source: brproud.com

Source: brproud.com

This form is provided to comply with the insurance act, and without prejudice to the liability of the insurer. Accordingly, the claimant (policyholder) will either receive or be denied any amount for the loss. This document helps justify the value of a. Submitting your claim on time is imperative! Links for irmi online subscribers only:

Source: printablelegaldoc.com

Source: printablelegaldoc.com

Or even, regarding your insurance policy in general.and that’s one simple fact: A proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property. Links for irmi online subscribers only: Each insurance company in north america may provide you with a form to document the loss of property, assets or objectives that are insured under your policy. Your insurer will request specific information from you in the event of a loss.

Source: signnow.com

Source: signnow.com

If the insurance companies requests in writing a proof of loss within the first 30 days of an insurance claim being filed or within 30 days of reopening a claim with the intention to supplement the. Now, there’s something essential that you have to remember, regarding your proof of loss form; When a tragedy does happen, your insurance company may provide financial compensation under your policy. The insurer determines whether to approve the claim and thereby cover the loss or not. Each insurance company provides a form that is used to document damaged or destroyed items.

Source: slideshare.net

Source: slideshare.net

Proof of loss of coverage letter template samples. There are many reasons why you might have a property loss: Each insurance company in north america may provide you with a form to document the loss of property, assets or objectives that are insured under your policy. A “proof of loss” is a document filled out by the policyholder when property damage occurs resulting in an insurance claim. Proof of loss of coverage letter template samples.

The insurance bureau of canada is a helpful starting place to go to find information about making insurance claims. The proof of loss form is a formal statement. Proof of loss is an insurance form filled out by a policyholder for an insurance claim when property damage occurs. The insurance bureau of canada is a helpful starting place to go to find information about making insurance claims. Proof of loss of coverage letter template samples.

Source: millerpublicadjusters.com

Source: millerpublicadjusters.com

Once submitted, this document is reviewed. A particular account of the loss is attached hereto and forms part of this proof. The insurance bureau of canada is a helpful starting place to go to find information about making insurance claims. What is a proof of loss in insurance terms? Once submitted, this document is reviewed.

Source: simpleartifact.com

Source: simpleartifact.com

This form is provided to comply with the insurance act, and without prejudice to the liability of the insurer. The insurer determines whether to approve the claim and thereby cover the loss or not. Variety of proof of loss of coverage letter template that will perfectly match your demands. Each insurance company provides a form that is used to document damaged or destroyed items. Submitting proof of loss is a formal step that most property insurance companies require when filing a claim.it is an official claim document submitted by you to your insurer that validates your loss�s repair and replacement estimates and inventories of items claimed.

Source: nationalgriefawarenessday.com

Source: nationalgriefawarenessday.com

Proof of loss of coverage letter template samples. Familiarize yourself with the laws that affect you. Proof of loss helps your insurer verify which of your belongings were damaged or destroyed in a covered claim, and how much they were worth, so your insurer can help reimburse you for the lost items. Keeping receipts and a current home inventory can assist the claims process. A particular account of the loss is attached hereto and forms part of this proof.

Source: formsbank.com

Source: formsbank.com

Your insurer will request specific information from you in the event of a loss. Each insurance company will have their own form, called an “insurance proof of loss” form, that you will need to submit to them in order to claim compensation for your missing or damaged property. A proof of loss is a formal, legal document that states the amount of money the policyholder is requesting from the insurance carrier. Proof of loss refers to the legal document a policyholder files to their insurance company to claim coverage for a loss. The insurance bureau of canada is a helpful starting place to go to find information about making insurance claims.

Source: formsbank.com

Source: formsbank.com

Each insurance company in north america may provide you with a form to document the loss of property, assets or objectives that are insured under your policy. When writing a formal or organisation letter, presentation design and layout is vital to earning an excellent impression. Proof of loss — a formal statement made by the insured to the insurer regarding a claim, especially in property insurance, so that the insurer may determine its liability under the policy. Familiarize yourself with the laws that affect you. This form helps to substantiate the value of the insured’s loss to the insurance company.

Source: simpleartifact.com

Source: simpleartifact.com

The insurance adjuster hired by the nfip insurer may provide a proof of loss form to the policyholder and may help complete it. Or even, regarding your insurance policy in general.and that’s one simple fact: Proof of loss — a formal statement made by the insured to the insurer regarding a claim, especially in property insurance, so that the insurer may determine its liability under the policy. When writing a formal or organisation letter, presentation design and layout is vital to earning an excellent impression. The actual cash value of the property insured, the actual amount of loss or damage, the total insurance thereon at the time of the said loss and the amount claimed under this policy are as follows:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title proof of loss insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information