Provincial auto insurance information

Home » Trending » Provincial auto insurance informationYour Provincial auto insurance images are ready in this website. Provincial auto insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Provincial auto insurance files here. Find and Download all royalty-free photos.

If you’re searching for provincial auto insurance images information linked to the provincial auto insurance interest, you have come to the right blog. Our website always provides you with hints for seeing the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that fit your interests.

Provincial Auto Insurance. Legal liability for property damage and bodily injury where the collision occurs outside québec One of the major drivers (pun intended) of auto insurance premiums springs from whether provincial insurance programmes are sponsored by a government agency or promoted by a private entity. Gnp is an a+ rated company that is financially stable and has been around since 1907. Ontario — the average cost of car insurance in ontario is approximately $1,528 per year.

Car Financing And Insurance • Provincial Auto Finance From provincialautofinance.ca

Car Financing And Insurance • Provincial Auto Finance From provincialautofinance.ca

Quick facts for car insurance in british columbia. Auto insurance in nova scotia. Gnp is an a+ rated company that is financially stable and has been around since 1907. The québec automobile insurance act requires all owners of vehicles on the road in the province to purchase civil liability coverage of at least $50,000 (for private passenger vehicles). Quebec has a mix of public and private options. Whether you�re in calgary or cold lake, belairdirect has the car insurance coverage to fit the driving needs of all albertans.

Depending on the province, regulators may oversee how insurance companies assess risk, determine prices and handle claims.

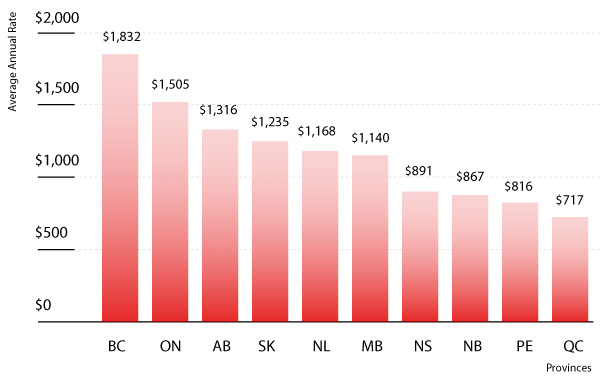

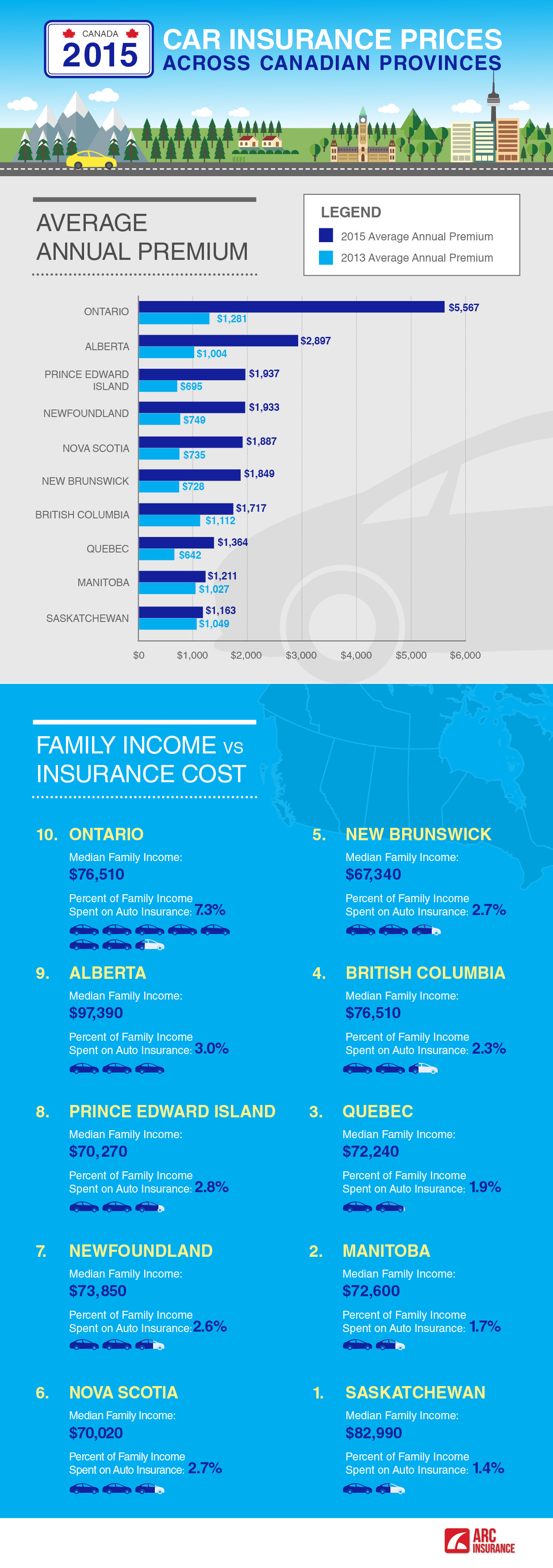

Auto insurance rates by province. This infographic shows the different minimum car insurance coverages required in every canadian province. Founded in 1608, it’s the second most populous city in the province and known for its distinctive european feel and classical architecture. Average car insurance rates by province One of the major drivers (pun intended) of auto insurance premiums springs from whether provincial insurance programmes are sponsored by a government agency or promoted by a private entity. The study says the average ontario estimated auto insurance premium in 2021 was $1,555, a 3.8% decrease from 2020, when the average was $1,616.

Source: readersdigest.ca

Source: readersdigest.ca

Average car insurance rates by province Legal liability for property damage and bodily injury where the collision occurs outside québec The quebec data includes the premium for material damage (private insurers) and the premium for bodily injury (saaq). Quebec car insurance quotes & rates calculator 24 november 2016 | helping canadians compare a wide range of personal finance products including car insurance, mortgage rates, credit cards, and more. Other provinces offer private insurance, which gives the customer more choice.

Source: lowestrates.ca

Source: lowestrates.ca

Across canada, auto insurance is mandatory for all drivers and the industry is closely monitored by the provincial government. Quick facts for car insurance in british columbia. The quebec data includes the premium for material damage (private insurers) and the premium for bodily injury (saaq). Across canada, auto insurance is mandatory for all drivers and the industry is closely monitored by the provincial government. The manitoba public insurance offers a wide array of options that include optional autopac, basic autopac, and the special risk extension package.

Source: surex.com

Source: surex.com

The study says the average ontario estimated auto insurance premium in 2021 was $1,555, a 3.8% decrease from 2020, when the average was $1,616. Grupo nacional provincial (gnp) is one of mexico’s largest insurance companies. $1,014 for new brunswick and. As our needs have grown throughout the years, provincial insurance has been there to look after all our needs and we say thank you! This infographic shows the different minimum car insurance coverages required in every canadian province.

Source: autoinsuranceratessonokise.blogspot.com

Source: autoinsuranceratessonokise.blogspot.com

Navigate over single locations to find more about auto insurance rates there. Because saskatchewan automobile insurance is mostly supplied by the government, we are unable to provide car insurance quotes to saskatchewan drivers at this time. In general, insurance premiums subjected to market forces gravitate toward the lower end of the price range. Insurance rates increase when more traffic collision victims or their families are awarded compensation. We offer custom insurance plans that feature multiple ways to save and online quotes that make it as easy as possible to.

Source: provincialautofinance.ca

Source: provincialautofinance.ca

The quebec data includes the premium for material damage (private insurers) and the premium for bodily injury (saaq). Toronto placed seventh most expensive with the average auto insurance premium estimated at $1,953, representing an 11.3% decrease from 2020. Auto insurers are still required by the hccra to notify the british columbia ministry of health within 60 days of learning of an act or omission by one of their insureds that may have caused or contributed to the personal injury or death of a beneficiary of the british columbia healthcare plan [4] and of the proposed settlement terms before any. Average car insurance rates by province $200,000 average annual car insurance costs:

Source: thinkinsure.ca

Source: thinkinsure.ca

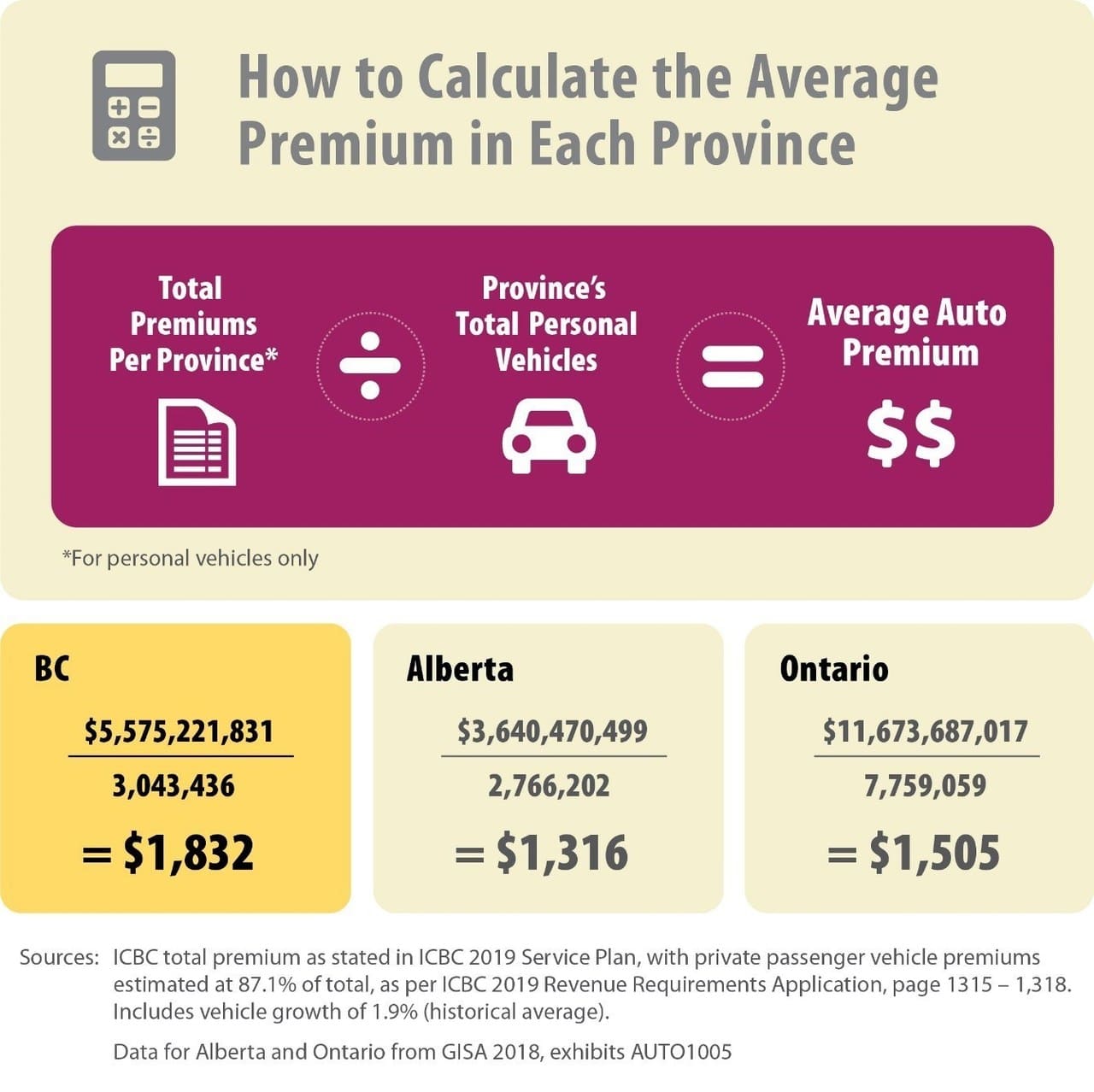

Average car insurance rates by province Ontario has $11,673,687,017 in premiums) / 7,759,059 (number of personal vehicles) = $1,505 average auto insurance premiums. Auto insurance in quebec city quebec city, the province’s capital, is a beautiful, seductive place, thanks to its clifftop position above the saint lawrence river and quaint backstreets. In some provinces, car insurance is issued by the government, meaning there is only one option. Quebec car insurance quotes & rates calculator 24 november 2016 | helping canadians compare a wide range of personal finance products including car insurance, mortgage rates, credit cards, and more.

Source: nugget.ca

Source: nugget.ca

In general, insurance premiums subjected to market forces gravitate toward the lower end of the price range. Across canada, auto insurance is mandatory for all drivers and the industry is closely monitored by the provincial government. British columbia has $5,575,221,831 (in premiums) / 3,043,436 (number of personal vehicles) = $1,832 average auto insurance premiums. In general, insurance premiums subjected to market forces gravitate toward the lower end of the price range. Auto insurers are still required by the hccra to notify the british columbia ministry of health within 60 days of learning of an act or omission by one of their insureds that may have caused or contributed to the personal injury or death of a beneficiary of the british columbia healthcare plan [4] and of the proposed settlement terms before any.

Source: cbc.ca

Source: cbc.ca

Other provinces offer private insurance, which gives the customer more choice. Depending on the province, regulators may oversee how insurance companies assess risk, determine prices and handle claims. Ontario — the average cost of car insurance in ontario is approximately $1,528 per year. Average car insurance rates by province Auto insurance in british columbia.

Check out the prices, rates, and get online quotes for car insurance based on your place of living. Insurance rates increase when more traffic collision victims or their families are awarded compensation. Toronto placed seventh most expensive with the average auto insurance premium estimated at $1,953, representing an 11.3% decrease from 2020. As our needs have grown throughout the years, provincial insurance has been there to look after all our needs and we say thank you! Navigate over single locations to find more about auto insurance rates there.

$200,000 average annual car insurance costs: Auto insurance in nova scotia. If you live in the province, you will need to have at least basic autopac. Because saskatchewan automobile insurance is mostly supplied by the government, we are unable to provide car insurance quotes to saskatchewan drivers at this time. Other provinces offer private insurance, which gives the customer more choice.

Quebec has a mix of public and private options. $1,832 if you live in british columbia, you’ve probably already discovered that you have to get your basic car insurance with icbc. Check out the prices, rates, and get online quotes for car insurance based on your place of living. If you live in the province, you will need to have at least basic autopac. Average car insurance rates by province

Source: arcinsurance.ca

Source: arcinsurance.ca

Depending on the province, regulators may oversee how insurance companies assess risk, determine prices and handle claims. Provincial automobile today continues to be amongst the leading dealers of mahindra & mahindra for their range of products in the personal segment, small commercial vehicles, farm equipments construction equipment and certified used cars with a data base of automobile customers of 20,000+ with 45% of the customers in semi urban and rural areas. The manitoba public insurance offers a wide array of options that include optional autopac, basic autopac, and the special risk extension package. Legal liability for property damage and bodily injury where the collision occurs outside québec Because saskatchewan automobile insurance is mostly supplied by the government, we are unable to provide car insurance quotes to saskatchewan drivers at this time.

Source: reddit.com

Source: reddit.com

$200,000 average annual car insurance costs: Gnp is an a+ rated company that is financially stable and has been around since 1907. Other provinces offer private insurance, which gives the customer more choice. We offer custom insurance plans that feature multiple ways to save and online quotes that make it as easy as possible to. This infographic shows the different minimum car insurance coverages required in every canadian province.

Source: provincialinsurance.in

Source: provincialinsurance.in

Quebec has a mix of public and private options. Quebec car insurance quotes & rates calculator 24 november 2016 | helping canadians compare a wide range of personal finance products including car insurance, mortgage rates, credit cards, and more. Provincial automobile today continues to be amongst the leading dealers of mahindra & mahindra for their range of products in the personal segment, small commercial vehicles, farm equipments construction equipment and certified used cars with a data base of automobile customers of 20,000+ with 45% of the customers in semi urban and rural areas. Depending on the province, regulators may oversee how insurance companies assess risk, determine prices and handle claims. The manitoba public insurance offers a wide array of options that include optional autopac, basic autopac, and the special risk extension package.

Source: isure.ca

Source: isure.ca

$1,014 for new brunswick and. In general, insurance premiums subjected to market forces gravitate toward the lower end of the price range. Other provinces offer private insurance, which gives the customer more choice. $1,014 for new brunswick and. Quebec, with an average premium of $857 (coverage for material damage and bodily injury) compared favourably with its two neighbouring provinces in 2020, where automobile insurance rates were significantly higher:

Source: hubinsurancehunter.ca

Source: hubinsurancehunter.ca

Quick facts for car insurance in british columbia. British columbia has $5,575,221,831 (in premiums) / 3,043,436 (number of personal vehicles) = $1,832 average auto insurance premiums. Across canada, auto insurance is mandatory for all drivers and the industry is closely monitored by the provincial government. Ontario has $11,673,687,017 in premiums) / 7,759,059 (number of personal vehicles) = $1,505 average auto insurance premiums. Ontario — the average cost of car insurance in ontario is approximately $1,528 per year.

Source: todocanada.ca

Source: todocanada.ca

Other provinces offer private insurance, which gives the customer more choice. Quebec, with an average premium of $857 (coverage for material damage and bodily injury) compared favourably with its two neighbouring provinces in 2020, where automobile insurance rates were significantly higher: Smith and his team really excel in regards to communication, details and follow up. Auto insurance in british columbia. If you live in the province, you will need to have at least basic autopac.

$1,832 if you live in british columbia, you’ve probably already discovered that you have to get your basic car insurance with icbc. $1,832 if you live in british columbia, you’ve probably already discovered that you have to get your basic car insurance with icbc. Legal liability for property damage and bodily injury where the collision occurs outside québec In some provinces, car insurance is issued by the government, meaning there is only one option. Other provinces offer private insurance, which gives the customer more choice.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title provincial auto insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information