Pros and cons of supplemental insurance information

Home » Trending » Pros and cons of supplemental insurance informationYour Pros and cons of supplemental insurance images are ready in this website. Pros and cons of supplemental insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Pros and cons of supplemental insurance files here. Find and Download all royalty-free images.

If you’re looking for pros and cons of supplemental insurance pictures information related to the pros and cons of supplemental insurance interest, you have pay a visit to the right site. Our website frequently gives you hints for seeking the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

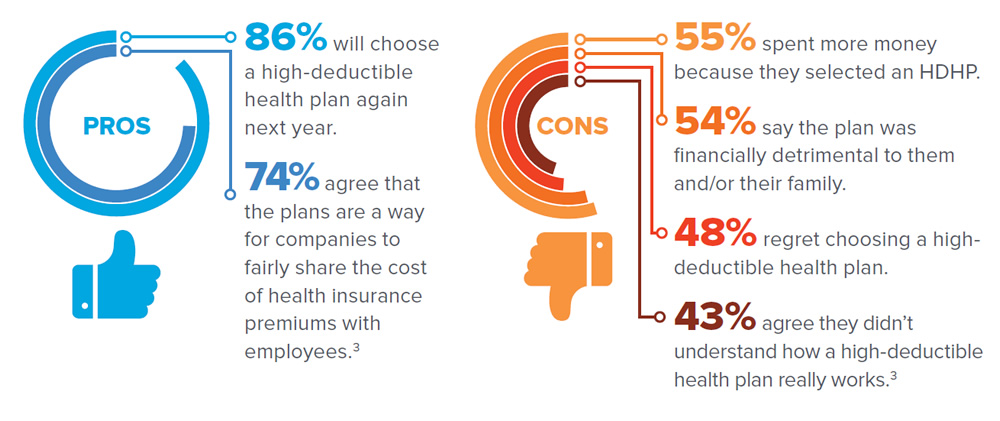

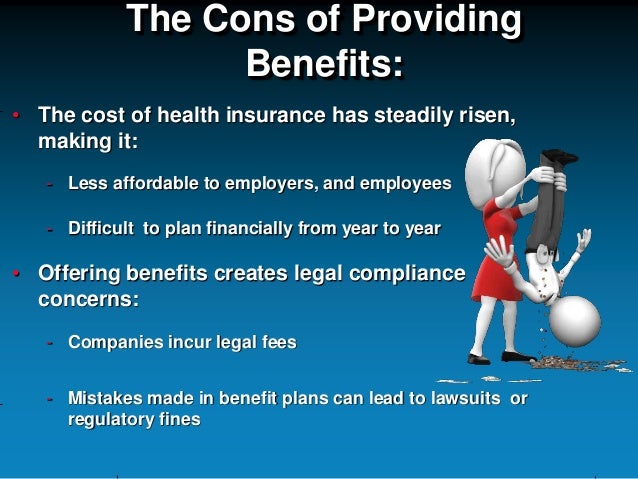

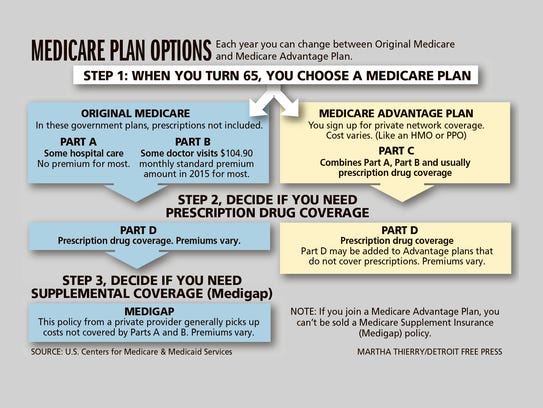

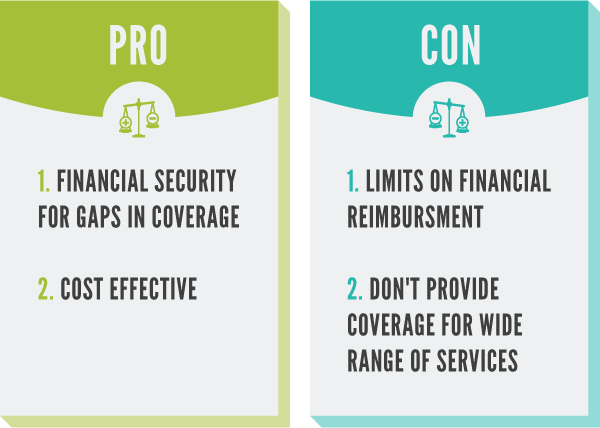

Pros And Cons Of Supplemental Insurance. This can help pay for your monthly bills and daily needs. Helps pay for hospital and outpatient deductibles, copays and coinsurance. Medicare supplement insurance, also called medigap, is designed to bridge the payment gap left by original medicare, a traditional indemnity plan that in most cases pays only a portion of. Health care system for military members and their families — takes care of its portion of your medical bills.

The Pros and Cons of Medicare Supplement Insurance From medicareworld.com

The Pros and Cons of Medicare Supplement Insurance From medicareworld.com

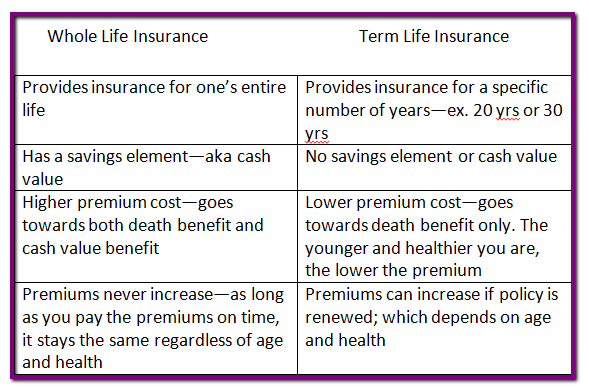

It also can pay for medicare deductibles and medicare copays. Investing in a supplemental plan is a good idea. This way you can avoid unwanted situations like foreclosures and the prospect of having to file for bankruptcy in case you are unable to earn an income due to disability. It may even pay for costs not covered by a traditional health plan, such as coinsurance, copays, and deductibles. An individual life insurance policy and supplemental life insurance together can provide solid life insurance protection. An advantage is that support is available to any individual who has limited income and is disabled, blind or at least 65 years old.

These types of policies help to cover expenses

Insurance provided by your employer, for. Insurance provided by your employer, for. Thanks to the program, millions of aging adults have been able to receive coverage. None of the current plans cover the annual part b deductible of $198. The benefits covered by basic insurance are the same irrespective of health Helps pay for hospital and outpatient deductibles, copays and coinsurance.

Source: mostpopularmedicaresupplementalinsura.blogspot.com

Source: mostpopularmedicaresupplementalinsura.blogspot.com

Pros and cons of supplemental insurance. The primary disadvantage of supplemental insurance is that it adds additional expenses to your monthly budget. Pros and cons of supplemental insurance. Medicare also covers many younger americans with disabilities. This could be especially bad if you are in the middle of treating a condition.

Source: nerdwallet.com

Source: nerdwallet.com

This means when a portion of your medical claim isn’t covered by your primary insurer, then you can go to your secondary insurer who. In my experience, many individuals turning 65, after reviewing the real pros and cons of a medicare supplement policy conclude it was time well spent in the process to compare medicare supplement. Here is an overview of the pros and cons of taking out basic and supplemental insurance with different insurers. Supplemental insurance products such as cancer and accidental injury insurance are not a replacement for major medical insurance. Eligibility there are both pros and cons associated with ssi eligibility criteria.

Source: dietsupl.blogspot.com

Source: dietsupl.blogspot.com

The primary disadvantage of supplemental insurance is that it adds additional expenses to your monthly budget. Pros of medicare medicare provides coverage to millions in many senses, medicare works. Long term care insurance pays for your final years in an assisted living facility. Unlike social security disability income, ssi eligibility does not depend on prior work history. It can have very high monthly premiums and after all it is a gamble as to whether you will ever wind up with cancer or not so you may be paying for years and years and never (hopefully) have to use it.

Source: aflac.com

Source: aflac.com

Offer full coverage for inpatient hospitalizations (part a) which pays the 20% of inpatient costs that original medicare doesn’t cover. The benefits covered by basic insurance are the same irrespective of health Medicare supplemental insurance (aka medigap) enhances original medicare to significantly extend hospital, skilled nursing, and travel coverage. Can be used nationwide, allowing you to see any doctor that accepts medicare without a referral. An individual policy isn’t dependent on.

Source: slideshare.net

Source: slideshare.net

The benefits covered by basic insurance are the same irrespective of health Pros of medicare medicare provides coverage to millions in many senses, medicare works. This way you can avoid unwanted situations like foreclosures and the prospect of having to file for bankruptcy in case you are unable to earn an income due to disability. In my experience, many individuals turning 65, after reviewing the real pros and cons of a medicare supplement policy conclude it was time well spent in the process to compare medicare supplement. It may provide extra coverage.

Source: seniormark.com

Source: seniormark.com

Supplemental insurance products such as cancer and accidental injury insurance are not a replacement for major medical insurance. An advantage is that support is available to any individual who has limited income and is disabled, blind or at least 65 years old. Pros and cons of supplemental insurance. They also do not offer vision, dental or prescription drug benefits. Here is an overview of the pros and cons of taking out basic and supplemental insurance with different insurers.

This means when a portion of your medical claim isn’t covered by your primary insurer, then you can go to your secondary insurer who. Insurance provided by your employer, for. Medicare also covers many younger americans with disabilities. A supplemental insurance policy pays out after tricare — the u.s. Medigap is the most comprehensive coverage you can buy.

Source: freep.com

Source: freep.com

It may even pay for costs not covered by a traditional health plan, such as coinsurance, copays, and deductibles. In my experience, many individuals turning 65, after reviewing the real pros and cons of a medicare supplement policy conclude it was time well spent in the process to compare medicare supplement. Medicare supplemental insurance (aka medigap) enhances original medicare to significantly extend hospital, skilled nursing, and travel coverage. Insurance provided by your employer, for. Option of reducing the cost of basic insurance premiums:

Source: medsuppnews.com

Source: medsuppnews.com

Option of reducing the cost of basic insurance premiums: Can be used nationwide, allowing you to see any doctor that accepts medicare without a referral. The benefits covered by basic insurance are the same irrespective of health Health care system for military members and their families — takes care of its portion of your medical bills. Available for american residents of 48 states plus washington, d.c.

Source: itshealthytobewealthy.com

Source: itshealthytobewealthy.com

Medicare supplement insurance, also called medigap, is designed to bridge the payment gap left by original medicare, a traditional indemnity plan that in most cases pays only a portion of. Pros & cons of supplemental insurance policies cost. Option of reducing the cost of basic insurance premiums: Pros and cons of medicare supplement insurance. These types of policies help to cover expenses

Source: insurance-companies.co

Source: insurance-companies.co

One of the biggest benefits to having several health plans is extended coverage. The primary disadvantage of supplemental insurance is that it adds additional expenses to your monthly budget. Pros & cons of supplemental insurance policies cost. Investing in a supplemental plan is a good idea. This can help pay for your monthly bills and daily needs.

Source: firstquotehealth.com

Source: firstquotehealth.com

Splitting basic and supplemental insurance: The younger you are when you take out a. Supplemental group life insurance many people opt to buy more insurance, known as supplemental life insurance, through their workplace plans. Pros of medicare medicare provides coverage to millions in many senses, medicare works. Pros and cons of medicare supplement insurance.

Source: remedigap.com

Source: remedigap.com

Pros of medicare medicare provides coverage to millions in many senses, medicare works. Medicare supplemental insurance (aka medigap) enhances original medicare to significantly extend hospital, skilled nursing, and travel coverage. It may even pay for costs not covered by a traditional health plan, such as coinsurance, copays, and deductibles. Take advantage of helpful resources. Pros & cons of supplemental insurance policies cost.

Source: thehealthinsurancestore.podbean.com

Source: thehealthinsurancestore.podbean.com

Take advantage of helpful resources. Helps pay for hospital and outpatient deductibles, copays and coinsurance. Thanks to the program, millions of aging adults have been able to receive coverage. An advantage is that support is available to any individual who has limited income and is disabled, blind or at least 65 years old. Option of reducing the cost of basic insurance premiums:

Source: remedigap.com

Source: remedigap.com

Medigap is the most comprehensive coverage you can buy. Cons of supplemental insurance supplemental insurance plans may have limited the money you receive towards your medical costs. Boost your disability benefit and receive closer to 80% to 100% of your predisability income with supplemental disability insurance. When you’re ready to start reviewing plans, check out the medicare plan finder tool, which will let you compare medicare advantage and part d prescription. Splitting basic and supplemental insurance:

Source: medicareworld.com

Source: medicareworld.com

It may provide extra coverage. The benefits covered by basic insurance are the same irrespective of health Boost your disability benefit and receive closer to 80% to 100% of your predisability income with supplemental disability insurance. Medicare is considered helpful because it covers so many people. It may provide extra coverage.

Source: medsuppnews.com

Source: medsuppnews.com

Can be used nationwide, allowing you to see any doctor that accepts medicare without a referral. Pros and cons of supplemental medicare coverage from cigna. Pros and cons of medicare supplement insurance. Medicare also covers many younger americans with disabilities. Cons of supplemental insurance supplemental insurance plans may have limited the money you receive towards your medical costs.

Source: pinterest.com

Source: pinterest.com

It can have very high monthly premiums and after all it is a gamble as to whether you will ever wind up with cancer or not so you may be paying for years and years and never (hopefully) have to use it. Medicare supplemental insurance (aka medigap) enhances original medicare to significantly extend hospital, skilled nursing, and travel coverage. Pros of medicare medicare provides coverage to millions in many senses, medicare works. Supplemental group life insurance many people opt to buy more insurance, known as supplemental life insurance, through their workplace plans. Pros and cons of supplemental insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title pros and cons of supplemental insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information