Proof of loss provision health insurance information

Home » Trend » Proof of loss provision health insurance informationYour Proof of loss provision health insurance images are available. Proof of loss provision health insurance are a topic that is being searched for and liked by netizens today. You can Download the Proof of loss provision health insurance files here. Get all royalty-free vectors.

If you’re searching for proof of loss provision health insurance pictures information related to the proof of loss provision health insurance keyword, you have visit the right blog. Our site always gives you hints for seeking the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

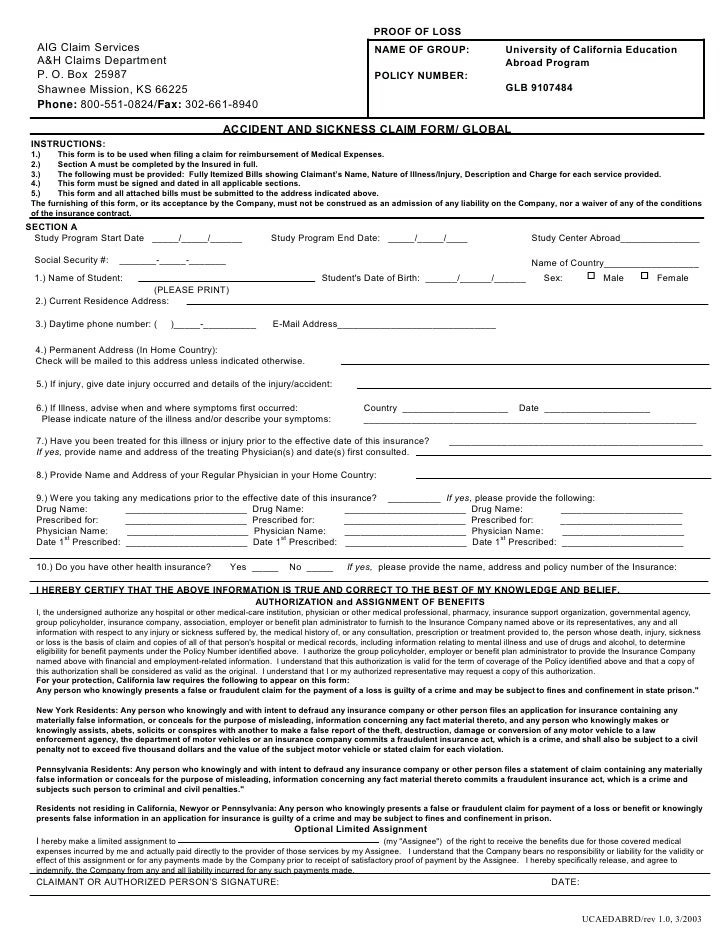

Proof Of Loss Provision Health Insurance. Which of the following statements best describes what the legal actions provision of an accident and health policy requires? In an accident and health insurance policy, the time of payment of claims provision provides for immediate payment of the claim after the insurer receives written proof of the loss. Types of insurance which may be written, this section should be modified to define accident and sickness insurance as “insurance against loss resulting from sickness or from bodily injury or death by accident, or both.” section 2. Document showing you lost coverage due to death of a family member, including:

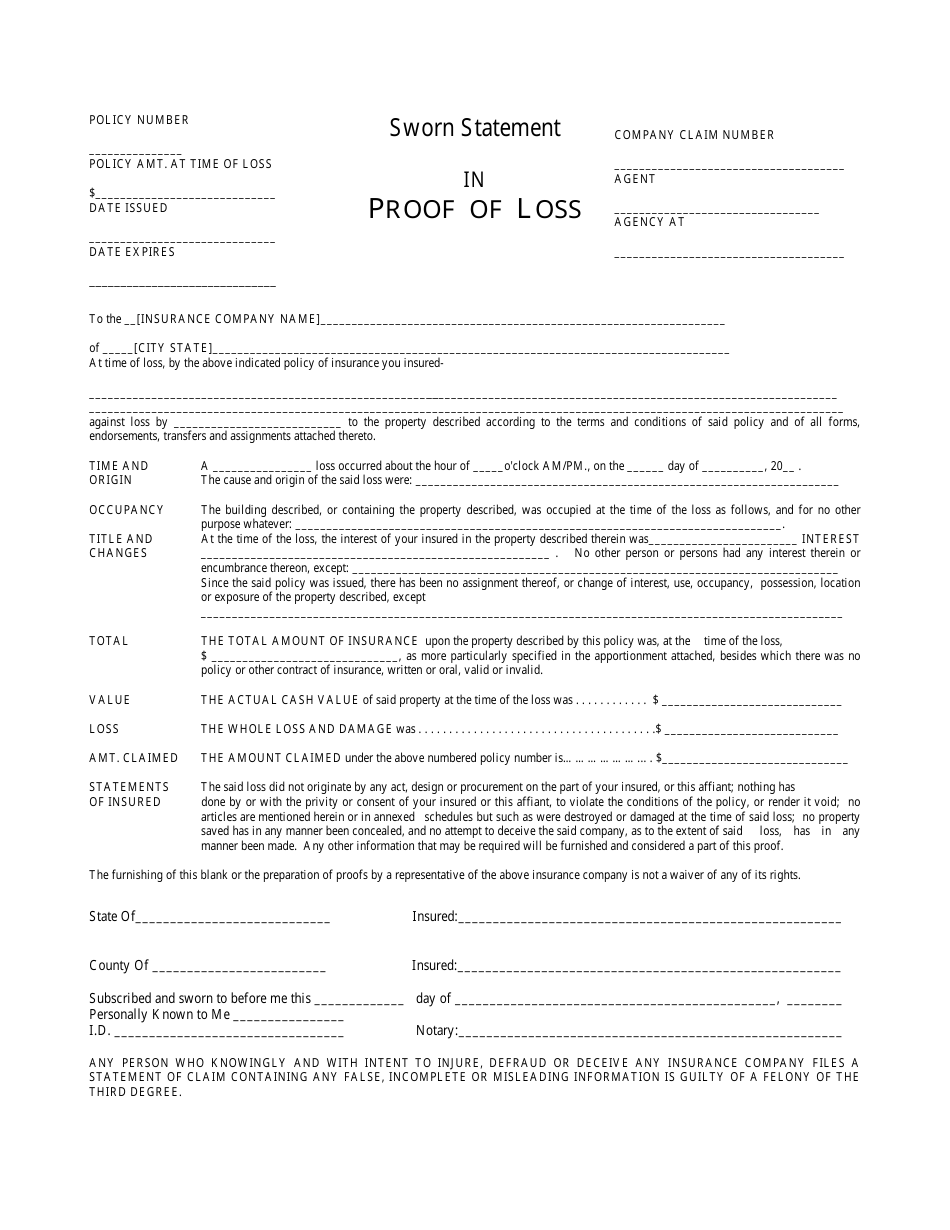

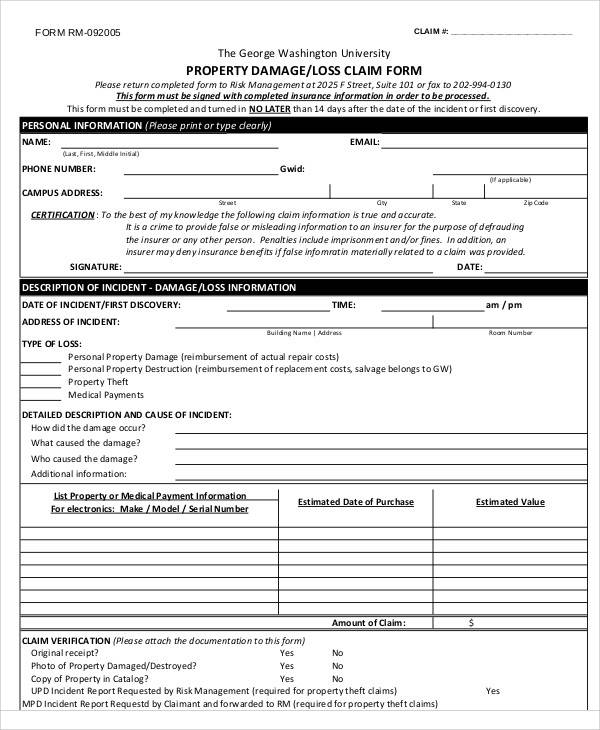

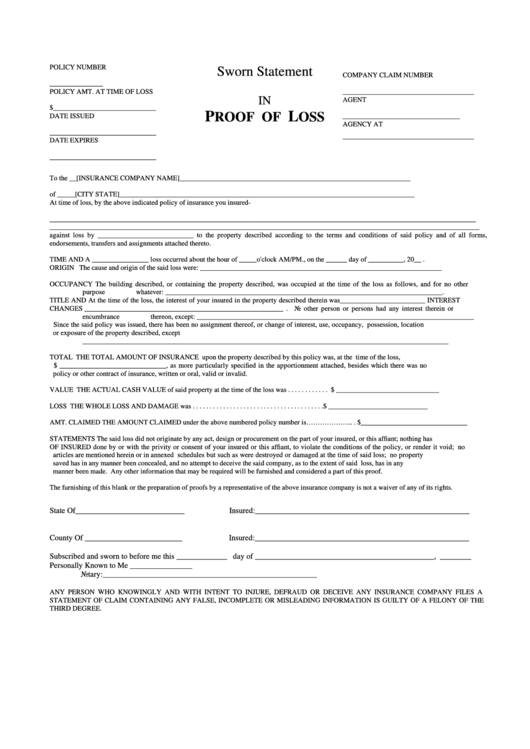

A health insurance must provide a proof of loss form a. Within 10 days of the actual loss b. The claim forms provision states that the insurer, no later than 15 days after receiving notice of the claim, must furnish the claimant with the forms required for filing proof of loss. Payment of claims (correct.) the payment of claims provision in a health. Document showing you lost coverage due to death of a family member, including: A proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property loss.

Proof of loss refers to the legal document a policyholder files to their insurance company to claim coverage for a loss.

Accordingly, the claimant (policyholder) will either receive or be denied any amount for the loss. A health insurance must provide a proof of loss form a. B) 60 days of a loss. A death certificate or public notice of death and proof that you were getting health coverage because of your relationship to the deceased person, like a letter from an insurance company or employer that shows the names of the people on the health plan.other confirmation that shows you lost. The provisions that cover the responsibilities of the policyholder include requirements that they notify the insurer of a claim within 20 days of a loss, provide proof of the extent of that loss,. If a “proof of loss” is requested, policyholders must comply.

Source: omnichannelretailingforum.com

Source: omnichannelretailingforum.com

The provisions that cover the responsibilities of the policyholder include requirements that they notify the insurer of a claim within 20 days of a loss, provide proof of the extent of that loss,. Which renewability provision allows an insurer to terminate a policy for any reason, and to increase the premiums for any class of insureds? Days after written proof of loss has been furnished. If a “proof of loss” is requested, policyholders must comply. Which of the following statements best describes what the legal actions provision of an accident and health policy requires?

Source: simpleartifact.com

Source: simpleartifact.com

The provision that defines to whom the insurer will pay benefits to is called. The proof of loss provision states that a policyholder has 90 days to tell the insurance company and provide documentation about a loss and provide information about the extent of. Payment of claims (correct.) the payment of claims provision in a health. S filed a written proof of loss for a disability income claim on september 1. A death certificate or public notice of death and proof that you were getting health coverage because of your relationship to the deceased person, like a letter from an insurance company or employer that shows the names of the people on the health plan.other confirmation that shows you lost.

Source: okinsurancelawblog.com

Source: okinsurancelawblog.com

Under the time of payment of claims provision, the insurer must pay the benefits immediately Unless a policy explicitly states otherwise, the “proof of loss” provision is not automatically triggered in the event of a covered loss. It is a way of dividing up the risks to a manageable level for everyone. However, if it is not possible to comply, the time parameter is extended to 1 year. Types of insurance which may be written, this section should be modified to define accident and sickness insurance as “insurance against loss resulting from sickness or from bodily injury or death by accident, or both.” section 2.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Which renewability provision allows an insurer to terminate a policy for any reason, and to increase the premiums for any class of insureds? S filed a written proof of loss for a disability income claim on september 1. The insurer determines whether to approve the claim and thereby cover the loss or not. A health insurance must provide a proof of loss form a. No suit can be brought after the expiration of three years after the time written proof of loss is required to be furnished.

Source: nationalgriefawarenessday.com

Source: nationalgriefawarenessday.com

Document showing you lost coverage due to death of a family member, including: D) 20 days of a loss. A death certificate or public notice of death and proof that you were getting health coverage because of your relationship to the deceased person, like a letter from an insurance company or employer that shows the names of the people on the health plan. Within 15 days of the actual loss No suit can be brought after the expiration of three years after the time written proof of loss is required to be furnished.

Source: marriageandbeyond.com

Source: marriageandbeyond.com

Under the time of payment of claims provision, the insurer must pay the benefits immediately This gives the insurer time to investigate a claim and determine its validity. No suit can be brought after the expiration of three years after the time written proof of loss is required to be furnished. Within 90 days or as soon as reasonable possible, but not to exceed 1 year *the proof of loss provision states the claimant must submit a proof of loss within 90 days; Which of the following statements best describes what the legal actions provision of an accident and health policy requires?

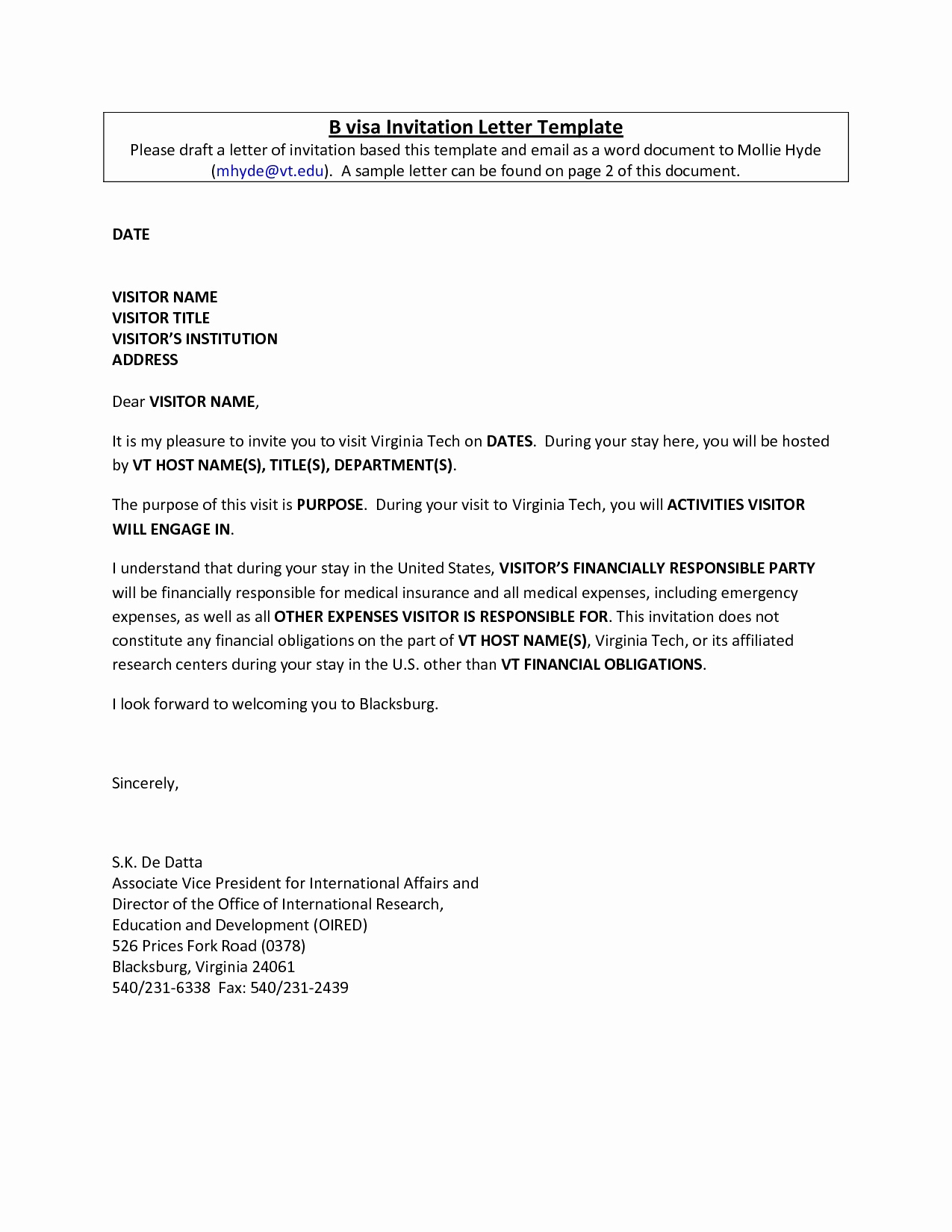

Source: templateroller.com

Source: templateroller.com

Within 10 days of receipt of the notice of loss c. An insurer receives proof of loss for an acceptable medical expense claim under an individual health insurance policy. D) 20 days of a loss. Accordingly, the claimant (policyholder) will either receive or be denied any amount for the loss. B) 60 days of a loss.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

A death certificate or public notice of death and proof that you were getting health coverage because of your relationship to the deceased person, like a letter from an insurance company or employer that shows the names of the people on the health plan.other confirmation that shows you lost. Within 15 days of the actual loss A death certificate or public notice of death and proof that you were getting health coverage because of your relationship to the deceased person, like a letter from an insurance company or employer that shows the names of the people on the health plan.other confirmation that shows you lost. Once submitted, this document is reviewed. Failure to furnish proof within the time required shall not invalidate nor reduce any claim if it was not reasonably possible to give proof within that time, provided such proof is furnished as soon as reasonably possible and in no.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

Change of beneficiary this provision applies to health or disability policies that include a death benefit. Under the time of payment of claims provision, the insurer must pay the benefits immediately The entire contract provision states that the health insurance policy, together with a copy of the signed application and attached riders and amendments, constitutes the entire contract. Provision to which they apply, or under an appropriate caption such as “exceptions,” or. Under the uniform required provisions, proof of loss under a health insurance policy normally should be filed within 90 days what provision would prevent the insurance company from paying a reinbursment claim to someone other than the policyowner?

Source: paymentproof2020.blogspot.com

Source: paymentproof2020.blogspot.com

The proof of loss provision states that a policyholder has 90 days to tell the insurance company and provide documentation about a loss and provide information about the extent of. Written proof of loss must be furnished to the insurance company at its office within ninety (90) days after the date of the loss. The provision that defines to whom the insurer will pay benefits to is called. Failure to furnish proof within the time required shall not invalidate nor reduce any claim if it was not reasonably possible to give proof within that time, provided such proof is furnished as soon as reasonably possible and in no. C) 90 days of a loss.

Failure to furnish proof within the time required shall not invalidate nor reduce any claim if it was not reasonably possible to give proof within that time, provided such proof is furnished as soon as reasonably possible and in no. Usually, an insurance company must request the “proof of loss” in order to enforce the provision. Provision to which they apply, or under an appropriate caption such as “exceptions,” or. Proof of loss refers to the legal document a policyholder files to their insurance company to claim coverage for a loss. Under the uniform required provisions, proof of loss under a health insurance policy normally should be filed within 90 days what provision would prevent the insurance company from paying a reinbursment claim to someone other than the policyowner?

Source: sampletemplates.com

Source: sampletemplates.com

Written proof of loss must be furnished to the insurance company at its office within ninety (90) days after the date of the loss. The claim forms provision states that the insurer, no later than 15 days after receiving notice of the claim, must furnish the claimant with the forms required for filing proof of loss. If a “proof of loss” is requested, policyholders must comply. Document showing you lost coverage due to death of a family member, including: Which of the following statements best describes what the legal actions provision of an accident and health policy requires?

Source: uclaim.com

Source: uclaim.com

Which of the following statements best describes what the legal actions provision of an accident and health policy requires? A death certificate or public notice of death and proof that you were getting health coverage because of your relationship to the deceased person, like a letter from an insurance company or employer that shows the names of the people on the health plan. Accordingly, the claimant (policyholder) will either receive or be denied any amount for the loss. Change of beneficiary this provision applies to health or disability policies that include a death benefit. An insurer receives proof of loss for an acceptable medical expense claim under an individual health insurance policy.

Document showing you lost coverage due to death of a family member, including: No suit can be brought after the expiration of three years after the time written proof of loss is required to be furnished. Proof of loss refers to the legal document a policyholder files to their insurance company to claim coverage for a loss. Payment of claims (correct.) the payment of claims provision in a health. Types of insurance which may be written, this section should be modified to define accident and sickness insurance as “insurance against loss resulting from sickness or from bodily injury or death by accident, or both.” section 2.

Source: formsbank.com

Source: formsbank.com

Which renewability provision allows an insurer to terminate a policy for any reason, and to increase the premiums for any class of insureds? An insurer receives proof of loss for an acceptable medical expense claim under an individual health insurance policy. In an accident and health insurance policy, the time of payment of claims provision provides for immediate payment of the claim after the insurer receives written proof of the loss. Proof of loss refers to the legal document a policyholder files to their insurance company to claim coverage for a loss. Provisions, proof of loss under a health insurance policy normally should be filed within a) 30 days of a loss.

Source: slideshare.net

Source: slideshare.net

Document showing you lost coverage due to death of a family member, including: A death certificate or public notice of death and proof that you were getting health coverage because of your relationship to the deceased person, like a letter from an insurance company or employer that shows the names of the people on the health plan.other confirmation that shows you lost. Once submitted, this document is reviewed. Change of beneficiary this provision applies to health or disability policies that include a death benefit. D) 20 days of a loss.

Source: dokumen.tips

Source: dokumen.tips

Proof of loss refers to the legal document a policyholder files to their insurance company to claim coverage for a loss. Document showing you lost coverage due to death of a family member, including: Proof of loss refers to the legal document a policyholder files to their insurance company to claim coverage for a loss. S filed a written proof of loss for a disability income claim on september 1. Usually, an insurance company must request the “proof of loss” in order to enforce the provision.

Source: 4gnewyork.com

Source: 4gnewyork.com

Within 15 days of receipt of the notice of loss d. Payment of claims (correct.) the payment of claims provision in a health. Types of insurance which may be written, this section should be modified to define accident and sickness insurance as “insurance against loss resulting from sickness or from bodily injury or death by accident, or both.” section 2. B) 60 days of a loss. Once submitted, this document is reviewed.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title proof of loss provision health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information