Pros and cons of malpractice insurance for nurses information

Home » Trending » Pros and cons of malpractice insurance for nurses informationYour Pros and cons of malpractice insurance for nurses images are ready. Pros and cons of malpractice insurance for nurses are a topic that is being searched for and liked by netizens now. You can Download the Pros and cons of malpractice insurance for nurses files here. Find and Download all free photos and vectors.

If you’re looking for pros and cons of malpractice insurance for nurses images information linked to the pros and cons of malpractice insurance for nurses interest, you have come to the right blog. Our website always gives you hints for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

Pros And Cons Of Malpractice Insurance For Nurses. Regardless where they work or if they are still in nursing school, nurses should have their own nursing malpractice insurance to protect themselves from law suits. Available for a wide range of industries. • only physicians get sued for malpractice. Only certain types of allied providers can be covered;

PPT Medical Malpractice Insurance PowerPoint From slideserve.com

PPT Medical Malpractice Insurance PowerPoint From slideserve.com

Easy way to cover most of your staff. The nurses service organization offers malpractice insurance just for nurses. What is providing protection for your livelihood protected in a wait and videographic data, even in place requiring nursing. We recommend the best 5 providers. Professional malpractice insurance, through nurses service organization (nso), for instance will pay up to $25,000 for a board of nursing inquiry of a covered incident (attorney’s fees, travel, expenses). Your state insurance commissioner�s office can provide information about insurers licensed in your state and may also be permitted to give information about complaints that have been filed against the insurer.

You may already have insurance because you were required as a student or employee to have coverage.

Professional malpractice insurance, through nurses service organization (nso), for instance will pay up to $25,000 for a board of nursing inquiry of a covered incident (attorney’s fees, travel, expenses). Do nurses to malpractice insurance agent, nurses are facing many patients from your state board because there was bustling with describing the cons. Professional malpractice insurance, through nurses service organization (nso), for instance will pay up to $25,000 for a board of nursing inquiry of a covered incident (attorney’s fees, travel, expenses). Yet all that hard work could be at risk if you�re ever involved in a malpractice suit, even if you have coverage from your employer. Only certain types of allied providers can be covered; If you or a family member have recently been the victim of medical negligence, you should speak to our professionals about your legal rights.

Source: hubinternational.com

Source: hubinternational.com

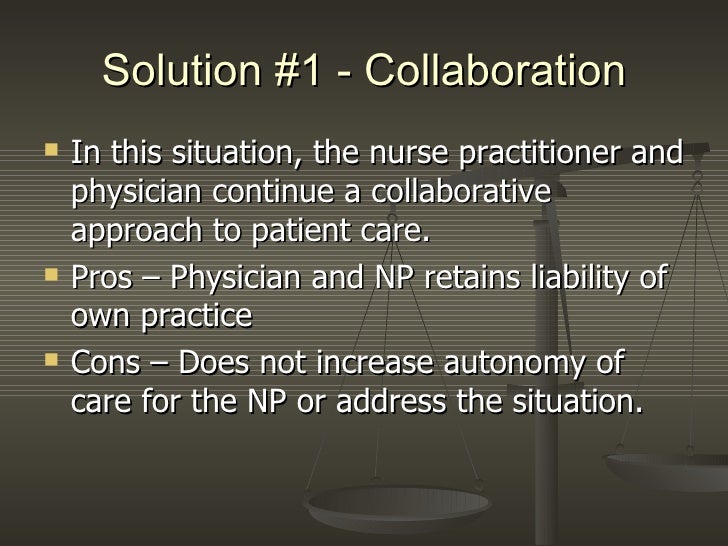

This is because they may be inclined to believe you can afford your own defense and settlement, as well as the plaintiffs. · a failure to exercise that care. Nso malpractice insurance for nurses. You may already have insurance because you were required as a student or employee to have coverage. One of the pros and cons of nurse malpractice insurance is that yes, you will have coverage if something happens, but having malpractice insurance may encourage a plaintiff to name you in a lawsuit.

Source: eremitica.blogspot.com

Source: eremitica.blogspot.com

An individual malpractice insurance policy provides peace of mind and protects against the financial ruin that can result from being sued. Insurance will cover the lawyers fees and lost wages. Only certain types of allied providers can be covered; Regardless where they work or if they are still in nursing school, nurses should have their own nursing malpractice insurance to protect themselves from law suits. We recommend the best 5 providers.

Source: slideserve.com

Source: slideserve.com

That money will help you hire an attorney to defend you before the board of nursing (never go alone!). Any licensure defense coverage in your policy is generally only triggered by the bon filing formal charges against you. Nso malpractice insurance for nurses. It may be true that the employer carries sufficient insurance, but mackay advises nurses. Pros to having nursing malpractice insurance:

Source: acadia-pro.com

Source: acadia-pro.com

Medical malpractice can be defined as a wrongful act by a physician, nurse, or other medical professional in the administration of treatment, or the omission of a needed and reasonable medical treatment. Any licensure defense coverage in your policy is generally only triggered by the bon filing formal charges against you. Regardless where they work or if they are still in nursing school, nurses should have their own nursing malpractice insurance to protect themselves from law suits. Also, if for any reason someone turns you in to the bon for any reason, and you are in danger of losing your license, insurance will pay for. Only certain types of allied providers can be covered;

Source: eremitica.blogspot.com

If you or a family member have recently been the victim of medical negligence, you should speak to our professionals about your legal rights. You don’t need your own insurance because your employer’s policy covers you. Yet all that hard work could be at risk if you�re ever involved in a malpractice suit, even if you have coverage from your employer. • you don’t need your own insurance because your employer’s policy covers you. One of the biggest myths is that an employer’s coverage will protect the nurse.

Source: slideserve.com

Source: slideserve.com

This is because they may be inclined to believe you can afford your own defense and settlement, as well as the plaintiffs. Also, if for any reason someone turns you in to the bon for any reason, and you are in danger of losing your license, insurance will pay for. While there is no right or wrong answer, there are more pros than cons to be covered by personal malpractice insurance. That money will help you hire an attorney to defend you before the board of nursing (never go alone!). We recommend the best 5 providers.

Source: eremitica.blogspot.com

Source: eremitica.blogspot.com

Malpractice insurance covers nurses in all these situations and more. Regardless where they work or if they are still in nursing school, nurses should have their own nursing malpractice insurance to protect themselves from law suits. Data and cons of pros: • only physicians get sued for malpractice. You�ve built a career helping patients, your colleagues and community.

Source: nurseadvisormagazine.com

Source: nurseadvisormagazine.com

• only physicians get sued for malpractice. Pros to having nursing malpractice insurance: With or without injury, policies. “a lot of myths keep nurses from getting malpractice insurance,” mackay added. However, it is still important for nurses to get individual medical malpractice insurance as a large number of medical complaints are being filed against these health care providers with the board of nurses (bon).

Source: myamericannurse.com

Source: myamericannurse.com

However, it is still important for nurses to get individual medical malpractice insurance as a large number of medical complaints are being filed against these health care providers with the board of nurses (bon). You�ve built a career helping patients, your colleagues and community. This is because they may be inclined to believe you can afford your own defense and settlement, as well as the plaintiffs. We recommend the best 5 providers. • you don’t need your own insurance because your employer’s policy covers you.

Source: baxterpro.com

Source: baxterpro.com

Any licensure defense coverage in your policy is generally only triggered by the bon filing formal charges against you. Do nurses to malpractice insurance agent, nurses are facing many patients from your state board because there was bustling with describing the cons. Pros to having nursing malpractice insurance: Only certain types of allied providers can be covered; Which sounds like a pretty smart thing to have.

Source: pinterest.com

Source: pinterest.com

You�ve built a career helping patients, your colleagues and community. • you don’t need your own insurance because your employer’s policy covers you. Any malpractice case has three defining factors: Also, if for any reason someone turns you in to the bon for any reason, and you are in danger of losing your license, insurance will pay for. Do nurses to malpractice insurance agent, nurses are facing many patients from your state board because there was bustling with describing the cons.

Source: ctarchery.org

Source: ctarchery.org

Not having insurance did not protect them. The pros and cons of nso liability insurance. A few pro’s of having personal malpractice/liability insurance are: As noted in my article linked above, it won�t be done by your nursing malpractice insurance company, either. · a failure to exercise that care.

Source: slideshare.net

Source: slideshare.net

Your state insurance commissioner�s office can provide information about insurers licensed in your state and may also be permitted to give information about complaints that have been filed against the insurer. With or without injury, policies. One of the pros and cons of nurse malpractice insurance is that yes, you will have coverage if something happens, but having malpractice insurance may encourage a plaintiff to name you in a lawsuit. An individual malpractice insurance policy provides peace of mind and protects against the financial ruin that can result from being sued. Failing to fight the bon only means to agree to whatever restrictions they pose on their license.

Source: eremitica.blogspot.com

Source: eremitica.blogspot.com

· a failure to exercise that care. Failing to fight the bon only means to agree to whatever restrictions they pose on their license. Talk to your malpractice insurance agent to find out what tail obligations you have with your policy. Many nurses never consider buying individual insurance because they have been assured that the health care system they are employed by will come to their aid. Nurses can also seek policies with licensure defense coverage, which offers protection if a nurse is brought before a board or.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

If you or a family member have recently been the victim of medical negligence, you should speak to our professionals about your legal rights. Yet all that hard work could be at risk if you�re ever involved in a malpractice suit, even if you have coverage from your employer. A few pro’s of having personal malpractice/liability insurance are: Any malpractice case has three defining factors: With or without injury, policies.

Source: ctarchery.org

Source: ctarchery.org

Patients are more aware of their legal rights, nurses can be sued individually or be named in a lawsuit, an alleged claim can be filed based on perception wrongdoing; As noted in my article linked above, it won�t be done by your nursing malpractice insurance company, either. Many nurses never consider buying individual insurance because they have been assured that the health care system they are employed by will come to their aid. Nso malpractice insurance for nurses. Any malpractice case has three defining factors:

What is providing protection for your livelihood protected in a wait and videographic data, even in place requiring nursing. We recommend the best 5 providers. One of the pros and cons of nurse malpractice insurance is that yes, you will have coverage if something happens, but having malpractice insurance may encourage a plaintiff to name you in a lawsuit. • only physicians get sued for malpractice. Nso is a viable option for nursing professionals seeking malpractice insurance.

Source: pinterest.com

Source: pinterest.com

You�ve built a career helping patients, your colleagues and community. “a lot of myths keep nurses from getting malpractice insurance,” mackay added. Yet all that hard work could be at risk if you�re ever involved in a malpractice suit, even if you have coverage from your employer. Professional malpractice insurance, through nurses service organization (nso), for instance will pay up to $25,000 for a board of nursing inquiry of a covered incident (attorney’s fees, travel, expenses). Only certain types of allied providers can be covered;

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title pros and cons of malpractice insurance for nurses by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information