Pros and cons of living benefits life insurance information

Home » Trend » Pros and cons of living benefits life insurance informationYour Pros and cons of living benefits life insurance images are ready. Pros and cons of living benefits life insurance are a topic that is being searched for and liked by netizens now. You can Download the Pros and cons of living benefits life insurance files here. Get all free images.

If you’re looking for pros and cons of living benefits life insurance pictures information linked to the pros and cons of living benefits life insurance interest, you have come to the right site. Our site always gives you suggestions for seeking the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

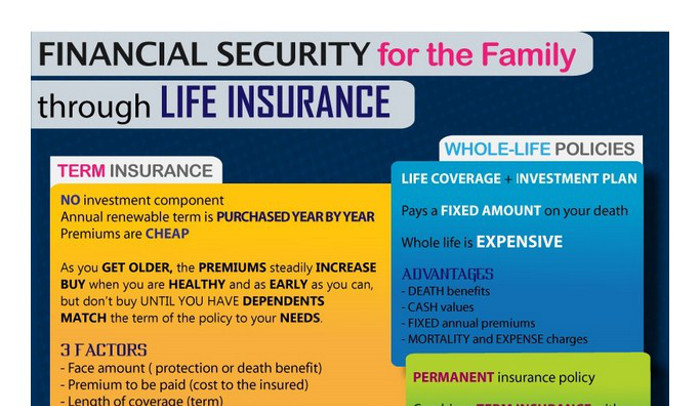

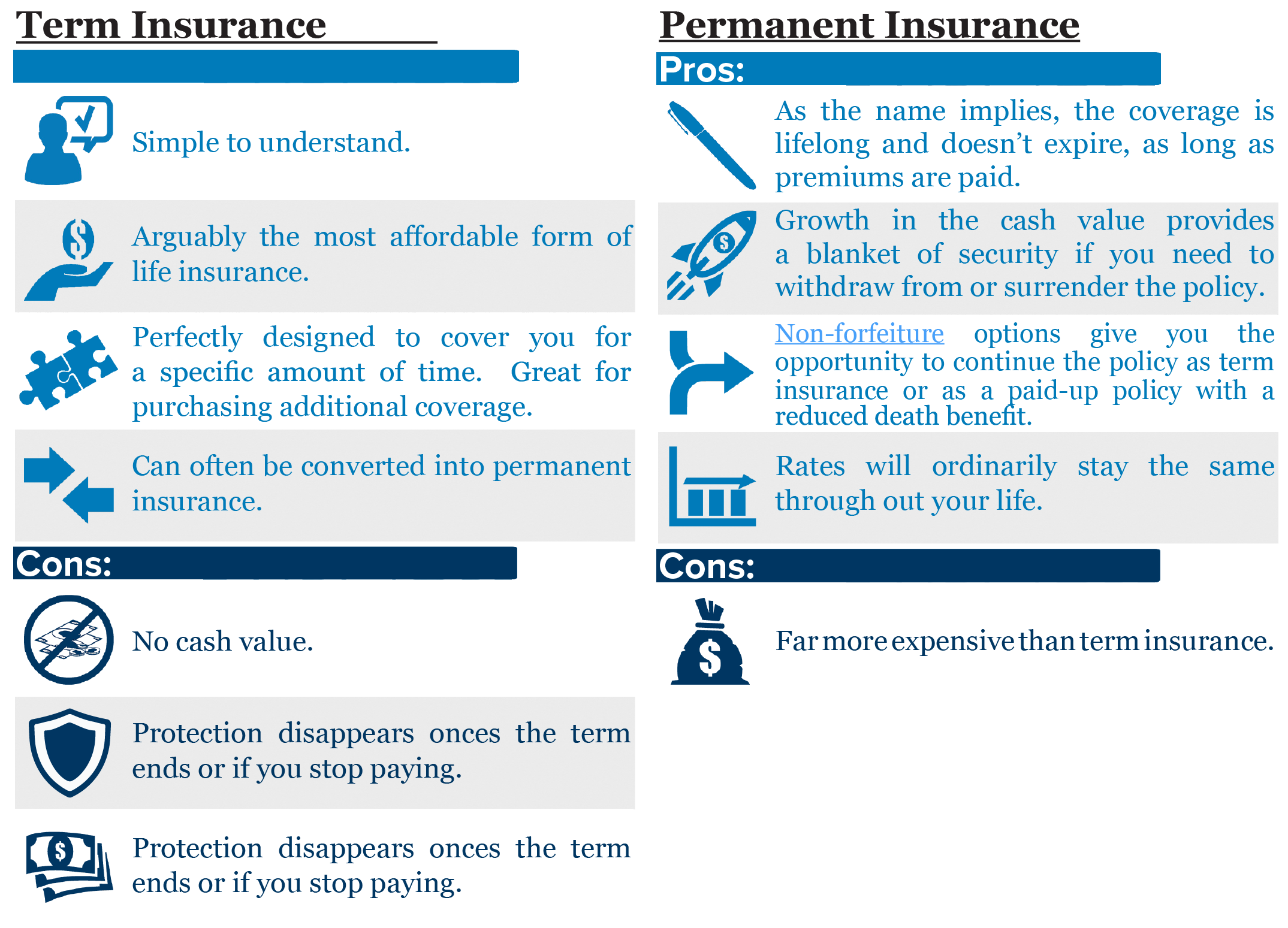

Pros And Cons Of Living Benefits Life Insurance. It’s good to know that one of the benefits of getting life insurance is the living benefits, which gives you access to a portion of. One of the many advantages of life insurance is that it provides many tax benefits. Terminally ill, and sometimes chronically ill, seniors that have life insurance policies are able to receive a portion of their death benefit from their insurance company in advance of their death. If you die, the policy pays out a lump sum death benefit to your beneficiary.

Whole Life Insurance A Good Investment? From moneyunder30.com

Whole Life Insurance A Good Investment? From moneyunder30.com

Yes, life insurance can offer the advantages of both death benefits and living benefits. Each once in for a spell, i will get budgetary inquiries from peruses. Yes, there is a buck to be made on. One of the many advantages of life insurance is that it provides many tax benefits. He purchases $500,000 life insurance with living benefits to protect his wife and 3 children. The pros of having life insurance outweigh the cons for most people with financial responsibilities such as mortgage payments, children, or student debt.

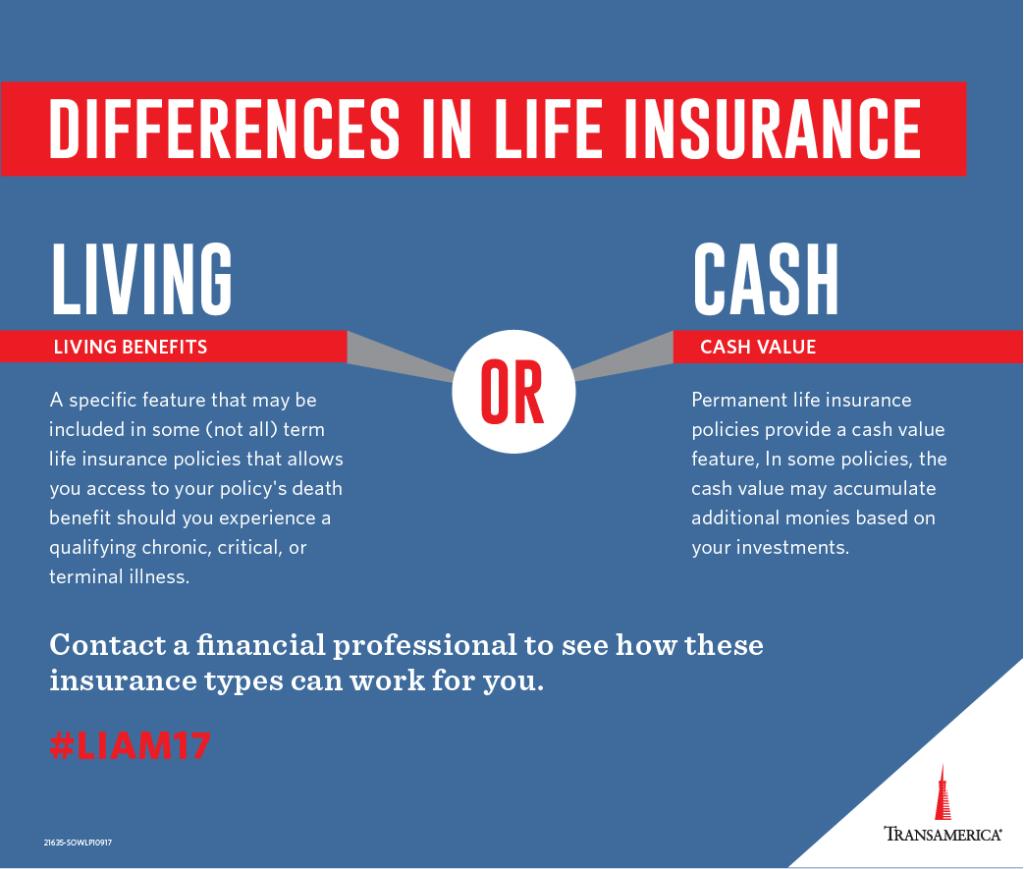

Living benefits give you more options on how to best use your life insurance policy because they allow you to use the accrued cash value or accelerate some of the death benefit for qualified expenses.

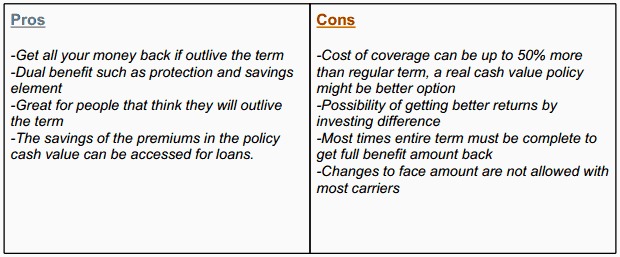

Life insurance companies arent only offering these living benefits out of the kindness of their hearts. The pros and cons of permanent life insurance. Finally, for a balanced approach we offer the disadvantages of iul insurance as well. Initially founded in 1919 in shanghai,. This is one of the key benefits of a whole life insurance policy. If you are a salaried employee and have purchased a life insurance policy, you can claim deduction under section 80c.

Source: iciciprulife.com

Source: iciciprulife.com

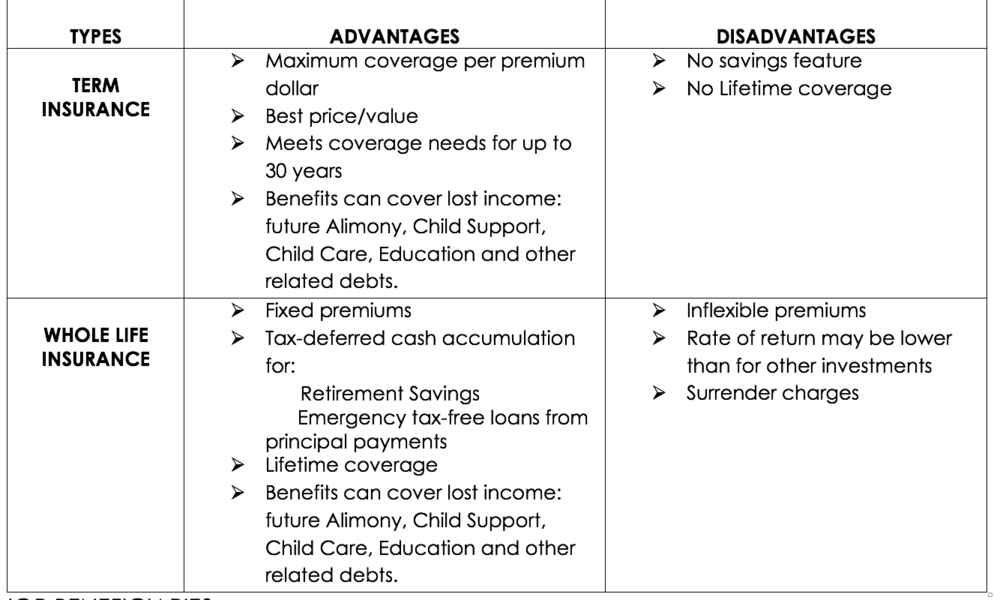

One of the many advantages of life insurance is that it provides many tax benefits. However, the disadvantages of term insurance. Aig scores points for term life insurance policies, including its quality of life plans with living benefits. Term life is easy, it is basically pure death insurance. Initially founded in 1919 in shanghai,.

Source: healthresearchfunding.org

Source: healthresearchfunding.org

A permanent policy’s cash value grows over time and can be used to pay premiums or take out a loan from the insurer. Indexed universal life insurance offers tax benefits and potentially higher returns, but it has a number of risks that need to be considered. Finally, for a balanced approach we offer the disadvantages of iul insurance as well. Lack of dependents who would need a death benefit. Pros & cons of accelerated death benefits.

Source: insurechance.com

Source: insurechance.com

Here are some of the most common disadvantages: Also known as accelerated death benefits, term life insurance with living benefits is offered as an additional rider in most cases. Pros and cons of living benefits life insurance. One of the many advantages of life insurance is that it provides many tax benefits. Living benefits are offered before you die, and death benefits are offered.

Source: pinterest.com

Source: pinterest.com

Each once in for a spell, i will get budgetary inquiries from peruses. Terminally ill, and sometimes chronically ill, seniors that have life insurance policies are able to receive a portion of their death benefit from their insurance company in advance of their death. Www.vecteezy.com * purchase life insurance with living benefits. It’s good to know that one of the benefits of getting life insurance is the living benefits, which gives you access to a portion of. Also known as accelerated death benefits, term life insurance with living benefits is offered as an additional rider in most cases.

Source: sproutt.com

Source: sproutt.com

This amazing rider to all our life. Each once in for a spell, i will get budgetary inquiries from peruses. In the second section, we get into the different indexed universal life insurance pros and cons, starting with the benefits. 15 main pros and cons of universal life insurance. This amazing rider to all our life.

Source: pinterest.ph

Source: pinterest.ph

Jason does not smoke and qualifies for a standard rating. Pros and cons of living benefits life insurance. The pros and cons of selling insurance are essential to review because this career can be lucrative, but it is also very challenging. If you die, the policy pays out a lump sum death benefit to your beneficiary. Presently, i am not a budgetary guide.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

Presently, i am not a budgetary guide. Permanent life insurance policies, such as whole and universal life insurance, offer lifelong coverage and typically have a cash value component. Life insurance companies arent only offering these living benefits out of the kindness of their hearts. Lack of dependents who would need a death benefit. Whole life insurance has many potential benefits that might make it a strong part of your financial plan.

Source: riskquoter.com

Source: riskquoter.com

A 30 year old man can get a $250,000 10 year term policy for under $10. However, the disadvantages of term insurance. On september 1, 2015, naic actuarial guideline 49 (aka “ag 49”), was put into effect. Jason does not smoke and qualifies for a standard rating. Aig scores points for term life insurance policies, including its quality of life plans with living benefits.

Source: 1investing.in

Source: 1investing.in

But life insurance is not a scam. Statistically speaking you are eight times as likely to develop cancer, have a heart attack or a stroke than to die prematurely. The disadvantages of buying life insurance may be less obvious, but they still exist. Jason does not smoke and qualifies for a standard rating. Other living benefits, like disability premium waiver and guaranteed insurability riders, allow you to keep your coverage even when.

Source: youtube.com

Source: youtube.com

Term life is cheap, at least at first. Living benefits give you more options on how to best use your life insurance policy because they allow you to use the accrued cash value or accelerate some of the death benefit for qualified expenses. The pros of having life insurance outweigh the cons for most people with financial responsibilities such as mortgage payments, children, or student debt. The inability to pay a monthly premium. This is one of the key benefits of a whole life insurance policy.

Source: elcomutual.com

Pros and cons of living benefits life insurance. 15 main pros and cons of universal life insurance. Living benefits life insurance is a modern better way to provide financial protection in the case of catastrophic illness or injury. Lack of dependents who would need a death benefit. If you die, the policy pays out a lump sum death benefit to your beneficiary.

Source: youtube.com

Source: youtube.com

Living benefits give you more options on how to best use your life insurance policy because they allow you to use the accrued cash value or accelerate some of the death benefit for qualified expenses. The living benefits of life insurance allow the policy owner to access cash while still living. But oftentimes traditional life insurance doesn’t cover the burdensome costs involved when a chronic, critical, or terminal illness strikes. Well, you get the picture. Other living benefits, like disability premium waiver and guaranteed insurability riders, allow you to keep your coverage even when.

Source: moneyunder30.com

Source: moneyunder30.com

One of the many advantages of life insurance is that it provides many tax benefits. Well, you get the picture. Pros & cons of accelerated death benefits. Permanent life insurance policies, such as whole and universal life insurance, offer lifelong coverage and typically have a cash value component. Statistically speaking you are eight times as likely to develop cancer, have a heart attack or a stroke than to die prematurely.

Source: pinterest.com

Source: pinterest.com

Permanent life insurance policies, such as whole and universal life insurance, offer lifelong coverage and typically have a cash value component. Jason does not smoke and qualifies for a standard rating. This amazing rider to all our life. Www.vecteezy.com * purchase life insurance with living benefits. Presently, i am not a budgetary guide.

Source: quickquote.com

Source: quickquote.com

Advantages and disadvantages of term life insurance. The disadvantages of buying life insurance may be less obvious, but they still exist. On september 1, 2015, naic actuarial guideline 49 (aka “ag 49”), was put into effect. Click the link to dive into the details life insurance with living benefits and how to protect your futur. Living benefits life insurance is a modern better way to provide financial protection in the case of catastrophic illness or injury.

Source: sproutt.com

Source: sproutt.com

However, the disadvantages of term insurance. He purchases $500,000 life insurance with living benefits to protect his wife and 3 children. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. This is one of the key benefits of a whole life insurance policy. And living benefits are the subject of this article.

Source: twitter.com

Source: twitter.com

It will pay a benefit. A permanent policy’s cash value grows over time and can be used to pay premiums or take out a loan from the insurer. Finally, for a balanced approach we offer the disadvantages of iul insurance as well. The pros of having life insurance outweigh the cons for most people with financial responsibilities such as mortgage payments, children, or student debt. A brief note on iul policies.

Source: insurance-companies.co

Source: insurance-companies.co

Permanent life insurance policies, such as whole and universal life insurance, offer lifelong coverage and typically have a cash value component. A brief note on iul policies. Yes, life insurance can offer the advantages of both death benefits and living benefits. On september 1, 2015, naic actuarial guideline 49 (aka “ag 49”), was put into effect. Other living benefits, like disability premium waiver and guaranteed insurability riders, allow you to keep your coverage even when.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title pros and cons of living benefits life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information