Pros and cons of having two health insurance information

Home » Trending » Pros and cons of having two health insurance informationYour Pros and cons of having two health insurance images are available. Pros and cons of having two health insurance are a topic that is being searched for and liked by netizens now. You can Get the Pros and cons of having two health insurance files here. Get all royalty-free vectors.

If you’re looking for pros and cons of having two health insurance pictures information connected with to the pros and cons of having two health insurance keyword, you have pay a visit to the ideal site. Our site frequently provides you with hints for seeing the maximum quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

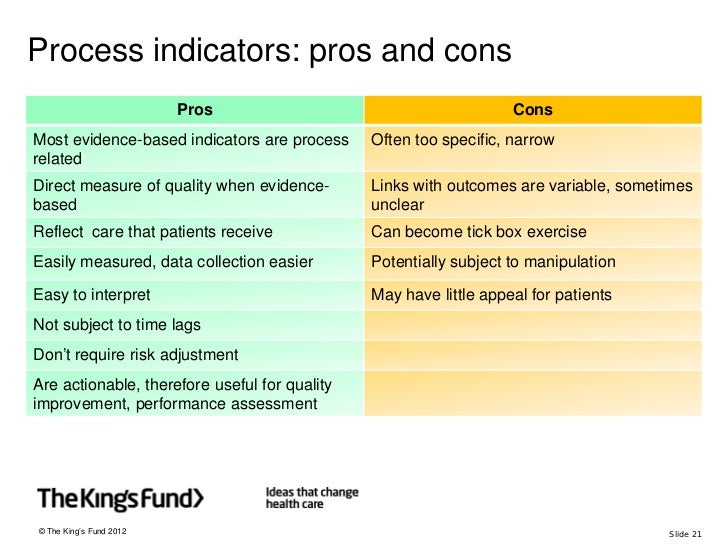

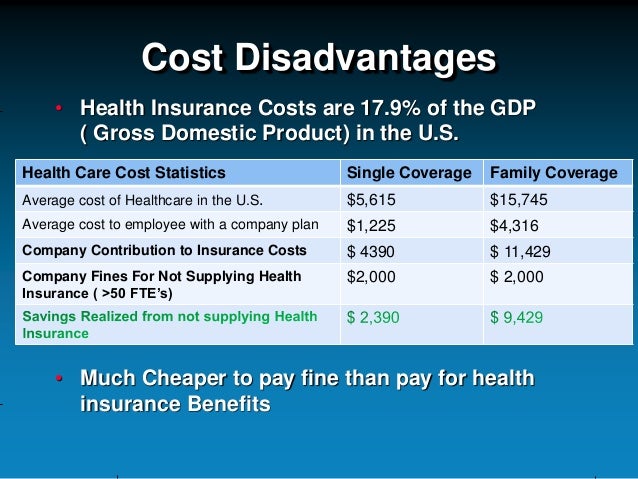

Pros And Cons Of Having Two Health Insurance. The pros and cons of mandated health insurance…and how investors can profit it�s no secret that health care costs are spiraling out of control in this country. Situations, where your claim is rejected, can lead to despair. Hedge against the rejection of claims. You will receive more coverage than you would with (5).

International health care 21311 From slideshare.net

International health care 21311 From slideshare.net

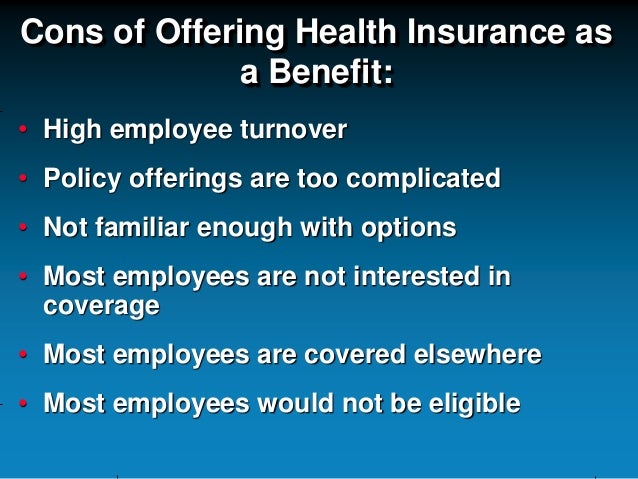

Here, multiple health insurance policies can be of great help. When an insurance company receives more then one submission on the same line of insurance for the same insured, it can trigger an underwriter to think this insured only cares about the premium and not coverage. This will allow you to feel greater peace of mind about daily life and have less concern over the unknown. Having two healthcare plans can be beneficial, but a downside is the need to pay two premiums and meet two separate deductibles. 1.) if you are using different brokers for the same line of insurance, this can get complicated and messy. The main disadvantage is premiums have to be paid for all plans.

Because paying for such a massive amount of bills of the hospital from own pocket can be a nightmare for many.

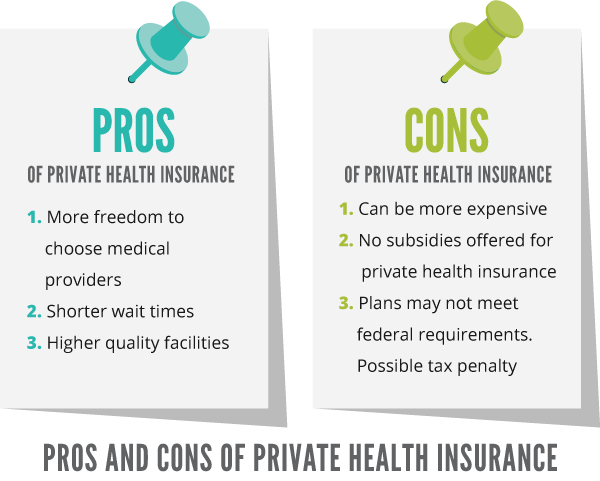

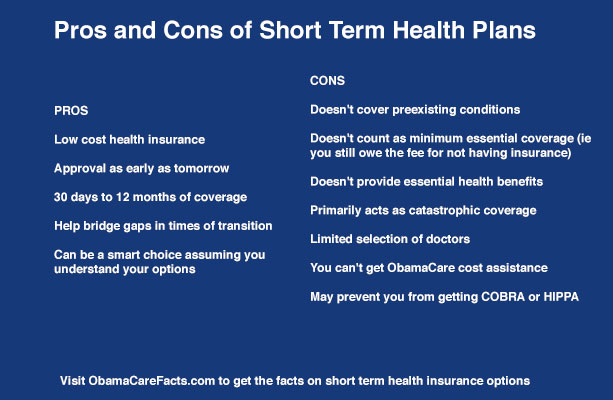

But in other cases, the added premium payment and deductible might increase your overall health expenses and. Should you take out a private health insurance policy or rely on the public system? We’ve provided a brief but substantive outline below of some of the pros and cons associated with four of the most popular types of health insurance plans. Bottom of the pile your submission goes. You will receive more coverage than you would with (5). Jun 22, 2020 — dual health insurance coverage can be an attractive option for eligible employees because the two plans can be essentially stacked on top of (6).

Source: advancedclinicaljobs.wordpress.com

Source: advancedclinicaljobs.wordpress.com

Benefits of having two (or more) health insurance policies. Jun 22, 2020 — dual health insurance coverage can be an attractive option for eligible employees because the two plans can be essentially stacked on top of (6). Having two or more health insurance plans can be a way to maximize benefits and potentially receive more coverage than if you only had one plan. Having two (or more) health plans can be a good choice if the savings you receive outweigh the costs. There are several benefits of having multiple health insurance plans as discussed herewith:

Source: slideshare.net

Source: slideshare.net

We�ve looked at some factors to consider when deciding. You can save money on your health care costs through what�s known as the coordination of benefits provision. The main disadvantage is premiums have to be paid for all plans. Benefits of having two (or more) health insurance policies. Having two health plans does help cover any health care costs better through the coordination of benefits provision.

Source: insurance-companies.co

Source: insurance-companies.co

Having two or more health insurance plans can be a way to maximize benefits and potentially receive more coverage than if you only had one plan. Health insurance allows individuals to be more prepared for the moments when life happens. These rules vary depending on where you live and the companies that cover you. Having two or more health insurance plans can be a way to maximize benefits and potentially receive more coverage than if you only had one plan. · you’ll still have to pay deductibles and premium fees (6).

Source: firstquotehealth.com

Source: firstquotehealth.com

The bill would be passed to your secondary insurance company, instead of directly to you. There are pros and cons of having more than one health insurance plan. You will know that both you and your loved ones are insured for any accidents or injuries and that you can recover without worrying about income levels. When an insurance company receives more then one submission on the same line of insurance for the same insured, it can trigger an underwriter to think this insured only cares about the premium and not coverage. You won’t get double the coverage by buying two health plans.

Source: jeffreybernard.com

Source: jeffreybernard.com

Having access to two health plans can be good when making health care claims. You will receive more coverage than you would with (5). 1.) if you are using different brokers for the same line of insurance, this can get complicated and messy. There are several benefits of having multiple health insurance plans as discussed herewith: This will allow you to feel greater peace of mind about daily life and have less concern over the unknown.

Source: slideshare.net

Source: slideshare.net

Benefits of having two (or more) health insurance policies. We’ve provided a brief but substantive outline below of some of the pros and cons associated with four of the most popular types of health insurance plans. Instead dual coverage is decided on by coordination of benefits. Having two or more health insurance plans can be a way to maximize benefits and potentially receive more coverage than if you only had one plan. Situations, where your claim is rejected, can lead to despair.

Source: wheelingit.us

Source: wheelingit.us

Rather, they can simply review the one insurance plan put forth by their employer. Having two healthcare plans can be beneficial, but a downside is the need to pay two premiums and meet two separate deductibles. This is particularly important when major illnesses, catastrophic injuries, or. 1.) if you are using different brokers for the same line of insurance, this can get complicated and messy. There are two main advantages to getting insurance through an employer:

Source: indiamart.com

Source: indiamart.com

Bottom of the pile your submission goes. The pros and cons of mandated health insurance…and how investors can profit it�s no secret that health care costs are spiraling out of control in this country. When an insurance company receives more then one submission on the same line of insurance for the same insured, it can trigger an underwriter to think this insured only cares about the premium and not coverage. We�ve looked at some factors to consider when deciding. Having two health plans can increase how much coverage you get.

Source: slideshare.net

Source: slideshare.net

Match with the search results: You won’t get double the coverage by buying two health plans. Jun 22, 2020 — dual health insurance coverage can be an attractive option for eligible employees because the two plans can be essentially stacked on top of (6). When an insurance company receives more then one submission on the same line of insurance for the same insured, it can trigger an underwriter to think this insured only cares about the premium and not coverage. Hedge against the rejection of claims.

Source: slideshare.net

Source: slideshare.net

Having two health plans can increase how much coverage you get. Dual health insurance coverage can be an attractive option for eligible employees because the two plans can be essentially stacked on top of each other to provide more extensive benefits. There are two main advantages to getting insurance through an employer: Instead dual coverage is decided on by coordination of benefits. 1.) if you are using different brokers for the same line of insurance, this can get complicated and messy.

Source: thebalance.com

Source: thebalance.com

You will know that both you and your loved ones are insured for any accidents or injuries and that you can recover without worrying about income levels. You will receive more coverage than you would with (5). These rules vary depending on where you live and the companies that cover you. Here, multiple health insurance policies can be of great help. You will know that both you and your loved ones are insured for any accidents or injuries and that you can recover without worrying about income levels.

Source: remedigap.com

Source: remedigap.com

For example, if you have to pay the full premium to maintain each plan, and the premiums are high, the costs might outweigh the savings. What are the pros and cons of availing a healthcare plan. This will allow you to feel greater peace of mind about daily life and have less concern over the unknown. When an insurance company receives more then one submission on the same line of insurance for the same insured, it can trigger an underwriter to think this insured only cares about the premium and not coverage. Rather, they can simply review the one insurance plan put forth by their employer.

Source: fbinsure.com

Source: fbinsure.com

Having two healthcare plans can be beneficial, but a downside is the need to pay two premiums and meet two separate deductibles. But in other cases, the added premium payment and deductible might increase your overall health expenses and. Hedge against the rejection of claims. Situations, where your claim is rejected, can lead to despair. This will allow you to feel greater peace of mind about daily life and have less concern over the unknown.

Source: insurancetailors.co.uk

Source: insurancetailors.co.uk

Having secondary insurance gives you a second chance when your primary insurance company chooses to deny payment for your medical bills. What are the pros and cons of availing a healthcare plan. Rather, they can simply review the one insurance plan put forth by their employer. Having two health plans helps you to maximize healthcare benefits. There are two main advantages to getting insurance through an employer:

Source: obamacarefacts.com

Source: obamacarefacts.com

Instead dual coverage is decided on by coordination of benefits. Having two healthcare plans can be beneficial, but a downside is the need to pay two premiums and meet two separate deductibles. Situations, where your claim is rejected, can lead to despair. Health insurance allows individuals to be more prepared for the moments when life happens. There are several benefits of having multiple health insurance plans as discussed herewith:

Source: slideshare.net

Source: slideshare.net

Having access to two health plans can be good when making health care claims. Having secondary insurance gives you a second chance when your primary insurance company chooses to deny payment for your medical bills. In the private healthcare system you often have more flexibility in choosing a doctor as well as medical facility. Second, getting insurance through an employer is almost. If you are thinking you will save money on health insurance by only having one plan, think about how combining care works and what.

Source: formosapost.com

Source: formosapost.com

You will receive more coverage than you would with (5). Advantages to having two health plans. You will know that both you and your loved ones are insured for any accidents or injuries and that you can recover without worrying about income levels. If you are thinking you will save money on health insurance by only having one plan, think about how combining care works and what. Here, multiple health insurance policies can be of great help.

Source: nfpforpharmacists.weebly.com

Source: nfpforpharmacists.weebly.com

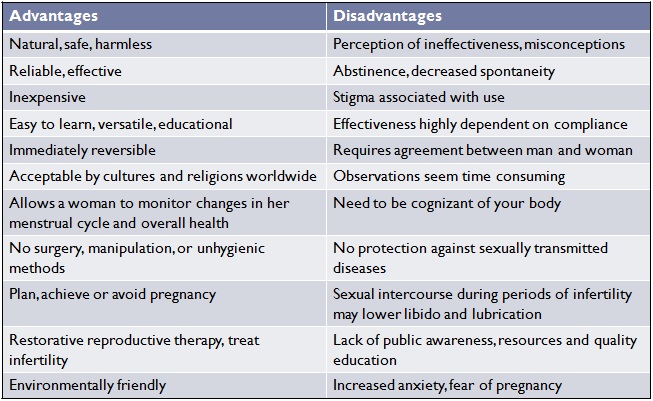

There are pros and cons of having more than one health insurance plan. Having two healthcare plans can be beneficial, but a downside is the need to pay two premiums and meet two separate deductibles. The pros and cons of mandated health insurance…and how investors can profit it�s no secret that health care costs are spiraling out of control in this country. The main disadvantage is premiums have to be paid for all plans. This will allow you to feel greater peace of mind about daily life and have less concern over the unknown.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title pros and cons of having two health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information