Pros and cons of final expense insurance Idea

Home » Trend » Pros and cons of final expense insurance IdeaYour Pros and cons of final expense insurance images are available in this site. Pros and cons of final expense insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Pros and cons of final expense insurance files here. Get all royalty-free photos and vectors.

If you’re looking for pros and cons of final expense insurance pictures information connected with to the pros and cons of final expense insurance interest, you have come to the right site. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

Pros And Cons Of Final Expense Insurance. Aig has the lowest better business bureau rating of the 25 life insurance companies we�ve reviewed. Aig has an aggregate trustpilot rating of 2.0, with many customers citing poor customer service. The death benefit never decreases. Final expense insurance is a type of whole life insurance that is designed to cover the costs of a.

Pros And Cons Of Final Expense Insurance Pros And Cons From famousmasahista.blogspot.com

Pros And Cons Of Final Expense Insurance Pros And Cons From famousmasahista.blogspot.com

Final expense and burial insurance do not cover as much as term life. Pros and cons of final expense insurance policy. $25,000 whole life insurance policy: Provide peace of mind to your loved ones. Final expense insurance is a type of whole life policy. Keep reading to learn more about final expense insurance and to find out if this insurance solution is right for you.

And these expenses increase with time.

Pros and cons of buying life insurance for kids. Bob hunter, director of insurance for the consumer federation of america, says juvenile life insurance is an unnecessary expense for most families. Keep reading to learn more about final expense insurance and to find out if this insurance solution is right for you. Funeral homes accept assignment of the payout. For example, obituaries and motorcycle escorts are costs that the funeral home cannot control. Due to its high cost for lower coverage amounts, final expense insurance is best suited for people who are ineligible for traditional coverage.

Source: medicarelifehealth.com

Source: medicarelifehealth.com

In fact, creativity is a barrier to having success selling many insurance products. 12 benefits of final expense insurance: For example, obituaries and motorcycle escorts are costs that the funeral home cannot control. And since it usually doesn’t require a medical. Prices become less competitive for individuals over 70 years old.

Source: quility.com

Source: quility.com

Aig has an aggregate trustpilot rating of 2.0, with many customers citing poor customer service. Provide peace of mind to your loved ones. Instant approval policies issued in as little as 48 hours. The death benefit never decreases. October 4, 2021 8 views 0

Source: simplyinsurance.com

Source: simplyinsurance.com

Final expense policy (burial insurance) flexible if plans change or circumstances of death require different arrangements. Final expense insurance is relatively affordable if you’re on a tight budget. With no health exam, you won’t get a discounted rate if you are in good health with little to no health information, the cost of the policy can. Prices become less competitive for individuals over 70 years old. Final expense and burial insurance do not cover as much as term life.

Source: unitedfinalexpenseservices.com

Source: unitedfinalexpenseservices.com

The application process for final expense insurance doesn’t require undertaking a medical examination. Aig has the lowest better business bureau rating of the 25 life insurance companies we�ve reviewed. It may not cover everything, such as paying off a large mortgage, but final expense insurance will at least help your loved ones pay the bills: 12 benefits of final expense insurance: Due to its high cost for lower coverage amounts, final expense insurance is best suited for people who are ineligible for traditional coverage.

Source: famousmasahista.blogspot.com

Source: famousmasahista.blogspot.com

Funeral homes accept assignment of the payout. It may not cover everything, such as paying off a large mortgage, but final expense insurance will at least help your loved ones pay the bills: The application process for final expense insurance doesn’t require undertaking a medical examination. Pros of final expense insurance the most positive features are as follows: Of course, the downside of this option lies with the potential uncertainty that long life can provide.

Source: insurmex.com

Source: insurmex.com

This option still gives your family peace of mind that all expenses are covered. It offers the security of guaranteed death benefit. With no health exam, you won’t get a discounted rate if you are in good health with little to no health information, the cost of the policy can. And these expenses increase with time. Final expense policies are usually easier to qualify for than traditional life insurance, and typically, the older you are, the higher your monthly premium will be.

Source: youtube.com

Source: youtube.com

Final expense insurance is relatively affordable if you’re on a tight budget. The average cost of a traditional casket funeral is over $9,000. Your beneficiaries receive the death proceeds tax free. It offers the security of guaranteed death benefit. October 4, 2021 8 views 0

Source: millennialmoney.com

Source: millennialmoney.com

Final expense insurance is a type of whole life insurance that is designed to cover the costs of a. Pros and cons of burial insurance a final expense policy can offer peace of mind and ease the financial burden on your family while they’re grieving. Your beneficiaries can use the death benefit how they choose. Pros and cons of final expense insurance policy. It may not cover everything, such as paying off a large mortgage, but final expense insurance will at least help your loved ones pay the bills:

Source: burialinsurance.org

Source: burialinsurance.org

Instant approval policies issued in as little as 48 hours. Prices become less competitive for individuals over 70 years old. Aig has the lowest better business bureau rating of the 25 life insurance companies we�ve reviewed. It typically doesn’t provide as much. Affordable for those who are on a budget.

Source: carolinaseniormarketing.com

Source: carolinaseniormarketing.com

Proceeds can be used for anything, including the many other final expenses a person will have in addition to the burial. If you’re a breadwinner, it’s likely you either own or plan to buy life insurance to protect your family’s income. Pros of final expense insurance the most positive features are as follows: Your beneficiaries receive the death proceeds tax free. Funeral homes accept assignment of the payout.

Source: sproutt.com

Source: sproutt.com

What are the pros and cons of final expense insurance? Prices become less competitive for individuals over 70 years old. The average cost of a traditional casket funeral is over $9,000. Finally, final expense insurance doesn’t only cover funeral costs — it can help pick up final health care bills that your children will be responsible for. Protection at an affordable price premiums are payable to age 100 and guaranteed never to increase.

Source: finalexpensedirect.com

Source: finalexpensedirect.com

If you’re a breadwinner, it’s likely you either own or plan to buy life insurance to protect your family’s income. Final expense policy (burial insurance) flexible if plans change or circumstances of death require different arrangements. Pros and cons of burial insurance a final expense policy can offer peace of mind and ease the financial burden on your family while they’re grieving. Final expense insurance is a type of whole life policy. Pros of final expense insurance plans your life insurance company makes policies available to applicants with poor health you can buy a policy with a lower death benefit ($50,000 or less) you provide peace of mind to your loved ones cons of final expense insurance some insurers provide incomplete information about final expense insurance policies

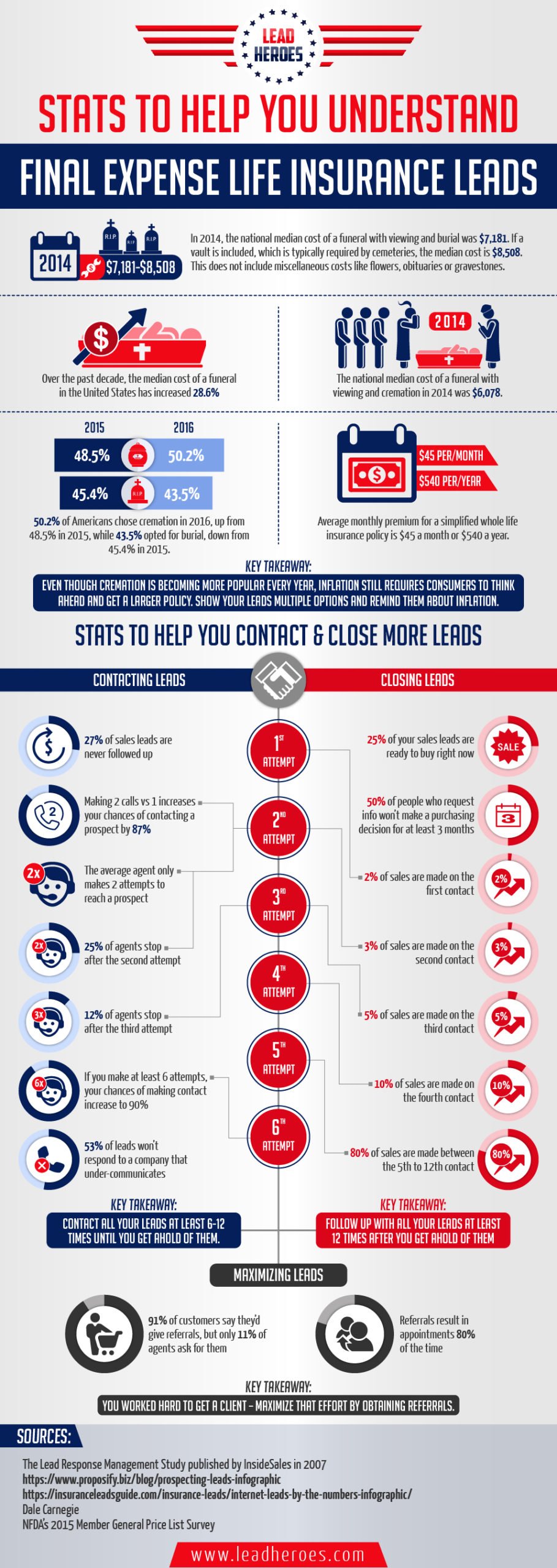

Source: leadheroes.com

Source: leadheroes.com

Protection at an affordable price premiums are payable to age 100 and guaranteed never to increase. The death benefit never decreases. Pros of final expense insurance applicants with poor health can easily access this kind of policy. Pros of final expense insurance the most positive features are as follows: Funeral homes accept assignment of the payout.

Source: finalexpenseinsurancenashingu.blogspot.com

Source: finalexpenseinsurancenashingu.blogspot.com

For example, obituaries and motorcycle escorts are costs that the funeral home cannot control. 12 benefits of final expense insurance: Your beneficiaries receive the death proceeds tax free. Affordable for those who are on a budget. Final expense policy (burial insurance) flexible if plans change or circumstances of death require different arrangements.

Source: surebridgeinsurance.com

Source: surebridgeinsurance.com

With final expense, it’s a straightforward strategy. Pros and cons of final expense insurance policy. Pros of final expense insurance the most positive features are as follows: Final expense policy (burial insurance) flexible if plans change or circumstances of death require different arrangements. Pros of final expense insurance plans your life insurance company makes policies available to applicants with poor health you can buy a policy with a lower death benefit ($50,000 or less) you provide peace of mind to your loved ones cons of final expense insurance some insurers provide incomplete information about final expense insurance policies

Source: ensurem.com

Source: ensurem.com

Final expense policies are usually easier to qualify for than traditional life insurance, and typically, the older you are, the higher your monthly premium will be. In other cases, burial or final expense insurance could be an option given the coverage amount of $25,000. For example, obituaries and motorcycle escorts are costs that the funeral home cannot control. Your beneficiaries receive the death proceeds tax free. $25,000 whole life insurance policy:

Source: brandongaille.com

Source: brandongaille.com

And these expenses increase with time. Due to its high cost for lower coverage amounts, final expense insurance is best suited for people who are ineligible for traditional coverage. And these expenses increase with time. Final expense insurance pros & cons you have the flexibility to choose between monthly or annual premium payments. Final expense insurance is a type of whole life policy.

Source: cremationinstitute.com

Source: cremationinstitute.com

Provide peace of mind to your loved ones. Pros and cons of final expense insurance policy. Aig has the lowest better business bureau rating of the 25 life insurance companies we�ve reviewed. Instead, the values necessary for success include: 12 benefits of final expense insurance:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title pros and cons of final expense insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information