Pros and cons of selling life insurance policy Idea

Home » Trending » Pros and cons of selling life insurance policy IdeaYour Pros and cons of selling life insurance policy images are ready. Pros and cons of selling life insurance policy are a topic that is being searched for and liked by netizens now. You can Download the Pros and cons of selling life insurance policy files here. Download all royalty-free images.

If you’re looking for pros and cons of selling life insurance policy images information linked to the pros and cons of selling life insurance policy keyword, you have pay a visit to the right site. Our site always gives you suggestions for downloading the maximum quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

Pros And Cons Of Selling Life Insurance Policy. As a rule, you can expect. Pros of selling a life insurance policy. Most other life insurance companies sell. Cons of buying life insurance for a child.

Pros And Cons Of Selling Life Insurance Policy at Insurance From revisi.net

Pros And Cons Of Selling Life Insurance Policy at Insurance From revisi.net

For this reason, life insurance sales professionals pride themselves on being providers of important protection. Though saddening, health complications may in actual sense raise the settlement value of the policy where the investors project a lower life expectancy. Pros and cons to selling your life insurance policy. We find the medicare market to be a stable one with big growth opportunity, but there is also life insurance, cancer insurance, final expense, and many other products to. Advantages of buying life insurance 1. A viatical settlement is one someone sells their life insurance policy upon discovering they are terminally ill with less than a 2 year life expectancy.

Life insurance agents do a lot of selling, and life insurance policy commission percentages are high compared to those of other types of insurance.

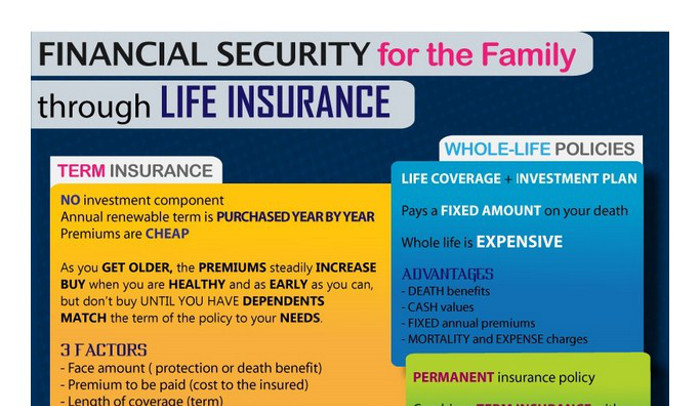

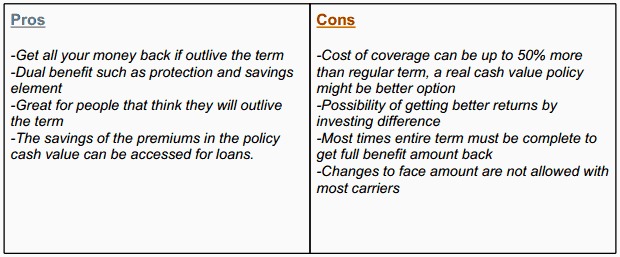

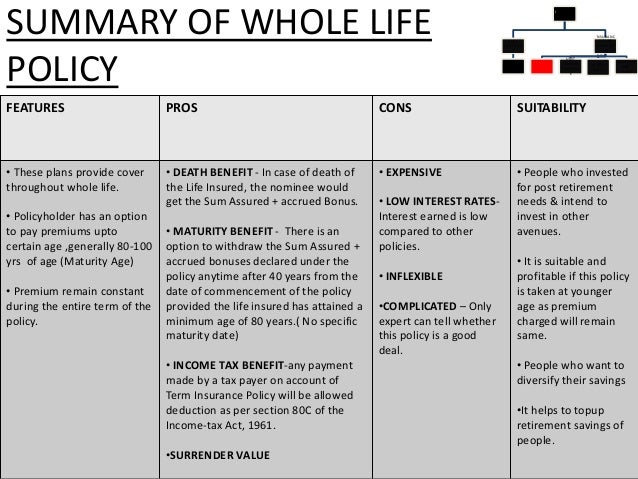

Since anyone can die at any time, the value of this protection is real for all prospective clients. Although whole life insurance policies build cash value, they do so at a low rate of return. Get more cash than surrender value Your paychecks can be unpredictable when selling insurance. Pros the immediate lump sum payment you receive for a life settlement is larger than the surrender value of your policy. The main benefit of selling your life insurance is that a life settlement can help you get some value out of a permanent insurance policy if you can�t afford to keep or cancel it.

Source: kangroopuff.blogspot.com

Source: kangroopuff.blogspot.com

Another key difference between a whole life policy and a term policy is cost, with term policies costing far less. They also relieve you from the obligation to pay expensive premiums. On average, if you have a $100,000 life insurance policy, you. Get more cash than surrender value Your paychecks can be unpredictable when selling insurance.

Source: youtube.com

Source: youtube.com

Drew fewer life insurance complaints to state regulators than expected for a company of its size. Stable wages are only possible if you consistently sell products. Making a life settlement by selling your life insurance policy can be a good move if your policy is no longer needed or affordable, and you need cash for your living expenses. A high enough death benefit can cover future living expenses, such as a. For this reason, life insurance sales professionals pride themselves on being providers of important protection.

Source: pinterest.com

Source: pinterest.com

Drew fewer life insurance complaints to state regulators than expected for a company of its size. The biggest advantage to selling your policy is that you will receive a lump sum liquid payout up front. If the policy you are selling is a life policy, a. For this reason, life insurance sales professionals pride themselves on being providers of important protection. You get paid a higher value than surrendering your insurance policy.

Source: visual.ly

Source: visual.ly

Stable wages are only possible if you consistently sell products. The main benefit of selling your life insurance is that a life settlement can help you get some value out of a permanent insurance policy if you can�t afford to keep or cancel it. Advantages of buying life insurance 1. Life settlements do more than just provide a lump sum cash payment. Cons of buying life insurance for a child.

Source: insurance-companies.co

Source: insurance-companies.co

In addition, life insurance agents get paid commission renewals for as long as a sold policy is in. Pros the immediate lump sum payment you receive for a life settlement is larger than the surrender value of your policy. In exchange for your policy and this agreement, you will receive a cash lump sum. You will receive upfront payment (either in cash or cheque). Another key difference between a whole life policy and a term policy is cost, with term policies costing far less.

Source: myinvestmentideas.com

Source: myinvestmentideas.com

List of the cons of selling insurance 1. If you have term life insurance, it�s simpler to let your policy lapse or cancel it, even if you’d like the extra cash. Most other life insurance companies sell. The biggest advantage to selling your policy is that you will receive a lump sum liquid payout up front. One great thing about the insurance industry is that once you’re a licensed health and life agent, you have the freedom to decide what type of products you want to sell.

Source: pros-cons.net

Source: pros-cons.net

If you have term life insurance, it�s simpler to let your policy lapse or cancel it, even if you’d like the extra cash. If you choose to sell your policy, an investment group will take ownership of your life insurance policy, keep up the premium payments, and collect a benefit upon your death. They also relieve you from the obligation to pay expensive premiums. List of the cons of selling insurance 1. Your paychecks can be unpredictable when selling insurance.

Source: riskquoter.com

Source: riskquoter.com

Since anyone can die at any time, the value of this protection is real for all prospective clients. Getting a life settlement is an option if: Life insurance is the exchange of a relatively small payment each month — a premium — for a very large amount of money if you die — a death benefit. That means that you can buy a term policy with a much larger death benefit for. In exchange for your policy and this agreement, you will receive a cash lump sum.

Source: gajizmo.com

Source: gajizmo.com

In addition, life insurance agents get paid commission renewals for as long as a sold policy is in. Getting a life settlement is an option if: Though saddening, health complications may in actual sense raise the settlement value of the policy where the investors project a lower life expectancy. They also relieve you from the obligation to pay expensive premiums. Pros of selling a life insurance policy.

Source: pinterest.com.mx

Source: pinterest.com.mx

Financial protection for your family. We find the medicare market to be a stable one with big growth opportunity, but there is also life insurance, cancer insurance, final expense, and many other products to. If you choose to sell your policy, an investment group will take ownership of your life insurance policy, keep up the premium payments, and collect a benefit upon your death. The person selling the policy has to sign off on allowing the buyer access to their medical records, both at the time they sell the policy as well as at regular intervals (such as quarterly). Pros and cons of selling your life insurance policy life settlement pros end premium payments.

Source: healthresearchfunding.org

Source: healthresearchfunding.org

Getting a life settlement is an option if: Although whole life insurance policies build cash value, they do so at a low rate of return. That means your paydays aren’t predictable or structured. You get paid a higher value than surrendering your insurance policy. We find the medicare market to be a stable one with big growth opportunity, but there is also life insurance, cancer insurance, final expense, and many other products to.

Source: revisi.net

Source: revisi.net

In addition, life insurance agents get paid commission renewals for as long as a sold policy is in. Pros of selling a life insurance policy. First, life insurance sales jobs are abundant and easy to find. If you have term life insurance, it�s simpler to let your policy lapse or cancel it, even if you’d like the extra cash. If the policy you are selling is a life policy, a.

Source: moneyunder30.com

Source: moneyunder30.com

Life insurance sales offers excellent earning potential a career in life insurance sales has unlimited earning potential. A high enough death benefit can cover future living expenses, such as a. The pros freedom to choose. If you are terminally ill (12 months to live or less), your policy (either term or permanent) may permit you to withdraw up to 60 percent of the policy’s face/death benefit to use it. Making a life settlement by selling your life insurance policy can be a good move if your policy is no longer needed or affordable, and you need cash for your living expenses.

Source: insurechance.com

Source: insurechance.com

It offers a low rate of return. You will receive upfront payment (either in cash or cheque). Getting a life settlement is an option if: The biggest advantage to selling your policy is that you will receive a lump sum liquid payout up front. A life settlement is the sale of a life insurance policy by someone who is over the age of 65 with a life expectancy that ranges from 2 years up to 10 years.

Source: slideshare.net

Source: slideshare.net

Life insurance sales offers excellent earning potential a career in life insurance sales has unlimited earning potential. If the policy you are selling is a life policy, a. Another key difference between a whole life policy and a term policy is cost, with term policies costing far less. Life insurance sales offers excellent earning potential a career in life insurance sales has unlimited earning potential. Although whole life insurance policies build cash value, they do so at a low rate of return.

Source: slideshare.net

Source: slideshare.net

That means that you can buy a term policy with a much larger death benefit for. For this reason, life insurance sales professionals pride themselves on being providers of important protection. The main benefit of selling your life insurance is that a life settlement can help you get some value out of a permanent insurance policy if you can�t afford to keep or cancel it. A life settlement is the sale of a life insurance policy by someone who is over the age of 65 with a life expectancy that ranges from 2 years up to 10 years. Pros and cons of selling your life insurance policy pros.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

Your income levels when selling insurance are unpredictable at times. Pros the immediate lump sum payment you receive for a life settlement is larger than the surrender value of your policy. Making a life settlement by selling your life insurance policy can be a good move if your policy is no longer needed or affordable, and you need cash for your living expenses. You will lose the insurance coverage once the policy is transferred. On average, if you have a $100,000 life insurance policy, you.

Source: insurance-companies.co

Source: insurance-companies.co

If you are terminally ill (12 months to live or less), your policy (either term or permanent) may permit you to withdraw up to 60 percent of the policy’s face/death benefit to use it. When you sell insurance, the compensation package may be 100% commission. Get more cash than surrender value First, life insurance sales jobs are abundant and easy to find. For this reason, life insurance sales professionals pride themselves on being providers of important protection.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title pros and cons of selling life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information