Pros and cons of child life insurance Idea

Home » Trend » Pros and cons of child life insurance IdeaYour Pros and cons of child life insurance images are available in this site. Pros and cons of child life insurance are a topic that is being searched for and liked by netizens now. You can Download the Pros and cons of child life insurance files here. Find and Download all royalty-free images.

If you’re looking for pros and cons of child life insurance pictures information linked to the pros and cons of child life insurance keyword, you have come to the ideal site. Our website frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

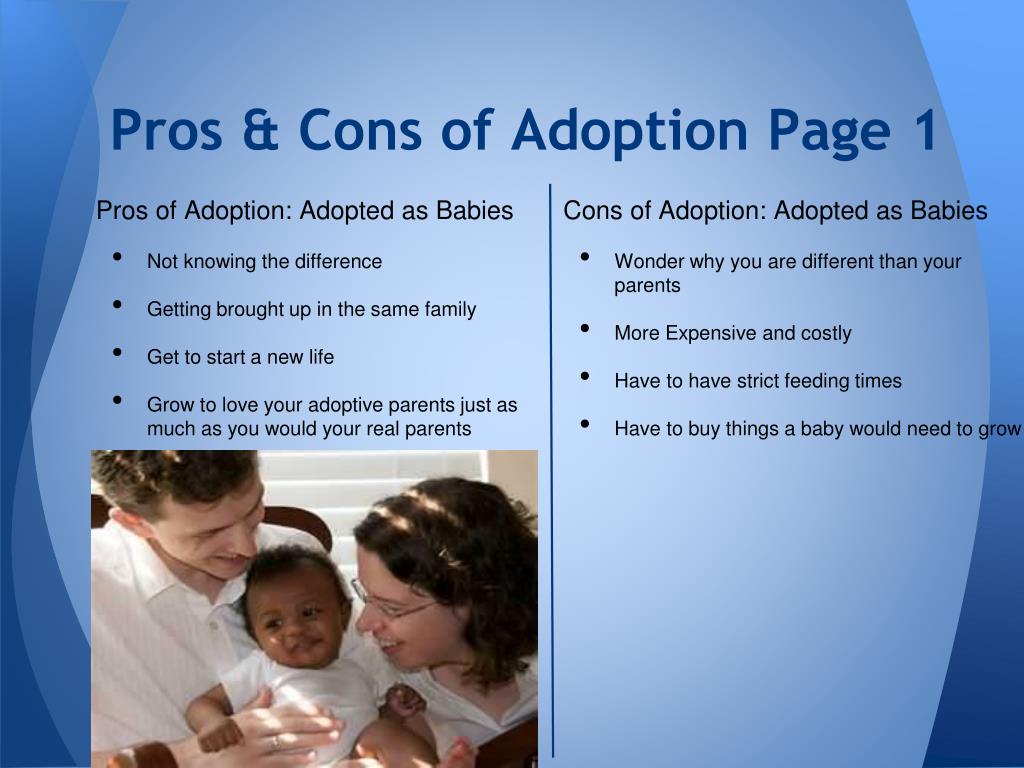

Pros And Cons Of Child Life Insurance. Parents may pay some extra sum to prolong the existing insurance for their kids. When a loan is taken out on a permanent life insurance policy it does not need to be paid back to the. Here are the pros and cons for you to consider: It’s necessary for the parents to have coverage.

Pros And Cons Of Child Life Insurance at Insurance From revisi.net

Pros And Cons Of Child Life Insurance at Insurance From revisi.net

Starting late is a mistake. While a child life insurance policy offers many benefits, it also has some drawbacks. On your own or with a licensed agent. This coverage costs less than the one that covers the entire life and can be also bought at the largest insurance corporations. We have established that naming a child as a beneficiary is not ideal, nor is naming a guardian. Provides policies without a medical exam, making it easier to get life insurance.

Cons of buying life insurance for a child it offers a low rate of return.

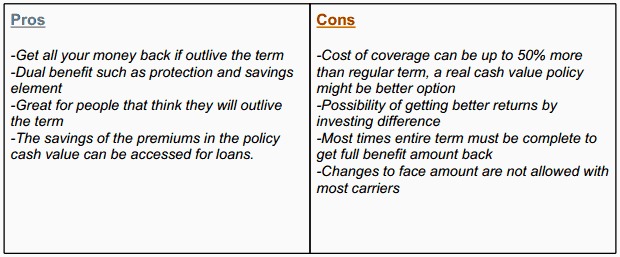

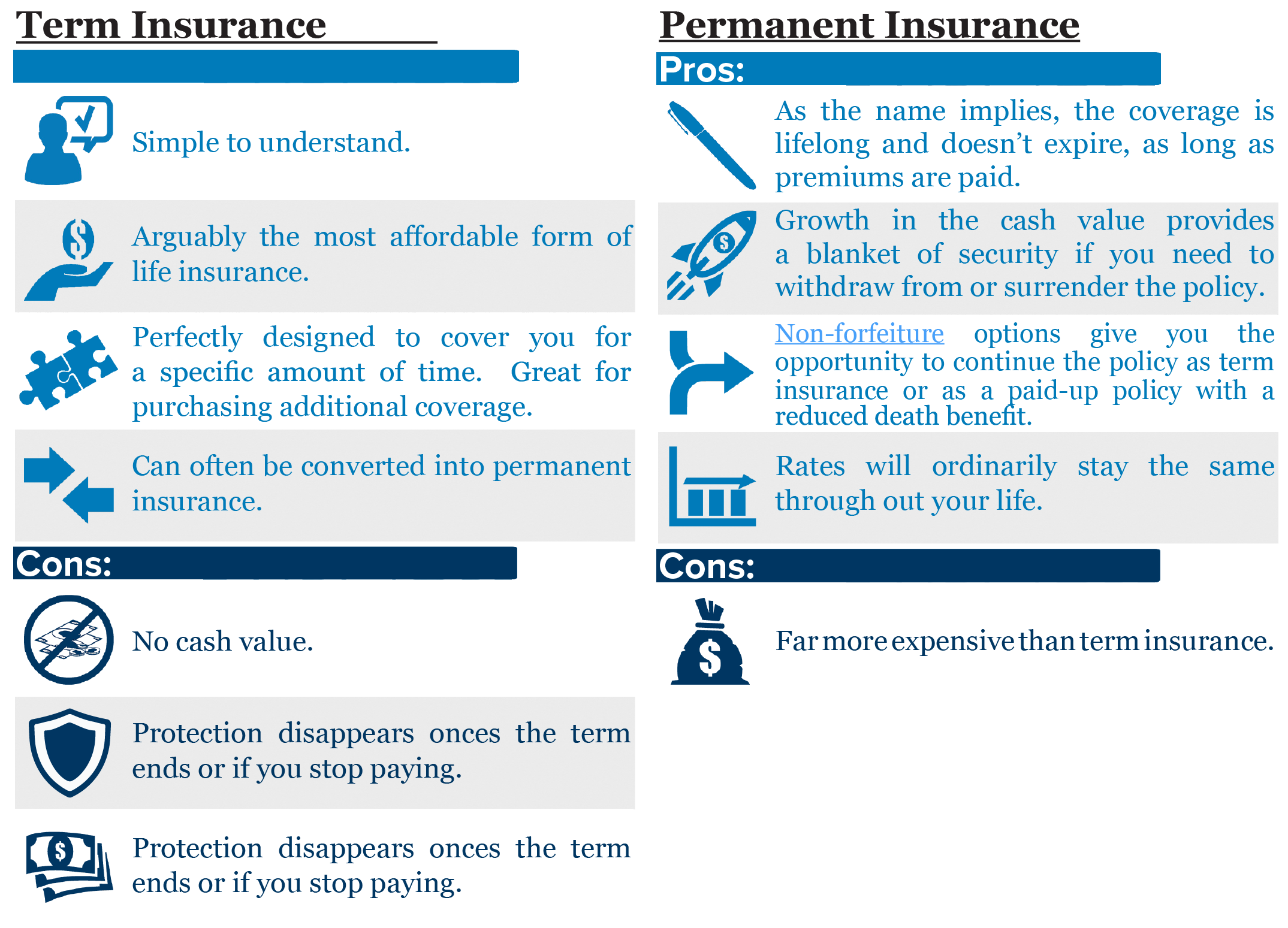

Typically, term policies remain in effect from five to 30 years, depending on the term you choose. Loans are only available for a policy that has accumulated a cash value. Term life plans are the most affordable type of life insurance. It not only pays out large sums of money, but it also allows policyholders to withdraw money from their savings account whenever they need it. It’s necessary for the parents to have coverage. When a loan is taken out on a permanent life insurance policy it does not need to be paid back to the.

Source: insurechance.com

Source: insurechance.com

Lump sum of money for funeral expenses. Drawbacks of purchasing life insurance for a child. Term life insurance offers policyholders a benefit only plan. Ad term life insurance at your pace. Typically, term policies remain in effect from five to 30 years, depending on the term you choose.

Source: revisi.net

Source: revisi.net

Bob hunter, director of insurance for the consumer federation of america, says juvenile life insurance is an unnecessary expense for most families. Term life plans can be renewable in some. Because of this, limited pay (paying down the entire policy in a short amount of time) can become an attractive option because of the lower cost. Following are the drawbacks of buying a child life insurance plan : Parents may pay some extra sum to prolong the existing insurance for their kids.

Source: insurance-companies.co

Source: insurance-companies.co

Below is the pros and cons of buying life insurance for children. A child�s life insurance plan, also known as a child plan, is a combination of insurance and investment that can help fulfil your children�s financial needs. Ad term life insurance at your pace. Although whole life insurance policies build cash value, they do so at a low rate of return. A loan can be taken out on the policy up to the cash value amount.

Source: elcomutual.com

You pay an affordable annual premium to insure your child’s life. Term life insurance offers policyholders a benefit only plan. Term life plans can be renewable in some. A loan can be taken out on the policy up to the cash value amount. Your premiums will be lower and your earnings will be larger if you start early.

Source: skloff.com

Source: skloff.com

Lump sum of money for funeral expenses. Provides policies without a medical exam, making it easier to get life insurance. Term life insurance for children. Lump sum of money for funeral expenses. Buying life insurance is a means to reduce financial risks and losses.

Source: revisi.net

Source: revisi.net

The pros and cons of life insurance for children. This is true for almost all types of insurance coverage. Loans are only available for a policy that has accumulated a cash value. By dubaikhalifas on feb 18, 2022 Should i buy life insurance for my child pros and cons.

Source: riskquoter.com

Source: riskquoter.com

There�s no clear and dry answer about whether parents should buy life insurance for their children. In general, people who are covered by health insurance often also have a significantly higher life expectancy compared to people who lack such insurance. The pros and cons of life insurance for children. Should i buy life insurance for my child pros and cons. When a permanent life insurance policy is purchased for a child there are benefits available when a child becomes an adult.

Source: howardkayeinsurance.com

Source: howardkayeinsurance.com

Starting late is a mistake. Buying life insurance is a means to reduce financial risks and losses. Bob hunter, director of insurance for the consumer federation of america, says juvenile life insurance is an unnecessary expense for most families. Cons of buying life insurance for a child it offers a low rate of return. When a loan is taken out on a permanent life insurance policy it does not need to be paid back to the.

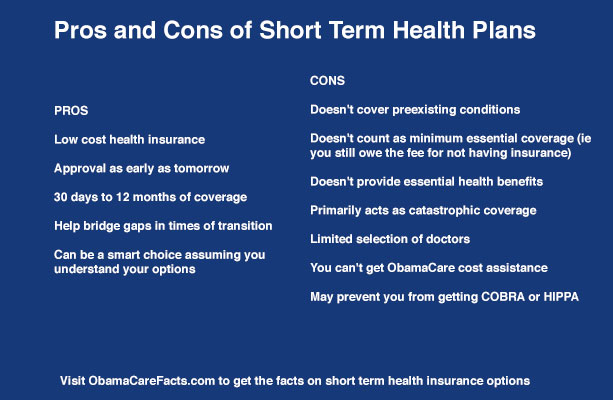

Source: obamacarefacts.com

Source: obamacarefacts.com

Children’s life insurance policies generally offer lower premiums due to the young age and relative health of the insured child. By dubaikhalifas on feb 18, 2022 Starting late is a mistake. Cons of buying life insurance for a child it offers a low rate of return. More than the expected number of complaints for a.

Source: insurance-companies.co

Source: insurance-companies.co

According to a survey by limra, about 20% of parents or grandparents have life insurance on their children and grandchildren. Should i buy life insurance for my child pros and cons. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. If your child develops a chronic disease, they may not be eligible for life insurance later. A loan can be taken out on the policy up to the cash value amount.

Source: quickquote.com

Source: quickquote.com

Bob hunter, director of insurance for the consumer federation of america, says juvenile life insurance is an unnecessary expense for most families. Children’s life insurance policies generally offer lower premiums due to the young age and relative health of the insured child. Cons of buying life insurance for a child it offers a low rate of return. Bob hunter, director of insurance for the consumer federation of america, says juvenile life insurance is an unnecessary expense for most families. On your own or with a licensed agent.

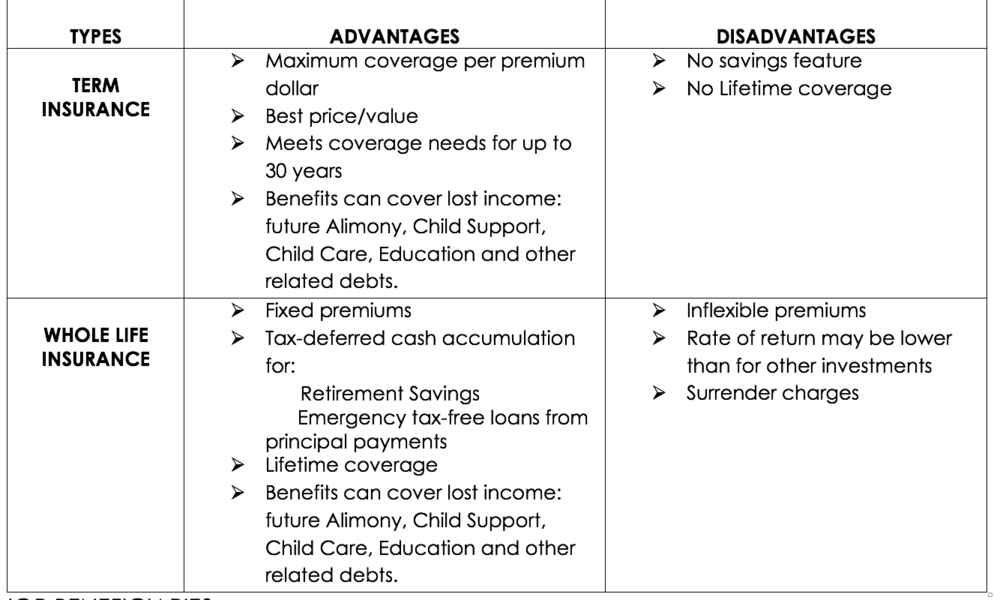

![How to protect your children and family [options and steps] How to protect your children and family [options and steps]](https://onestoplifeinsurance.com/wp-content/uploads/2017/08/Term-Vs-WL-vs-UL.png) Source: onestoplifeinsurance.com

Source: onestoplifeinsurance.com

Should i buy life insurance for my child pros and cons. Typically, term policies remain in effect from five to 30 years, depending on the term you choose. This is quite logical since if you are not able to pay for expensive surgeries or other important medical treatment, the chances to die from your health condition will be much higher. The pros and cons of life insurance for children. Following are the drawbacks of buying a child life insurance plan :

Source: revisi.net

Source: revisi.net

On your own or with a licensed agent. A loan can be taken out on the policy up to the cash value amount. “losing a child brings emotional damage. It would help if you had a trust for the beneficiary. You cannot purchase a life insurance policy to secure your child’s financial future, only for it to become the opposite.

Source: moneyunder30.com

Source: moneyunder30.com

Term life plans can be renewable in some. By dubaikhalifas on feb 18, 2022 Term life plans can be renewable in some. Should i buy life insurance for my child pros and cons. Term life plans are easy to understand.

Source: 1investing.in

Source: 1investing.in

We have established that naming a child as a beneficiary is not ideal, nor is naming a guardian. Bob hunter, director of insurance for the consumer federation of america, says juvenile life insurance is an unnecessary expense for most families. Following are the drawbacks of buying a child life insurance plan : “losing a child brings emotional damage. Because of this, limited pay (paying down the entire policy in a short amount of time) can become an attractive option because of the lower cost.

Source: pinterest.com.mx

Source: pinterest.com.mx

Starting late is a mistake. A child�s insurance coverage is no different. This coverage costs less than the one that covers the entire life and can be also bought at the largest insurance corporations. Children’s life insurance policies generally offer lower premiums due to the young age and relative health of the insured child. Starting late is a mistake.

Source: revisi.net

Source: revisi.net

Term life insurance for children. We have established that naming a child as a beneficiary is not ideal, nor is naming a guardian. A loan can be taken out on the policy up to the cash value amount. Although whole life insurance policies build cash value, they do so at a low rate of return. If your child develops a chronic disease, they may not be eligible for life insurance later.

Source: quility.com

Source: quility.com

Cons of buying life insurance for a child it offers a low rate of return. Term life plans are the most affordable type of life insurance. Cons of buying life insurance for a child it offers a low rate of return. Cons of buying life insurance for a child it offers a low rate of return. You cannot purchase a life insurance policy to secure your child’s financial future, only for it to become the opposite.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title pros and cons of child life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information