Property casualty insurance industry overview information

Home » Trend » Property casualty insurance industry overview informationYour Property casualty insurance industry overview images are available. Property casualty insurance industry overview are a topic that is being searched for and liked by netizens today. You can Find and Download the Property casualty insurance industry overview files here. Find and Download all royalty-free photos and vectors.

If you’re searching for property casualty insurance industry overview pictures information linked to the property casualty insurance industry overview interest, you have visit the ideal blog. Our site frequently provides you with hints for viewing the highest quality video and picture content, please kindly surf and find more informative video content and images that fit your interests.

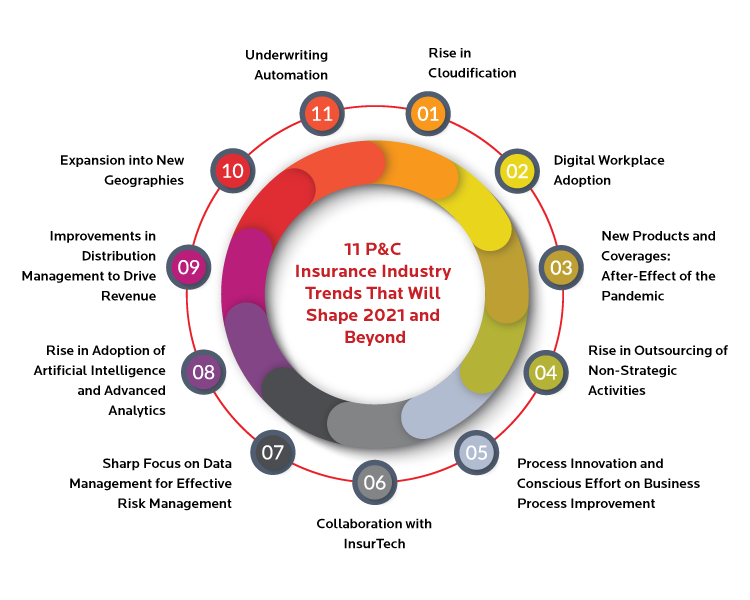

Property Casualty Insurance Industry Overview. The property and casualty insurance landscape is evolving quickly with the changing risk landscape, entry of new players, and changing customer expectations. Liability losses are losses that occur as a result of the insured’s interactions with others or their property. This can include lawsuits, damage to personal assets, car crashes and more. Property & casualty (p&c) solutions | appian p&c insurance deliver an intelligent, connected p&c insurance experience.

Top10 Trends in Property & Casualty Insurance 2018 From slideshare.net

Top10 Trends in Property & Casualty Insurance 2018 From slideshare.net

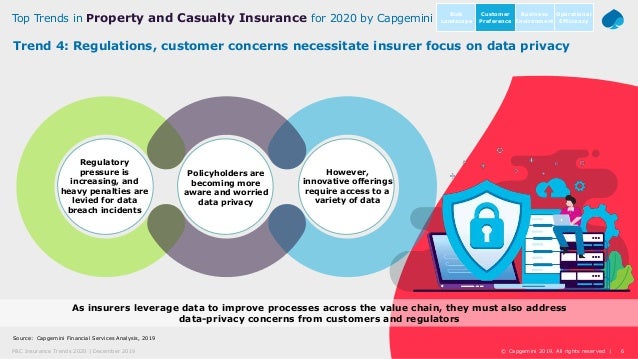

However, following a rise in competitive Despite all this, the sector remains financially strong with a solid foundation for the future. Capgemini’s 2022 overview synthesizes the top p&c insurance trends shaped by carriers’ innovative reimagining of their business and operating models. Learn more about appian connected claims leading property and casualty insurers trust appian. For over a decade, soft market conditions have existed in the property & casualty insurance industry as insurers reported strong balance sheets, pricing, and broad terms and conditions. A section deals with the structure of the p/c insurance industry, including organizational and marketing structure of insurers, and facts about the industry, another section.

However, following a rise in competitive

A section deals with the structure of the p/c insurance industry, including organizational and marketing structure of insurers, and facts about the industry, another section. This can include lawsuits, damage to personal assets, car crashes and more. Property & casualty (p&c) solutions | appian p&c insurance deliver an intelligent, connected p&c insurance experience. Emerging technologies and innovation are transforming nearly every aspect of the property and casualty industry. The future of property and casualty insurance is fast, simple, agile. For over a decade, soft market conditions have existed in the property & casualty insurance industry as insurers reported strong balance sheets, pricing, and broad terms and conditions.

Source: worldinsurtechreport.com

Source: worldinsurtechreport.com

Property & casualty insurance industry. Property and casualty (p&c) insurers are companies that provide coverage on assets, as well as liability insurance for accidents, injuries, and damage to others or their belongings. Despite all this, the sector remains financially strong with a solid foundation for the future. P&c insurers cover a number of things, including auto insurance, home insurance, marine insurance, and professional liability insurance. This can include lawsuits, damage to personal assets, car crashes and more.

Source: birlasoft.com

Source: birlasoft.com

One of the most important types of casualty insurance is liability insurance. Insurers in the property & casualty sector offer products that generally protect against the risk of financial loss associated with damage to property or exposure to. Casualty insurance is more difficult to define because it includes a wide variety of basically unrelated insurance products. However, following a rise in competitive Property and casualty insurance refers to a type of contract that contains two primary coverages, namely liability and property protection coverage.

Source: slideshare.net

Source: slideshare.net

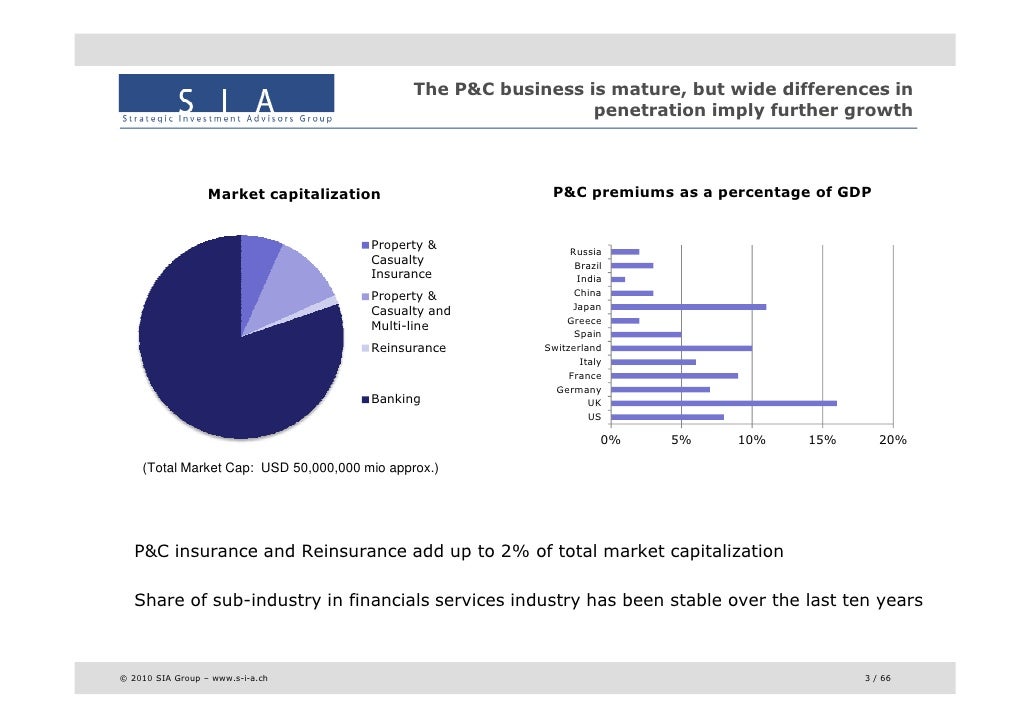

Large property and casualty insurers. The future of property and casualty insurance is fast, simple, agile. Despite all this, the sector remains financially strong with a solid foundation for the future. Insurance industry net premiums written totaled $1.28 trillion in 2020, with premiums recorded by property/casualty (p/c) insurers accounting for 51 percent, and premiums by life/annuity insurers accounting for 49 percent, according to s&p global market intelligence. Property & casualty (p&c) solutions | appian p&c insurance deliver an intelligent, connected p&c insurance experience.

Source: slideshare.net

Source: slideshare.net

As customer expectations and motivations for insurance change and the risk landscape evolves, it presents substantial. Despite all this, the sector remains financially strong with a solid foundation for the future. Top trends in property and casualty insurance: Liability losses are losses that occur as a result of the insured’s interactions with others or their property. For over a decade, soft market conditions have existed in the property & casualty insurance industry as insurers reported strong balance sheets, pricing, and broad terms and conditions.

Source: slideshare.net

Source: slideshare.net

Liability losses are losses that occur as a result of the insured’s interactions with others or their property. Property & casualty insurance industry. Property & casualty (p&c) solutions | appian p&c insurance deliver an intelligent, connected p&c insurance experience. Top trends in property and casualty insurance: Property & casualty insurance industry jumped nearly 50% to $39.8 billion for the first six months of 2021 compared to $26.8 billion for

Source: anythingresearch.com

Source: anythingresearch.com

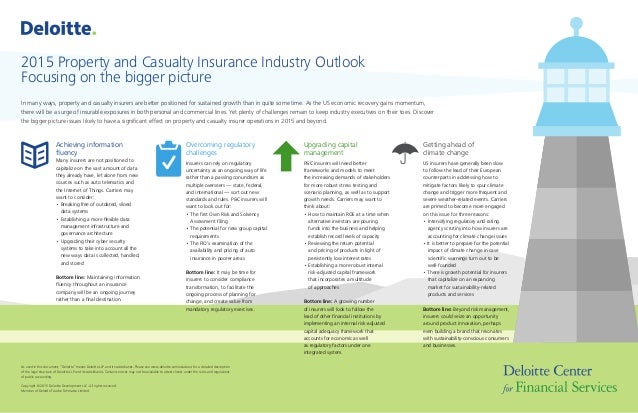

The future of property and casualty insurance is fast, simple, agile. Insurance industry net premiums written totaled $1.28 trillion in 2020, with premiums recorded by property/casualty (p/c) insurers accounting for 51 percent, and premiums by life/annuity insurers accounting for 49 percent, according to s&p global market intelligence. Learn more about appian connected claims leading property and casualty insurers trust appian. Turkish insurers potentially significant exposure to catastrophe risk from earthquake events, many domestic insurers have limited net exposure to large property and engineering business as result of surrendering the bulk of commercial risk to reinsurers and the majority of residential. Deloitte’s insurance group brings together specialists from actuarial, risk, operations, technology, tax and audit.

Source: worldinsurtechreport.com

Source: worldinsurtechreport.com

Am best is estimating an underwriting loss for the u.s. Capgemini’s 2022 overview synthesizes the top p&c insurance trends shaped by carriers’ innovative reimagining of their business and operating models. Property and casualty (p&c) insurers are companies that provide coverage on assets, as well as liability insurance for accidents, injuries, and damage to others or their belongings. A section deals with the structure of the p/c insurance industry, including organizational and marketing structure of insurers, and facts about the industry, another section. Toronto, ontario m5c 1c4 tel:

Source: slideshare.net

Source: slideshare.net

P&c insurers cover a number of things, including auto insurance, home insurance, marine insurance, and professional liability insurance. The future of property and casualty insurance is fast, simple, agile. Property & casualty overview net income in the u.s. A section deals with the structure of the p/c insurance industry, including organizational and marketing structure of insurers, and facts about the industry, another section. Toronto, ontario m5c 1c4 tel:

Source: slideshare.net

Source: slideshare.net

Insurance industry net premiums written totaled $1.28 trillion in 2020, with premiums recorded by property/casualty (p/c) insurers accounting for 51 percent, and premiums by life/annuity insurers accounting for 49 percent, according to s&p global market intelligence. The future of property and casualty insurance is fast, simple, agile. Capgemini’s 2022 overview synthesizes the top p&c insurance trends shaped by carriers’ innovative reimagining of their business and operating models. For over a decade, soft market conditions have existed in the property & casualty insurance industry as insurers reported strong balance sheets, pricing, and broad terms and conditions. Despite all this, the sector remains financially strong with a solid foundation for the future.

Source: armadarisk.com

Source: armadarisk.com

Deloitte’s insurance group brings together specialists from actuarial, risk, operations, technology, tax and audit. As customer expectations and motivations for insurance change and the risk landscape evolves, it presents substantial. Property & casualty insurance industry jumped nearly 50% to $39.8 billion for the first six months of 2021 compared to $26.8 billion for This powerpoint presentation by robert hartwig, president of the insurance information institute, provides an overview of the property/casualty (p/c) insurance industry. However, following a rise in competitive

Source: collisionweek.com

Source: collisionweek.com

One of the most important types of casualty insurance is liability insurance. Property & casualty insurance industry. Learn more about appian connected claims leading property and casualty insurers trust appian. A section deals with the structure of the p/c insurance industry, including organizational and marketing structure of insurers, and facts about the industry, another section. Capgemini’s 2022 overview synthesizes the top p&c insurance trends shaped by carriers’ innovative reimagining of their business and operating models.

Source: slideshare.net

Source: slideshare.net

Property and casualty insurance refers to a type of contract that contains two primary coverages, namely liability and property protection coverage. Capgemini’s 2022 overview synthesizes the top p&c insurance trends shaped by carriers’ innovative reimagining of their business and operating models. Toronto, ontario m5c 1c4 tel: Property & casualty insurance industry jumped nearly 50% to $39.8 billion for the first six months of 2021 compared to $26.8 billion for The future of property and casualty insurance is fast, simple, agile.

Source: propertycasualty360.com

Source: propertycasualty360.com

Insurers in the property & casualty sector offer products that generally protect against the risk of financial loss associated with damage to property or exposure to. For over a decade, soft market conditions have existed in the property & casualty insurance industry as insurers reported strong balance sheets, pricing, and broad terms and conditions. Toronto, ontario m5c 1c4 tel: Property & casualty insurance industry. Insurers in the property & casualty sector offer products that generally protect against the risk of financial loss associated with damage to property or exposure to.

Source: slideshare.net

Source: slideshare.net

Property & casualty insurance industry jumped nearly 50% to $39.8 billion for the first six months of 2021 compared to $26.8 billion for One of the most important types of casualty insurance is liability insurance. Insurance industry net premiums written totaled $1.28 trillion in 2020, with premiums recorded by property/casualty (p/c) insurers accounting for 51 percent, and premiums by life/annuity insurers accounting for 49 percent, according to s&p global market intelligence. However, following a rise in competitive The future of property and casualty insurance is fast, simple, agile.

Source: slideshare.net

Source: slideshare.net

Casualty insurance is more difficult to define because it includes a wide variety of basically unrelated insurance products. Turkish insurers potentially significant exposure to catastrophe risk from earthquake events, many domestic insurers have limited net exposure to large property and engineering business as result of surrendering the bulk of commercial risk to reinsurers and the majority of residential. Despite all this, the sector remains financially strong with a solid foundation for the future. Property & casualty insurance industry jumped nearly 50% to $39.8 billion for the first six months of 2021 compared to $26.8 billion for Property & casualty insurance industry.

Source: bbinsurance.com

Source: bbinsurance.com

Property & casualty insurance industry. Large property and casualty insurers. Property and casualty (p&c) insurers are companies that provide coverage on assets, as well as liability insurance for accidents, injuries, and damage to others or their belongings. These skill sets, combined with deep industry knowledge, allow us to provide a breadth of services to life, property and casualty, reinsurers and insurance broker clients. This powerpoint presentation by robert hartwig, president of the insurance information institute, provides an overview of the property/casualty (p/c) insurance industry.

Source: slideshare.net

Source: slideshare.net

Property & casualty overview net income in the u.s. P&c insurers cover a number of things, including auto insurance, home insurance, marine insurance, and professional liability insurance. The future of property and casualty insurance is fast, simple, agile. Capgemini’s 2022 overview synthesizes the top p&c insurance trends shaped by carriers’ innovative reimagining of their business and operating models. The property and casualty insurance landscape is evolving quickly with the changing risk landscape, entry of new players, and changing customer expectations.

Source: capgemini.com

Source: capgemini.com

A section deals with the structure of the p/c insurance industry, including organizational and marketing structure of insurers, and facts about the industry, another section. Property and casualty (p&c) insurers are companies that provide coverage on assets, as well as liability insurance for accidents, injuries, and damage to others or their belongings. However, following a rise in competitive These skill sets, combined with deep industry knowledge, allow us to provide a breadth of services to life, property and casualty, reinsurers and insurance broker clients. Casualty insurance is more difficult to define because it includes a wide variety of basically unrelated insurance products.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title property casualty insurance industry overview by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information