Property insurance binder Idea

Home » Trending » Property insurance binder IdeaYour Property insurance binder images are ready. Property insurance binder are a topic that is being searched for and liked by netizens today. You can Get the Property insurance binder files here. Get all royalty-free vectors.

If you’re searching for property insurance binder images information connected with to the property insurance binder keyword, you have come to the right site. Our site always gives you hints for refferencing the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Property Insurance Binder. The name and address of the lender as loss payee; When to obtain a binder of insurance A rapid and pragmatic approach to all aspects of underwriting. Your home insurance binder will be required for the underwriting process and before you close on a mortgage.

Insurance binder form insurance From greatoutdoorsabq.com

Insurance binder form insurance From greatoutdoorsabq.com

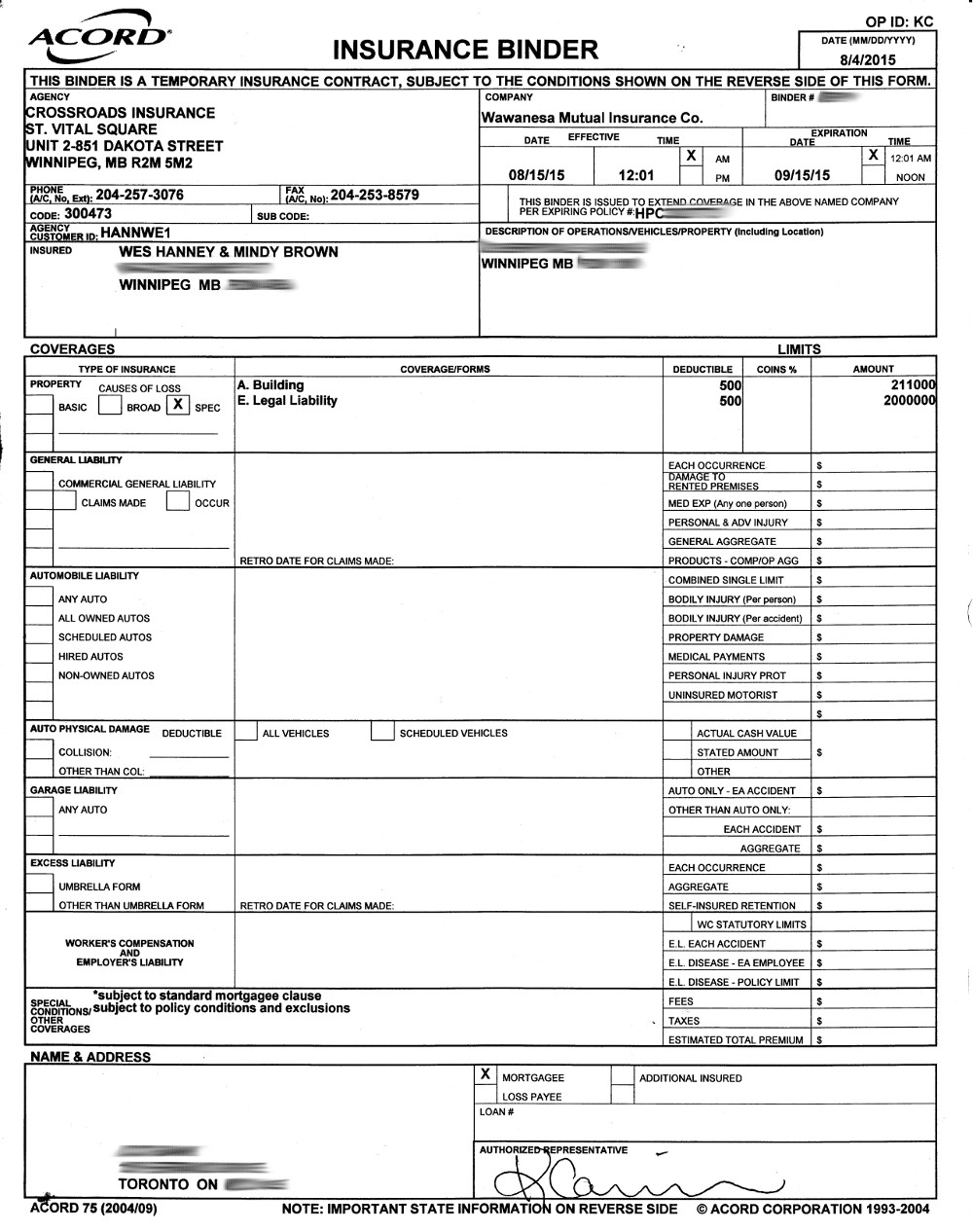

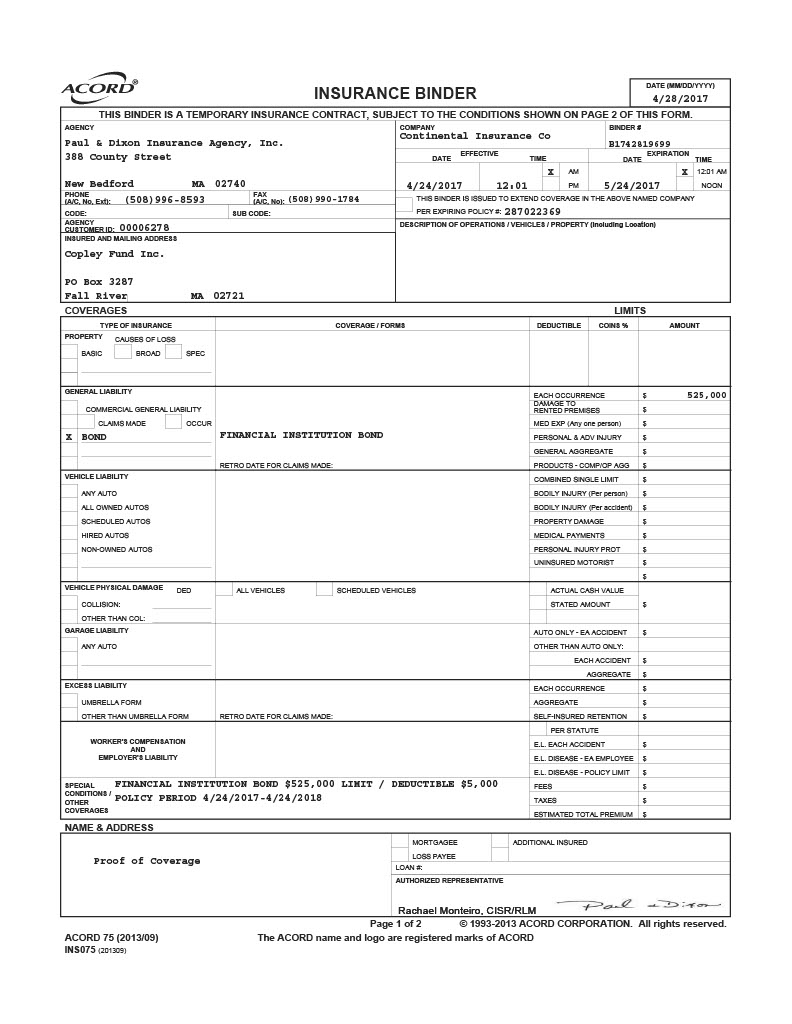

Your insurance binder contains important policy details like coverage limits and deductible amounts. Aventum group mga rokstone has signed a facultative property binder with slovenian insurer zavarovalnica triglav, providing it with. Property shall accept as evidence of insurance a written binder issued by an authorized insurer or its agent if the binder includes or is accompanied by: A description of the insured real property; We are insuring this property.” binders are temporary confirmations of insurance, to help you get things done while you’re waiting for your final policy to arrive. The insured uses the binder to serve as proof of coverage until your formal policy is officially issued.

If it�s a car insurance binder, the make, model and vehicle identification number (vin) are essential.

Anyone who gets homeowners insurance should ask for a binder. It is a confirmation note that an insurance policy will soon be issued and that your property is covered accordingly. A homeowners insurance binder is a temporary document issued by an authorized insurance representative that can serve as proof of insurance for your home, car, or property. That’s what binders are for. A home insurance binder is used to prove that you have coverage on your home. Who needs a homeowners insurance binder?

Source: universalnetworkcable.com

Source: universalnetworkcable.com

The insurance binder should specify exactly what�s being insured. Aventum group mga rokstone has signed a facultative property binder with slovenian insurer zavarovalnica triglav, providing it with. You can obtain auto insurance, homeowners insurance, and commercial property binders. Property binders property binders alistair maurice principal underwriter a first class client experience delivered by people who understand your needs. An insurance binder is a document that represents the agreement between you and your insurance provider.

Source: alquilercastilloshinchables.info

Source: alquilercastilloshinchables.info

A description of the insured real property; The name and address of the lender as loss payee; Who needs a homeowners insurance binder? What is an insurance binder? Your homeowners’ insurance binder is valid until you receive your official contract.

Source: lopriore.com

Source: lopriore.com

This document is crucial because it represents proof of the insurance until you will be able to receive the actual policy. Who needs a homeowners insurance binder? In the insurance world, a binder is a temporary document issued by your insurance company that basically says: 01 fast turnaround we can provide insurance binders in as little is 30 minutes from the time we receive the client and property information that is needed. A provision that the binder may not be canceled

Source: alquilercastilloshinchables.info

Source: alquilercastilloshinchables.info

Your home insurance binder will be required for the underwriting process and before you close on a mortgage. This may be paid to the agent or collected at the closing. That’s what binders are for. Your insurance binder contains important policy details like coverage limits and deductible amounts. 3 you should see the amount of insurance on the building, as well as the deductible, the named insured, and the term.

Source: zazzle.com

Source: zazzle.com

We are insuring this property.” binders are temporary confirmations of insurance, to help you get things done while you’re waiting for your final policy to arrive. Travelers property team underwrite a range of us and north american property risk portfolios on a binding authority / delegated underwriting basis. The lender usually requires the buyer to insure the building for physical damage by purchasing commercial property insurance. An insurance binder is a temporary policy that serves as a placeholder until your formal policy is issued. This temporary document outlines the details of your insurance plan and should be provided automatically by your insurance agent.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

The name and address of the borrower; Get property insurance binders with the most competitive carriers. Many businesses purchase commercial buildings by obtaining financing from a lender and using the building as collateral for the loan. The name and address of the borrower; Who needs a homeowners insurance binder?

Source: pinterest.com

Source: pinterest.com

That’s what binders are for. It is a single document that is usually one or two pages long, and it acts as temporary proof of insurance. A rapid and pragmatic approach to all aspects of underwriting. A description of the insured real property; Home insurance binders are used to show proof of insurance coverage on a property.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Our appetite covers a range of commercial and personal property risks, covering everything from business interruption, through to boiler machinery breakdown. Our appetite covers a range of commercial and personal property risks, covering everything from business interruption, through to boiler machinery breakdown. Your home insurance binder will be required for the underwriting process and before you close on a mortgage. Property binders property binders alistair maurice principal underwriter a first class client experience delivered by people who understand your needs. We are insuring this property.” binders are temporary confirmations of insurance, to help you get things done while you’re waiting for your final policy to arrive.

Source: honestpolicy.com

Source: honestpolicy.com

Binders are typically used to show evidence of things like property liability coverage to a lender, or when buying a new property. A description of the insured real property; 3 you should see the amount of insurance on the building, as well as the deductible, the named insured, and the term. Your homeowners’ insurance binder is valid until you receive your official contract. Home insurance binders are used to show proof of insurance coverage on a property.

Source: insurify.com

Source: insurify.com

What is an insurance binder? Your insurance binder contains important policy details like coverage limits and deductible amounts. Property shall accept as evidence of insurance a written binder issued by an authorized insurer or its agent if the binder includes or is accompanied by: Home insurance binders are used to show proof of insurance coverage on a property. A description of the insured real property;

Source: simply-easier-acord-forms.blogspot.com

Source: simply-easier-acord-forms.blogspot.com

A homeowners insurance binder is a temporary legal insurance contract that furnishes coverage and evidence of insurance. The name and address of the borrower; Binders are also used as evidence of property insurance. If it�s a car insurance binder, the make, model and vehicle identification number (vin) are essential. When purchasing a new home or car, you�ll typically need insurance that begins the day you assume ownership.

Source: thebalance.com

Source: thebalance.com

Property shall accept as evidence of insurance a written binder issued by an authorized insurer or its agent if the binder includes or is accompanied by: An insurance binder is a temporary insurance contract, not a permanent solution. When purchasing a new home or car, you�ll typically need insurance that begins the day you assume ownership. When to obtain a binder of insurance Get property insurance binders with the most competitive carriers.

Source: urbaninsuranceagency.com

Source: urbaninsuranceagency.com

A homeowners insurance binder is a temporary document issued by an authorized insurance representative that can serve as proof of insurance for your home, car, or property. A rapid and pragmatic approach to all aspects of underwriting. A description of the insured real property; Your insurance binder contains important policy details like coverage limits and deductible amounts. The name and address of the lender as loss payee;

Source: insurancecompanies20.blogspot.com

Source: insurancecompanies20.blogspot.com

A provision that the binder may not be canceled The name and address of the borrower; A binder is typically replaced within 30 to 90 days. Aventum group mga rokstone has signed a facultative property binder with slovenian insurer zavarovalnica triglav, providing it with. The name and address of the borrower;

Source: influenciaahlnl.blogspot.com

Source: influenciaahlnl.blogspot.com

A provision that the binder may not be canceled You can obtain auto insurance, homeowners insurance, and commercial property binders. The name and address of the lender as loss payee; A provision that the binder may not be canceled A home insurance binder is used to prove that you have coverage on your home.

Source: reviewhome.co

Source: reviewhome.co

An insurance binder is a temporary policy that serves as a placeholder until your formal policy is issued. This document is crucial because it represents proof of the insurance until you will be able to receive the actual policy. That’s what binders are for. The name and address of the lender as loss payee; The name and address of the lender as loss payee;

Source: youngalfred.com

Source: youngalfred.com

Home insurance binders are used to show proof of insurance coverage on a property. What is an insurance binder? The insurance binder itself lists the home insurance coverages, property location, policy period, annual premium and mortgagee information. The name and address of the lender as loss payee; The insurance binder is legally binding, provides.

Source: universalnetworkcable.com

Source: universalnetworkcable.com

Your homeowners’ insurance binder is valid until you receive your official contract. Typically, the bank or mortgage company will request that the insurance be paid in full for the closing, and that the binder state that. When purchasing a new home or car, you�ll typically need insurance that begins the day you assume ownership. A provision that the binder may not be canceled within the term Get property insurance binders with the most competitive carriers.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title property insurance binder by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information